Roundup: US Credit Rating Downgrade & Declining Tax Revenues

Dylan LeClair | Guest Contributor

Aug 3, 2023

Hi all,

This is Dylan LeClair, presenting this week’s Onramp Weekly Roundup.

Before we get started… If you’re a HNWI or Institution looking for the best way to get exposure to bitcoin, Onramp Bitcoin could be the right fit for you – schedule a chat with us to discuss your situation & needs.

And now, here’s the weekly roundup…

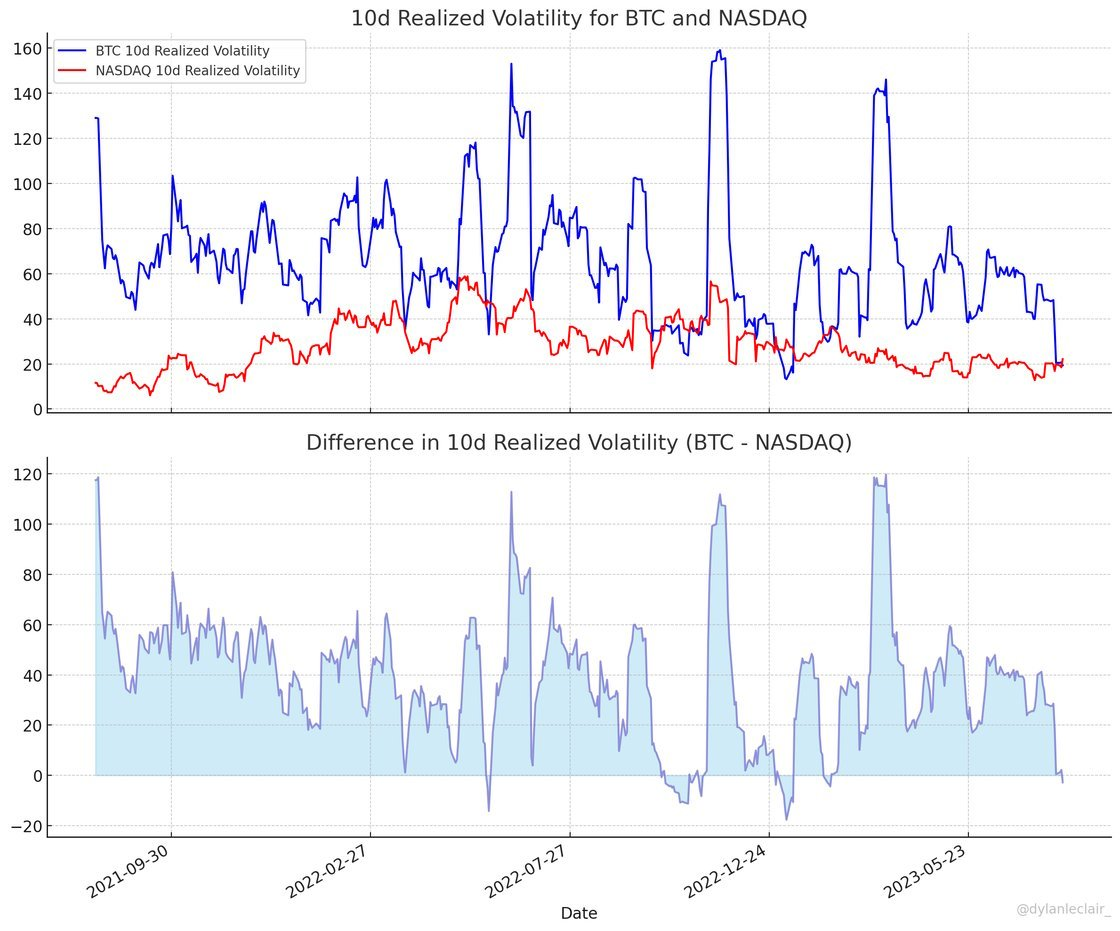

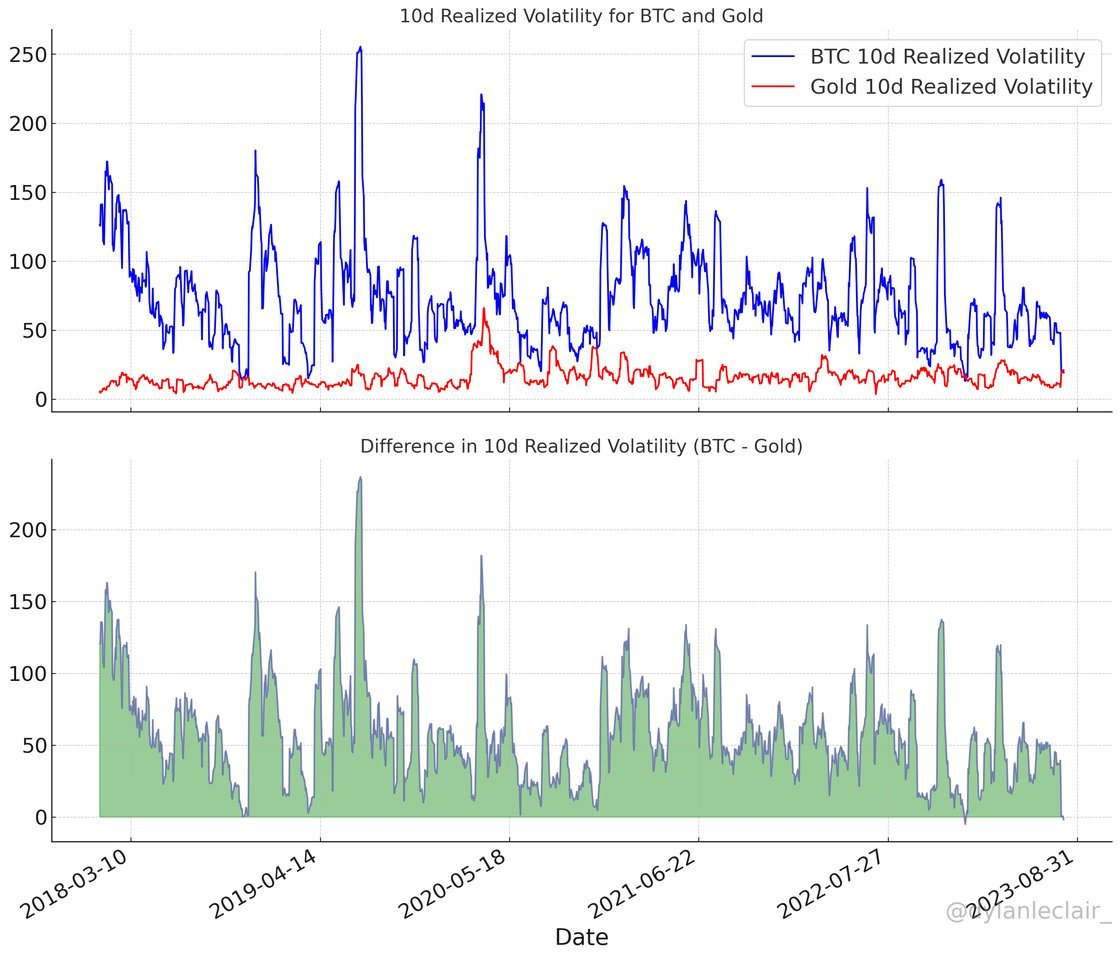

Bitcoin Volatility Falls Below Nasdaq & Gold

In an intriguing turn of events, Bitcoin’s 10-day realized volatility has dipped below that of both the Nasdaq and Gold, marking a rare occurrence. This shift speaks to Bitcoin’s maturation and the current lull in volatility, as both bullish and bearish interest seem muted at present levels. Notably, one of Bitcoin’s major criticisms over the years has been its high volatility, which critics—especially gold proponents—have termed as rendering it “too risky”. This recent change of guard poses an interesting counter to such assertions and demonstrates Bitcoin’s potential for a stable financial future.

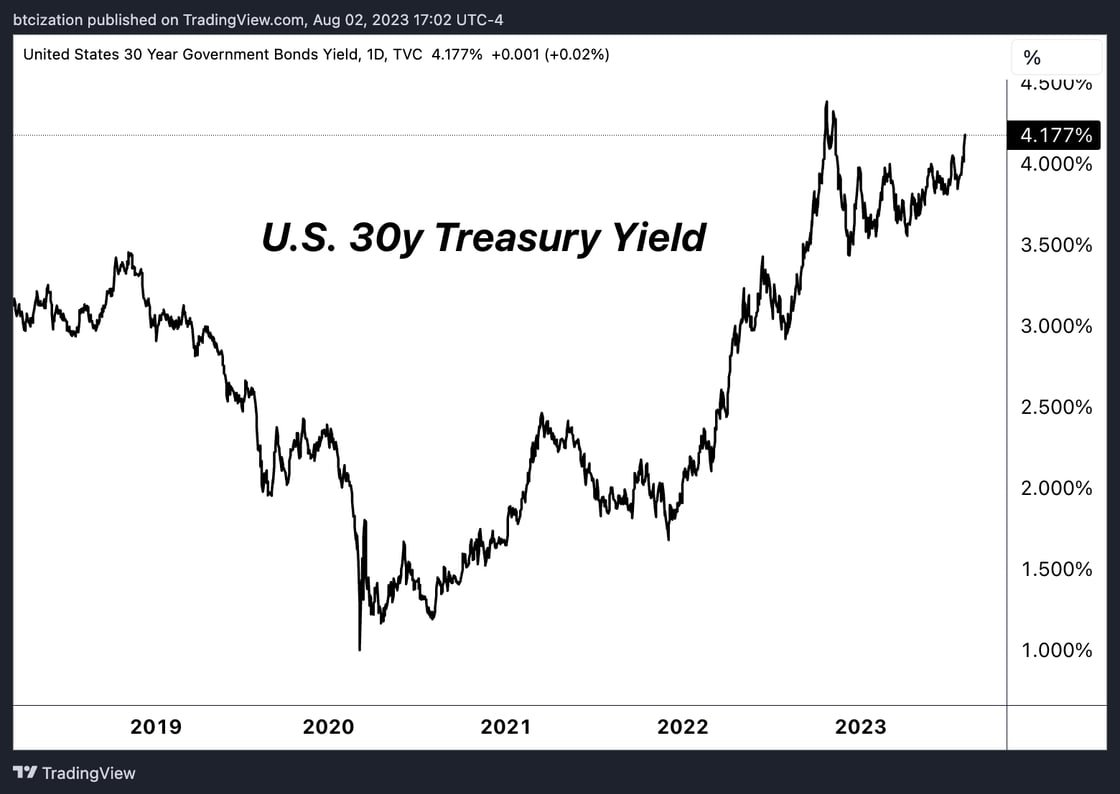

Fitch Downgrades U.S. Credit Rating

Credit rating agency, Fitch, has announced a downgrade in the US credit rating due to a ‘steady deterioration’ in US governance, particularly observed in frequent debt ceiling battles. According to Fitch, “In our view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025.”

Fitch further notes that the recurring political standoffs around the debt-limit, paired with last-minute resolutions, have undermined confidence in fiscal management. This announcement has sparked a response in the bond markets, with long duration bond yields visiting their highest levels since November as traders digest an uptick in US government issuance alongside the sovereign credit downgrade.

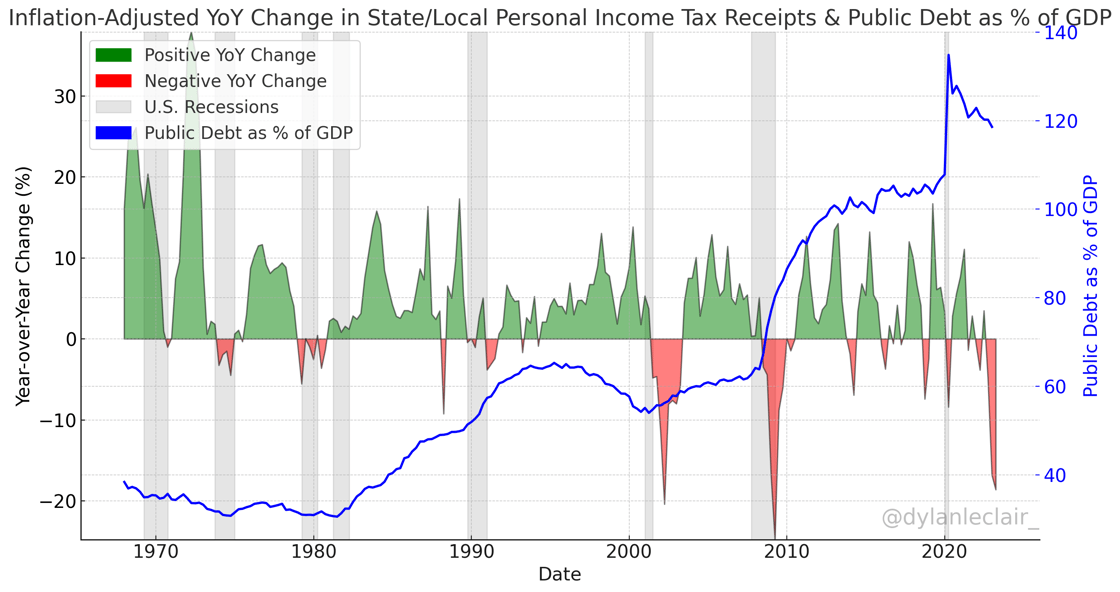

Historic Decline in Tax Revenues for US State and Local Governments

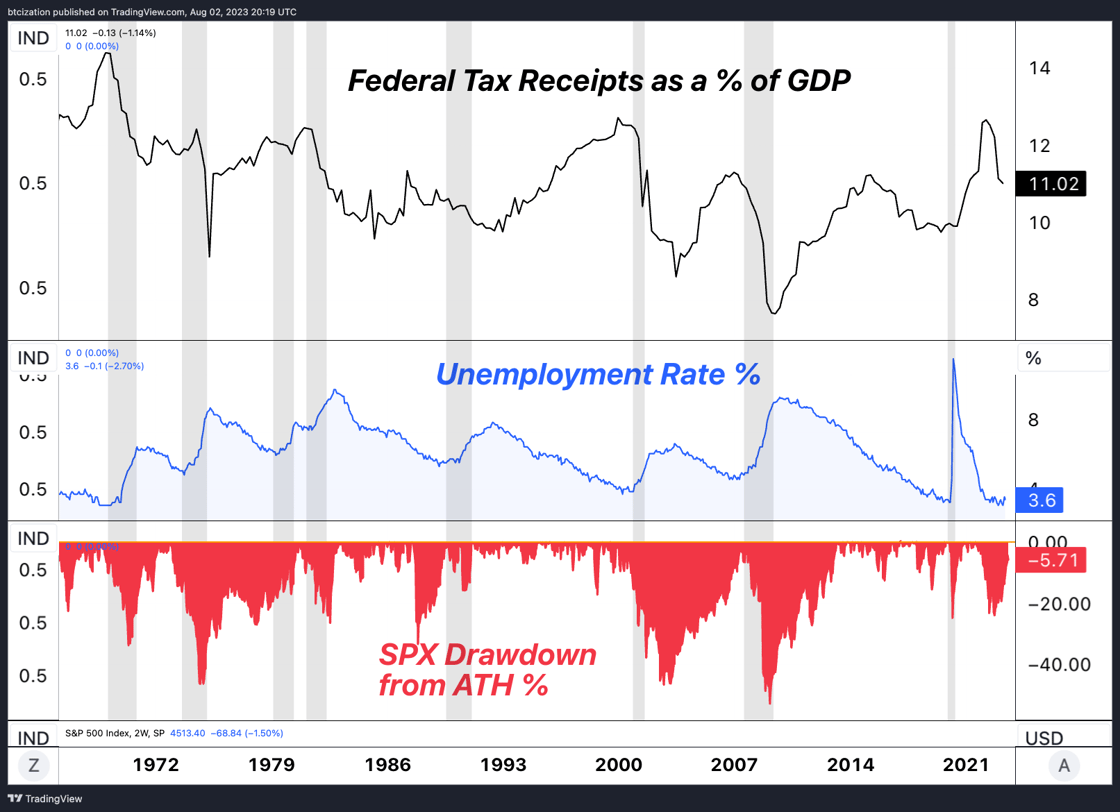

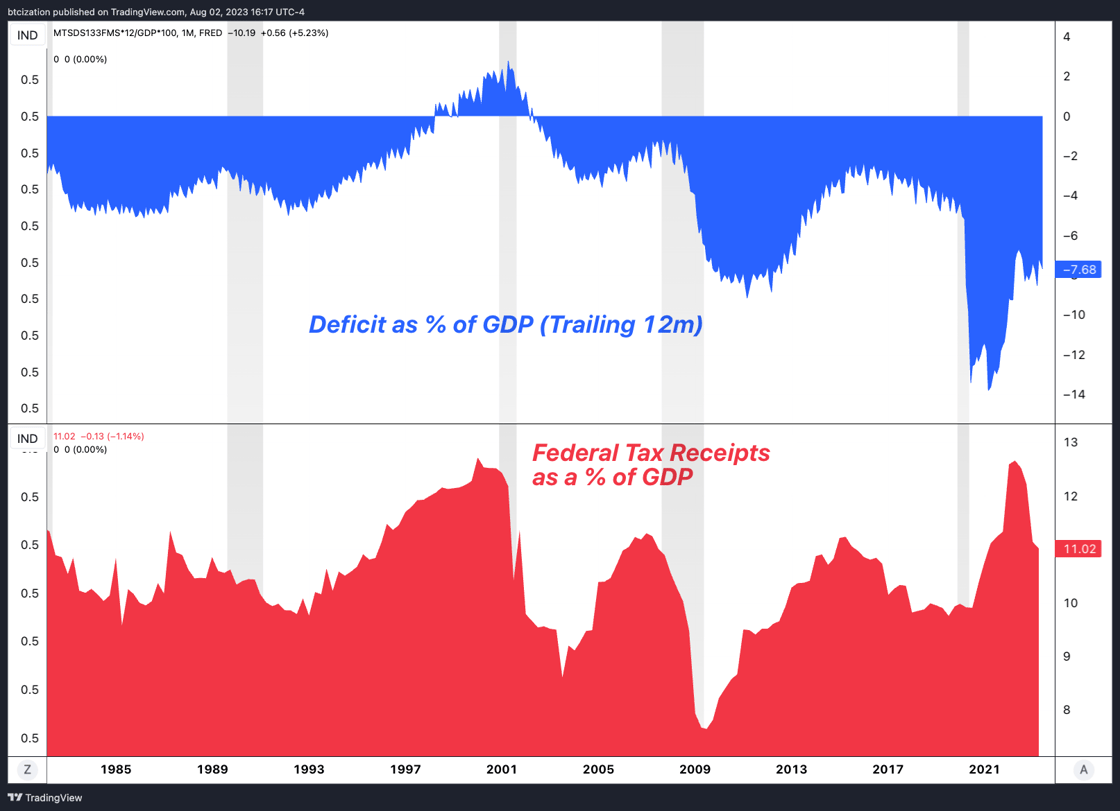

As reported by Tavi Costa, US state and local governments have witnessed the largest ever decline in income tax revenues, measured in nominal billions. This constitutes the second steepest year-over-year percentage drop in history, with only the Global Financial Crisis (GFC) resulting in a worse outcome. The data, indexed to inflation and displayed in year-on-year percentage change terms, reveals a grim situation when juxtaposed with public debt as a percentage of GDP.

Historical analogs to the current precipitous decline in tax receipts are waving potential red flags for the US economy, suggesting we could be heading towards a recession in 2024. Conventionally during recessions, deficit spending as a percentage of GDP tends to inflate due to the adoption of expansionary fiscal policies aimed at stimulating economic activity. On the flip side, tax revenues as a percentage of GDP generally decrease due to lower incomes and corporate profits, and sometimes tax cuts aimed at providing relief and spurring consumption and investment.

Alarmingly, US deficits remain wide in historical terms. The widening interest rates on long-duration debt and interest expense on the verge of surpassing $1 trillion for the first time ever warrant serious considerations about the nation’s fiscal health. It is within this economic backdrop that Bitcoin’s role becomes increasingly significant.

As governments around the world face mounting fiscal challenges and resort to inflationary measures, like printing more fiat currencies, Bitcoin stands as a viable alternative that every asset allocator must evaluate against a portfolio of fiat denominated debt instruments and equities.

Podcast of the Week

E010: Building and Managing Generational Wealth with Morgen Rochard, The Last Trade

This week on The Last Trade, hosts Marty Bent, Jesse Myers and Michael Tanguma sit down with founder of wealth manager Origin Wealth, Morgen Rochard. The conversation ranged from discussing the unique wealth management issues that Bitcoiners face, spending vs. compulsive saving, and tailoring products to bridge the gap between the traditional wealth management space and Bitcoin.

Check out the full episode here.

Closing Note

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair