Roundup: Regulatory Winds Shifting

Zack Morris | Research Analyst

May 23, 2024

Regulatory Winds Shifting

The political climate with respect to the crypto industry seems to have taken an abrupt 180 degree turn in literally just this past week.

SAB 121

First, last Thursday the Senate voted to approve a resolution rejecting the SEC’s Staff Accounting Bulletin 121 policy on crypto accounting, known as SAB 121.

The policy, issued by the SEC in 2022, holds that US public companies under GAAP accounting must account for client digital assets held in custody as liabilities on their own balance sheet. The policy has effectively legislated banks out of the digital asset custody business because of bank capital requirements. While fees for custodial services are typically sub 50 basis points, the current cost of capital is the fed funds rate of 5.25%. If banks were to hold matching assets to their customer’s digital assets, they’d be effectively borrowing at 5.25% to earn at 0.50%. That’s not good business.

Non banks aren’t subject to the same capital requirements. This has allowed crypto-native non-banks like Coinbase, Gemini, and BitGo to win the majority of the business custodying bitcoin ETF assets, for example, while traditional financial asset custodian powerhouses like State Street and BNY Mellon have been left out of the business despite hiring for and building digital asset custody capabilities over many years leading up to the approval of the bitcoin ETFs. Banking industry interest groups were reportedly applying pressure to lawmakers to vote to reject SAB 121 as it left them unable to compete.

The Democrat controlled Senate’s vote to approve the resolution follows the Republican controlled House, and the bipartisan vote represents the first time Congress has passed standalone crypto legislation. Senate democrats broke ranks from the Biden Administration on the vote, defying the President’s threats to veto the resolution if approved. Senate Majority Leader Chuck Schumer urged democrats to “vote their conscience” on SAB 121 ahead of the vote.

President Biden has until May 28th to follow through on his veto promise, but in any event it seems the political tides are turning for the industry as we head into election season.

Spot Ether ETF

Next, a complete shocker on Monday afternoon when multiple news outlets picked up that the SEC was suddenly asking exchanges to update 19b-4 filings “on an accelerated basis” ahead of today’s (5/23) initial deadline to approve or reject VanEck’s application for a spot ether ETF. Prediction market Polymarket was pricing in a 10% of May approval before the news broke.

19b-4 filings are due from the exchanges that wish to list the ETF as part one of a two-part approval process for the ETF to ultimately list. The other is an S-1 filing, due from the ETF issuer. It is possible for the SEC to approve the 19b-4 filings but not the S-1 filings this week, delaying the launch but ultimately paving the way for listing of the ETFs soon.

The change in stance from the SEC caught many by surprise as there had been a complete lack of engagement from the agency on ETH ETFs, in contrast to the bitcoin ETFs which were approved earlier this year. Moreover, the SEC has been generally hostile to the crypto industry under Chair Gary Gensler, who noted in his Statement on the Approval of Spot Bitcoin ETFs that he only approved them because the courts forced the SEC’s hand, and that the approval of ETFs holding one non-security commodity, bitcoin, “should in no way signal the Commission’s willingness to approve listing standards for crypto asset securities. Nor does the approval signal anything about the Commission’s views as to the status of other crypto assets under the federal securities laws…”

It is, of course, unfortunate that it now seems obvious that politics have more to do with interpreting and applying securities laws than principled lawmaking does. But, whatever one’s stance on ETH and other digital assets, this pivot from lawmakers certainly represents a change in attitude from one of hostility to perhaps being more willing to work with the industry to create sensible digital asset legislation, and can only be seen as a net positive for the industry.

FIT21

Finally, on Wednesday 5/22 the House voted in favor of the Financial Innovation and Technology for the 21st Century bill, known as FIT21. The bill will now be sent to the Senate.

FIT21 is the most significant digital asset legislation proposed in the US to date. The key provision in the bill is to classify digital assets as commodities provided they meet certain standards of decentralization. Under the bill, a digital asset is considered decentralized if no single entity has unilateral control over the blockchain or its usage, and no issuer or affiliated party holds 20% or more of the digital asset or its voting power.

The bill would give jurisdiction over digital commodities to the CFTC and digital securities to the SEC. The bill also provides a roadmap for transforming from a digital security to a digital commodity through a decentralization process.

Proponents of the bill cite consumer protection and clarity for entrepreneurs and innovators as the bill’s key virtues.

Opponents of the bill, including the White House and SEC Chair Gary Gensler, claim that the bill “would create new regulatory gaps and undermine decades of precedent regarding the oversight of investment contracts, putting investors and capital markets at immeasurable risk.”

In Sum…

Again, regardless of one’s views on bitcoin and non-bitcoin digital assets, a couple things seem to be clear.

The first is that “crypto” is now a political issue, and politicians see it as swinging votes. They are responding to constituent and industry calls to take a more good faith approach to working with the industry to create sensible regulation. I think this is clearly a net good for bitcoin, as we would rather have the government embrace the network than actively try and hinder it.

In an ironic twist of fate, the news the SEC was set to approve spot ether ETFs, sending ETH up 18%, comes exactly three years to the day after China banned bitcoin mining and sent the bitcoin price spiraling 30% on May 21, 2021. Today, bitcoin hashrate is at an all-time high and is 3.5x what it was before the China ban. It is a reminder how in the short-term, government action can either accelerate or impede bitcoin’s progress, but in the long-run the incentives, usefulness, and resilience of the network is what matters.

The second is that the banking sector is feeling left out of the game and wants in. The banks mentioned above have invested resources in building out digital asset infrastructure and want to be able to employ it and build new businesses. Their clients want it too.

Finally, while much of the above commentary and laws apply to the “crypto” industry as a whole, and are probably even more impactful for non-bitcoin digital assets in the short run, it does not mean bitcoin and crypto are the same thing. In the long-run a more favorable regulatory environment sets the stage for an open, free market competition among all digital assets to be adopted as money.

Bitcoin is unique among all assets, digital or not, with respect to its monetary properties. To learn more about why bitcoin is different, I encourage you to read Proof-of-Work vs. Proof-of-Stake, The Crypto Catch-22: Why Bitcoin Only, and Bitcoin, Not Crypto from the Onramp Fundamentals Series.

CME Reportedly to Launch Spot Bitcoin Trading

In news that would have led bitcoin bulletins in most other weeks, the Financial Times reported last week that futures exchange CME (Chicago Mercantile Exchange) was planning to launch bitcoin trading.

CME Group already hosts the largest bitcoin futures trading venue globally, and integrating spot bitcoin trading would better enable investors to engage in basis trading, a strategy where they sell futures and buy spot, capturing a small difference between the two.

The report ironically comes just weeks after CME’s competitor CBOE announced plans to shutter its spot digital asset trading platform, citing regulatory uncertainty.

Coinbase, the largest US-based bitcoin trading venue and second largest globally behind Binance, saw its stock drop 9% on news of CME entering the market. Coinbase, however, appears to be responding competitively with its own plans to expand its derivatives trading platform to include retail-sized futures contracts for oil and gold.

13F Filing Rundown

Last week, we discussed how it was revealed through 13F filings that the State of Wisconsin Investment Board (SWIB) had purchased about $156 million of the new bitcoin ETFs, getting off zero on behalf of Wisconsin state pensioners.

With the rest of the 13F filings now public, we have a more complete picture of who was buying the bitcoin ETFs in Q1.

Hedge fund Millennium was the largest holder, with $2 billion across four bitcoin ETFs. Hedge fund Schonfield was 2nd with $450 million. Hedge funds are likely to be holding the ETFs as part of a hedged pair trade, and it is unlikely that these investments represent outright long exposure to the asset.

According to Bloomberg ETF analyst Eric Balchunas, at an aggregate level investment advisors were the largest holders (60%) and hedge funds were second (25%).

All told, over 500 filers reported holding the new bitcoin ETFs as of March 31, which is about 200x the average for new ETFs according to Balchunas. IBIT alone had 414 reported holders, a record for an ETF in its first filing period.

13F filings are required of institutional investors who manage over $100 million in assets to disclose their holdings on a quarterly basis.

With the filings official, we can confirm what we already expected: the institutional appetite for bitcoin as an investable asset far exceeds anything comparable that has come before it.

Chart of the Week

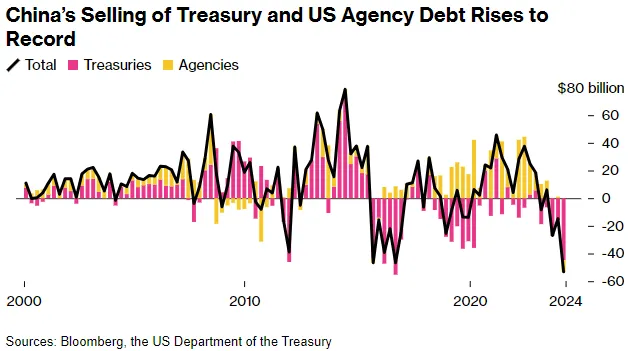

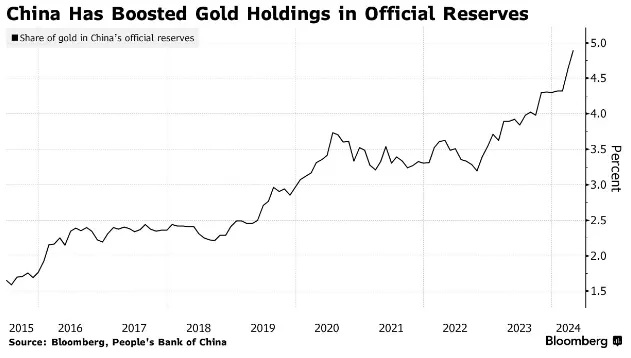

China sells a record amount of US debt to buy gold in Q1, courtesy of Bloomberg.

Quote of the Week

“They say in 30 years a burger and fries will cost $16, a vacation $12,500, and a basic car $65,000.

No problem. You’ll eat in. You won’t drive. And you won’t go anywhere.”

TIAA CREF magazine advertisement, 1996.

Market Update

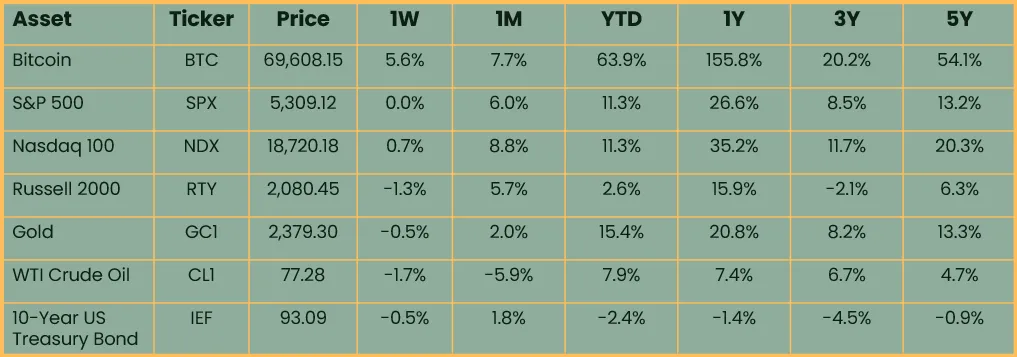

as of 5/22/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Bitcoin rallied 5.6% on the week as the whole crypto space rose on news of an imminent spot ether ETF approval from the SEC. Stocks finished flat on the week on low volumes as investors waited patiently for Nvidia to report quarterly results on Wednesday evening. Gold, crude, and bonds all fell in reaction to Fed speakers saying it was possible that the Fed’s next move could be tightening instead of easing.

Podcasts of the Week

The Last Trade E050: Bitcoin’s Monetary Realities with Bitstein

In this episode of The Last Trade, Michael Goldstein (Bitstein), President of the Satoshi Nakamoto Institute, joins to discuss bitcoin’s monetary realities, Austrian economics, finite scarcity, exponential growth & hyperbitcoinization, meme-based rhetoric, the mission of the Satoshi Nakamoto Institute, & more.

Final Settlement E006: Value 4 Value (Part I) with Oscar Merry of Fountain

In this episode of Final Settlement, Oscar Merry from Fountain joins the pod to discuss the ‘value for value’ philosophy, content monetization, empowering creators & users, nostr & discoverability, & more.

Final Settlement E007: Value 4 Value (Part II) with Sam Means of Wavlake

In this episode of Final Settlement, Sam Means from Wavlake joins the pod to discuss the evolution of Wavlake, fixing broken incentive models, improving monetization methods, reimagining event ticketing, & more.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris