Roundup: Bitcoin‘s Volatility & ECB Update

Dylan LeClair | Guest Contributor

Aug 24, 2023

Hi all,

This is Dylan LeClair, presenting this week’s Onramp Weekly Roundup.

Before we get started… If you’re a HNWI or Institution looking for the best way to get exposure to bitcoin, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, here’s the weekly roundup…

Bitcoin Volatility Returns: A Derivative Phenomenon

Last Thursday evening marked a notorious return of Bitcoin’s volatility, ending months of consolidation around the $30,000 level. This price awakening wasn’t triggered by any specific news-based event, such as rumors of SpaceX selling Bitcoin or the approval/dismissal of a spot Bitcoin ETF. Instead, the crash was a result of old-fashioned derivative liquidation, a clear instance of more sellers than buyers leading to the downside.

In our 8/3/23 Roundup we highlighted bitcoin’s realized volatility falling below that of equities and gold, while in our 8/10/23 release, we highlighted how derivative trading volumes relative to spot market volumes had fallen to all time lows.

With last week’s move, we caught a glimpse as to the significance of both of the data points.

Historical trends reveal that low periods of realized and implied volatility in Bitcoin often precede large volatility bounces. This massive move, although downwards, may signal a new regime in Bitcoin as the market seeks equilibrium. While the derivatives market’s growth is neither good nor bad in the long run, its short-to-medium-term development can cause large unexpected volatility, resulting from aggressive trading to resolve imbalances.

End of Summer Doldrums?

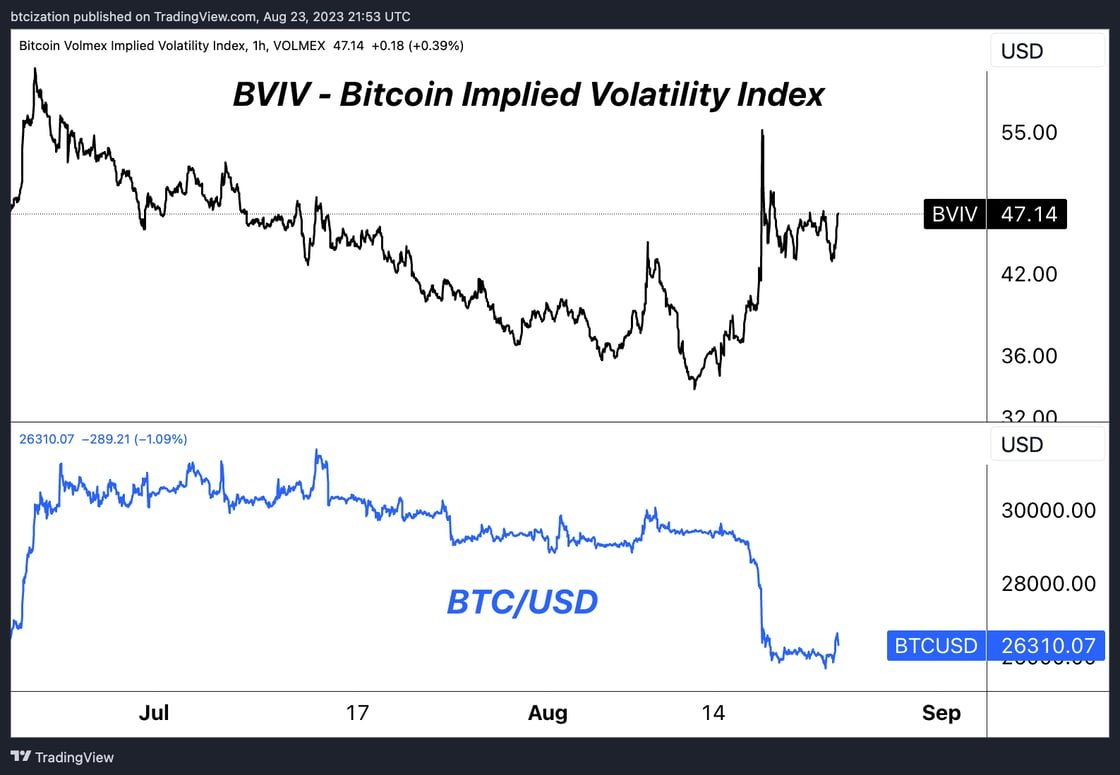

Over the summer months, selling or shorting volatility became a popular trade, as observed through the Volmex Bitcoin Implied Volatility Index (BVIV). This created a stabilizing “pinning” effect near specific price levels, maintained by market makers dynamically buying or selling the underlying asset. However, this equilibrium was shattered last Thursday, leading to a significant price and volatility movement.

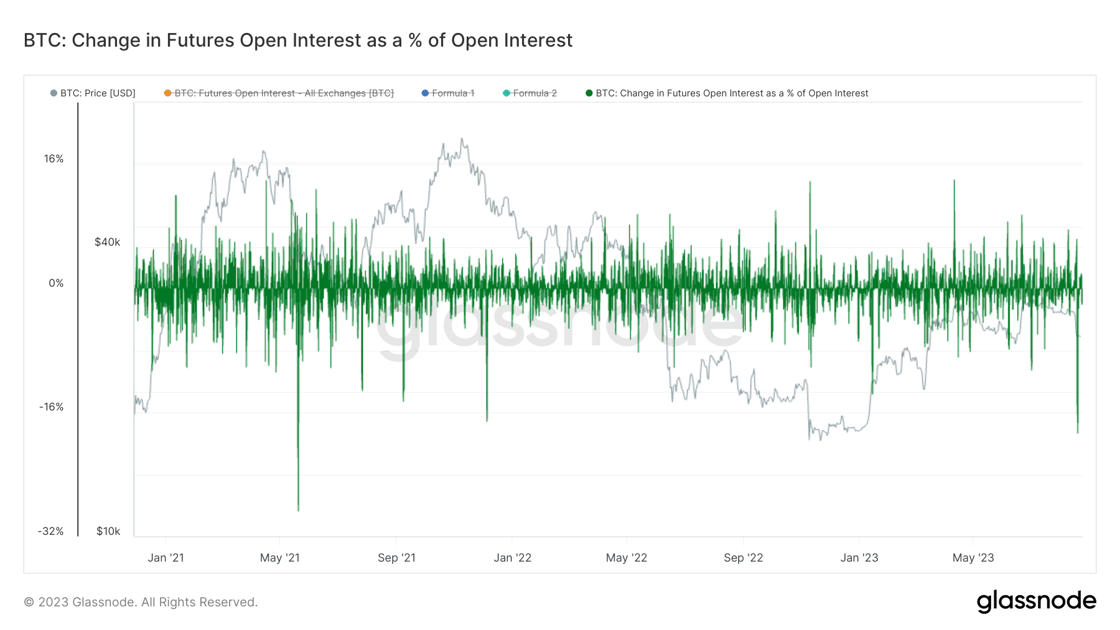

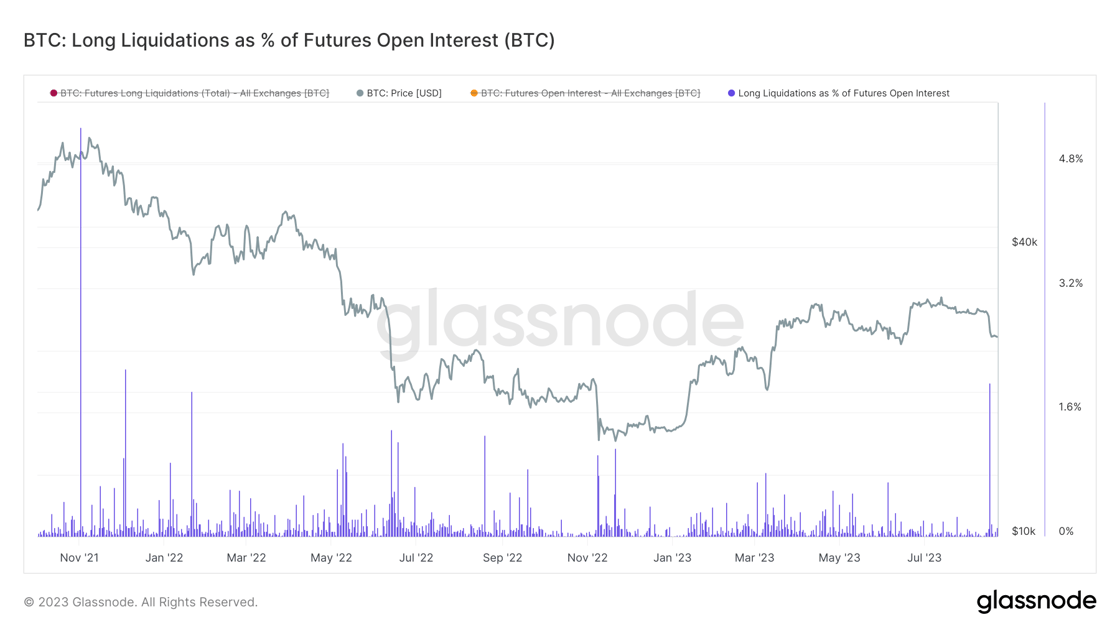

The spread between perpetual swaps in the derivatives market and the price in the spot bitcoin market widened drastically. Those caught implicitly or explicitly shorting volatility were caught off sides, resulting in a massive dislocation and liquidation event. The daily change in open interest was larger than the collapse of FTX, with 89,000 BTC less open interest than 24 hours prior. Another notable point was that long liquidations as a percent of open interest were the largest in a one day period since November of 2021.

The large bout of volatility, though typical in extremely low volatility periods, indicates a short-term increase in uncertainty. The market will now be closely watching for news on potential Bitcoin spot ETF approvals heading into 2024, as the price seeks a new equilibrium point.

Euro Area's Economic Downturn: Eyes on the ECB

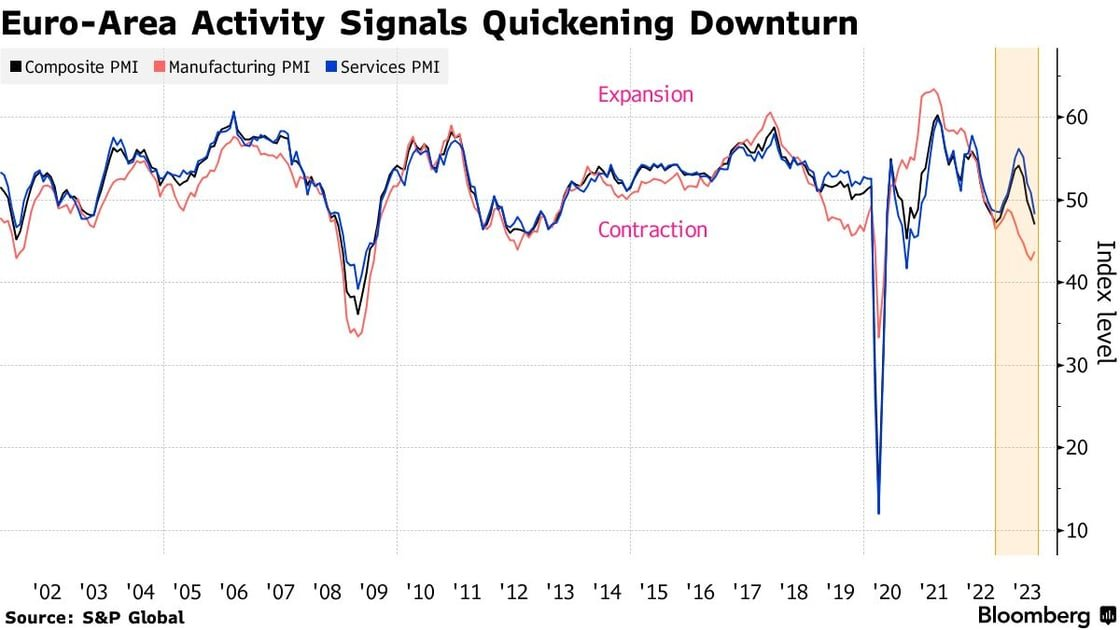

The euro area is facing a deepening contraction of private-sector activity, leading to growing speculation that the European Central Bank (ECB) will pause its interest-rate hikes next month. The flash Purchasing Managers’ Index (PMI) for the region fell to 47, below the growth threshold, with services activity shrinking for the first time since the end of 2022. Particularly concerning figures emerged from Germany, where the decline in overall activity was the fastest since May 2020.

The data suggests that the euro area could shrink by 0.2% in the third quarter, compared to 0.3% growth in the previous quarter. European bonds rallied, and traders now price a 40% chance of a quarter-point ECB hike next month, down from 55% before the release. The situation is further complicated by stubborn price pressures, leading some to speculate that the ECB may still be tempted to rush one last hike in September if core inflation surprises on the upside.

Value, Growth, and Bonds: The Debate Rages On

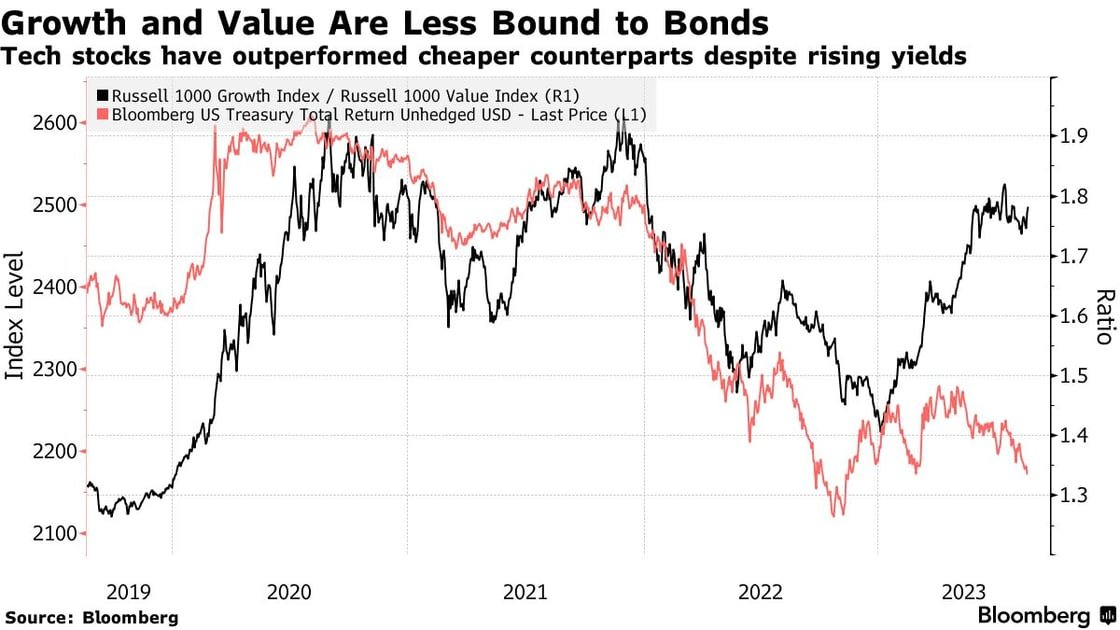

Multi-asset managers have come to note an increasing disconnect between stocks and bonds, leading to diverging views among investors and analysts. While growth stocks have outperformed value even as bond yields have jumped, the correlation between growth & value and bonds has significantly weakened.

Some traders interpret this shift as a new paradigm for growth stocks. The artificial intelligence (AI) boom of 2023 has particularly boosted growth stocks’ expected future profits, softening the threat of elevated interest rates. This trend has led some to believe that the market’s underlying dynamics have fundamentally changed, heralding a new era for growth investing.

On the other hand, value investors highlight that “nothing new is under the sun.” They argue that the disconnect between valuations in growth stocks relative to value stocks and bond yields is a temporary phenomenon that will eventually come to roost. In this view, the timeless rule that lower-valued equities tend to outperform over the long term remains unchanged. The debate between these two perspectives continues to rage, as each side interprets the current market dynamics in light of their investment philosophy.

Podcast of the Week

E013: A Market Whistling Past the Graveyard with Gary Brode, from The Last Trade

This week, Wall Street hedge fund veteran, Gary Brode, joins Marty Bent, Jesse Myers, and Michael Tanguma on The Last Trade. Gary puts on a clinic of explaining the fiscal nightmare that the United States finds itself in, strategies for navigating a time of great uncertainty in markets, and shares his insider wisdom about institutional considerations for Bitcoin adoption.

Check out the full episode here.

Closing Note

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair