Roundup: Inflation & Fed Rate Expectations

Dylan LeClair | Guest Contributor

Jul 13, 2023

Hi all,

This is Dylan LeClair, presenting this week’s Onramp Weekly Roundup.

Before we get started… If you’re a HNWI or Institution looking for the best way to get exposure to bitcoin, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, here’s the weekly roundup…

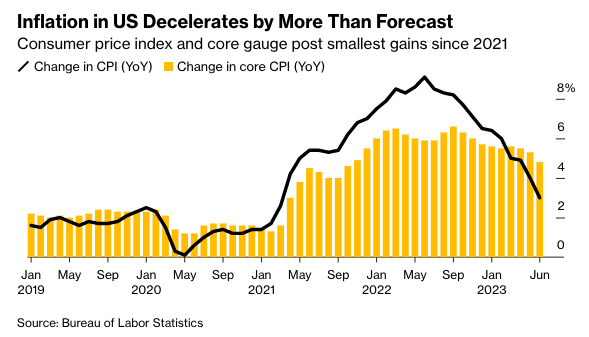

US Consumer Inflation Hits 27-Month Low Amidst Record Declines Streak

The US Consumer Price Inflation has plunged to a 27-month low, marking a record streak of declines. The drop in the headline CPI was from 4.0% YoY to 3.1% YoY, primarily driven by shelter, used cars, and seasonals.

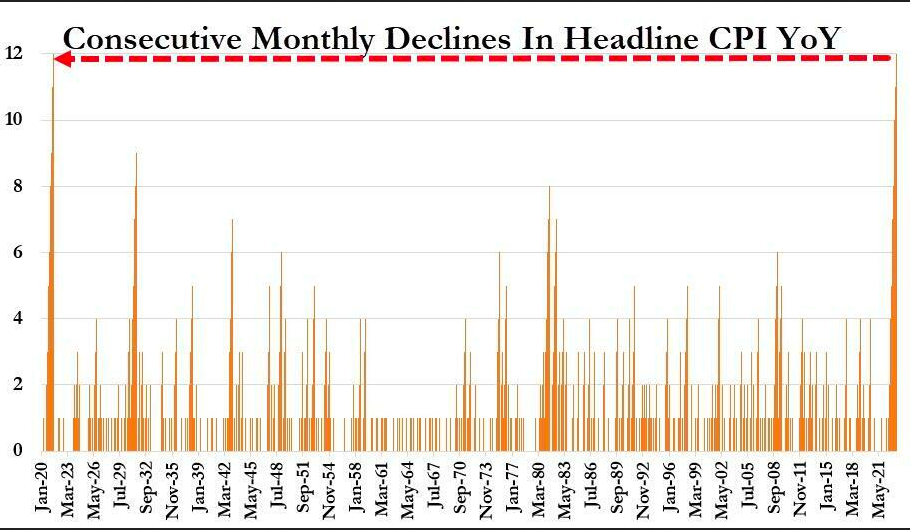

This is the 12th consecutive month of YoY declines in headline CPI, tying the longest streak of declines since 1921.

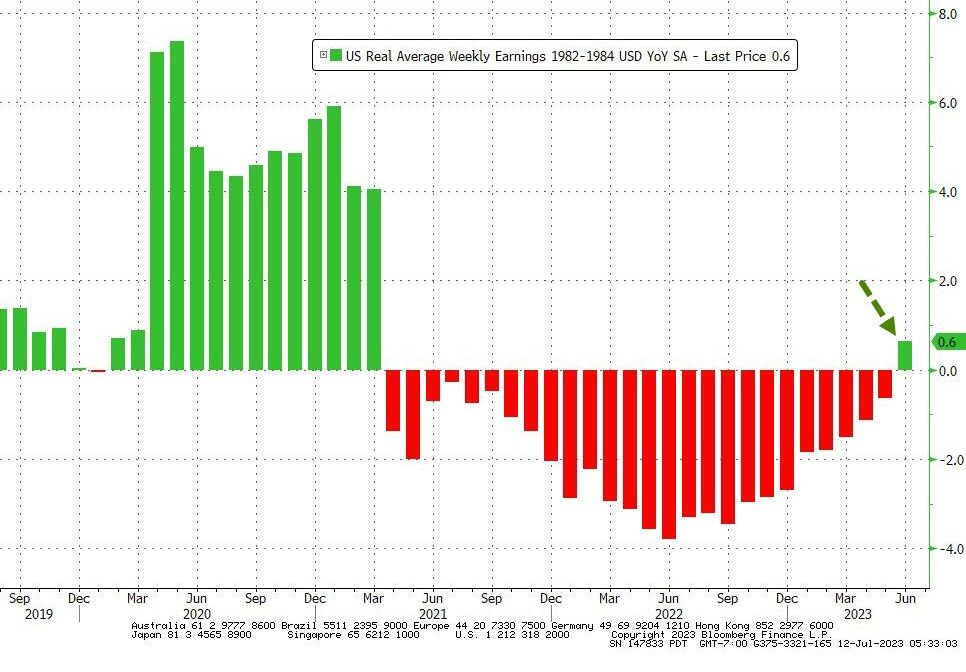

Fed interest rate cuts are priced in throughout 2024, encouraged by the cool print in the consumer price index. The increase in real wages is a sign of the tightening cycle beginning to filter through the labor market, with the Federal Funds Rate now being definitively over the year over year inflation rate. With inflation concerns abating, the attention now shifts to the labor market, where the effects of tightening are likely to arise next.

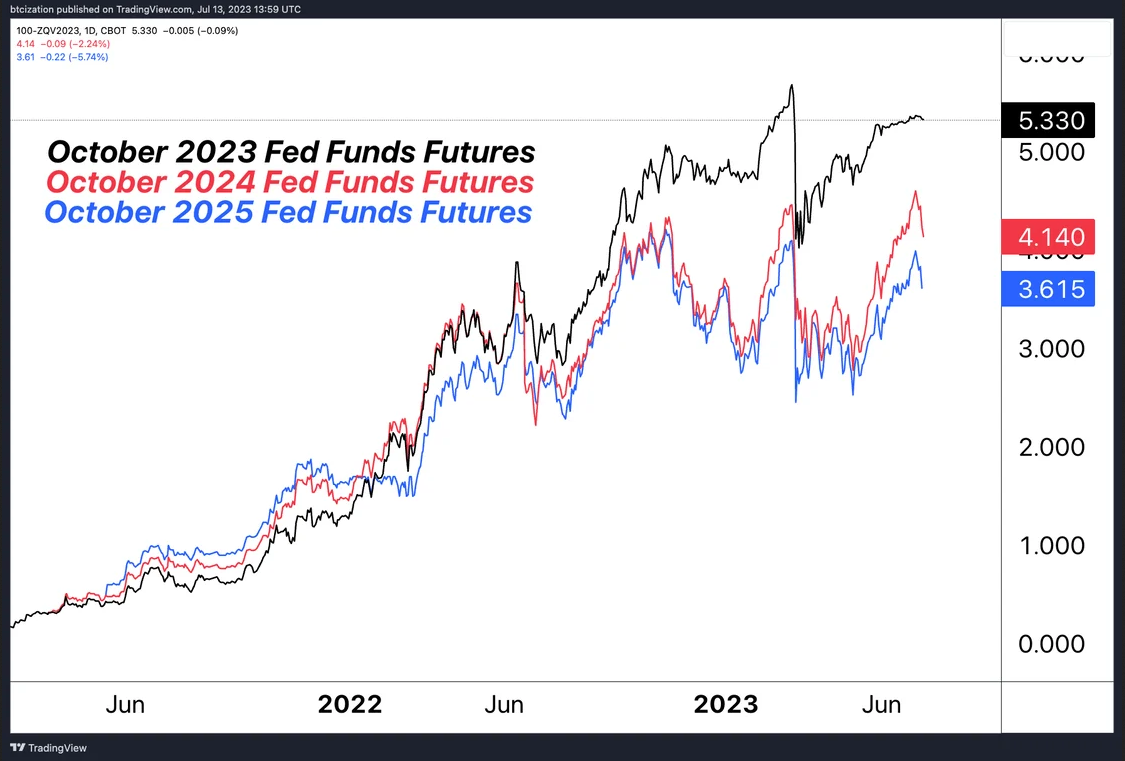

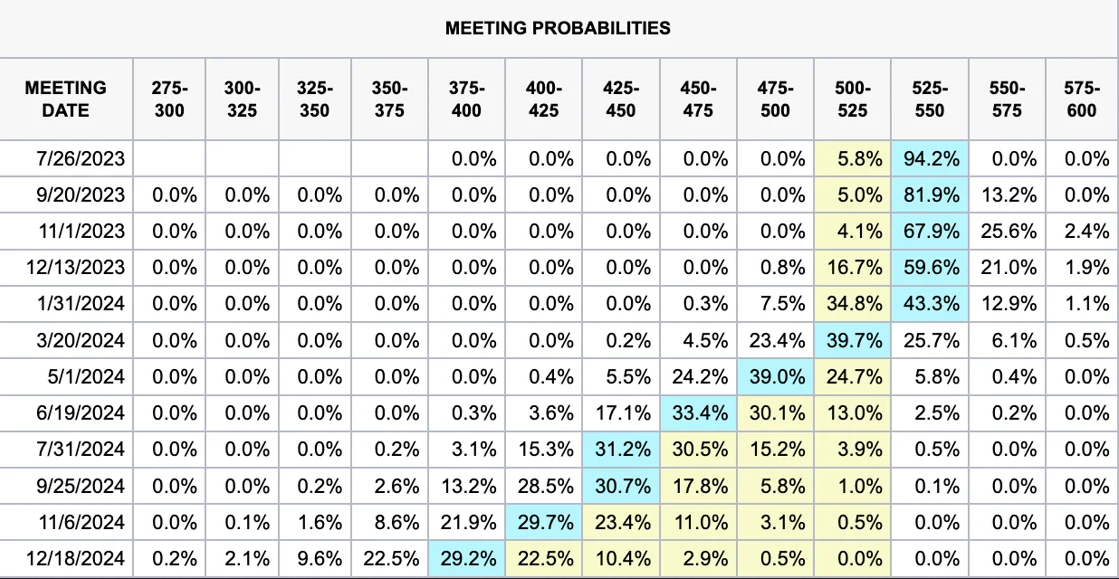

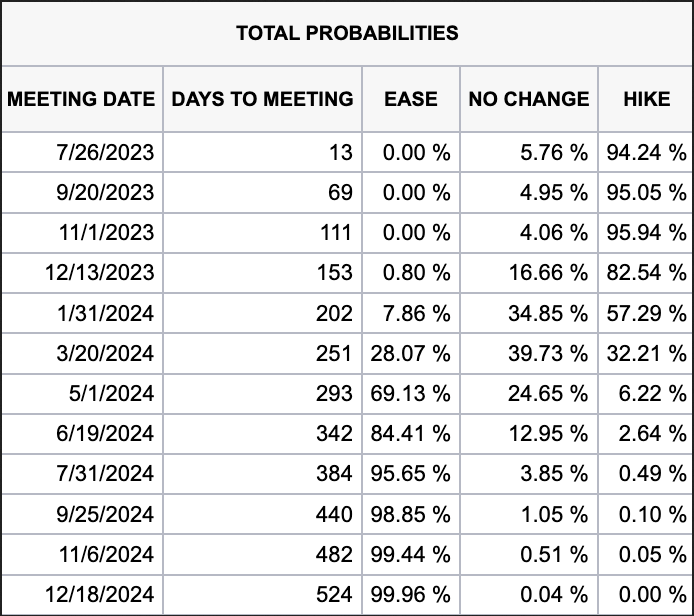

Fed Funds Futures Expectations Dive After CPI Print

With the cool inflation print coming in this week, expectations for future rate cuts increased, according to the CME FedWatch Tool. Rates in October of 2024 and 2025 are expected to be 4.14% and 3.61%, respectively, definitively lower than the rate today but also far from a return to the pre-pandemic zero lower bound.

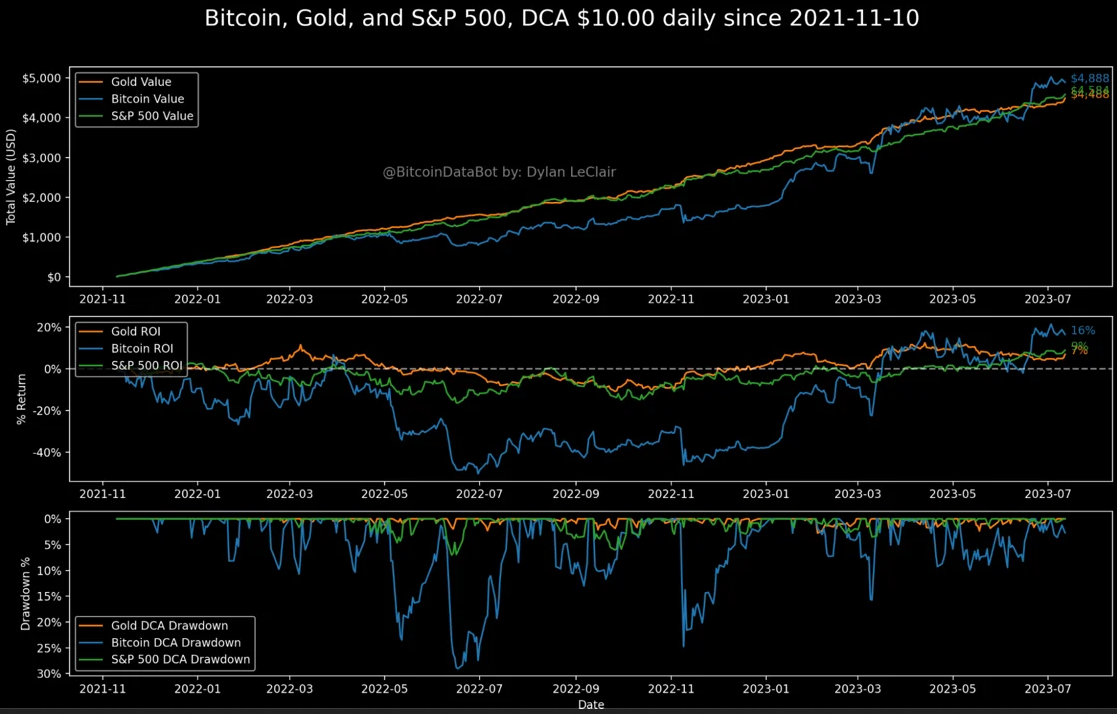

Bitcoin DCA for The Win

Despite being over 50% below its former all time highs, steady bitcoin accumulation is proving to be a winning strategy. Dollar cost averaging into bitcoin starting from the day of the $69,000 all time high has outperformed dollar cost averaging both stocks and gold during the same time period, though accompanied by higher volatility.

Dollar-cost averaging has resulted in returns of +16% for Bitcoin, +9% for the S&P 500 Index, and +7% for gold since November of 2021.

The data underlines the effectiveness of a consistent accumulation strategy once a high-performing asset has been identified, emphasizing a long-term perspective and the potential for holding (HODLing).

New Hash Rate All Time Highs, Again

The 7-day moving average hash rate has marked a new all-time high at 392 EH/s.

This milestone is accompanied by a +6.45% increase in the recent difficulty adjustment, following a downward adjustment of -3.26% in the prior epoch, which was the second-largest adjustment in 2023.

Volatility Expansion on the Horizon?

As bitcoin consolidates just over the $30,000 level, bollinger bands, a measure of historical volatility have continued to compress, while BVIV, a bitcoin implied volatility index, flirts with year to date lows. Historically, periods of tight trading range compression are followed by large breakouts in either direction. Whatever way bitcoin decides to break out in the short to medium term, expect fireworks.

Podcast of the Week

E007: Cathedral Building in Bitcoin, with Alex Leishman, The Last Trade

On this week’s episode of The Last Trade, Founder and CEO of River, Alex Leishman, sits down with hosts Marty Bent, Jesse Myers, and Michael Tanguma.

This conversation provides a behind-the-scenes view of the decisions and trade-offs when building a Bitcoin company. Topics include building cathedrals in Bitcoin, unqualified “qualified custodians,” and Bitcoin saving the United States.

Check out the full episode here.

Closing Note

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair