Roundup: Potential Fed Pivot & FASB Update Confirmed

Dylan LeClair | Guest Contributor

Dec 14, 2023

Hi all,

This is Dylan LeClair, presenting this week’s Onramp Weekly Roundup.

Before we get started… If you’re a HNWI or Institution looking for the best way to get exposure to bitcoin, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

Fed's Pivot Toward Lower Rates Amid Declining Inflation

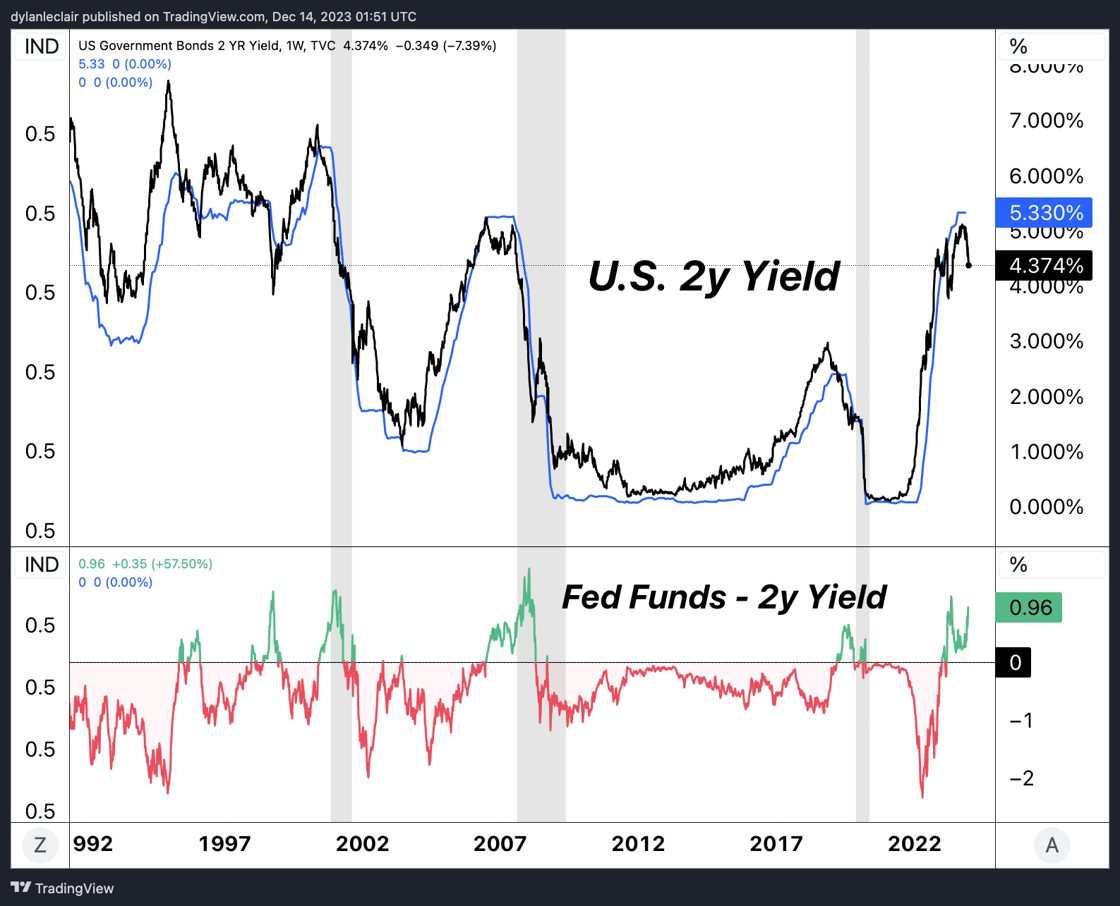

Fed Chair Jerome Powell announced the central bank’s shift from raising interest rates to considering rate cuts amidst slowing rates of inflation, a move that spurred an all encompassing rally. Despite leaving the door open for further rate hikes, the Fed’s stance has notably softened, with Powell emphasizing the risks of keeping rates too high. The Fed held its federal-funds rate steady, indicating that its July increase might mark the end of rate hikes.

Economic Projections and Market Response

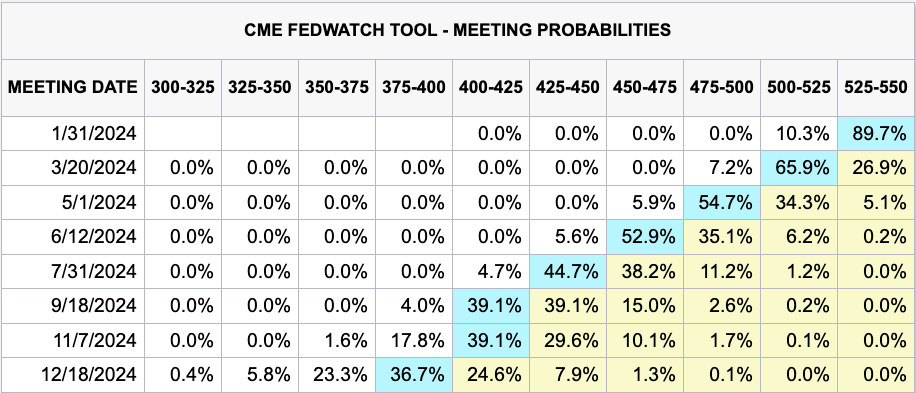

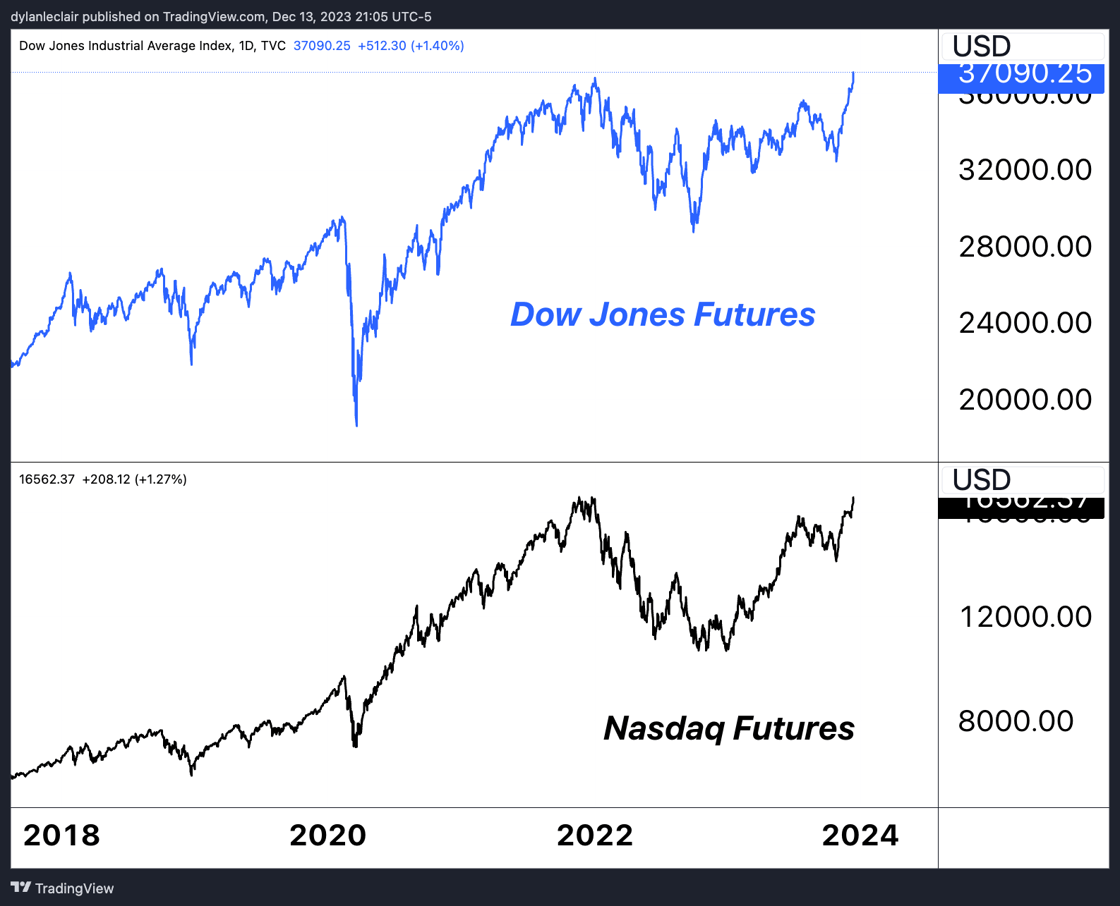

The interest-rate futures market, there is now an 73% implied probability of rate cuts starting in March. This shift is underpinned by improvements in the U.S. economic outlook, with slowing inflation and wage growth offering the Fed more flexibility. Powell’s strategy reflects a balance between avoiding economic harm from high rates and sustaining slower growth necessary for controlling inflation. The Fed’s approach in the coming year will involve carefully navigating these economic indicators to ensure a stable inflation rate. There was figurative celebration all around, with Dow and Nasdaq futures markets swiftly responded with all time highs throughout the day. “This has worked out beautifully. Things are going very well from [The Fed’s] perspective,” said William Dudley, a former president of the New York Fed.

FASB's Accounting Update Set for December 2024

Shifting our focus to bitcoin, the strong post FOMC reaction from risk markets was aided beforehand with news of the Financial Accounting Standards Board (FASB) officially changing how bitcoin is accounted for and disclosed, starting December 15, 2024. This update, a response to widespread demand, aims to make financial reporting on crypto assets more transparent and accurately reflective of their economic value. It will require crypto assets, including bitcoin, to be measured at fair value each reporting period, with any changes affecting net income. Additionally, there’s an emphasis on clearer disclosure about significant holdings and contractual restrictions. Early adoption is permitted, offering flexibility for entities preparing to potentially include crypto assets on their balance sheets. Previously, many companies were hesitant to add bitcoin due to its classification as an intangible asset, which meant that only unrealized losses, and not unrealized gains, were factored into quarterly earnings.

Podcast of the Week

E029: Shaping Bitcoin Policy with Lee Bratcher

This week’s episode of The Last Trade features Lee Bratcher from the Texas Blockchain Council discussing the challenges and work being conducted around bitcoin regulation. The conversation moves to discussing the Treasury Department’s proposal for nodes and mining pools to comply with the Bank Secrecy Act, before highlights Texas’ influence on policy-making due to its economic weight, particularly its role in building a more robust electricity grid. The episode also explores grassroots bitcoin politics, emphasizing local political engagement and the impact of politicians like Senator Cruz and RFK on the perception of bitcoin.

Don’t miss the full discussion — check out the entire episode here.

Closing Note

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair