Roundup: Market Turmoil & Conflicting Data

Zack Morris | Research Analyst

Aug 8, 2024

Market Turmoil in Japan

On Monday, the Japanese stock market suffered it’s largest one day drawdown since “Black Monday” on October 20, 1987. The Nikkei 255 index was down 12.4%. On Tuesday, it bounced back 10.2%.

It is thought that the massive sell-off was triggered by an unwind of the “yen carry trade,” whereby investors borrow Japanese yen at 0% interest rates and sell the yen for US dollars earning 5%, or to invest in other higher-yielding assets like the Japanese or US stock markets. This 5% annualized spread compensates investors for the risk of the yen strengthening vs. the dollar. If the yen weakens against the dollar, all the better. But, a 5% currency move in the wrong direction can wipe out a year’s worth of gains.

Since the trade has become popular, so many investors shorting yen and buying dollars has caused the yen to weaken by nearly 15% vs. the dollar over the past year, which increased the returns on the yen carry trade.

That is, until this week:

Plenty of ink has been spilled covering the dynamics of this trade this week, so we’ll point you to friend of the Roundup Peruvian Bull’s excellent article on the topic here and simply to try to add what we think has been an under discussed part of the picture in the wake of the chaos in markets.

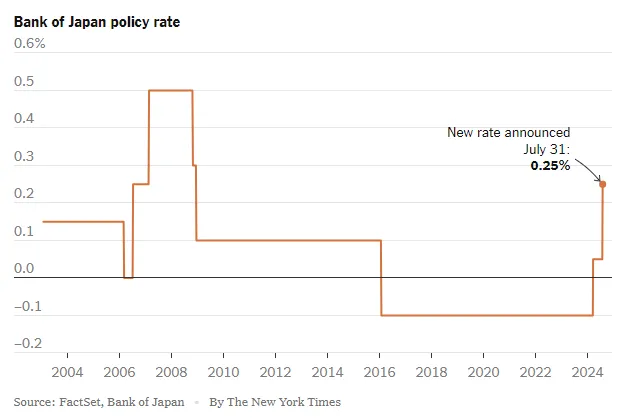

While much of the focus has been on the Bank of Japan’s surprise 15 basis point rate hike last Wednesday, July 31, as the catalyst for the unwind, that is only half of the picture.

source: The New York Times

The attractiveness of the yen carry trade depends on the spread between the interest rate on yen and dollars, meaning, US rates coming down can have just as much impact as Japanese rates going up.

And what happened last week on the US side of the equation was a weak July employment report on Friday stoked investor fears that the Fed might be behind the curve on rate cuts and the US economy might be tipping into a recession.

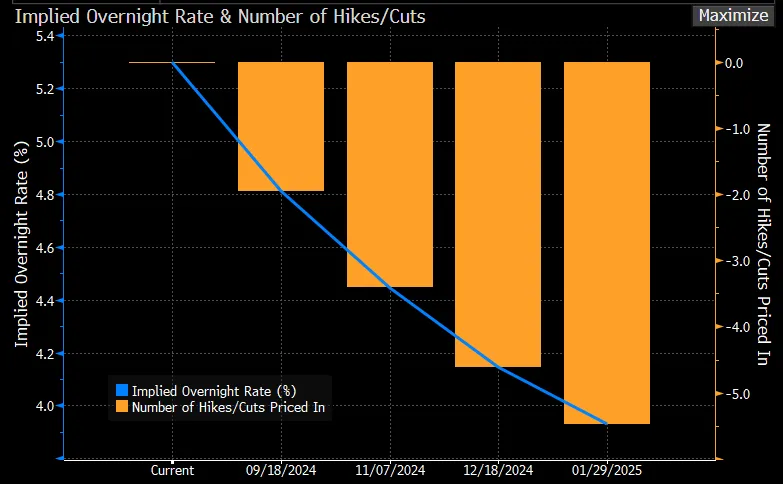

Suddenly, 50 bps of cuts got priced into the Fed’s September policy rate decision, and another 50-75 bps by the end of the year:

source: Bloomberg

This rapid repricing of future US rate cuts by the market, I would argue, is what contributed the most to the vicious rally in the yen. A 15 bps hike in Japan just doesn’t move the needle for traders as compared to a sudden repricing for 125 bps cuts in the US by year-end.

So, for US investors calling for emergency rate cuts in response to the global stock sell-off, be careful what you wish for. It is exactly this sudden change in forward looking interest rate expectations that arguably caused the global market volatility in the first place.

All of this begs the question though: are we actually getting 125 bps of rate cuts in the US by the end of the year? Is the US economy heading for a recession, or already in one?

Conflicting Macroeconomic Data

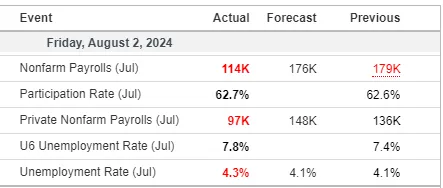

The report that sparked fears of recession last Friday was the July Non-Farm Payrolls report, which contained new information of slower than expected job growth in July and an increase in the unemployment rate from 4.1% to 4.3%.

On the surface, it looks bad:

source: Lyn Alden on X

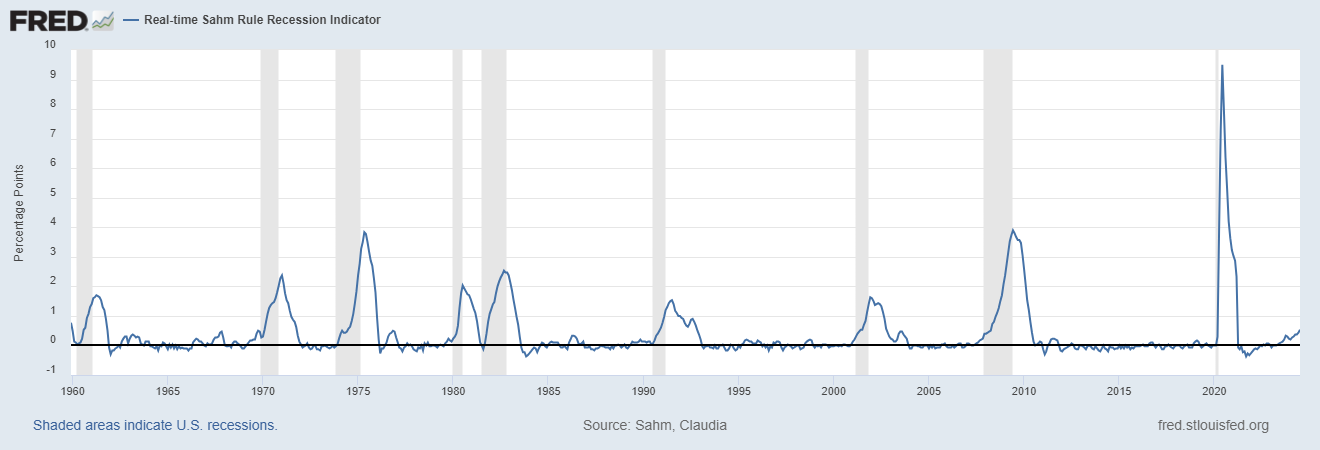

While the US economy still added 114k jobs in July, investors were concerned that job growth fell short of expectations by a large margin, and that the unemployment rate ticked up to 4.3%, which triggered the widely followed Sahm Rule Recession Indicator:

What this chart shows you is that every time the 3-month moving average unemployment rate has moved at least 0.50% higher than the minimum 3-month moving average unemployment rate over the last 12 months, it has predicted recession. Certainly an unwelcome harbinger.

In addition to the soft employment report, the ISM Manufacturing PMI showed an accelerating contraction in the goods economy.

But it’s not all bad.

Just days later the ISM Services PMI showed an acceleration in the expansion of the services economy, giving some economic forecasters comfort as services make up a larger part of the US economy than goods.

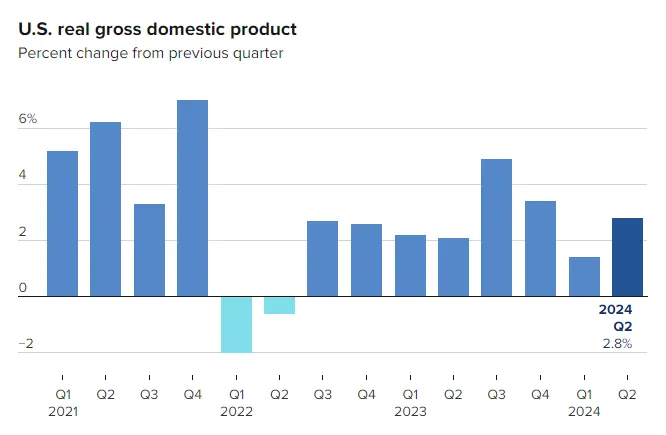

And as we soon forget, just two weeks ago the Q2 GDP report showed us that the “economy grew at a 2.8% pace in the second quarter, much more than expected.”

That’s real, not nominal:

source: CNBC

Finally, the most recent data point, just on Tuesday the Fed came out with their real GDP forecast for the third quarter of 2.9%, up from 2.5% previously.

If you’re confused, so is the market!

Taking in the totality of the recent data, I think the takeaway is that the market narrative has been aggressively flip-flopping without sustained evidence in either direction. Think about it — in the space of two weeks, we went from concerns over economic re-acceleration and inflation to calls for emergency rate cuts!

In fact, I think you can make the argument that this “too hot, nevermind too cold” economy is exactly what the fabled “soft-landing” should look like. I know, I know, famous last words…

Quote of the Week

“In addition, we’re one of the few companies in the world that have access to a 3-nanometer fab. Bitmain is producing chips that are 6-nanometer. So we can build a far better product that’s far more reliable, far more open and configurable. And this is super attractive to every single miner that we’ve talked to, and you’re seeing the result of that within one of the deals we just announced, and we have a very strong pipeline behind it as well. So I’m fully confident and have no doubt that this is going to be a significant business for us, and we’re going to take a majority of the market share.”

— Jack Dorsey, CEO, on Block’s Q2 2024 earnings call when asked about the opportunity he sees in bitcoin mining.

Market Update

As of 8/7/2024:

Source: Onramp, Koyfin. 3-, 5-year figures annualized.

A late week sell-off in global risk assets accelerated on Monday as the VIX index, a measure of stock market volatility and widely thought to be a fear gauge, spiked to its highest levels ever outside of the market events of 2008 and 2020. A surprise 15 bps rate hike by the Bank of Japan, coupled with weak employment data and recession fears in the US, are thought to be the drivers of the sudden repricing of risk. Bitcoin led the way lower, wicking down to $49,000 on Sunday night before recovering to $55,000 as of Wednesday at 4pm. The repositioning going on under the hood of the market is illustrated by the one month and year-to-date performance of the Nasdaq 100 vs. the Russell 2000, with the QQQs still up 6.2% ytd despite a 12.4% drawdown in the last month, while the small cap index is about flat over the last month and ytd. Gold, typically a safe-haven bid, also fell 2.5%. After a long period of underperformance, bonds reminded investors of their historical place in a 60/40 portfolio this week, rallying 0.8% as stocks slid.

Podcasts of the Week

The New Frontier E001: Bitcoin And The Middle East

Subscribe to Onramp MENA’s YouTube channel to catch new episodes of The New Frontier podcast! A dynamic, bitcoin-centric podcast that bridges the gap between the transformative world of Bitcoin and the unique financial landscape of the Middle East, covering both conventional and Islamic finance.

Wake Up Call (8.5.24): Contextualizing the Global Market Selloff with Jackson Mikalic

Wake Up Call is a weekly show that will be streamed live on LinkedIn every Monday morning. To catch the premier of each episode, follow Onramp’s LinkedIn page and add Wake Up Call events to your calendar. Hosted by Mark Connors, Onramp’s Head of Global Macro Strategy, and Rich Kerr, Onramp’s President of Managed Wealth, this show seeks to provide financial professionals the “wake up call” they need, prompt them to have an open mind with respect to bitcoin, rethink their prior assumptions, become more educated on the topic, and learn from others who are already farther down this path.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Zack Morris