Roundup: 3Q24 Market Radar

Zack Morris | Research Analyst

Jul 11, 2024

CPI: July 11, August 14, September 11

By the time you’re reading this, this morning’s CPI print will have been released (8:30am ET) and getting digested by the market.

June’s CPI inflation reading is forecasted to come in at 3.1% year-over-year. Barring an epic miss, this would mark the third consecutive month of disinflation after a bump from 3.1% to 3.5% to start of the year. Investors will be watching in Q3 to make sure inflation stays steady on a path below 3% as that will likely be enough evidence for the Fed to cut interest rates in the back half of the year.

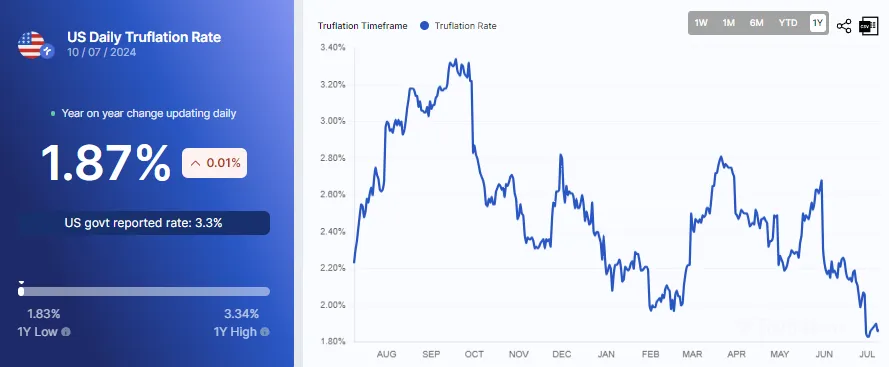

Popular real-time inflation gauge Truflation is showing that inflation has already dropped below 2%:

Q3s remaining inflation readings will come on August 14 and September 11. The September print, in particular, figures to be of outsized importance to the market as it will be one of the final pieces of economic data released before the Fed’s September meeting, where the market is currently pricing a 70% chance of a rate cut.

Unemployment: August 2, September 6

While you were hopefully out barbecuing last Friday, July 5, we got our first piece of economic data in Q3 with the unemployment report.

Per the report, US employers added 206,000 jobs in June which beat forecasts of 200,000 but represents a continued slowing in the pace of job growth. Government and healthcare services hiring accounted for about three-quarters of the jobs added.

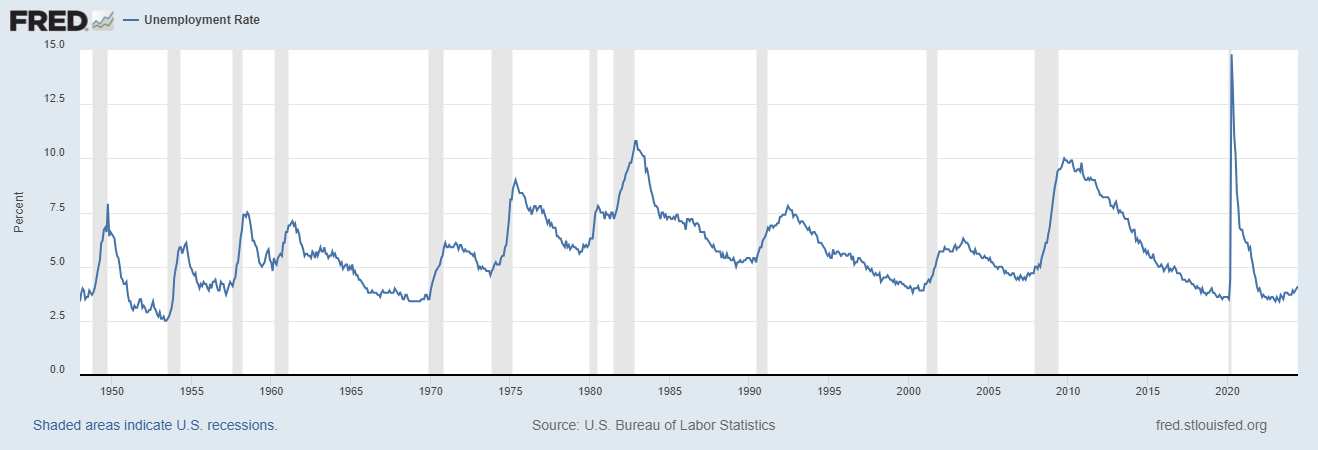

Despite the gain in jobs, the unemployment rate once again ticked higher to 4.1%, the highest level since October 2021.

Some market practitioners are pointing to the below chart and noting than never in the history of the data has unemployment risen out of a trough as in the current environment and not immediately preceded a recession:

While the absolute level of unemployment remains low, any further ticks higher in the future would likely influence the Fed to cut rates at a quicker pace.

Unemployment is always released on the first Friday of the month. The next unemployment report comes on August 2, with another on September 6 ahead of a “live” September FOMC meeting and interest rate decision.

FOMC Meeting: July 31, September 18

Fed Chair Jerome Powell spoke before congress earlier this week saying that the US “is no longer an overheated economy … We are well aware that we now face two-sided risks.”

The comments further signal to the market that rate cuts are coming in the back half of this year. Currently, the market is pricing in just a 7% chance of a quarter-point cut in July but a 74% chance of one in September. Some had thought a rate cut in September, at the final meeting before November’s election, would be unlikely as the Fed would not want to be seen as influencing the outcome of the election, but Powell has repeatedly put that notion to rest.

Markets are currently assigning a 96% chance of at least one cut by the end of the year, 72% chance of at least two, and a 25% chance of three.

Treasury QRA: August 7

An important data point for predicting market liquidity, the QRA’s primary piece of information is the mix of short-term bills and long-term coupons it will use to fund the deficit over the coming quarter. Bills are positive for market liquidity as they are treated by holders as cash substitutes, while heavy coupon issuance weighs on risk assets as funding must be sourced (for example, by selling stocks) and long-term interest rates rise.

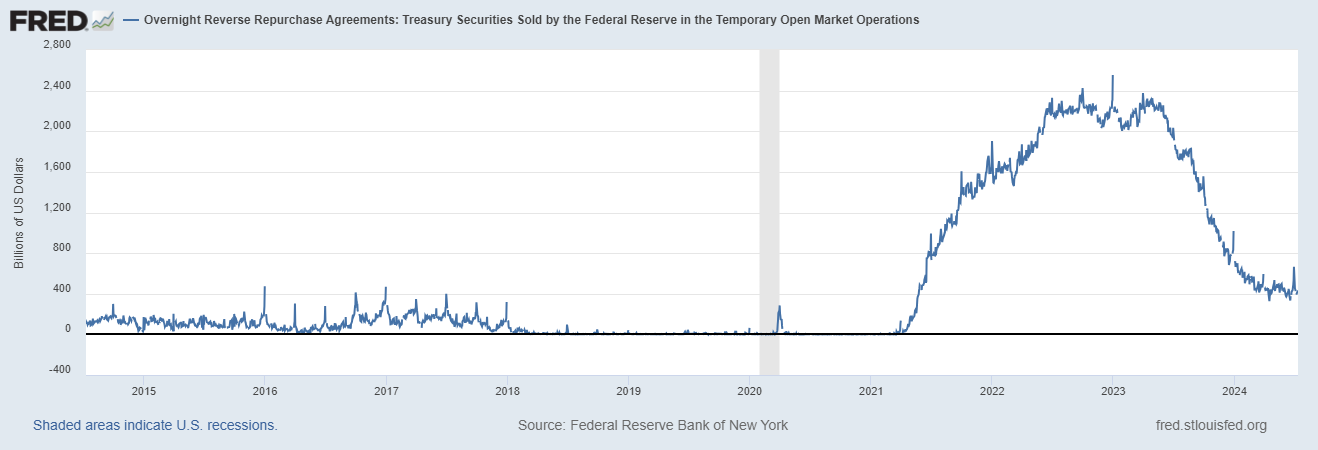

The change in total market liquidity can be measured by the change in the Fed’s balance sheet, minus the change in the Treasury General Account (TGA), minus the change in the reverse repo facility (RRP).

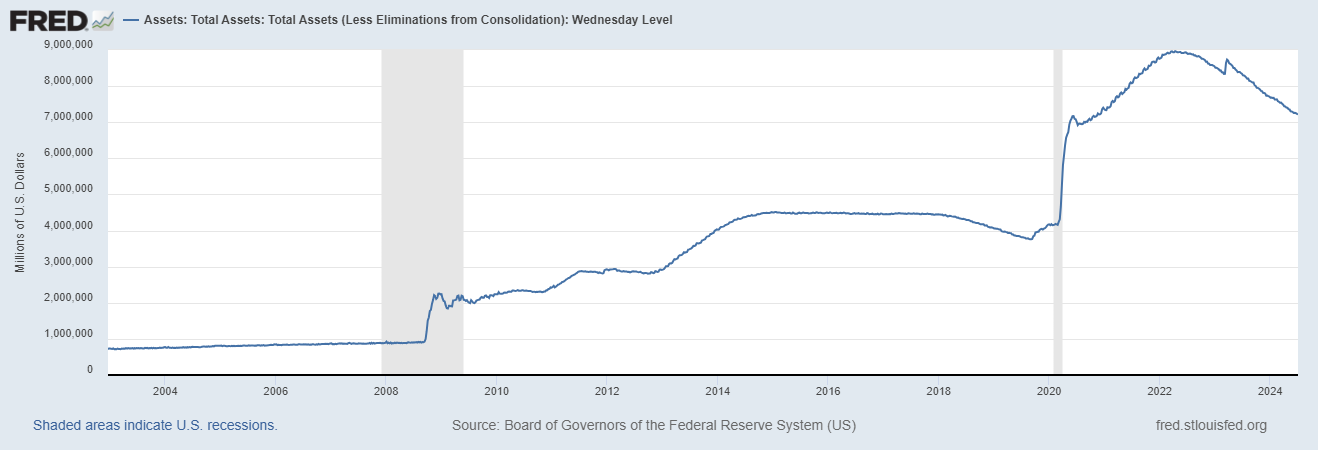

Over the past year, the Fed’s balance sheet has shrunk by $1.1 trillion (negative for liquidity) and the TGA has increased by $300 billion (negative), perfectly offset by the RRP declining by $1.4 trillion (positive). Basically, the Fed’s balance sheet run-off and the deficit over the past year has been financed entirely by a slush fund built up in the wake of the pandemic:

Looking forward, the Fed has announced a decrease in the pace of balance sheet reductions and the RRP has leveled out at around $400 billion. As long as this remains the case, markets should remain sanguine about the overall liquidity picture.

If anything were to take a turn for the worst, expect the Fed’s balance sheet to be the release valve and resume expansion:

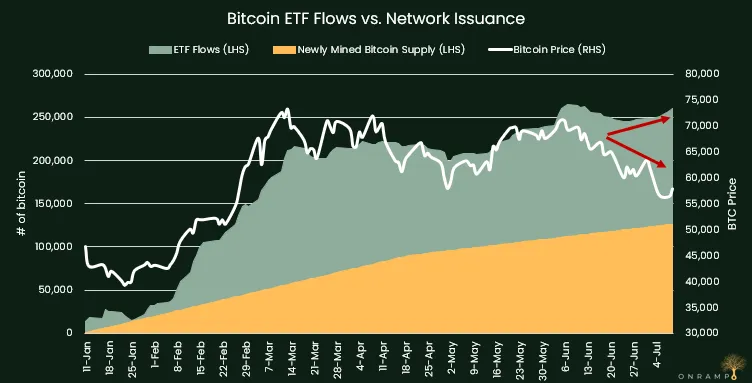

Government Sales and ETF Flows

Last week on the night of the July 4th holiday in the US, bitcoin wicked down to $53,500, putting in a new post-halving low and extending the drawdown from all-time highs to 28%.

On-chain analysts have picked up that German law enforcement has been liquidating a stack of 50,000 BTC it seized from movie piracy site Movie.2k. As of writing on afternoon July 10, NYDIG reports that the agency has 13,100 BTC still to sell.

While the German government is selling, US retail is taking the other side of the trade. ETFs have seen a robust $654 million in inflows from July 5-9 in the first notable divergence between flows and price since the ETFs launched.

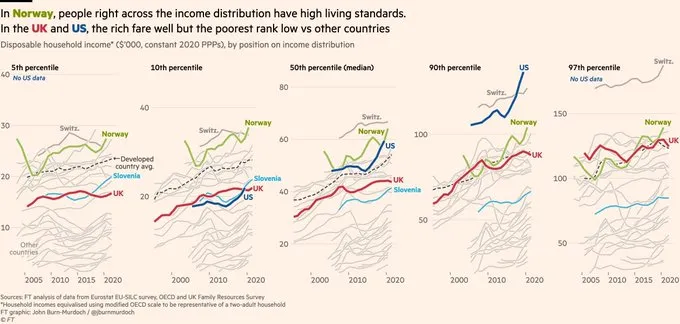

Chart of the Week

Courtesy of Keith Woods on X:

Quote of the Week

“The idea that you must make your money grow is one of the greatest lies ever told. It isn’t true at all. Central banks have created that false dilemma. The greatest trick that central banks ever pulled was convincing the world that individuals must perpetually take risk just to preserve value already created (and saved).”

Parker Lewis, Gradually, Then Suddenly

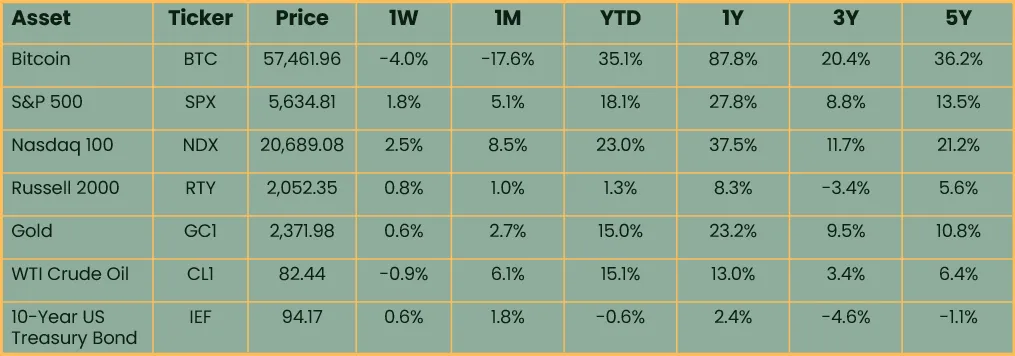

Market Update

As of 7/10/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

Bitcoin was a laggard on the week as a German law enforcement agency liquidated hundreds of millions in seized BTC. Bitcoin has further diverged from a buoyant stock market lately but is still the highest returning asset year-to-date. Large cap stocks extended all-time highs as interest rates fell and bonds rallied. Bond traders piled in after an uptick in the unemployment rate and Jerome Powell’s comments before congress further evidenced rate cuts would be coming in the back half of the year. Gold ticked higher and crude ticked lower.

Podcasts of the Week

Onramp Webinar Series E003: Bitcoin & Veterans – A Natural Alignment

In the latest installment of the Onramp Webinar Series, Onramp’s Head of Private

Wealth, Cam Stromme, hosts an insightful discussion with current and former US service members Wes Lippman, David Thayer, & Lee Bratcher, about the alignment between bitcoin and military veterans.

Scarce Assets E014: Matthew Pines – Technological Evolution & State Power

In this episode of Scarce Assets, Matthew Pines, Director at SentinelOne & National Security Fellow at the Bitcoin Policy Institute, joins Andy Edstrom & Jesse Myers to discuss global power competition, cybernetic security, techno-authoritarianism vs decentralization, bitcoin’s role in national security, & more.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris