Roundup: The Buck is Bucking

Mark Connors | Managing Director, Head of Global Macro Strategy

Oct 17, 2024

The Buck is Bucking

Through the noise of bank earnings, we find some signal about the Treasury market.

Banks are booming, credit is tight…feels like 2007, but don’t wait for another 2008 Global Financial Crisis. The March 2023 bank failures demonstrated that the Fed will do just about anything to keep banks afloat. There is a good chance we will not have a 2008 crisis again. Instead, the pain is being felt at the Federal Level.

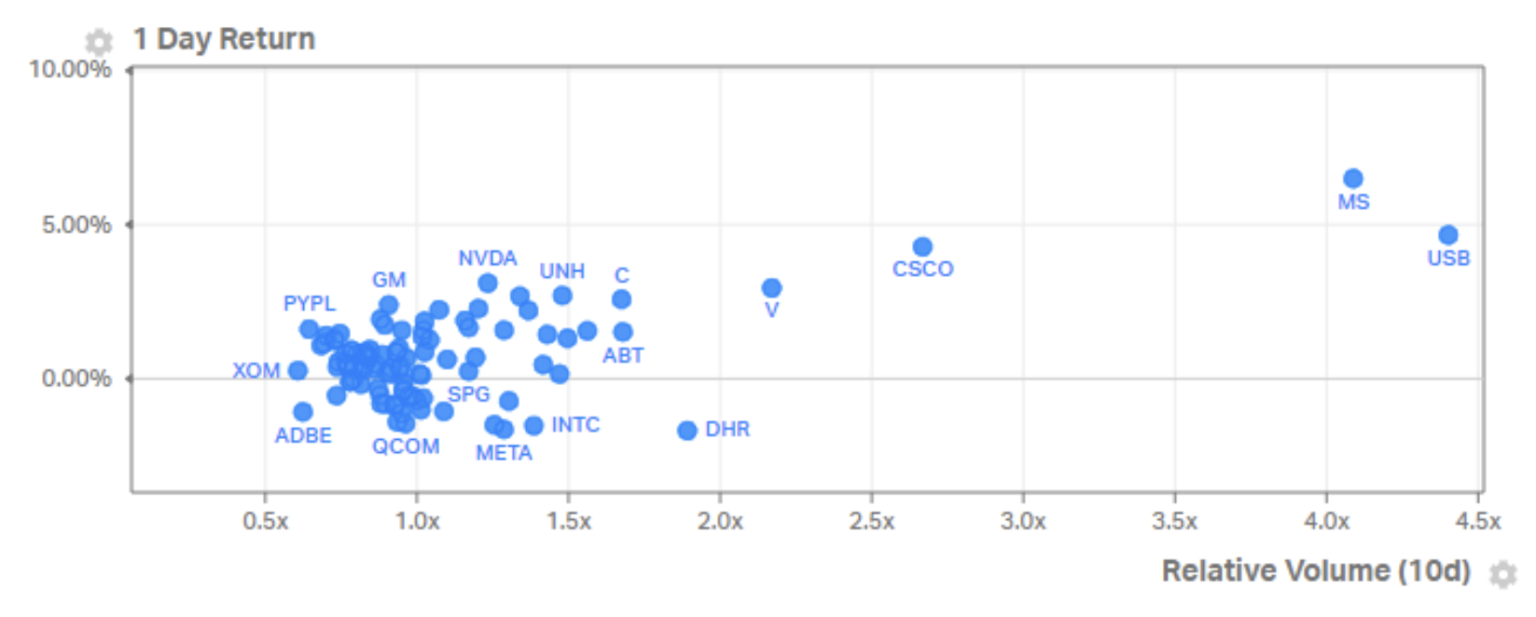

The good news? Banks posted higher than expected earnings on trading and asset management gains, lifting Morgan Stanley +6.5% and US Bancorp +4.5%, on heavy volume as shown below.

source: Onramp, Koyfin

Good day, but we still believe that the majority of U.S. banks are ‘wards of the state’, captured by the Fed after 2008, with little chance of earning their way out of their capital structures as tech alternatives continue to disintermediate them from clients and capital.

Yes, Citi also had a good quarter, lifting the stock 2.6% today, bringing YTD gains to 28.4%. But the moribund state of Citi is a legacy of Sandy Weill’s attempt to create America’s Financial Supermarket. An effort whose lasting result is best characterized by one statistic:

Citibank’s stock price is lower today than it was in 1993.

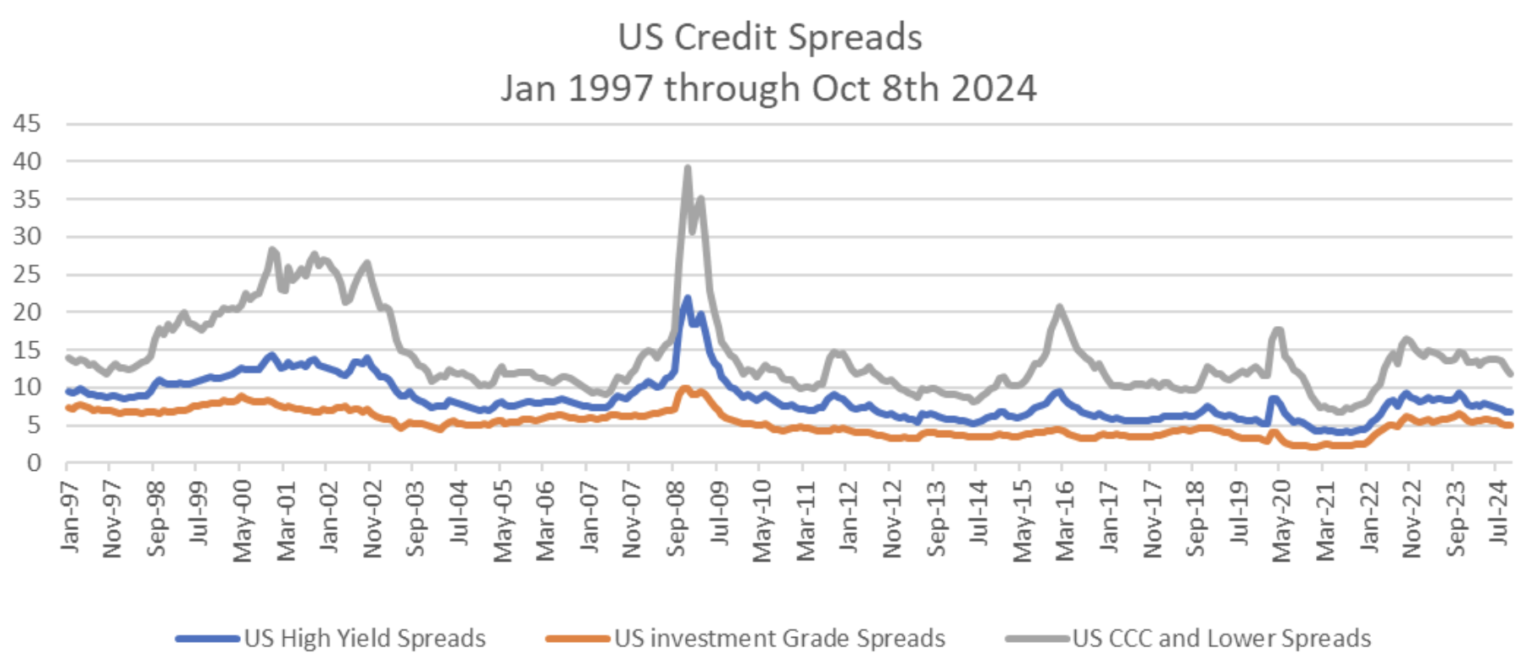

One reason why banks may be doing well is that corporate credit spreads have tightened throughout the year. This reduces the instances of charge-offs and reserves. A reprieve and very different from the pain in commercial real estate (CRE) portfolios being felt by the regionals and some on the commercial banking side.

The spring is coiled…but will it release?

source: Onramp, St. Louis Federal Reserve, BAML

When markets sell-off like we saw during Covid, the oil shock of 1Q16, and the 2008 Global Financial Crisis, credit spreads tend to widen as the risk of default increases.

In addition to the absolute levels increasing, the basis or difference between credit segments increases as well.

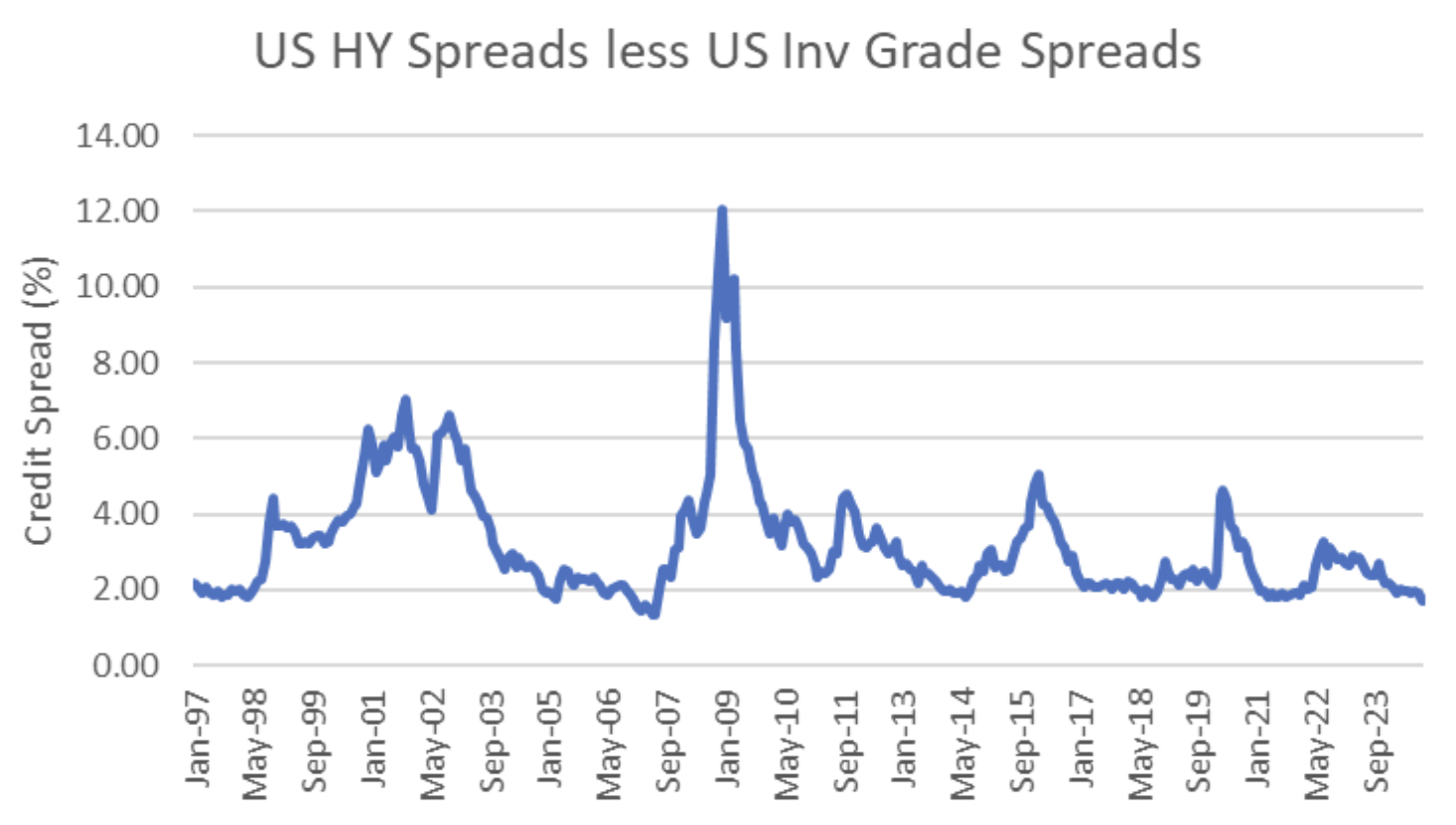

By that measure, we are FAR from any type of recession or concern as measured by the HY less IG basis provided below.

source: Onramp, St Louis Federal Reserve, BAML

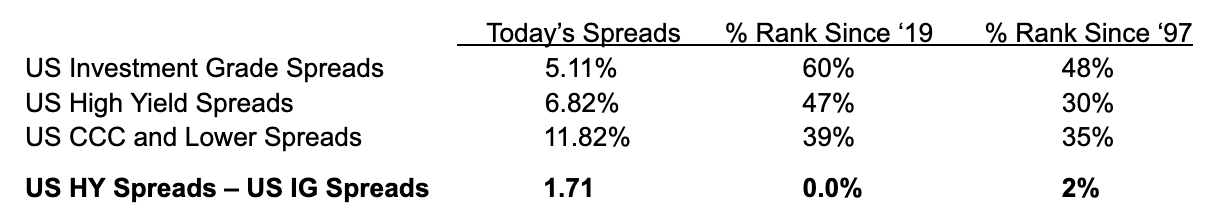

The listing of spreads and the basis at bottom of the table above are accompanied by a ranking for two periods; 1997 to present and October 2019 to present. For example, the 5.11% spread for Investment Grade Bonds ranks in the 60th percentile. So a bit above average.

The same spread ranks in the 48th percentile when compared to the longer time frame going back to 1997. The lower percent rank of 48% indicates that there were MORE instances of spreads higher than 5.11% from 1997 to present, than 2019 to present. It is a relative ranking.

We share two insights:

The past five years have seen unusually low spreads based on the full sample of data back to 1997.

The basis between HY and IG is VERY low. This means the market is NOT distinguishing between junk (HY) credits and Investment Grade credits to the degree they have in the past.

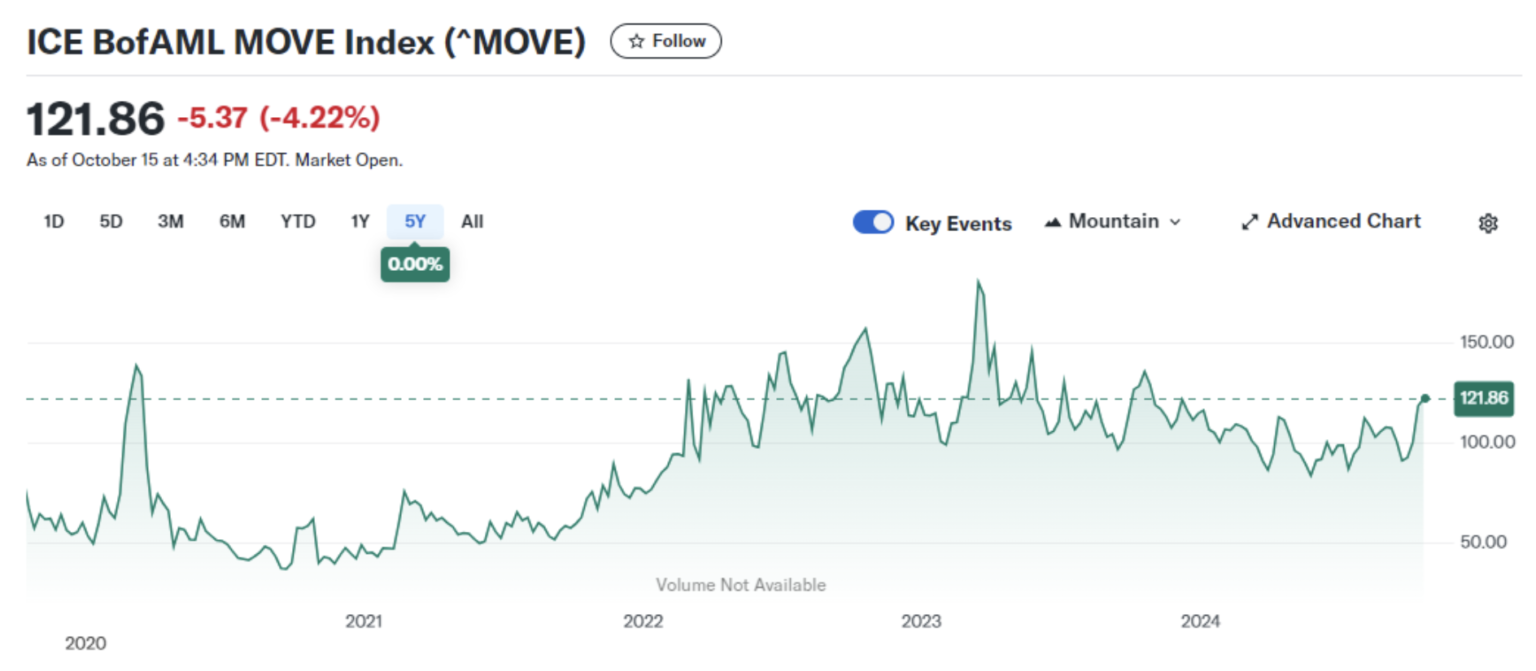

In fact, today’s basis is the lowest since June 2007. In the past, such a tight basis does not usually last, but we think accommodation by the Fed absorbs this risk and we now see it in the MOVE Index, a measure of US Treasury volatility via the US Treasury futures market. See below:

source: Yahoo Finance

The not so good news? The MOVE Index is shooting a distress signal to markets. Equities and corporate credit are flashing green, but why the red from US Treasury markets?

source: Yahoo Finance

A longer term view shows that the index has NOT receded from the 2022 Fed hiking induced risk-off move in markets. A point we have made before, with good reason as it is one of two signals we see worth following.

Bitcoin’s price and adoption being the other, of course.

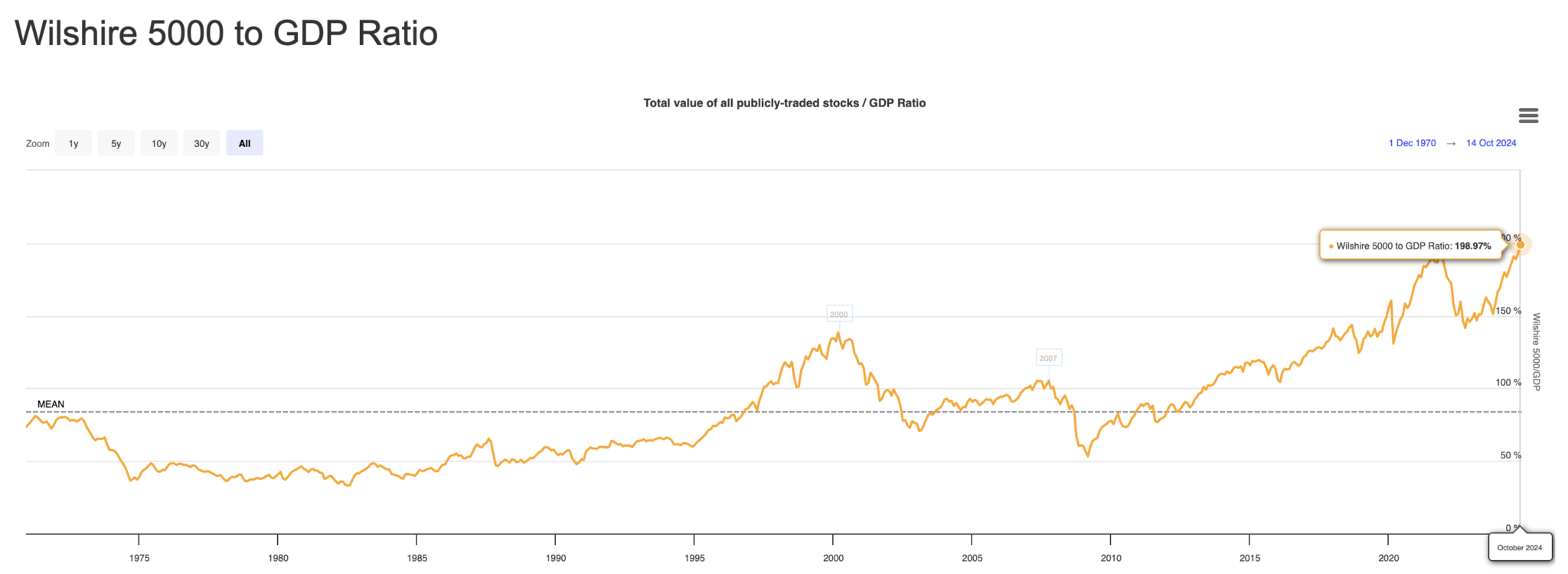

Chart of the Week

Courtesy of Longtermtrends:

The “Buffett Indicator” is a valuation multiple used to assess how expensive or cheap the aggregate stock market is at a given point in time. It was proposed as a metric by Warren Buffett in 2001, who called it “probably the best single measure of where valuations stand at any given moment”, and its modern form compares the capitalization of the US Wilshire 5000 index to US GDP.

The “Buffett Indicator” is currently near all-time highs, around ~200%.

Quote of the Week

“When you buy Bitcoin, you’re buying a category-leading tech product that solves a universal problem: where to put your hard-earned savings so that they can’t be seized or debased.

The real killer feature is that last part: Bitcoin cannot be debased. There will always be more fiat, more homes, more big tech shares, more government bonds, more gold bars, more sports cars, etc. But there will never be more than 21 million Bitcoin.”

Podcasts of the Week

The Last Trade E069: A Random Walk Down the Timechain with Bob Burnett

In this episode of The Last Trade, Bob Burnett, founder of Barefoot Mining & board member at Ocean Mining, joins to discuss entropy engines & randomness, hashing & its implications, blockspace scarcity, mining centralization challenges, & more.

Scarce Assets E021: Michael Saylor – Pursuit of Bitcoin Yield

In this episode of Scarce Assets, hosts Jesse Myers & Andy Edstrom are joined by Michael Saylor to discuss corporate bitcoin adoption, custodial considerations, the pursuit of BTC ‘yield’, bitcoin as digital capital, & more.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Mark Connors & Brian Cubellis