Roundup: Cycle Positioning & Bitcoin Treasury Strategies

Zack Morris | Research Analyst

Jun 6, 2024

Cycle Positioning

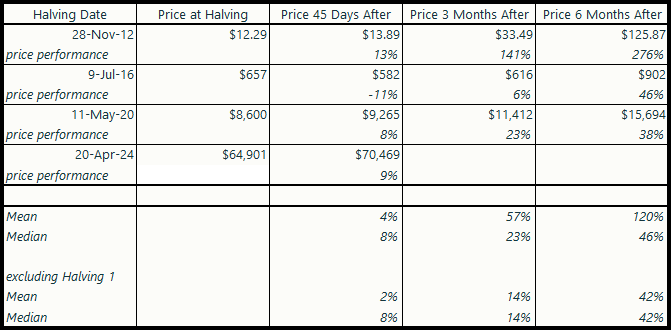

This week, we take a look back at bitcoin price performance post prior halving events in an attempt to contextualize where we are in the current market cycle.

As of writing, we are 45 days post the April 20, 2024 bitcoin halving.

Source: glassnode, cfbenchmarks, Onramp

With bitcoin appreciating 9% since the halving, current cycle post-halving price performance so far is in line with previous halving cycles.

If previous cycle price patterns were to hold (discarding the first halving as an outlier), we would expect another 45 days or so of modest price performance, taking us through mid-July.

Price appreciation then historically picks up substantially in the 3-6 month post-halving time period, which would take us from mid-July through October in the current cycle.

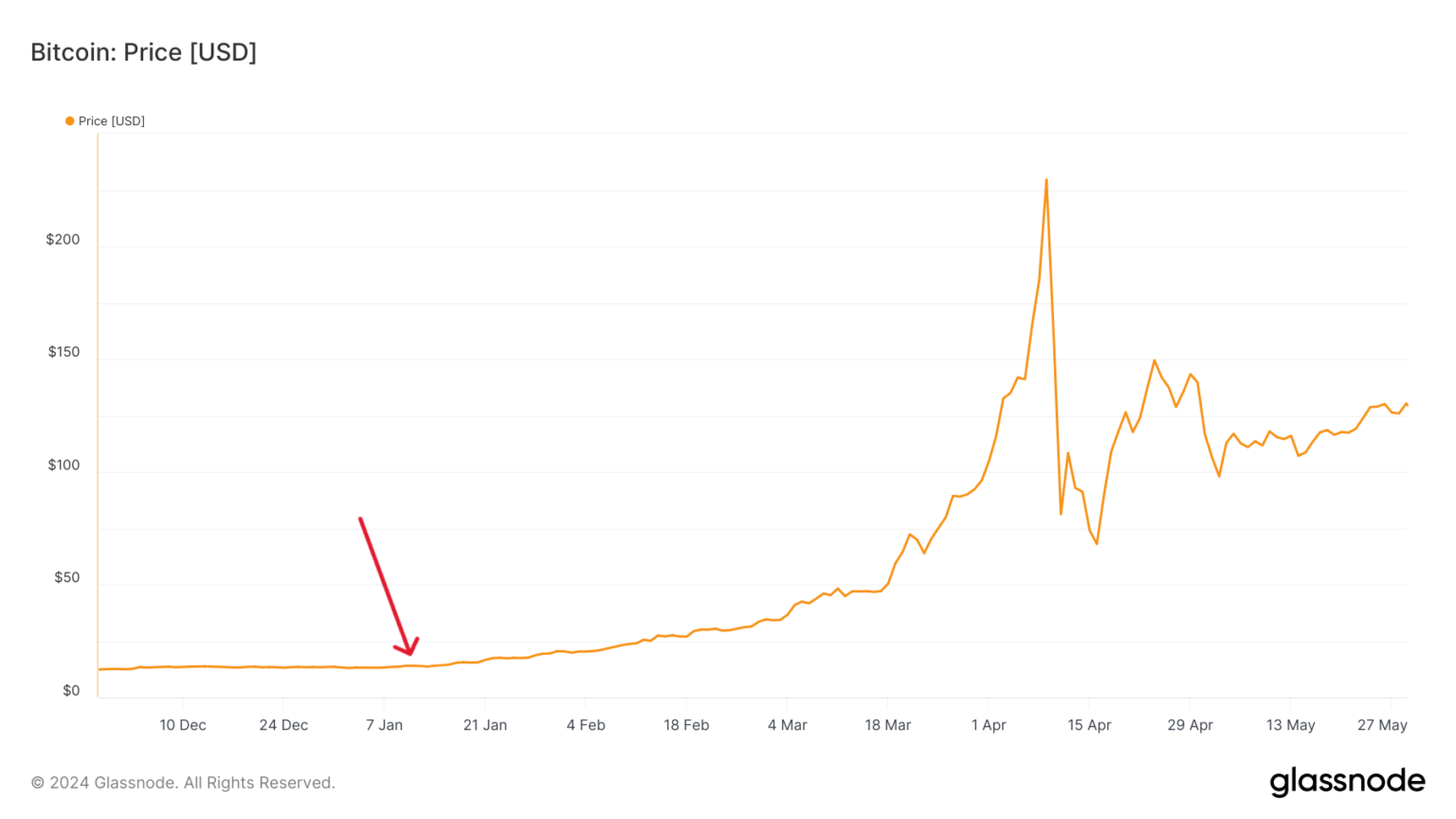

Halving 1 (red arrow indicates where we are in time in current cycle):

Halving 2:

Halving 3:

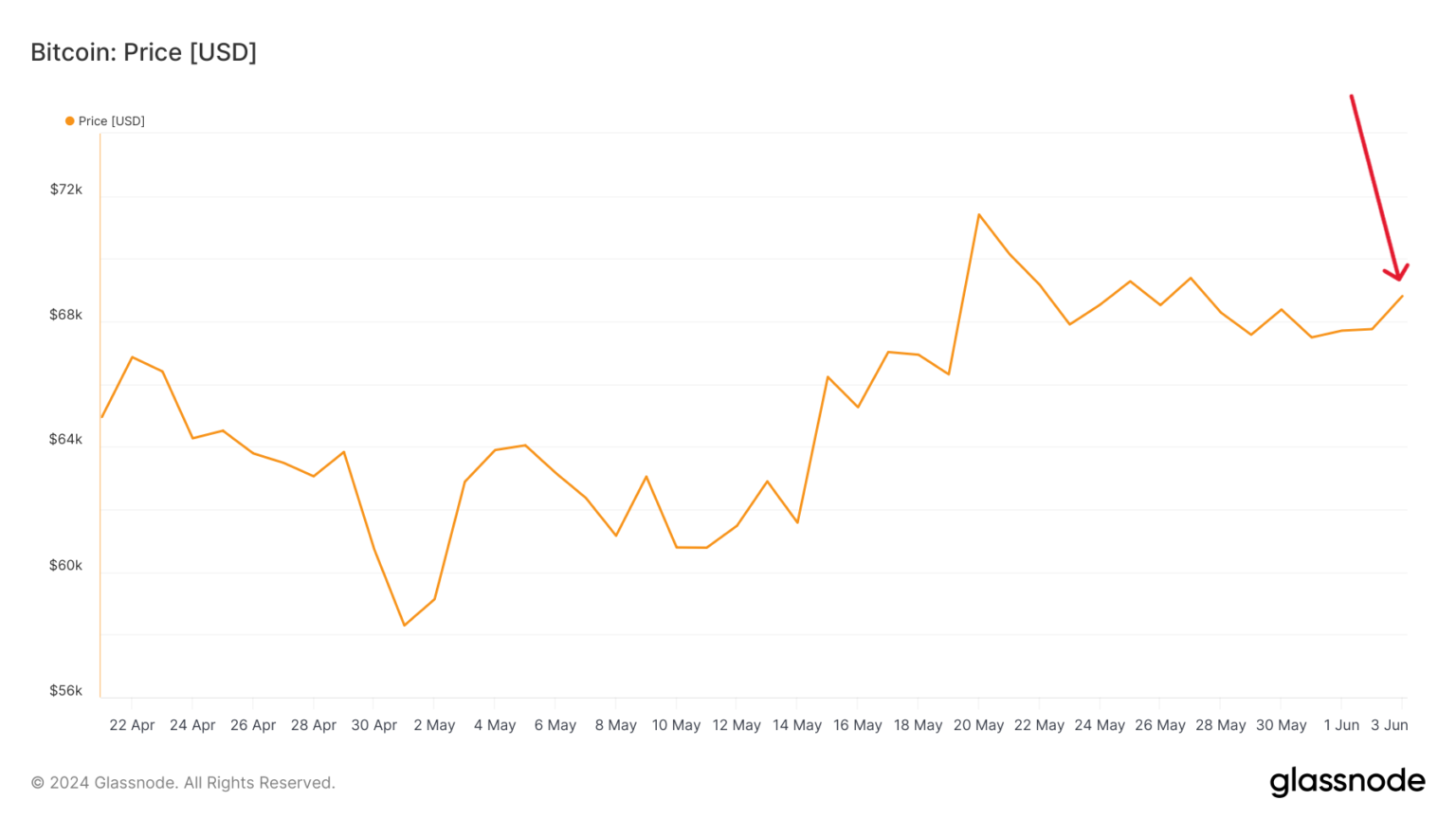

Halving 4:

Every cycle is different and comes with its own idiosyncrasies. There are no guarantees this cycle will follow the pattern of previous cycles.

But time is on the bitcoiner’s side.

What Kind of Company Should Adopt a Bitcoin Treasury Strategy?

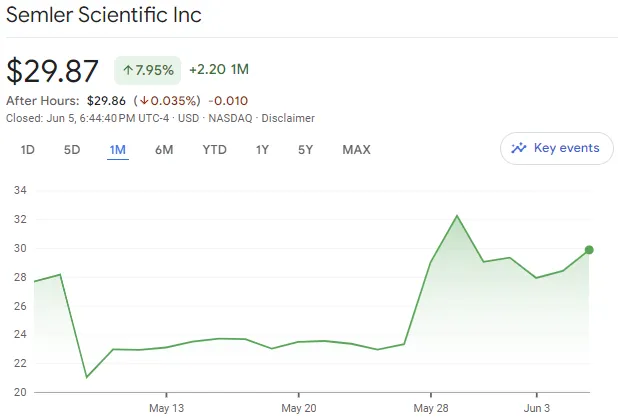

With the news last week of Semler Scientific adopting bitcoin as their primary treasury asset, it’s worth pondering — when and why does a bitcoin treasury strategy make sense for a publicly traded company?

1. Companies with bitcoin revenue or providing bitcoin-related products and services

This I think is the first and most obvious set of public companies that should adopt a bitcoin treasury strategy, and indeed describes a majority of the companies who have already done so today: companies in the bitcoin business.

This includes miners, exchanges, custodians, and layer-3 wallets. Some public companies in these groups with bitcoin treasury strategies include all the public miners, Coinbase, and Block.

If you’re in the bitcoin business, your shareholders are likely aligned with your vision and share a similar view on bitcoin’s future prospects. They know what business they’re getting into when they buy your stock. It is a natural and relatively frictionless next step to begin to save in the asset you’re earning in, likely in proportion to the amount of the overall business that is bitcoin-related. If the bitcoin business grows relative to the rest of the business, more of the treasury is saved in bitcoin, naturally reflecting the growth and relative importance of the asset.

2. Companies that want to transform their stock into a bitcoin financial product

This is MicroStrategy.

I don’t know if this was the original intention, but Michael Saylor has now alluded to the fact many times that investors wanted/want their stock as a bitcoin proxy in equity portfolios/brokerage accounts/IRAs, their convertible bonds for bitcoin exposure in bond portfolios, and their options both as a tool for leverage and for hedging.

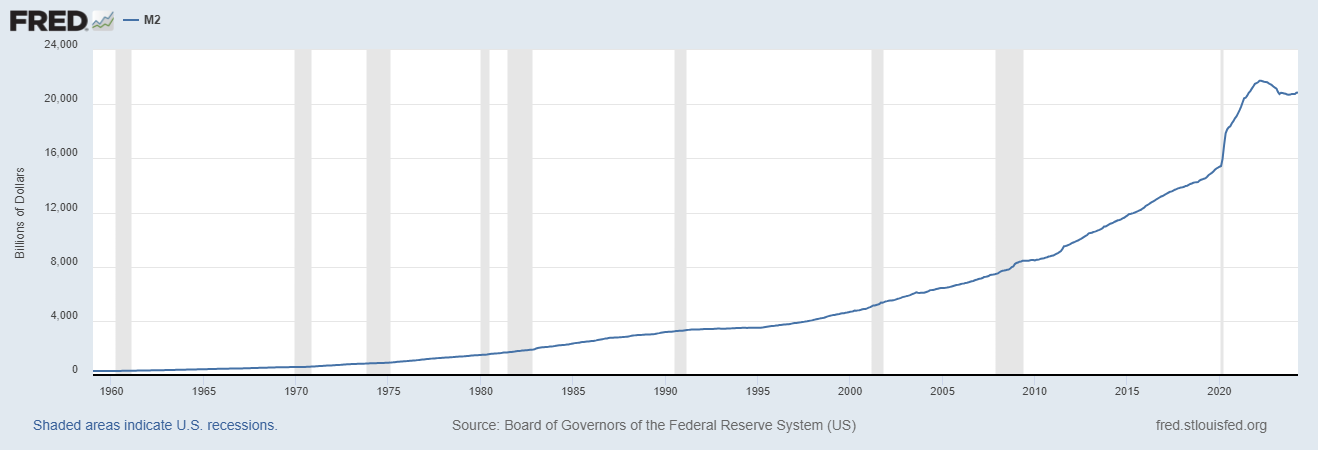

MSTR had no bitcoin-related business before they bought bitcoin in 2020. But Saylor realized this: MSTR was a profitable, no-growth software business with over half of their market cap sitting in cash earning 0% in an environment where the money supply just went up 40%. In that kind of environment you need to find something to do with that cash or you are simply waiting to die as a company.

Option 1 was to return the cash to shareholders.

In Saylor’s own words on the What Bitcoin Did podcast:

“Give the money back, decapitalize, have no assets, right? Once you lose your financial capital, you’re gonna lose your human capital. Because if you have no money on the balance sheet and if your business has no volatility, the stock options have no value. You can’t afford, you can’t overpay the employees, you don’t have the cash and so you’re probably gonna lose the employees.

And then 3 to 6 years later, the product’s not gonna be competitive. So the fast death wasn’t all that appealing. If you’re going to do that, you might as well just sell the company.”

Option 2 was to sit on it:

“The slow death is sit on $600 million in cash, which, you know, we could run at an operating loss for 20 years with that much cash, but you’re just waiting to die, right?”

Option 3 was to use that cash to invest in an asset that would:

- make their stock attractive to Wall St.

- make their stock attractive to employees for purposes of retaining and attracting talent

- return more than their cost of capital, which Saylor defined as the growth in the money supply, which has compounded at ~7% annually over just about any meaningful period of time and increased by 26% in 2020:

For MicroStrategy in 2020, the choice was to adopt bitcoin or face death as a company.

They took their $600 million, bought $250 million of bitcoin and at the same time bought back $250 million of their own stock to give any shareholders who disagreed with the company’s strategy an exit ramp.

Why not return all $600 million to shareholders and let them decide if they want to invest in bitcoin? I think it is a fair and good question.

There are certain advantages to being a public company that individual investors can’t access on their own. Most notably, access to the capital markets, which were wide open at the time. Cheap debt, convertible debt, and the ability to issue your own stock as currency to raise money to buy more bitcoin are tools that are unavailable to individuals.

Even today with the approval of bitcoin ETFs, MicroStrategy retains these capital market advantages as a bitcoin exposure vehicle. Moreover, there are as yet no listed options on the bitcoin ETFs, so MSTR still provides investors financial tools they can’t get anywhere else in a traditional setting.

For MicroStrategy, what started as a survival tactic turned into bitcoin-financial-products-as-a-service for investors, and has now led to them rebranding as a Bitcoin Development Company and building products on-chain to grow the bitcoin ecosystem.

Bitcoin breathed life and a future into an otherwise dying enterprise.

This brings us to a possible third category of public companies that should consider buying bitcoin:

3. Cash rich, no growth companies seeking a future

It strikes me that there are probably a lot of public companies out there today that are facing the same prospects as MicroStrategy in 2020: a fast death or a slow death.

Companies that:

- have a profitable but low or no-growth operating business

- don’t have any compelling opportunities to invest in organic or inorganic growth

- have a substantial percentage of their market cap in cash

What should they do?

As Saylor pointed out, they are likely facing either a fast or slow death. And that might be the correct path for any given business to pursue! Every situation is unique.

For some businesses, accepting this fate, returning cash to shareholders, cutting costs and milking the business for cash flows in run-off mode is probably the right course of action. That is the economy naturally and efficiently reallocating capital and labor to higher and better uses.

That is the fast death.

The slow death is to sit on it or misallocate it. In fact, in a world where the cost of capital is 7% and short-term interest rates are at 5%, sitting on it is misallocating it.

The business continues to operate, probably spends a bit more than it needs to, maybe blows some shareholder money on moonshots, maybe starts incurring operating losses and covering them for years with cash on hand, as Saylor suggested was possible with MicroStrategy. Employees and management keep collecting paychecks until eventually the treasury runs dry and the company is bankrupt.

This is the slow death, which is actually the lived fate of a large percentage of public companies. Most businesses eventually go broke or are sold to larger businesses!

So should they buy bitcoin?

If the company wants to survive as a standalone entity, then it makes sense.

I’m not saying they should want to survive. But if they do, for whatever reason, I think bitcoin is an option to breathe life back into a dying company in a similar way to what MSTR did. Attract talent that wants to be “paid in bitcoin” through the company’s stock options. New talent may open new doors for the business. And, to use SMLR as an example, listed options on a $30 stock are a higher precision tool which can be useful to more people than listed options on a $1,700 stock (SMLR has no listed options at the moment, nor am I suggesting the reason for their bitcoin treasury strategy is to turn their stock into a bitcoin financial product!).

Or, perhaps a company doesn’t see any compelling areas for investment right now, but has reason to anticipate there may be in the future — think a regulatory change or approval — and they need a store-of-value asset to get the company from here to there.

4. Companies explicitly adopting a bitcoin standard

Finally, perhaps a company wished to adopt a bitcoin standard to force more effective capital allocation decisions.

A bitcoin standard means they measure every business investment opportunity versus simply buying and holding bitcoin, and they measure their success based on how much bitcoin they can accumulate, and ultimately return to shareholders.

Instead of paying cash dividends, they plan on one day paying bitcoin dividends, and they effectively communicate this.

Realistically, this perspective could apply to any company, public or private, that recognizes bitcoin’s appreciation as the true cost of capital.

In any event, the company’s reason/strategy/intention should be clearly communicated when adopting a bitcoin treasury strategy, so shareholders can decide if they want in or out.

So, what category is Semler Scientific in?

Here is what they said:

“Our Decision to Adopt Bitcoin as Our Primary Reserve Strategy

We are in the fortunate position of being a company that has consistently generated cash and has a strong balance sheet with substantial net cash. Our board of directors and senior management have been examining potential uses of cash, including acquisitions and stock repurchases. After studying various alternatives, we decided that investing in bitcoin is currently the best use of our excess cash. Bitcoin will be our principal treasury holding on an ongoing basis, subject to market conditions and our anticipated cash needs. As we embark on our new treasury strategy, our board intends to proactively evaluate our use of excess cash.”

I don’t know much about SMLR’s business or future business prospects, only what I can read in the financial statements.

Historically, they’ve grown quite nicely, compounding revenue at 41% over the past decade. The stock has returned 16.2% annually over that time. At first glance, this seems like a business shareholders would want to own for being in the Semler Scientific business, not necessarily the bitcoin business.

It seems to me like Founder and Chairman Eric Semler might simply be a bitcoiner, and is perhaps adopting a bitcoin standard for his company. Or maybe he too wishes to turn SMLR stock into a bitcoin exposure vehicle, offering Wall St. different bitcoin financial products? Neither of these things is explicitly stated in the above, though.

One thing is certain — whoever doesn’t like the strategy was provided a nice opportunity to exit. The stock was up as much as 48% in the two days following SMLR’s announcement:

It will be fascinating to monitor how Semler Scientific’s bitcoin strategy unfolds, and if we see more publicly traded companies adopt similar strategies.

With stock price reactions like that, I’m sure there will be many more to come.

Chart of the Week

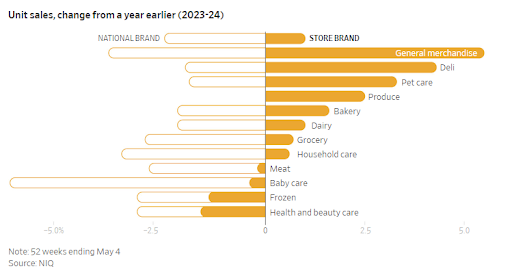

Courtesy of the WSJ:

Consumers are swapping out national brands for store brands in their shopping carts as they look to reign in costs amid rising prices.

This is the inflation that doesn’t show up in the CPI: swapping for cheaper but inferior goods.

Quote of the Week

“And before you dismiss matters of money as perhaps trite or inelegant, we can at least agree that its influence is similarly potent. Both God and money are among the greatest influences on individuals, of families, and of entire civilizations. The Protestant struggle was with the Catholic Church as intermediary to God. The early colonial struggle was with the British Crown as intermediary to governance. Our struggle is with the central bank as intermediary to money.”

— Erik Voorhees, keynote speech at Coin Center’s 10th Anniversary Dinner.

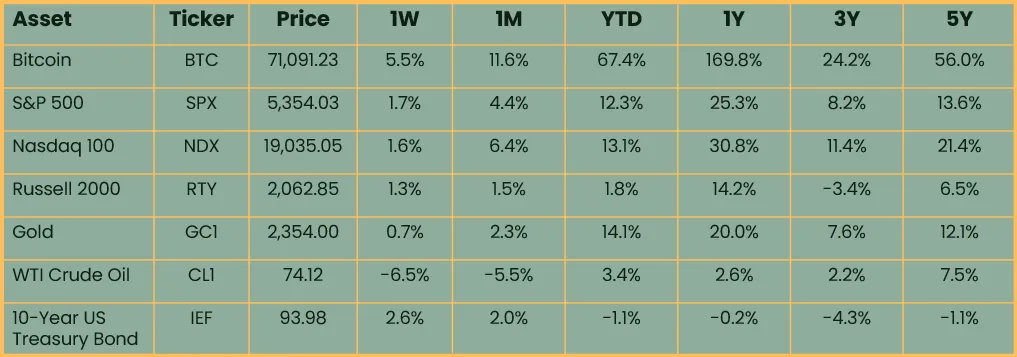

Market Update

as of 6/5/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Risk assets sustained a broad rally over the past week, fueled by the market pricing in more and sooner interest rate cuts as some economic data came in weak. Inflation concerns were quelled by a plummeting oil price and broad weakness in commodities. Oil was down 6.5% and is now up a mere 3.4% year-to-date after being up as much as 23% earlier in the year.

Bitcoin was the best performing asset on the week, furthering its lead as the best performing asset on the year.

Podcasts of the Week

The Last Trade E052: Bitcoin is Winning with NVK

In this episode of The Last Trade, NVK, founder of Coinkite, joins to discuss bitcoin hardware, authentication methods, institutional incentives, political game theory, building cypherpunk tools, & more.

Onramp Webinar Series E002: Bitcoin Inheritance Planning with Amanda Kita

In this session of the Onramp Webinar Series, Amanda Kita, Attorney at Stradley Ronon, joins Cam Stromme, Head of Private Wealth at Onramp, for an insightful discussion about bitcoin inheritance planning.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris