Roundup: US Treasury Yields & Global Liquidity

Dylan LeClair | Guest Contributor

Aug 10, 2023

Hi all,

This is Dylan LeClair, presenting this week’s Onramp Weekly Roundup.

Before we get started… If you’re a HNWI or Institution looking for the best way to get exposure to bitcoin, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, here’s the weekly roundup…

2-Year Yields, Fed Speakers, Signal End of the Tightening Cycle

Philadelphia Fed President Patrick Harker recently provided some insights into the economic forecast and the possibility of a shift in monetary policy. Here’s a summary of his statement:

“I expect core PCE inflation to decline to a rate perhaps just below 4 percent year over year by the end of 2023… I forecast unemployment to tick up slightly and better align with the natural unemployment rate as labor tightness continues to ease… Absent any alarming new data between now and mid-September, I believe we may be at the point where we can be patient and hold rates steady and let the monetary policy actions we have taken do their work.”

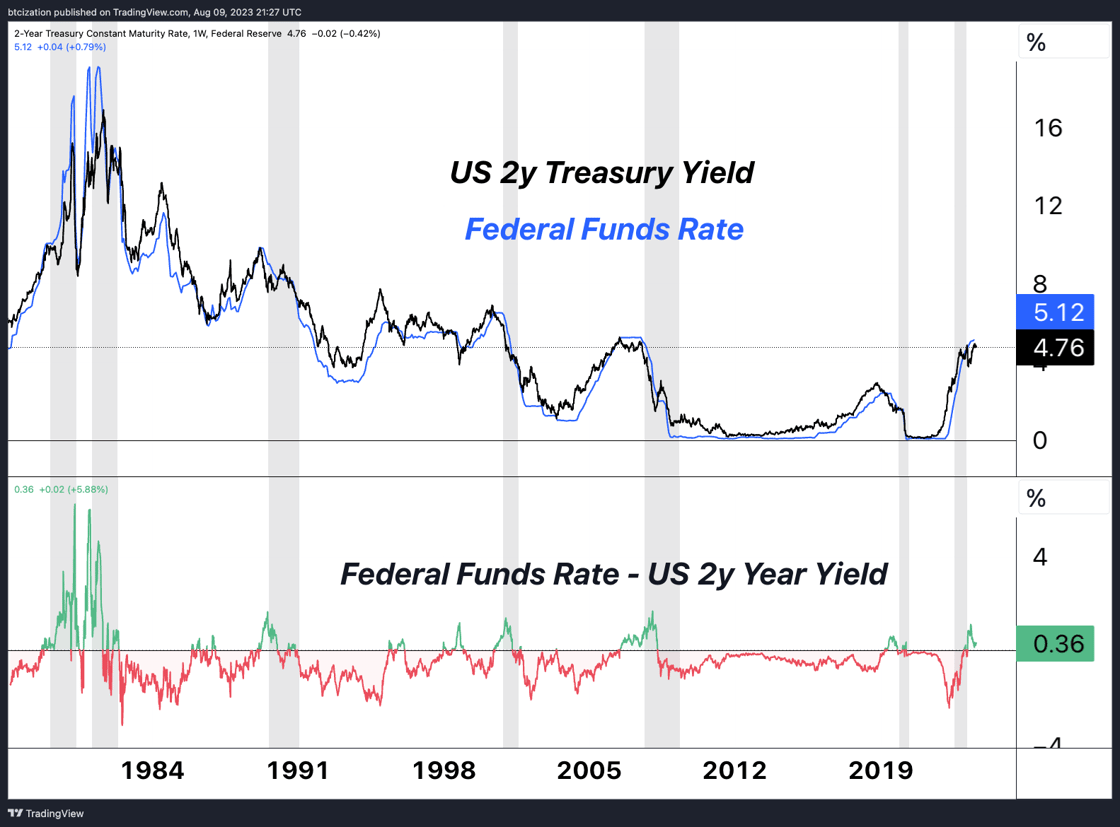

In addition to President Harker’s outlook, 2-year yields are signaling that the tightening cycle is likely over. These yields, seen as a proxy for the market’s expectations for rates over the coming two years, are 36 basis points below the current Fed funds rate. This is a clear indication from the market that it believes the Fed is finished with tightening.

US Five-Year Real Yields at 15-Year Highs

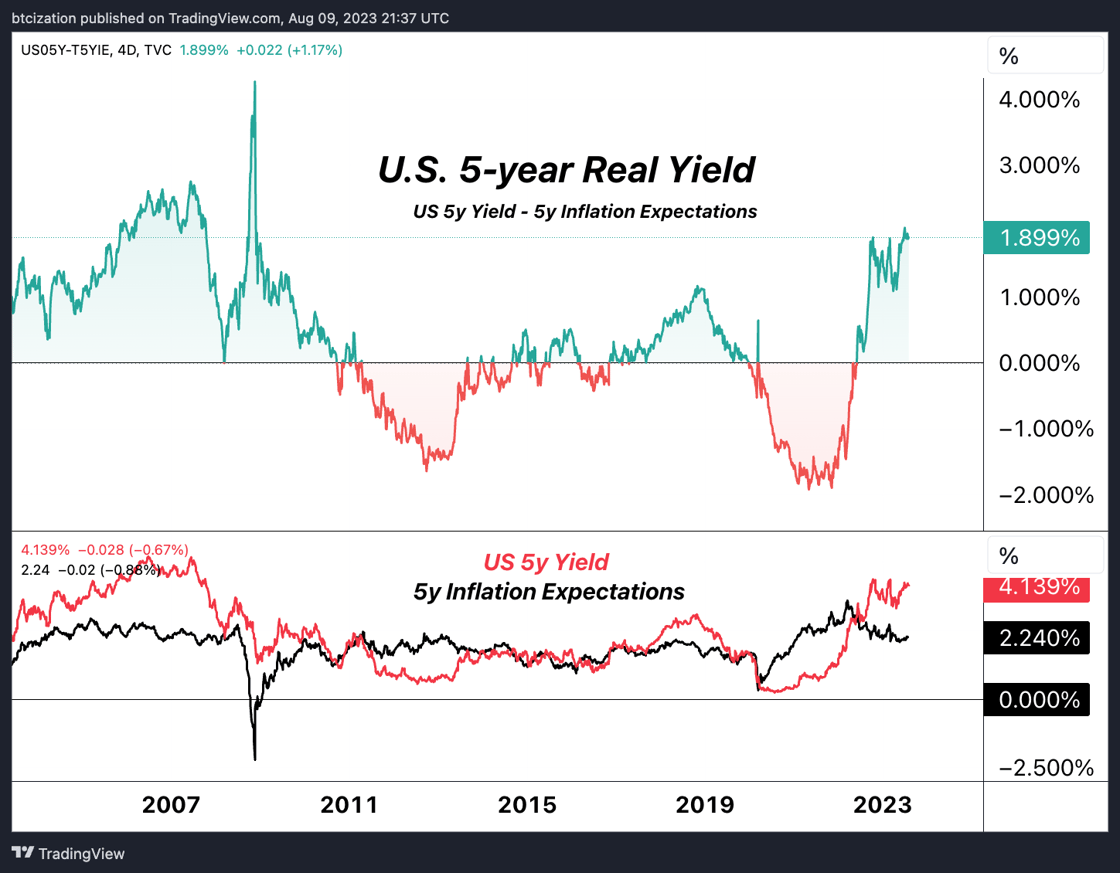

Real yields, which represent the yields on US Treasury securities minus the market’s forward expectations for inflation, are at their highest point in fifteen years. This comes after a decade where negative or very low real yields were the norm. The market is unaccustomed to such a tight environment, and it remains unclear just how negative of an impact this dynamic will have on the real economy if it stays elevated for an extended period of time.

Global Liquidity and U.S. Markets Diverge

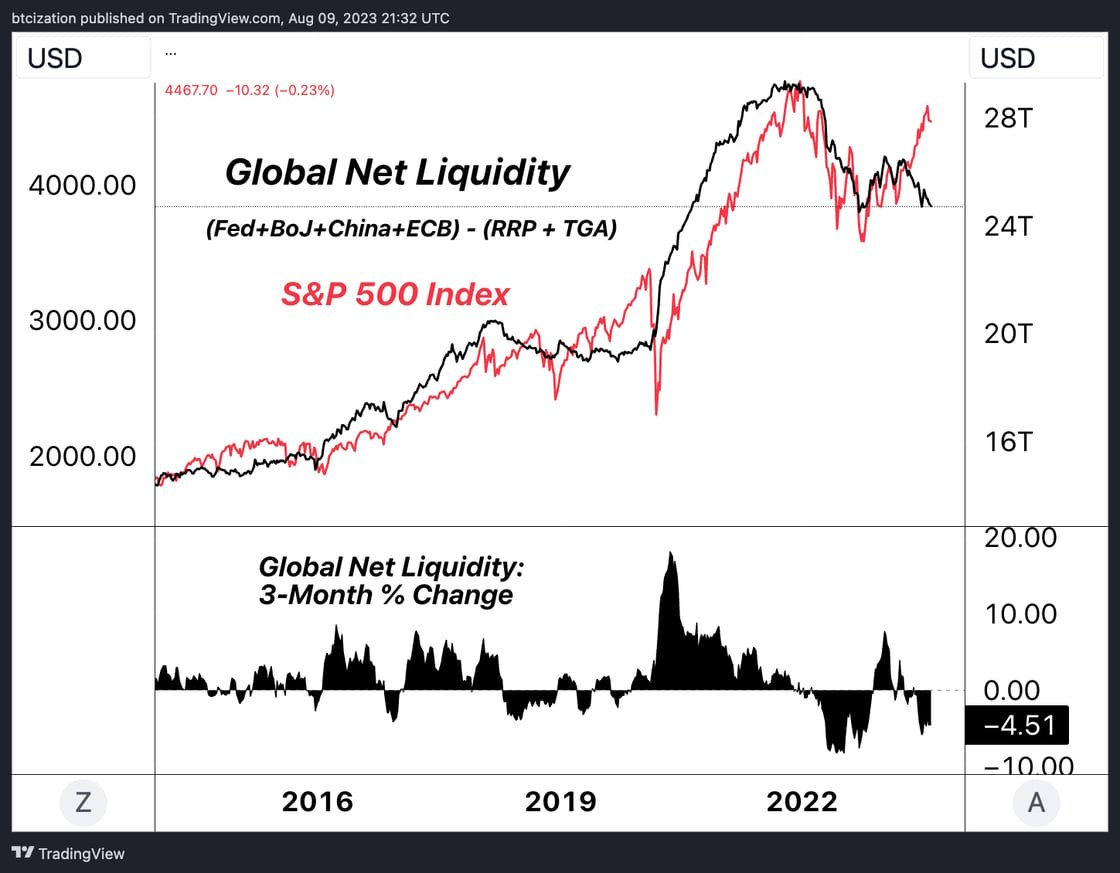

In recent months, there has been a growing divergence between global liquidity and U.S. equity markets. While liquidity isn’t everything, it almost is. Utilizing a composite measure of liquidity (balance sheets of Fed, BoJ, China, ECB, minus liquidity in the reverse repo facility and the US Treasury cash balance), we arrive at a reasonable enough proxy for determining if global liquidity is declining or increasing.

The recent separation of equity markets to the upside does raise some concerns, especially considering the tight monetary policy currently in place. This divergence and what it means for the broader financial landscape will be a key trend to monitor as the global economy continues to navigate the post-pandemic era.

Bitcoin Spot to Derivatives Market Volume at All-Time Lows

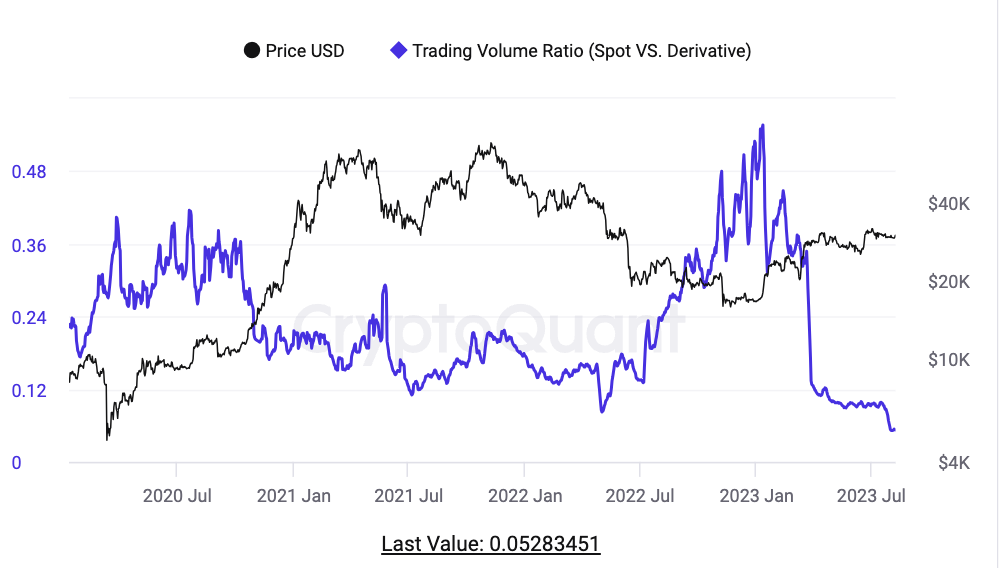

Current spot volumes in comparison to notional derivative volumes in the Bitcoin market have reached all-time lows, reflecting a recent period of muted volatility and summer stagnation. This trend aligns with Bitcoin’s historical pattern of consolidation following bear market phases. The advent of large global derivative markets, being relatively new, adds an additional layer to it.

The key takeaway is a holding pattern: Bulls, having endured the bear market, show no interest in selling, while new capital waits on the sidelines for upcoming ETF decisions and the anticipated 2024 Bitcoin halving.

While elevated derivative volumes are expected due to the inherent leverage that speculators can utilize, these all-time lows point to a broader market ennui. There seems to be a lack of large willing sellers or buyers at the moment in the spot market, while derivative traders get chopped to oblivion by fees and high leverage speculation.

Podcast of the Week

E011: Multigenerational Security for Bitcoin with Matt McClintock

Matt McClintock of Bespoke joined us for The Last Trade. The conversation went deep on estate planning considerations for Bitcoiners – if you’ve ever wondered if a revocable or irrevocable trust strategy could help your family retain its Bitcoin wealth for generations.

Check out the full episode here.

Closing Note

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair