Roundup: Speculative Memes vs. Sound Money

Brian Cubellis | Chief Strategy Officer

Jan 23, 2025

Speculative Memes vs. Sound Money

This week ushered in a whirlwind of headlines as Donald Trump was sworn in as the 47th president on Monday and quickly signed a flurry of executive orders. For bitcoiners, his campaign promises took center stage—chiefly, pledges to free Ross Ulbricht, establish a Strategic Bitcoin Reserve, and promote innovation-friendly regulation.

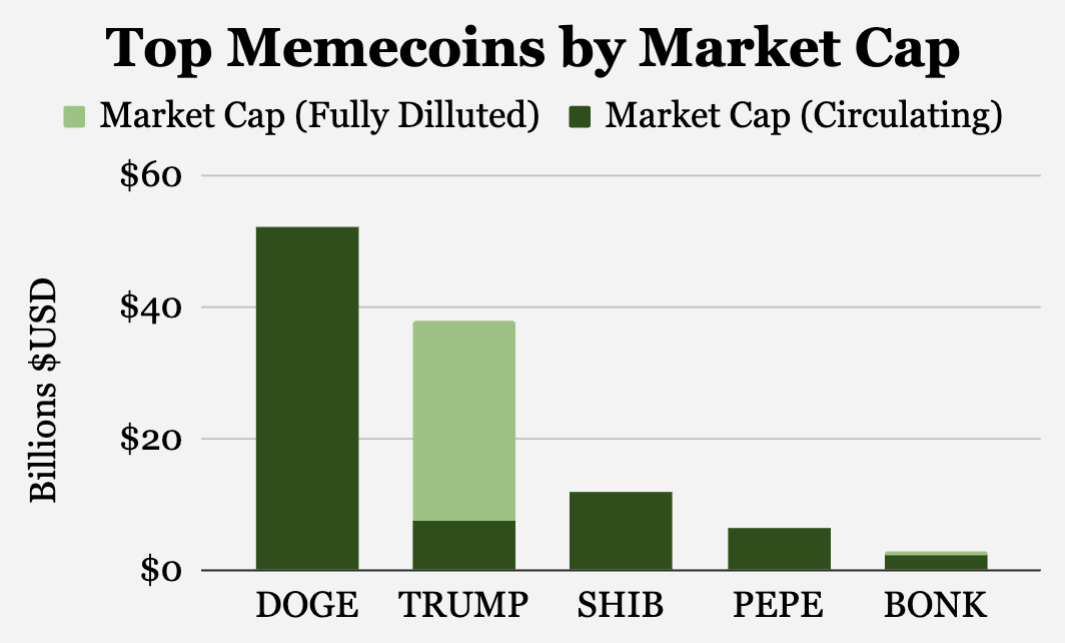

Before any of that could unfold, however, an unexpected development stole the limelight last Friday evening: the launch of $TRUMP, the official “Trump memecoin,” which within 48 hours briefly soared to a circulating market cap of ~$14.5B (~$73B fully diluted). Since those highs, the coin has retraced about ~50% of its gains, and currently sits at a circulating market cap of ~$7.5B.

source: Onramp & CoinGecko

In true memecoin fashion, $TRUMP rapidly drained liquidity from the broader altcoin market, with thousands of tokens shedding half their value in minutes. Eighty percent of $TRUMP’s supply is locked up by insiders on a three-year vesting schedule, evoking memories of the 2017 ICO era: large insider stakes, minimal float, and eventual insider selling.

Unlike crypto projects of the past that once touted “decentralized utility” or “transformative tech,” $TRUMP is refreshingly explicit about its meme-driven speculation—it offers no functional use case. In a bizarre twist, Melania Trump launched her own coin ($MELANIA) just days later on Sunday, fracturing the memecoin hype (and liquidity) even further. Both tokens have meaningfully slid from their highs, leaving many buyers nursing losses.

Beyond the spectacle lies a telling reality: most of what passes for “crypto” beyond bitcoin has morphed into high-stakes speculation on memes and fleeting narratives. While these tokens may provide some gamblers with short-term thrills, they lack any semblance of long-term monetary soundness or serious use. Indeed, the veneer of “utility” surrounding many altcoins, NFTS, and DeFi projects has given way to a near-constant cycle of token launches, insider allocations, and the over-hyped financialization of the attention economy. A coin can be spun up in seconds, so scarcity and genuine decentralization are non-existent.

By contrast, bitcoin stands alone as a truly decentralized, finite, and neutral asset. Yes, bitcoin has a founder—Satoshi Nakamoto—but Satoshi mined coins in the same manner as any other early participant, then disappeared. Those coins, famously, have never moved. In walking away, Satoshi ceded control to the network’s global consensus, ensuring no single entity could manipulate the protocol.

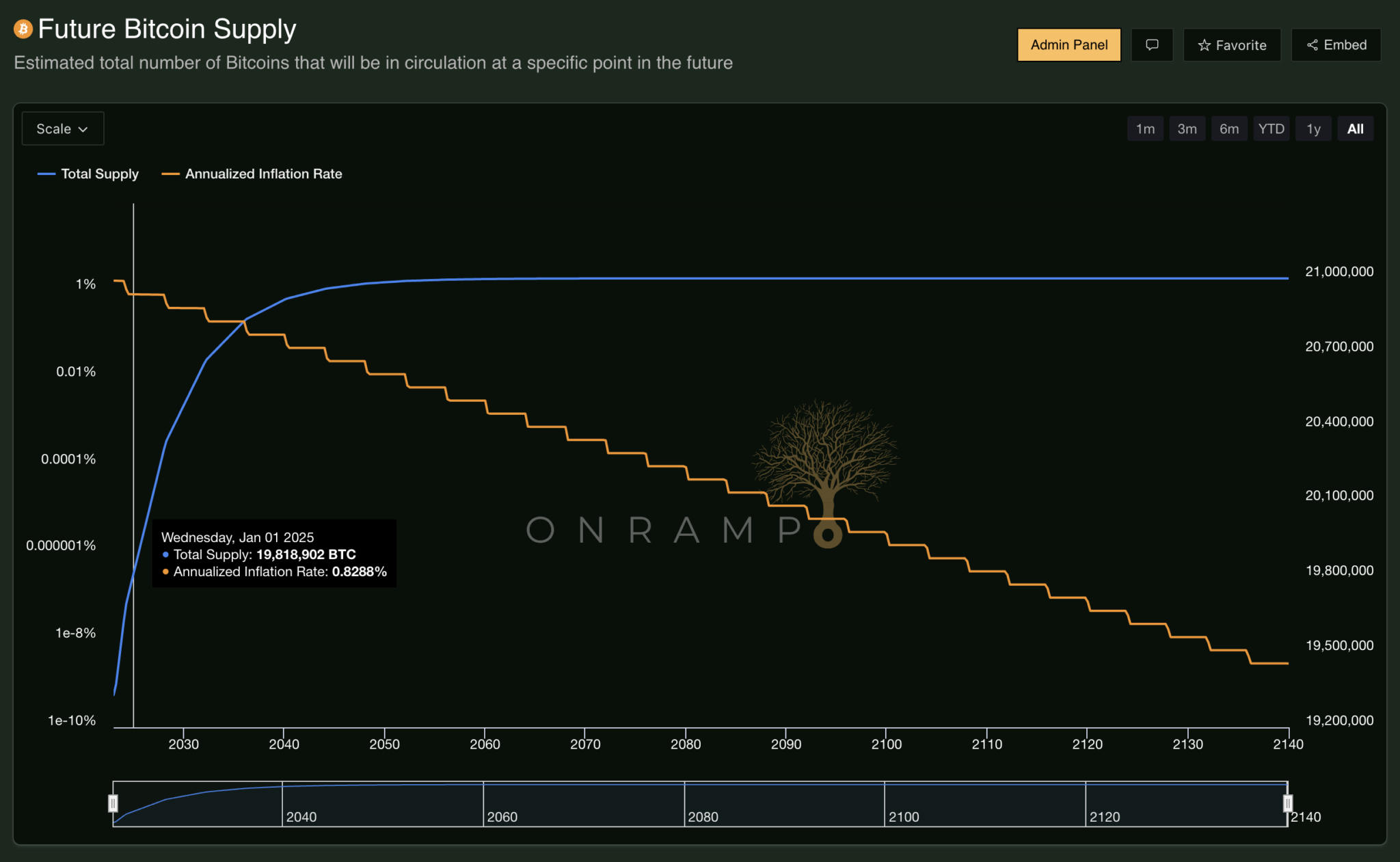

Crucially, bitcoin’s monetary policy—its predictable issuance rate and 21 million supply cap—is transparent and immutable, enforced by a worldwide network of miners and full nodes. No insider allocations, no vesting schedules, no capacity for unilateral inflation.

source: Onramp Terminal

Despite the memecoin noise, President Trump did follow through on one significant campaign pledge this week: pardoning Ross Ulbricht, which many interpret as a strong signal of his administration’s pro-bitcoin leanings. Interestingly, the pardon came on January 21st, which some may perceive as a subtle nod to bitcoin’s 21 million supply limit—maybe Trump knew, maybe Barron knew, or maybe it’s just a coincidence. Technically speaking, however, it qualifies as a “day one” promise kept if you count Inauguration Day as day zero.

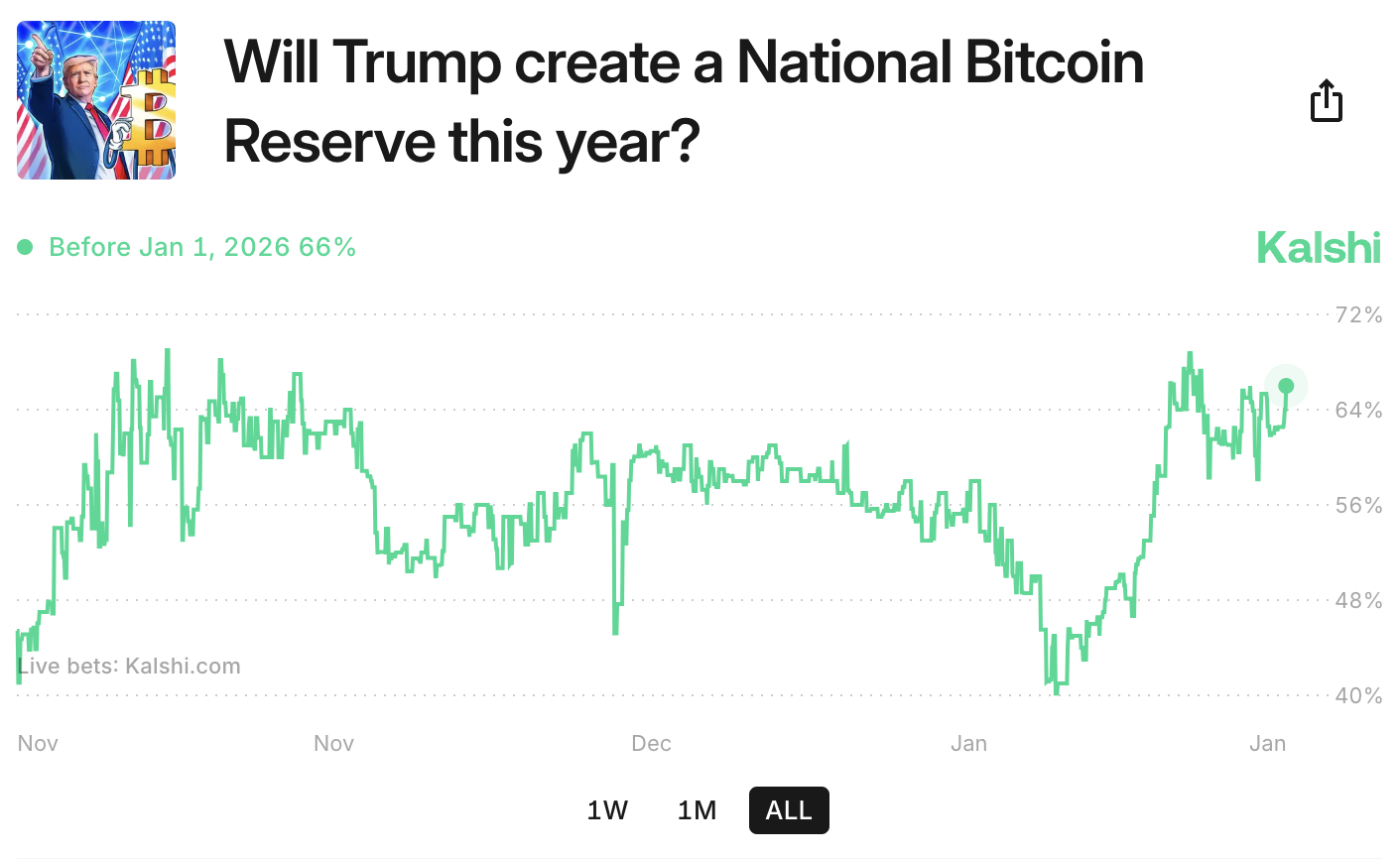

Meanwhile, investors are eyeing prediction markets that track the odds of the new administration establishing a Strategic Bitcoin Reserve (SBR). Polymarket is currently pricing the odds of an SBR (within the first 100 days) at around 44%, while Kalshi’s market (based on an SBR within 2025) sits around 67%. While these probabilities remain modest, they’ve been inching higher, and several states have taken up their own SBR legislation, suggesting a push for state-level bitcoin reserves could accelerate federal momentum.

It’s worth reiterating that crypto (ex-bitcoin) fundamentally lacks the credible neutrality that defines genuine sound money. For that reason, the increasingly serious discussions around government-driven strategic reserves are centered around bitcoin, and bitcoin only. Most altcoins function more like tech startups or common enterprises—governed by a founding team or foundation whose promises drive investor interest. Earlier this week on X, Ethereum founder Vitalik Buterin conceded this reality.

Even if this administration were to fully legalize all forms of token sales, classification as “legal” doesn’t make an altcoin sound money. At best, these tokens remain speculative bets on a group’s potential execution, riddled with insider allocations and adjustable supply schedules. Calling altcoins “tech startups” is arguably the most generous characterization; they are certainly not decentralized, neutral currencies.

The contrast between these memecoin launches and bitcoin’s fundamentals couldn’t be more pronounced. Memecoins will continue to come and go, but a verifiably finite, truly decentralized currency with no single point of failure and no capacity for arbitrary inflation is unique to bitcoin.

As we watch this new administration navigate the line between memecoin mania and sound-money principles, it’s worth remembering that bitcoin’s superiority lies not only in its fair launch dynamics, but in its unalterable rules, historical track record, distributed consensus, and immutably capped supply (i.e. credible neutrality). Every new meme token that gets launched only underscores why bitcoin remains in a league of its own.

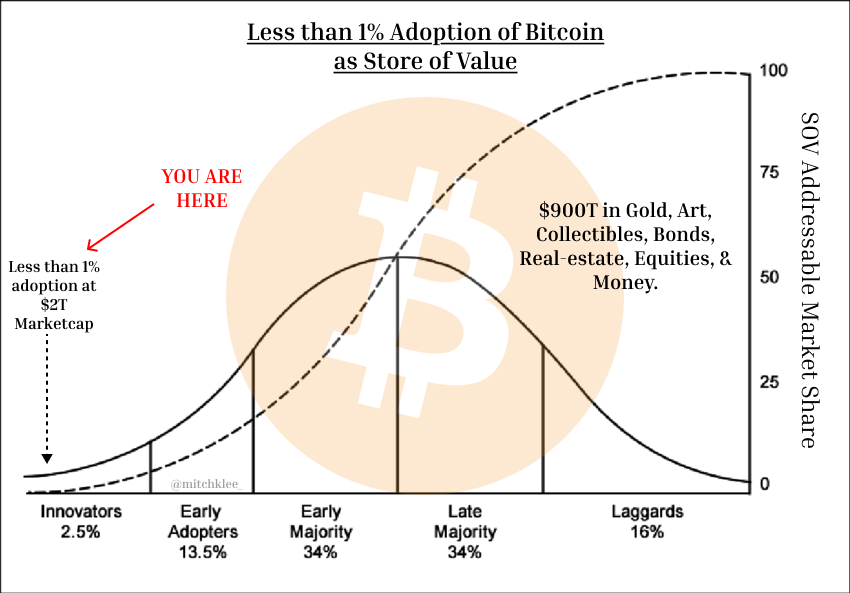

Chart of the Week

“Bitcoin is currently a ~$2 trillion dollar asset and its total addressable market for store-of-value is ~$900 Trillion.”

Quote of the Week

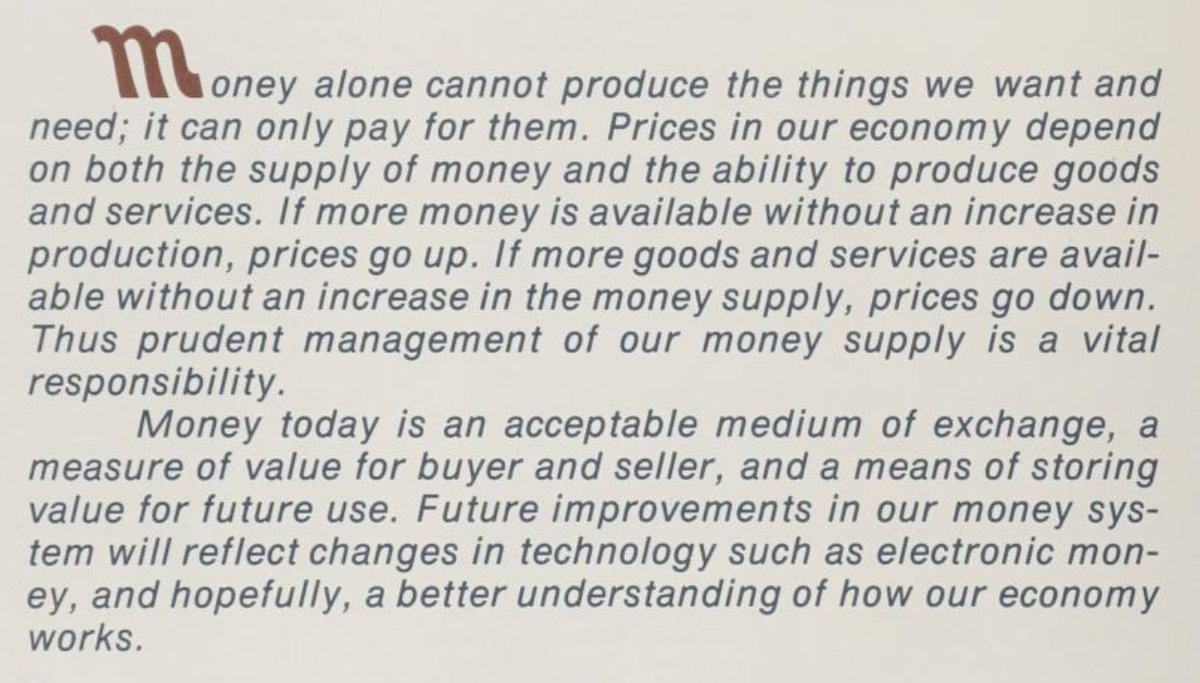

“Believe it or not, this was written by the Federal Reserve in 1970. Imagine going back in time to tell the author that in the year 2025, their institution inflated the money supply by ~40% in just four years, and that a new form of electronic money is taking the world by storm.”

Podcasts of the Week

Onramp Institutional Series | James Lavish & David Foley

In this inaugural session of the Onramp Institutional Series, we’re joined by James Lavish & David Foley of the Bitcoin Opportunity Fund to discuss the macro backdrop, tailwinds for bitcoin in 2025, and institutional allocation strategies.

Why Bitcoin Belongs in Every Portfolio | Glenn Cameron | TLT082

In this episode of The Last Trade, our new Global Head of Onramp Institutional, Glenn Cameron, joins to discuss bridging TradFi & bitcoin, the launch of Onramp Institutional, counterparty risk, education & domain expertise, bitcoin for family offices, & more!

The Institutions & Nation-States Have Arrived | Glenn Cameron | FS018

In this episode of Final Settlement, our new Global Head of Onramp Institutional, Glenn Cameron, joins to discuss his journey to Onramp, the launch of Onramp Institutional, market structure gaps, bitcoin’s role in portfolios, sovereign game theory, & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Brian Cubellis