Roundup: Bitcoin 2023 Results

Zack Morris | Research Analyst

Jan 4, 2024

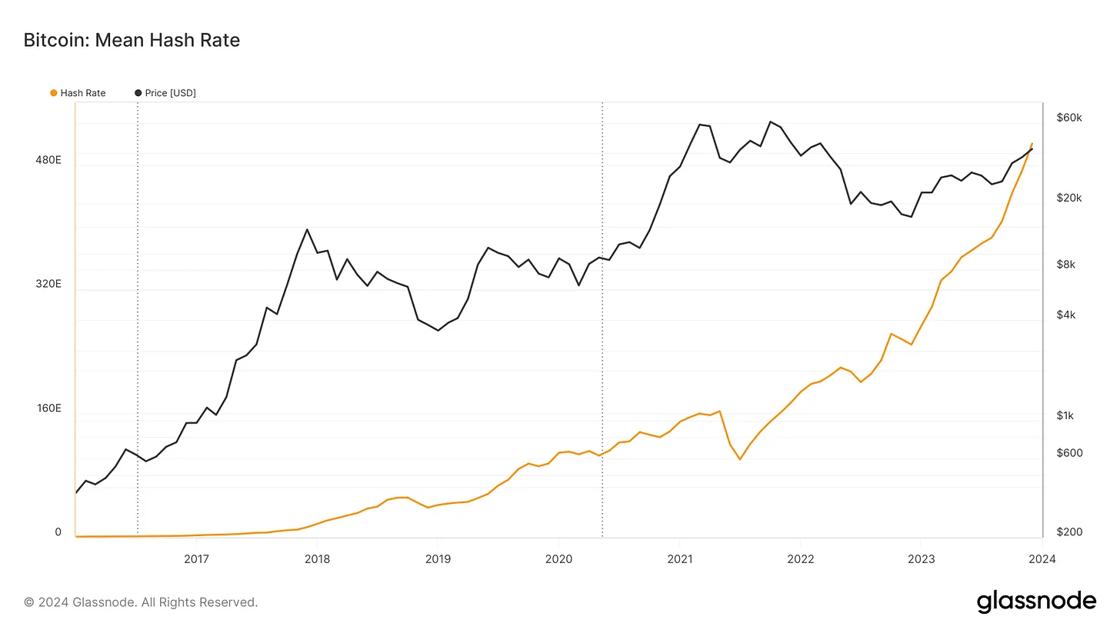

Bitcoin 2023 Results

Happy New Year! It’s time for a look at growth in network fundamentals for Bitcoin in 2023.

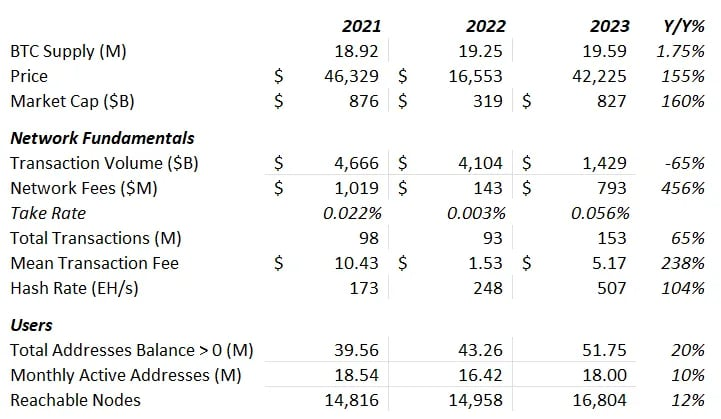

Adoption, as measured by total on-chain addresses with a non-zero balance, increased 20% to an all-time high of 51.75 million:

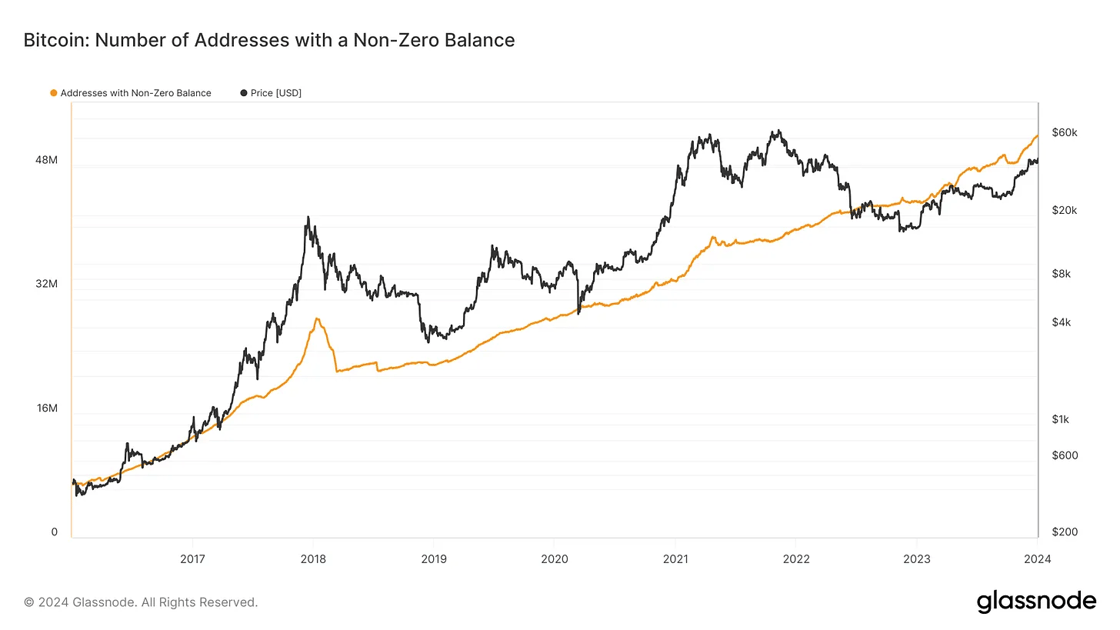

Decentralization, as measured by reachable nodes, increased 12% to 16,804:

source: Bitnodes

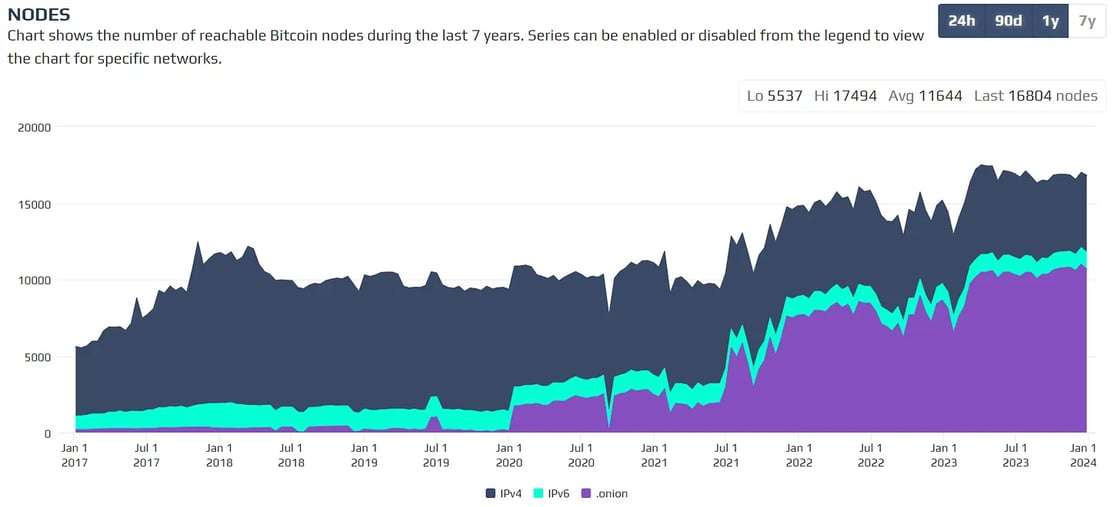

Security, as measured by hash-rate, increased 104% to an all-time high of 507 EH/s (exahashes per second) to end 2023:

Adoption, decentralization, and security are perhaps the three most vital Bitcoin fundamentals to monitor. Bitcoin, like any money, is a network, and the value of any network grows exponentially as users are added to the network.

That adoption of the Bitcoin Network has continued unabated throughout its history and may be accelerating as we exit 2023 is an encouraging sign for future continued network strength. That we’ve only just crossed over 50 million addresses shows how early we still are on the adoption curve for a global monetary network.

And, as long as Bitcoin remains decentralized and secure, one can find confidence in continued future adoption.

Ordinals and Inscriptions Fuel Transaction and Fee Revenue Growth

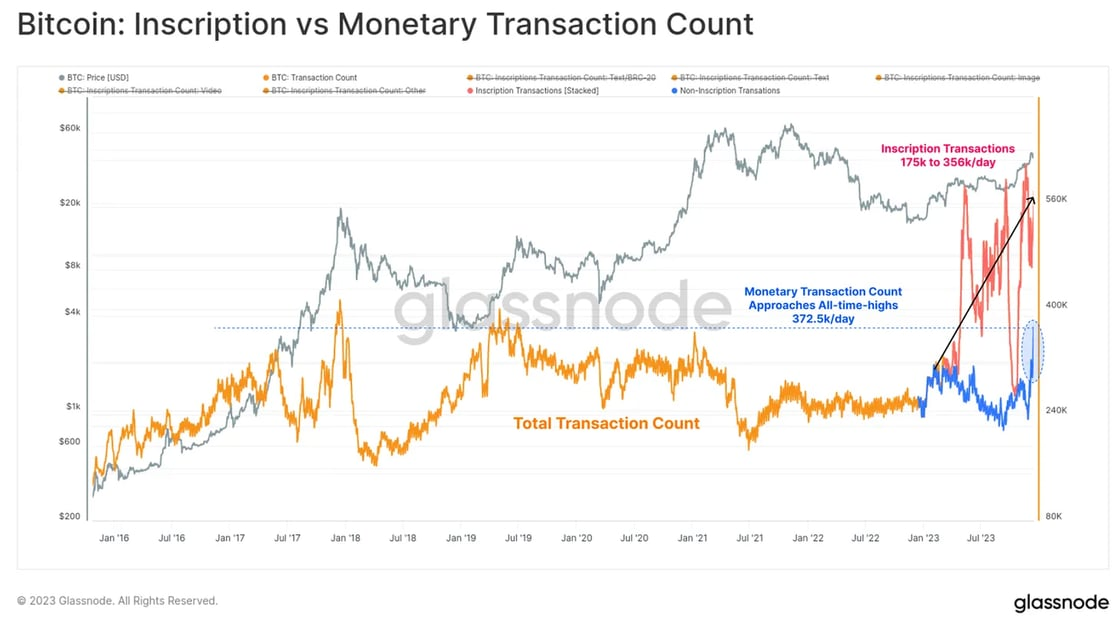

Fueled by Ordinals and Inscriptions, Bitcoin saw record transactions of 153 million in 2023, an increase of 65% from 2022.

Glassnode has a nice chart breaking out monetary transactions from inscriptions:

While daily monetary transactions currently sit just below all-time highs, inscriptions, an entirely new transaction type discovered in 2023, are now accounting for nearly as many transactions.

As debate around the ramifications of this novel, non-monetary use of Bitcoin continues, it has been a welcome development for miners in 2023.

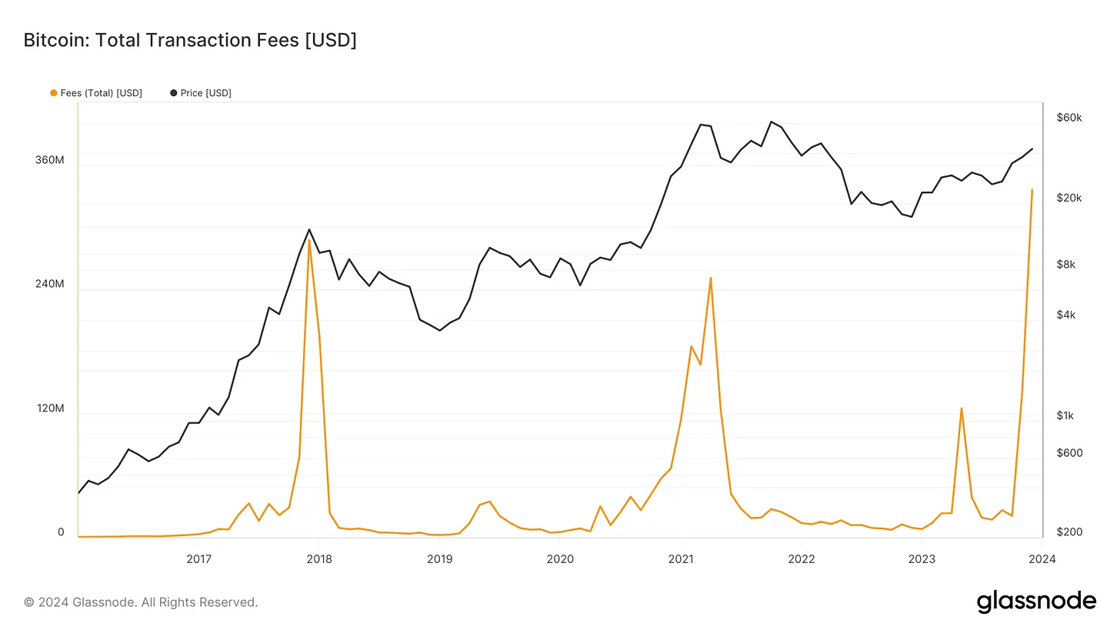

Network fees increased 456% to $793 million in 2023. While the annual total sits below the all-time high of just over $1 billion in fees set in 2021, miners exit 2023 earning more fee revenue in USD terms than ever before:

The current fee spike from inscriptions tops previous fee spikes that were achieved only when the bitcoin price was at all-time highs.

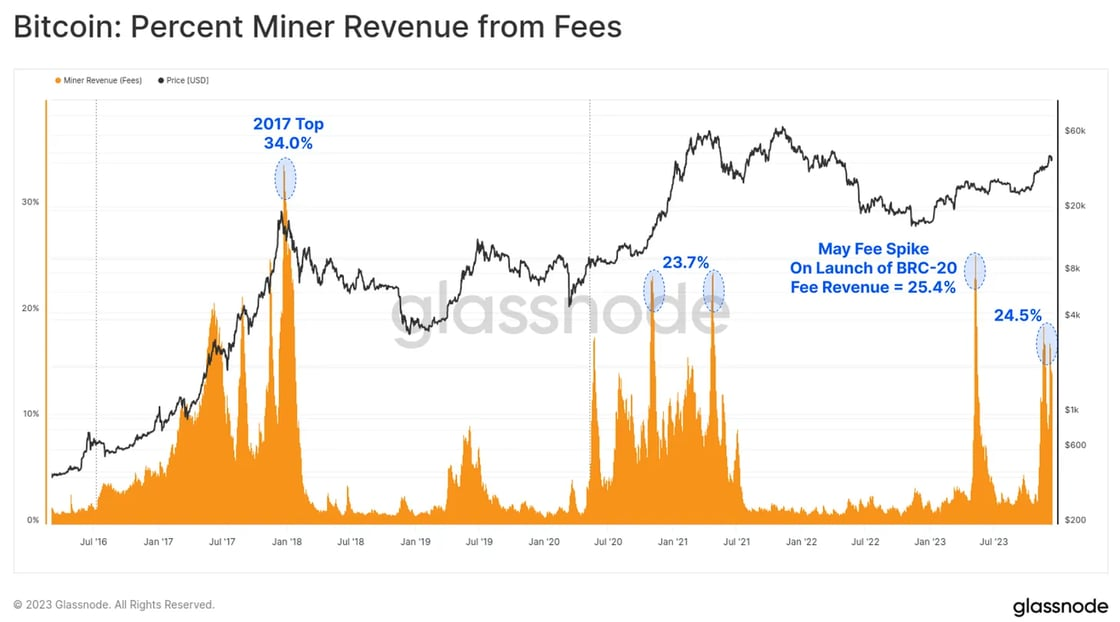

Percent of miner revenue from fees currently sits at 24.5% (chart from Glassnode):

Of course, the remaining 75.5% comes from the block subsidy, which is set to halve in 2024 and will ultimately decrease to zero.

With network fees representing the long-term sustainable “security budget” for Bitcoin, it is encouraging to see a robust fee market materialize in 2023 without the all-time high prices that have typically accompanied an increase in fees.

Total Transaction Volume Lags

The one, glaring on-chain fundamental that lagged in 2023 is total transaction volume, which fell 65% in 2023 to $1.4 trillion, down from $4.1 trillion in 2022.

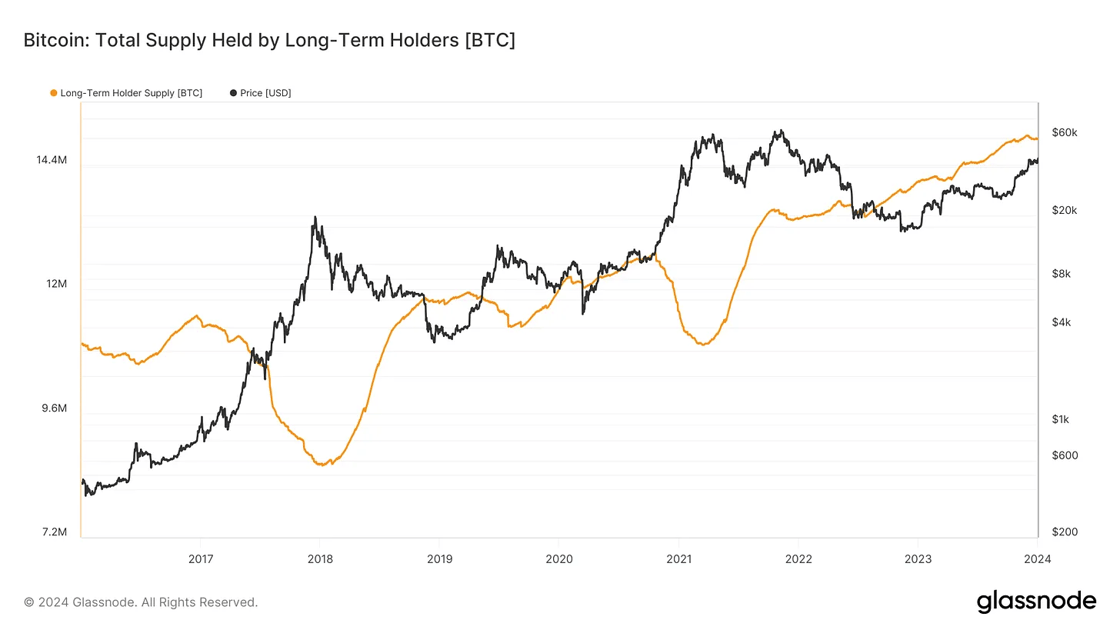

This is somewhat perplexing given the increase in other on-chain metrics, but is perhaps explained by a record amount of coins becoming dormant, or not having moved on-chain in the last 155 days, as represented by long-term holder supply reaching new all-time highs:

As the long-term holder supply approaches 15 million, or 77% of the total supply, as we exit 2023, this could be taken as an indicator that holders maintain high conviction and a low propensity to sell at current levels as we enter 2024.

Looking Ahead in 2024

Halving. ETF. Election year. Interest rate cuts.

There is no shortage of catalysts or narratives to pick from in the year ahead, but I want to highlight one that we know with a high degree of confidence will come to fruition.

With the halving expected in April 2024, Bitcoin’s annual supply inflation rate will decrease from 1.75% to ~0.86%. This means that, for the first time, Bitcoin will achieve a lower inflation rate and a higher stock-to-flow ratio than gold, which has historically averaged an annual supply increase of 1.62%.

2024 promises to be the year bitcoin evolves from promising to be the world’s hardest monetary asset to becoming the world’s hardest monetary asset.

Good luck to everyone in the New Year!

Podcast of the Week

The Last Trade E031: The Last Last Trade of the Year with Brian Cubellis

Last week’s episode of The Last Trade featured Brian Cubellis, Onramp’s Head of Strategy & Research. The Onramp team reflected on the recently completed year and considered forthcoming inflection points for bitcoin in 2024 and beyond. From imminent ETF approvals to the bitcoin halving in April, and everything in between, bitcoin is at a pivotal moment in its relatively short history.

Don’t miss the full discussion — check out the entire episode here.

Closing Note

Onramp provides bitcoin investment solutions built on top of multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris