Roundup: Miner Capitulation, Hash Ribbons, & Price

Zack Morris | Research Analyst

Jun 20, 2024

Miner Capitulation, Hash Ribbons, & Price

“Miner capitulation” has been cited by many as the cause of the recent, tepid bitcoin price action.

But what is miner capitulation, and how do we know when it is happening and when it is likely to end? What clues into future price action does being armed with this information give us?

Miner capitulation is when bitcoin miners start shuttering operations because they’ve become unprofitable, often accompanied by selling bitcoin to shore up balance sheets in this time of stress.

Specifically, the cost to mine bitcoin, borne mostly by the cost of electricity, starts to exceed the revenue from mining bitcoin. This can happen to a bitcoin miner when they’re costs unexpectedly rise, the quantity of bitcoin they’re mining per unit of cost falls due to either the block subsidy getting halved and/or a reduction in network fees, or, finally, when the bitcoin price falls in USD terms. Since a bitcoin miner’s costs are denominated in dollars but they’re revenues are dominated in bitcoin, the BTC/USD exchange rate is a crucial component of miner profitability although it is largely outside of a miner’s control.

Industry-wide miner capitulation typically happens in bear markets, because the bitcoin price is falling rapidly, and in the period post-halving, because the block subsidy is cut in half. Throughout bitcoin’s history, the block subsidy has comprised the substantial majority of miner revenue, with fees being the minority. As bitcoin matures and the block subsidy continues to halve every four years, fees will at some point flip the block subsidy as the primary source of miner revenue, and perhaps we will no longer consistently go through periods of miner capitulation post-halving.

As it stands today, though, we are currently going through another period of post-halving miner capitulation.

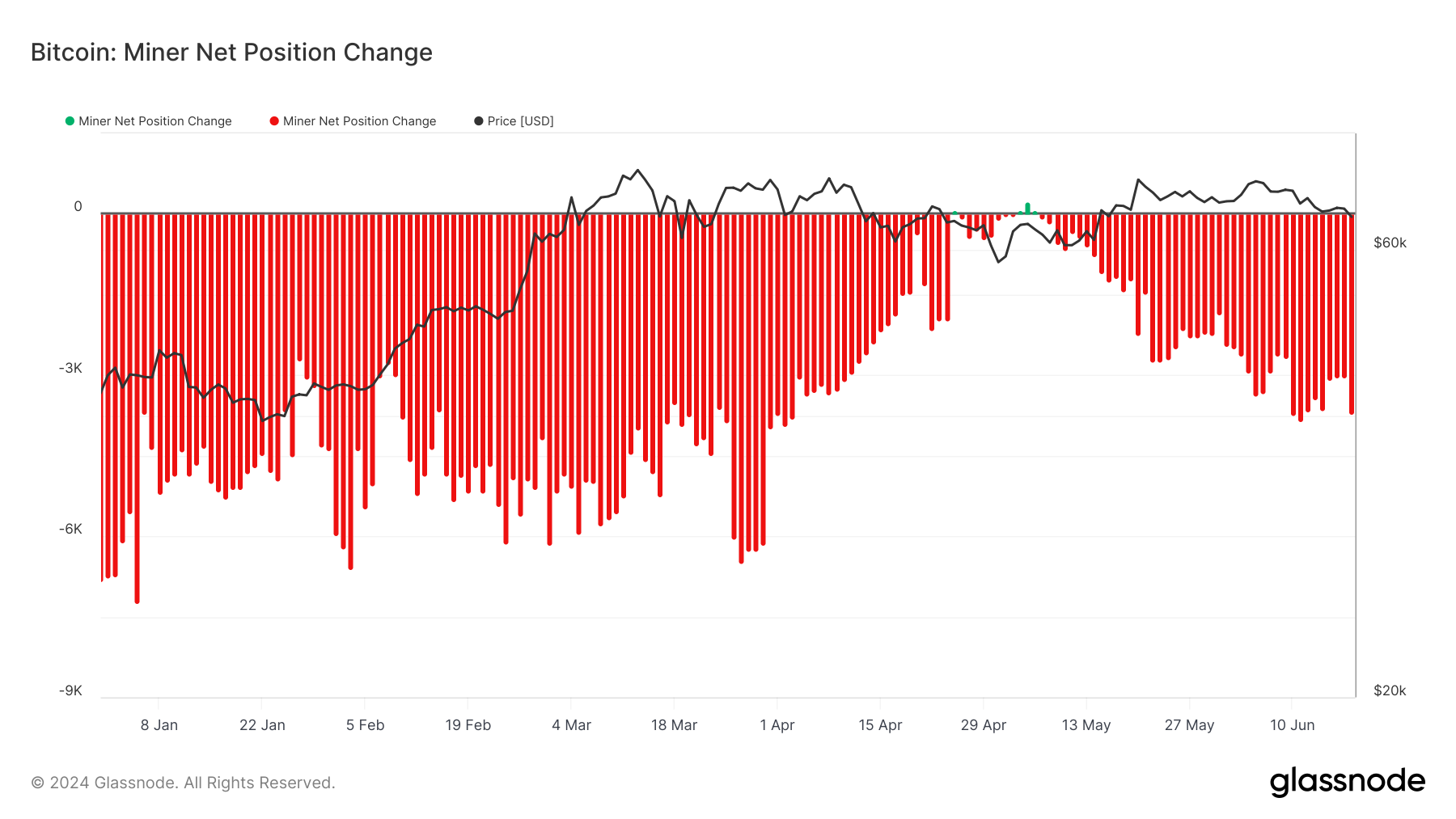

This can be seen on-chain in the modest, but visible, recent dip in the weekly mean network hashrate as can be found on the Onramp Terminal and is confirmed when we look at miner net position change — the 30 day change in the supply held in known miner addresses:

Source: Glassnode

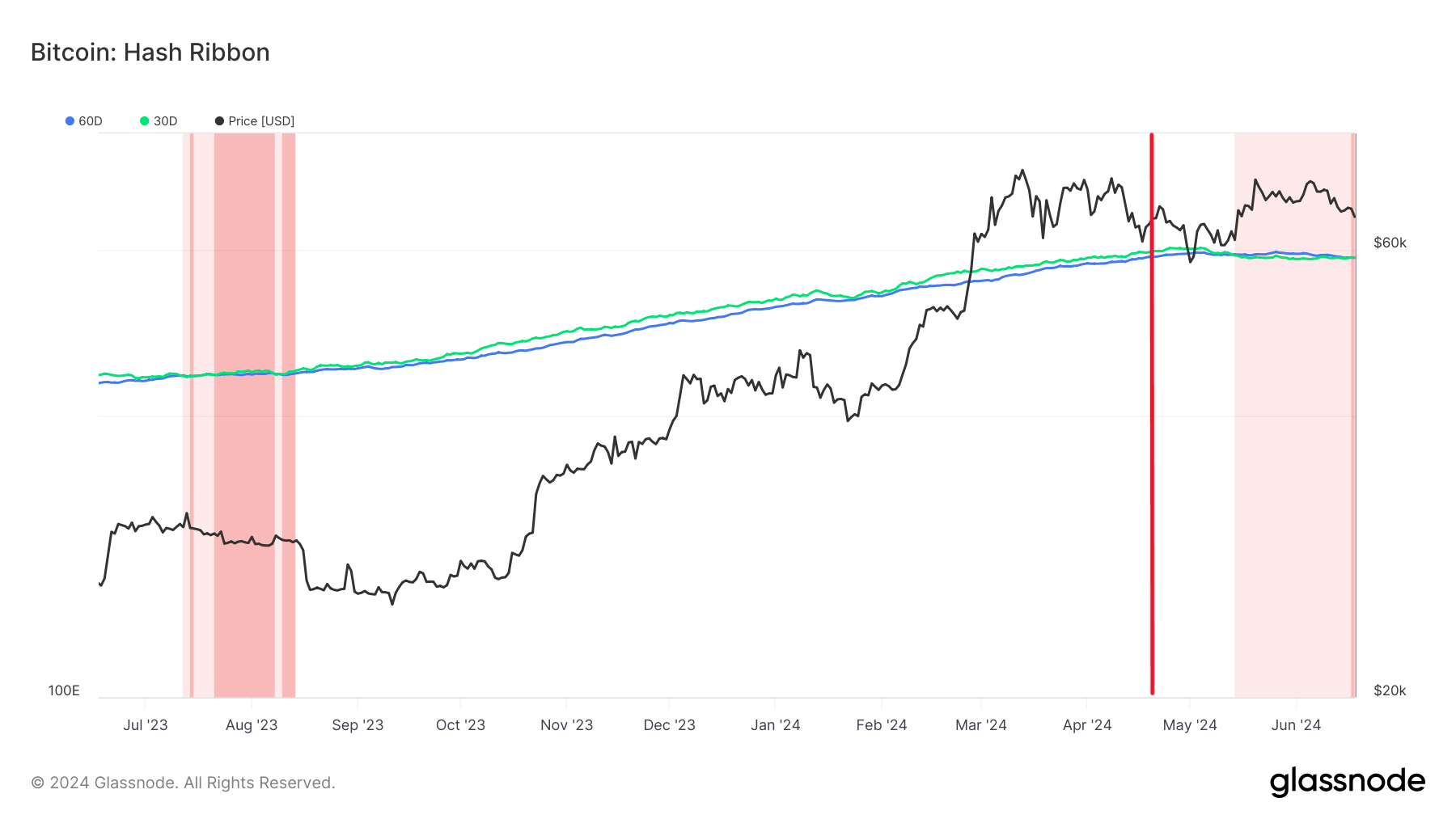

We can also get a more granular view into miner capitulation by looking at Hash Ribbons. The hash ribbon we’re going to be looking at is the most popular and shows us the relationship between the 30-day moving average and the 60-day moving average network hashrate (different “ribbons” show us the relationship between different moving averages, for example, 10-day and 20-day).

When the 30d MA crosses over the 60d MA to the downside, this signals miner capitulation and a declining network hashrate. When the 30d MA crosses back over the 60d MA to the upside, this signals that miner capitulation is over and we are back on trend of a sustained move higher in network hashrate. This positive 30-60 cross has also historically had predictive power for price.

Let’s take a look back at Hash Ribbon and price in the year after the first three bitcoin halvings to contextualize where we are in the current market and get clues as to what might be next.

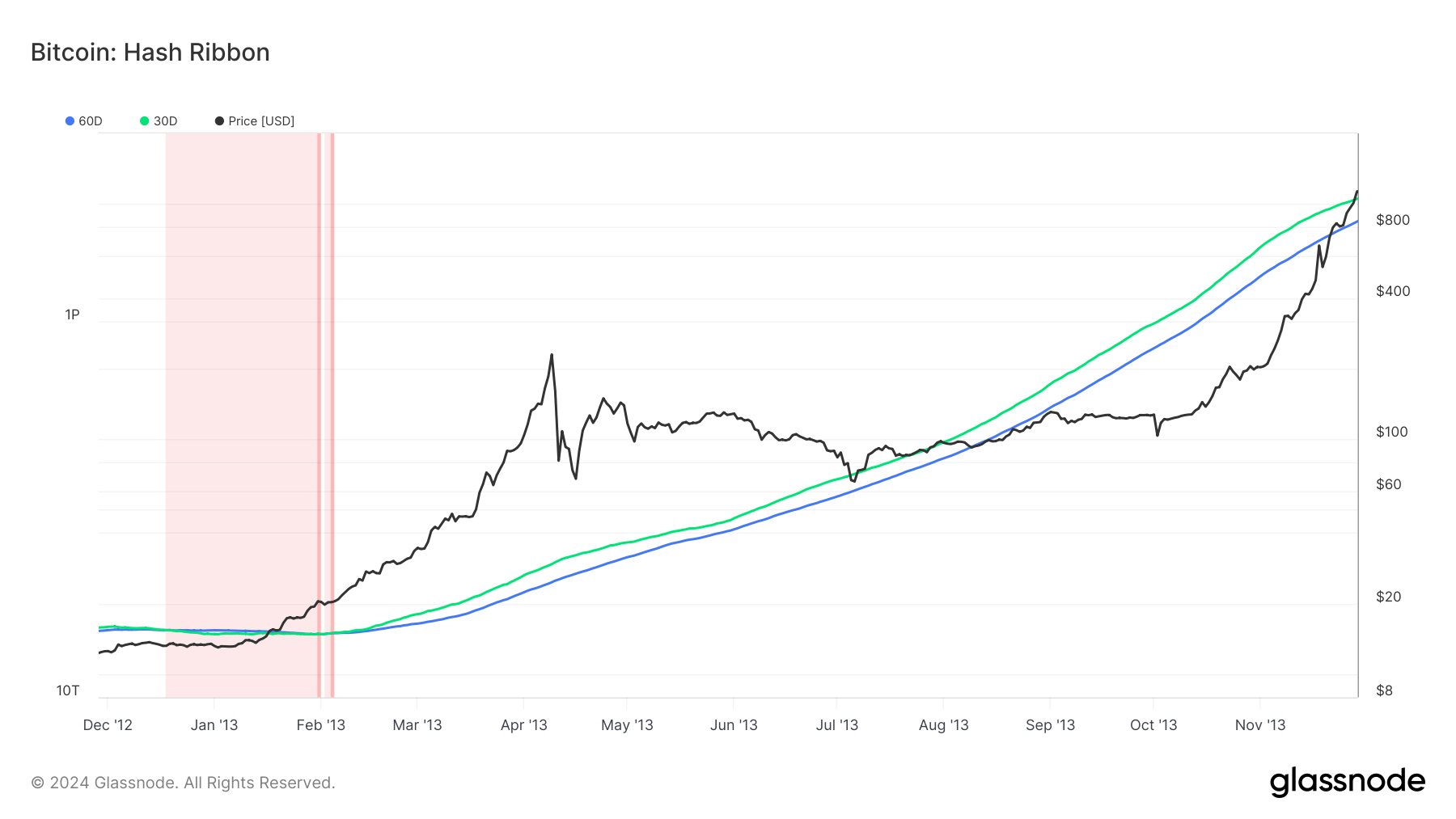

Halving 1: November 8, 2012

Source: Glassnode

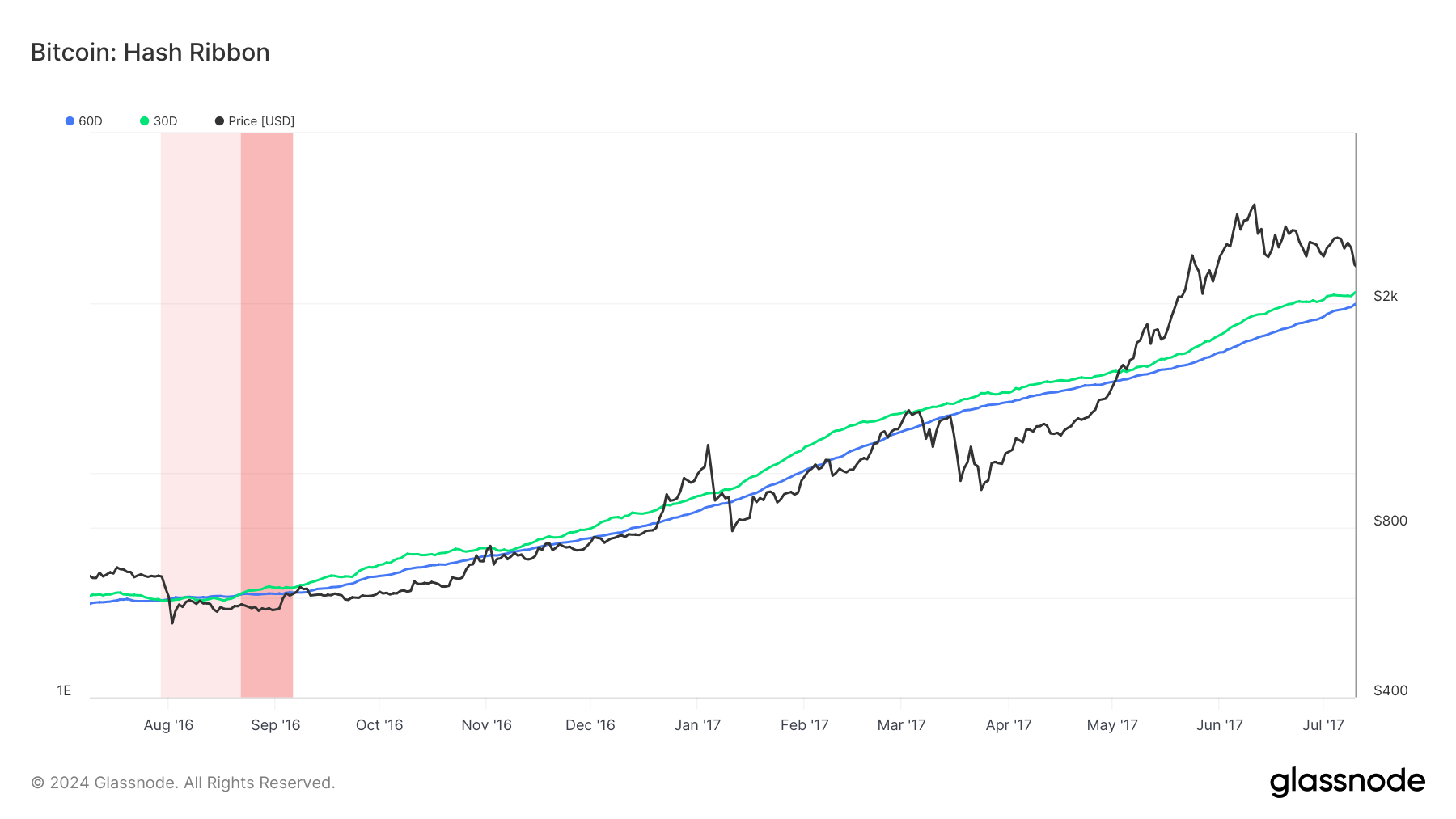

Halving 2: July 9, 2016

Source: Glassnode

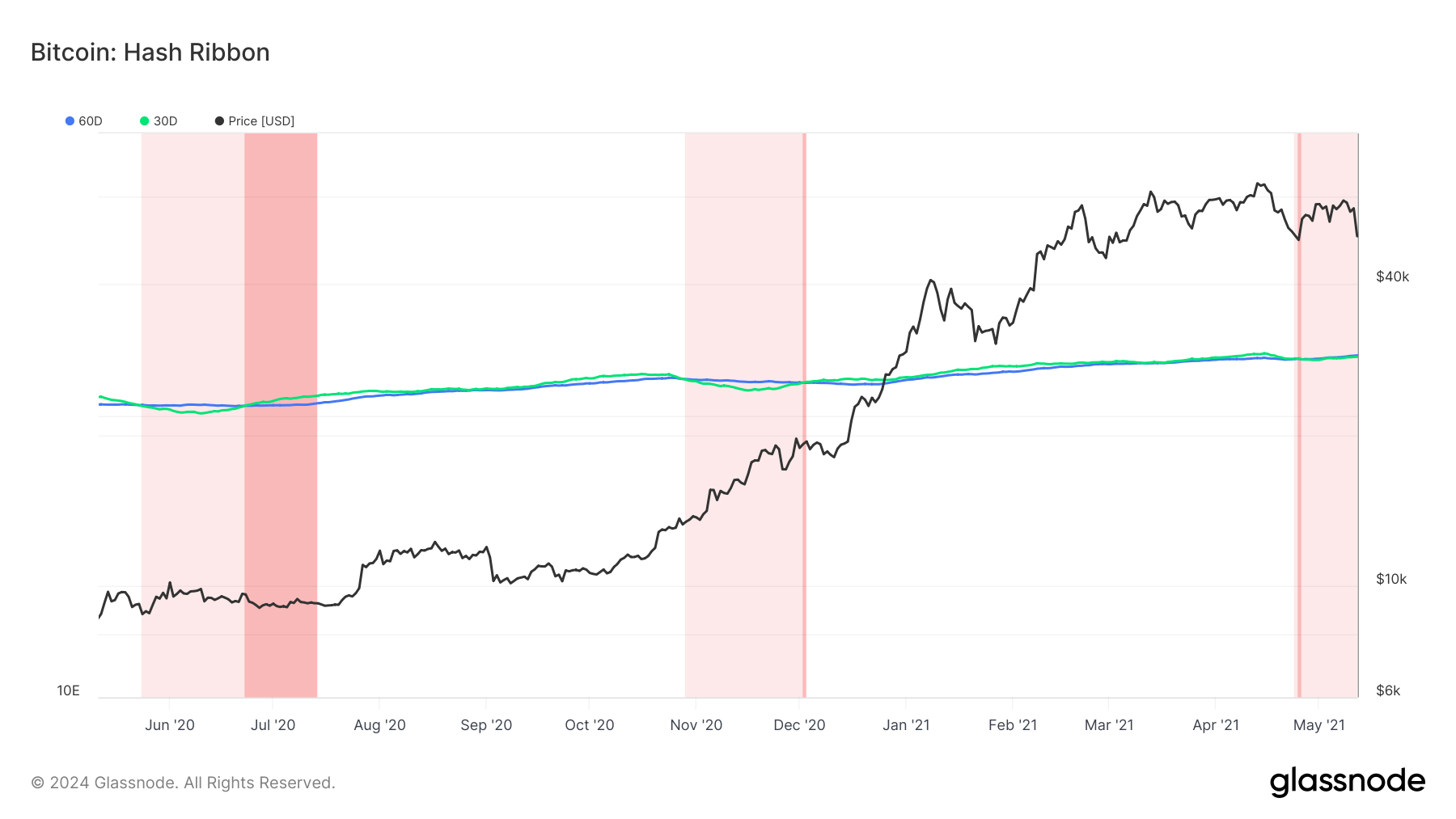

Halving 3: May 11, 2020

Source: Glassnode

Current (halving date marked by thick red line on April 20, 2024)

Source: Glassnode

As we can see visually, each halving has been marked by a period of miner capitulation soon after, as measured by the 30d MA hashrate crossing below the 60d MA hashrate. The point where it crosses below is marked on the charts by the beginning of the light-red shading, and the point where it crosses back above is marked by the end of the light-red shading.

As we can also see, post the first three halvings, the hash ribbon turning from negative back to positive has marked a good entry point for investors and the end of post-halving, flat-to-negative price consolidation.

(For completeness, the dark-red shading in the charts above is a “price ribbon” which continues marking out a period where the 10d MA price is below the 20d MA price. The end of the dark-red shading marks where the 10d MA flips back above the 20d MA price, indicating a flip from negative to positive price momentum.)

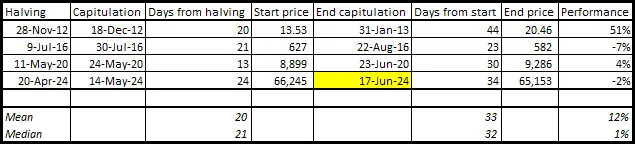

Let’s put a finer point on it with some numbers and timelines:

Source: Glassnode, Coinbase, Onramp

According to 30-60d MA hash ribbons, we emerged from miner capitulation earlier this week on June 17. As illustrated in the table, the current post-halving market mirrors previous cycles in terms of when post-halving miner capitulation occurred, how long it lasted, and bitcoin’s price performance over that ~30 day period.

Let’s take a look at what has happened to price after the end of miner capitulation in post-halving environments:

Source: Glassnode, Coinbase, Onramp

The 30-day post-halving, post-miner-capitulation period we are entering right now has historically seen bitcoin at least double in price.

As always, past performance is not indicative of future results!

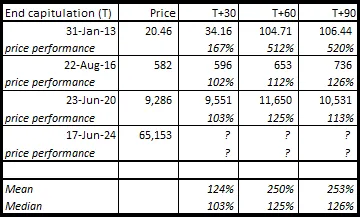

Chart of the Week

Courtesy of The Daily Shot on X:

US federal interest payments now exceed the defense budget.

Quote of the Week

“CBO now projects that deficit spending for FY24 will reach a staggering $1.9 trillion, an estimate that is $400 billion higher than CBO predicted just four months earlier. This is the third highest yearly deficit increase in American history.”

— House Budget Committee Chairman Jodey Arrington (R-TX) statement following CBO’s updated baseline, June 18, 2024.

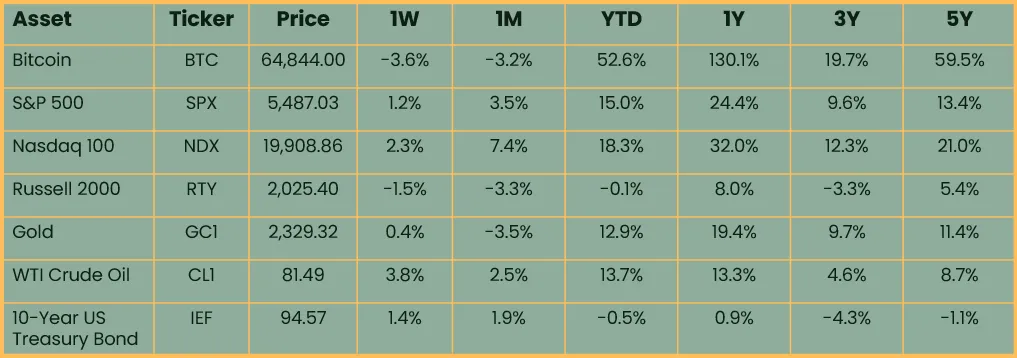

Market Update

as of 6/19/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

US stock and bond markets were closed on 6/19 for the Juneteenth holiday and their prices above reflect 6/18 closing prices.

Risk assets and specifically large cap US stocks remain buoyant amid a benign macroeconomic backdrop as we enter summer. Investors digested last week’s lower than expected CPI reading and Fed commentary and came out positive on stocks and rates. Stock indices were driven to new all-time highs this week as NVIDIA assumed the largest market cap in the world. Oil sustained a recent rally back above $80/barrel. Bitcoin price consolidated sideways as hashrate dipped due to post-halving miner capitulation.

Podcasts of the Week

The Last Trade E054: Gold, Bitcoin, & Counterparty Risk with Mark Valek

In this episode of The Last Trade, Mark Valek, fund manager & partner at Incrementum AG, joins to discuss the need for sound money, the rise of hard assets, risks of a debt-based system, the combination of gold & bitcoin, realities of counterparty risk, & more.

Final Settlement E009: Corporate Bitcoin Adoption with eBay’s Mason Carter

In this episode of Final Settlement, Mason Carter, bitcoin advocate & Treasury Associate at eBay, joins to discuss corporate treasury adoption, nominal vs real returns, deflationary technology, bitcoin infrastructure gaps & more.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris