Roundup: GameStop Embraces the Endgame

Brian Cubellis | Chief Strategy Officer

Mar 27, 2025

GameStop Embraces the Endgame

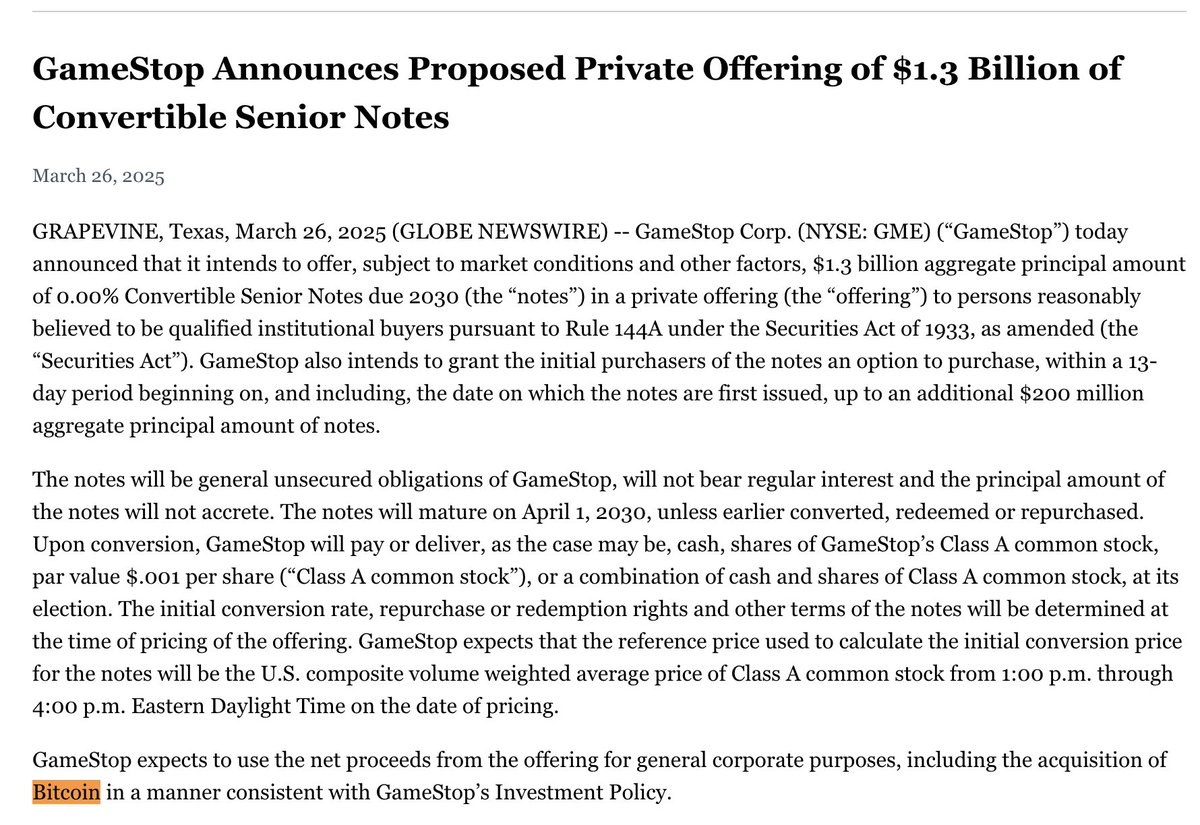

This week, GameStop announced it will begin building a bitcoin treasury, revealing plans to allocate its substantial $4.6 billion in cash reserves—and newly secured convertible debt proceeds—into bitcoin.

Hot on the heels of an earnings call confirming the shift, the company disclosed a $1.3 billion convertible debt offering, signaling an aggressive, MicroStrategy-inspired strategy to accumulate as much bitcoin as possible. Once a mere rumor fueled by meme-stock speculation, GameStop’s pivot is now official.

Why It Matters

A Household Name Joins the Fray: While Tesla and some lesser known firms like Semler Scientific have adopted bitcoin to varying degrees, GameStop is a ubiquitous retail brand that nearly every American recognizes—thanks in large part to its meme-stock mania saga. This move could open the door for more mainstream corporations to view bitcoin as a strategic reserve asset, further normalizing the concept in boardrooms across the country.

The Meme-Stock Legacy Evolves: GameStop’s share-price explosion in early 2021 was primarily driven by a desire to corner short-selling hedge funds, with little emphasis on long-term corporate fundamentals. This time around, however, the narrative centers on building a fortress balance sheet, emphasizing bitcoin’s scarcity and role as a hedge against dollar debasement. The loyal retail investor base that championed GameStop is likely to be equally enthusiastic about a pivot to the accumulation of bitcoin.

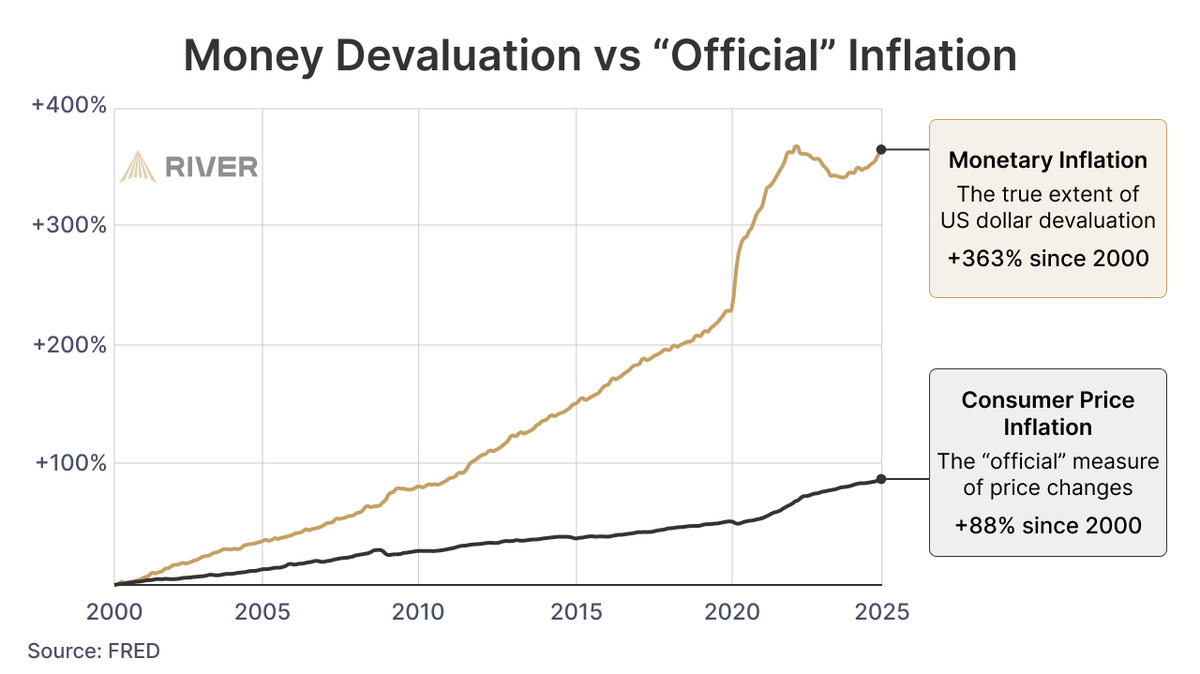

Deploying Excess Cash: Sitting on $4.6 billion and ready to raise an additional $1.3 billion, GameStop faced a classic dilemma: how to preserve and grow its capital in a monetary environment that continually erodes purchasing power. Bitcoin offers a straightforward solution—park wealth in a provably finite asset. This approach buys time and optionality for future acquisitions or strategic moves, while avoiding the slow bleed of inflation.

The Domino Effect: GameStop won’t be the last. Rumors already swirl around Meta and Dell, whose CEOs have previously signaled proclivities for bitcoin; and speculation abounds in Japan, where Nintendo might follow in the footsteps of MetaPlanet (the best-performing stock in Japan since they adopted a bitcoin treasury strategy). These moves, if realized, stand to further shift the Overton window for what’s considered fiscally prudent in corporate treasury management.

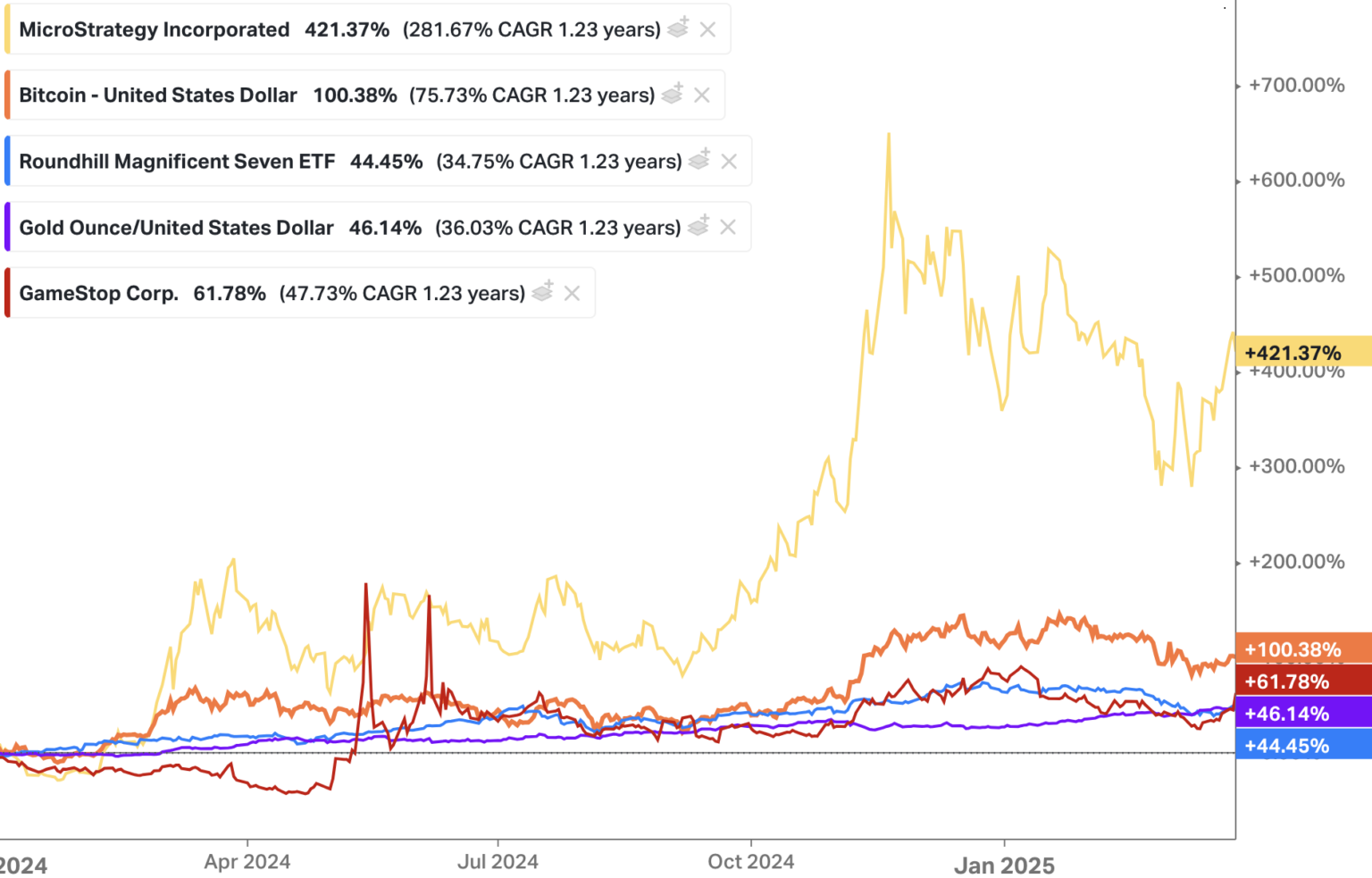

Unique Financial Market Leverage: Adopting Bitcoin can also heighten attention and volatility around a company’s stock, potentially allowing them to borrow or issue equity at very low effective costs. With a bitcoin-backed narrative, corporates can tap capital markets in unique ways like MicroStrategy has demonstrated—enabling repeated fundraising at attractive terms.

Building a Meaningful Allocation: Smaller corporates experimenting with bitcoin might accumulate a modest position, but GameStop’s robust balance sheet gives it the chance to compete at a scale more akin to MicroStrategy or large-scale miners. Thanks to billions in existing cash plus the forthcoming $1.3 billion, it could secure a significant slice of the bitcoin supply—potentially joining the upper echelon of corporate BTC holders.

A Coiled Spring

Global signals—from nation-state bitcoin reserves to looming quantitative easing—point toward a exceptionally constructive undercurrent for bitcoin. Yet the price remains relatively muted. It’s crucial to remember that announcements and intentions alone won’t drive sustained price movements; large-scale accumulation and liquidity flows must follow.

The U.S. government naming bitcoin a strategic reserve asset, for instance, is a powerful “signal,” but real demand arrives when these entities actively purchase bitcoin in volume. These developments are still in the “announcement” phase. As actual bitcoin buying unfolds (and global liquidity trends point toward further monetary easing), the pieces are in place for a potential surge.

Low Time Preference Wins

For those watching from the sidelines, these developments reinforce the fact that bitcoin’s 21-million finite supply stands in stark contrast to debt-laden fiat systems. Each day, more corporations and even nation-states awaken to that reality, concluding they must accumulate bitcoin to safeguard purchasing power.

In the meantime, it’s important to focus on structural adoption trends and the inevitability of monetary easing (and ultimately debasement). Over the long haul, bitcoin’s scarcity, network effects and growing acceptance as global money form the bedrock of the asset’s value proposition.

GameStop’s pivot to a bitcoin treasury strategy serves as the latest milestone in a cascade of adoption that started with early pioneers like MicroStrategy and has now reached mainstream consumer companies. While it remains to be seen how aggressively GameStop will deploy its sizable capital into bitcoin, the stage is set for continued corporate uptake.

Chart of the Week

“There is a 275% gap between the inflation you’re told and real inflation.

This is why we Bitcoin.”

Quotes of the Week

“The world is converging on a #Bitcoin Standard — most just don’t realize it yet.”

Podcasts of the Week

The Ultimate Savings Tech: How Insurance Fortifies Bitcoin’s Promise

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, Brian Cubellis, Tim Kotzman & special guest Bram Kanstein discuss bitcoin’s asymmetric opportunity, public perception & adoption, gold versus digital gold, the ultimate savings technology, private key mgmt. & bitcoin insurance & more!

The U.S. Just Kicked Off the Bitcoin Gold Rush—Here’s What It Means

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, Brian Cubellis, & Tim Kotzman discuss volatility & sentiment, significance of the SBR EO, the digital gold rush, sovereign game theory, recapping Bitcoin for America in DC, key industry deals & more!

Why Institutions Still Don’t Get Bitcoin—And What Will Change That

In this episode of Scarce Assets, we’re joined by Bob Griffin, founder of CactusPEAK Digital, to discuss Bob’s journey from Wall Street to bitcoin, educating clients on bitcoin vs crypto, the state of institutional adoption, the role of consultants & more!

A New Era of Coverage: Bitcoin Insurance Powered by Distributed Custody

In this episode of Final Settlement, we’re joined by Ben Davis, CEO of Native Insurance to discuss Onramp & Native’s recent partnership, historical insurance market gaps, Lloyd’s underwriting of multi-institution custody, benefits of redundant, distributed custody models & more!