Roundup: Hashrate & Bitcoin Supply Metrics

Dylan LeClair | Guest Contributor

Jun 29, 2023

Hi all,

This is Dylan LeClair, presenting this week’s Onramp Weekly Roundup.

Before we get started… If you’re a HNWI or Institution looking for the best way to get exposure to bitcoin, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, here’s the weekly roundup…

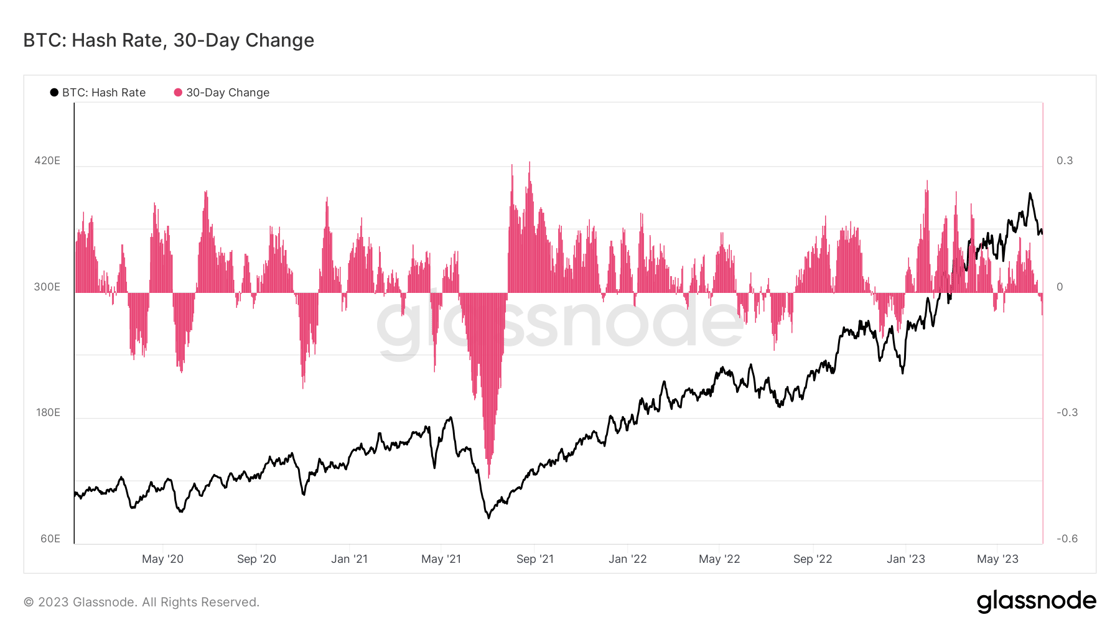

Hash Rate Dips from Highs

Bitcoin hash rate has slightly fallen from all time highs of 393 EH/s, down a mere 5.3% month over month, with the latest mining difficulty adjustment recently coming in at -3.26%, the largest downward revision since January.

Despite the recent pullback from the highs, hash rate is still an astounding 71% above its level from one year prior.

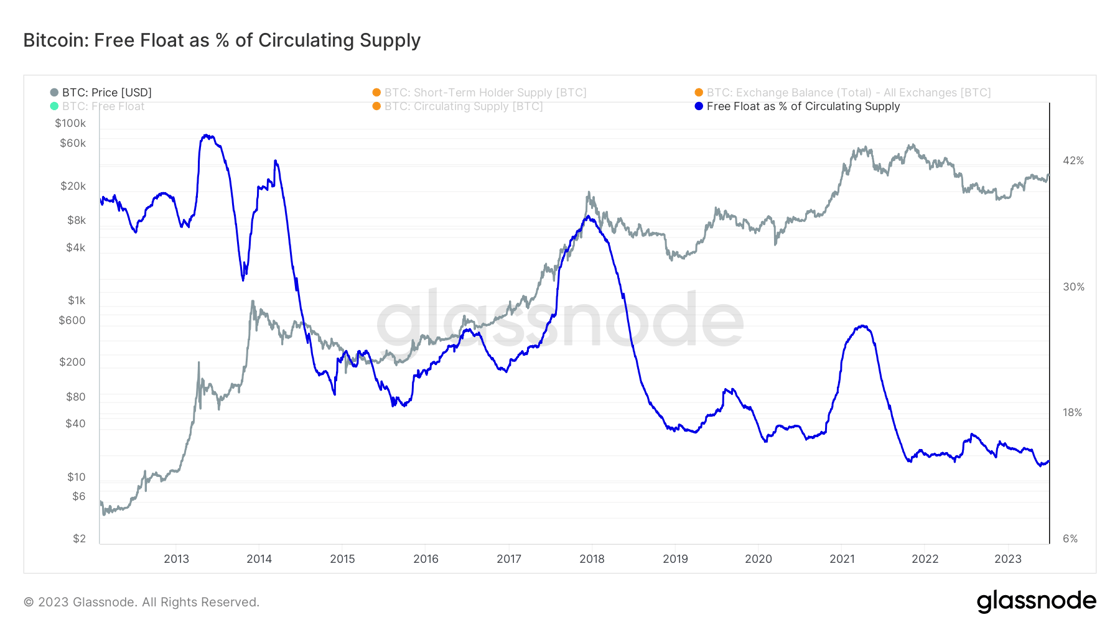

Free Float Supply Constraints at Historic Levels

With the free float Bitcoin supply – calculated as the balance on exchanges plus the short-term holder supply (who are statistically more likely to spend their coins) – hovering near historic lows at less than 14% of the Bitcoin market cap, we’re seeing a scenario eerily reminiscent of the supply side shock preceding the 2017 and 2021 bull markets.

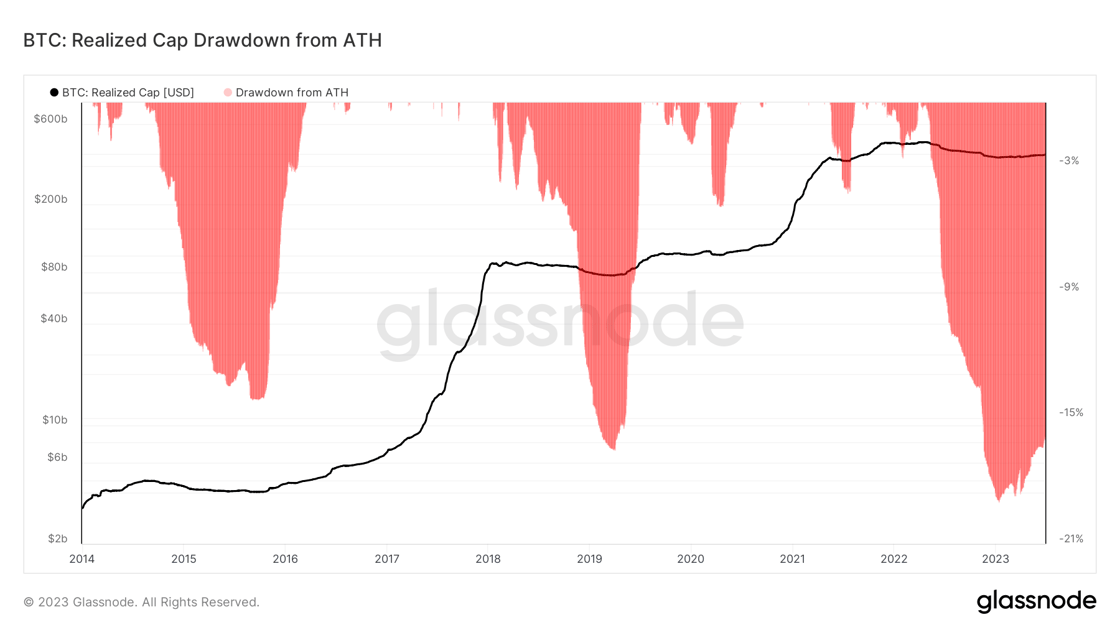

Realized Market Capitalization Recovery

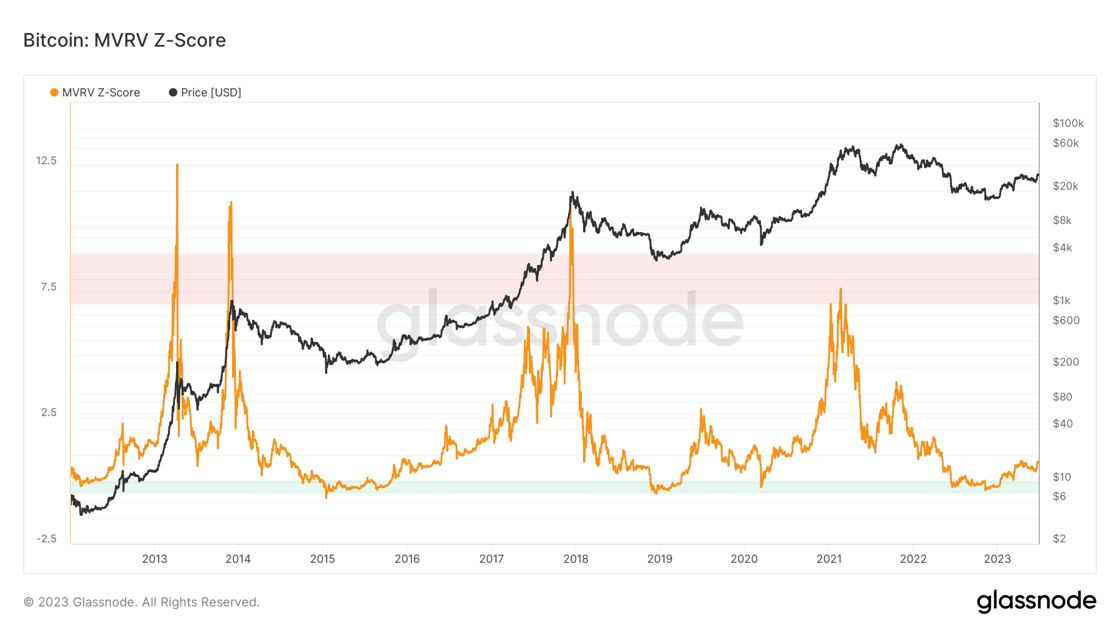

Realized Cap provides a nuanced view of Bitcoin’s value by attributing different prices to different parts of the supply based on when each UTXO (Unspent Transaction Output) was last moved, rather than using a uniform daily closing price.

Considering the Realized Cap metric, which assigns distinct values to each portion of Bitcoin’s supply based on when it was last moved, the MVRV (market value to realized value ratio) Z-Score proves to be a crucial market gauge, standardizing Bitcoin’s relative valuation by finding the difference between the market cap and realized cap, while taking into account the volatility of the market cap via a standardized z-score.

Two main takeaways from realized cap analysis:

- Capital flows into bitcoin are far less volatile than you’d think just by viewing the exchange rate, realized cap is the true signal.

- With realized cap still below all time highs and MVRV Z-score still far from overheated levels, bitcoin is attractive at current market valuations if history serves as precedent.

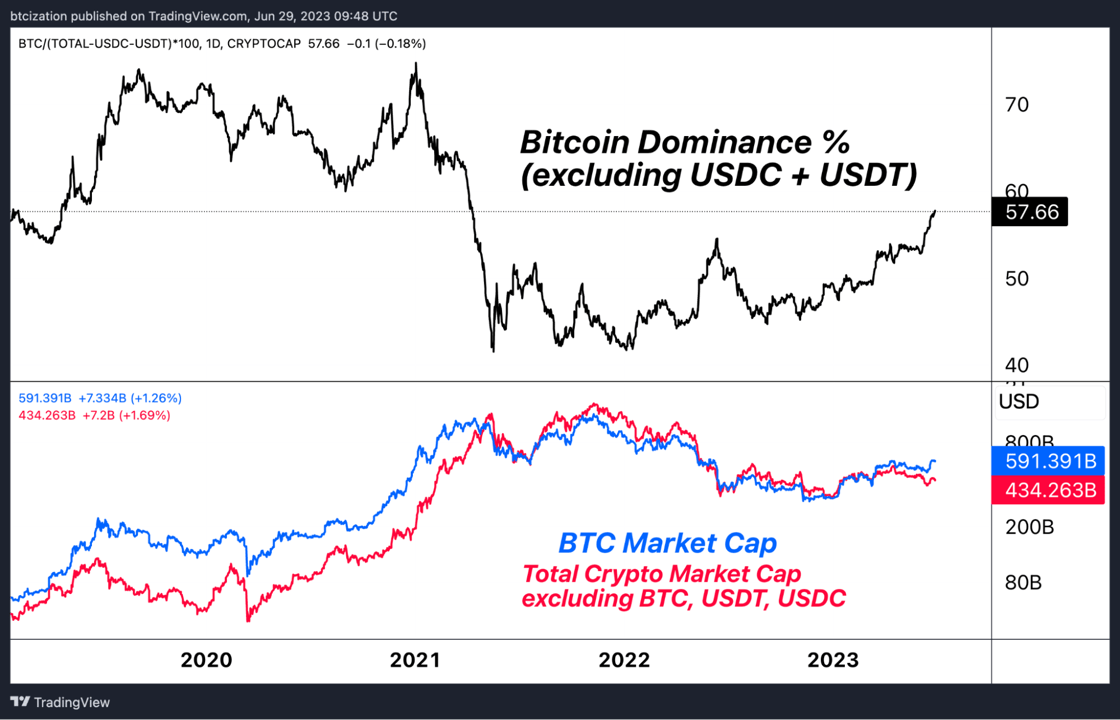

Bitcoin Strength Shines Clear in Crypto

Bitcoin dominance, less major stablecoins, continues its steady ascent, fueled by emerging institutional support and increasing regulatory clarity within the broader crypto space. Despite being an imperfect gauge, the upward trend provides a glimpse of signal shining through the noise.

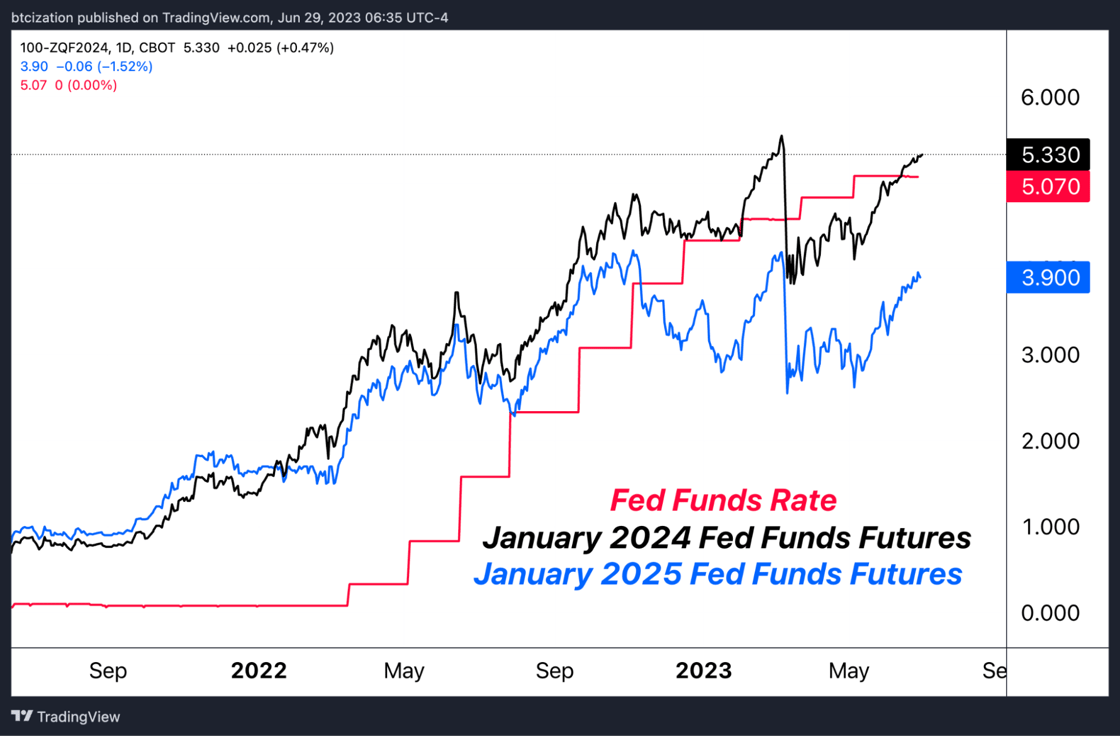

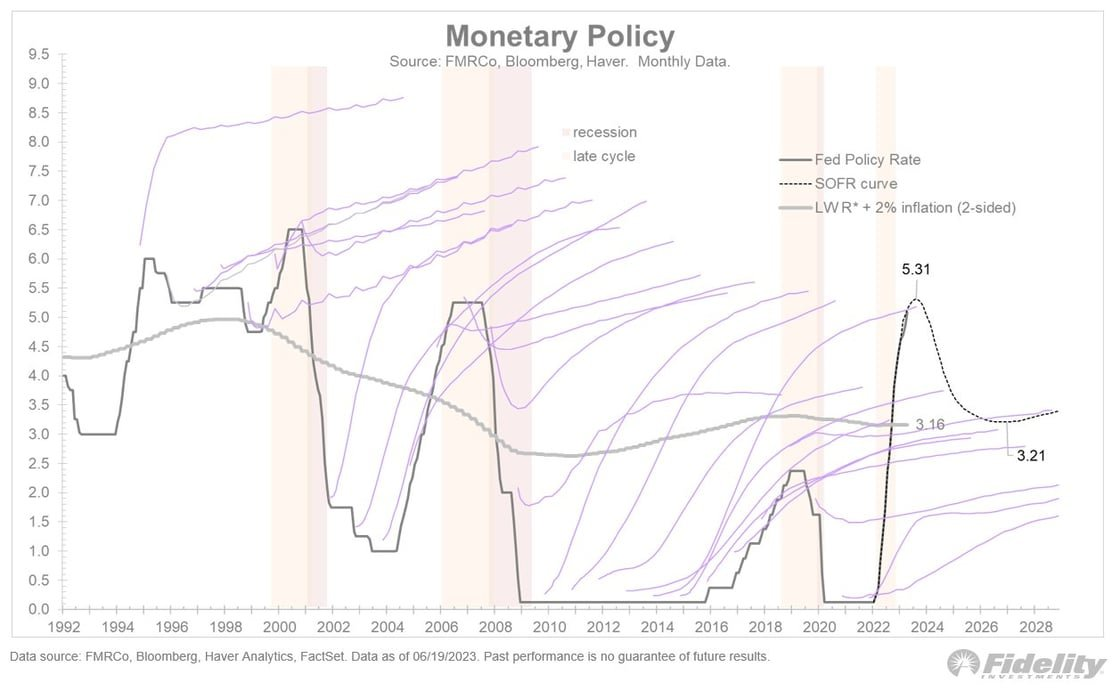

Additional Rate Hikes Expected in 2023, Cuts in 2024

Expectations in the short-term interest rate show the possibility for two additional interest rate hikes during the rest of 2023 before approximately six cuts (143 basis points) in 2024.

This positioning is unique in the history of tightening cycles, where generally the market believes the Federal Reserve will maintain its tight monetary policy stands for an extended period of time, which are then always usurped by recessionary fears and stock market crashes.

Is the market right, is this time different? Does historic levels of indebtedness as a percentage of GDP cause the Fed to reverse course and loosen the figurative belt in 2024?

The market certainly believes so.

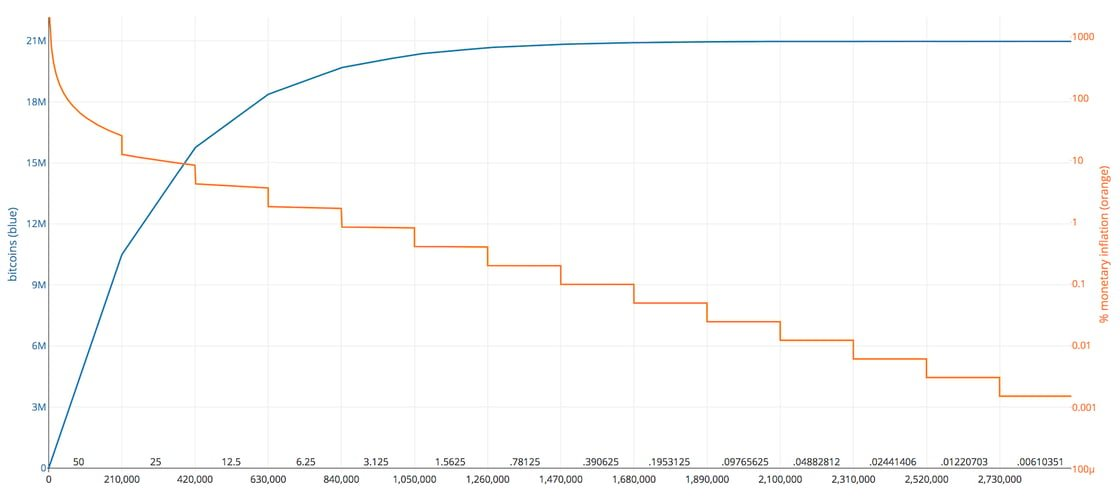

On a completely unrelated note, bitcoin’s immutable monetary policy dictates an algorithmic 50% decline in supply issuance in 43,617 blocks (approximately 302 days), from 6.25 BTC per block to 3.125 BTC.

Podcast of the Week

BlackRock ETF and the Future of Retirement Plans with Matt Dines, The Last Trade

On this week’s episode of The Last Trade, Wall Street veteran Matt Dines sat down with hosts Marty Bent, Jesse Myers, and Michael Tanguma. The conversation ranged from BlackRock’s new Bitcoin ETF proposal, to how Wall Street will get burned as it learns about bitcoin the hard way, to how retirement plans will have to shift in an environment of structural inflation encroaching on the value proposition of traditional bond portfolios.

Check out the full episode here.

Closing Note

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair