Roundup: Global Liquidity in Focus

Mark Connors | Managing Director, Head of Global Macro Strategy

Sep 26, 2024

China Turns Dovish

When it comes to money, there is never enough when you’re a Central Banker in the 2020s. Headlines across industry, markets and central banks suggest we will see familiar trends in 2025 that will rhyme, but not necessarily repeat. China has flinched first and taken their most dovish monetary actions since the onset of Covid.

Earlier this week, The People’s Bank of China (PBoC), China’s central bank, cut rates by 20bps to 30bps, rolled near-term loans out to medium-term and is set to cut the amount of reserve ratio that defines the amount of capital banks hold against loans.

Today, there are reports the PBoC is considering a direct injection of capital ($142B per Bloomberg) in addition to reserve ratios being slashed. PBoC governor Pan Gongsheng has been in the job for just over one year and already is rolling back on the ‘hard money’ tough stance on industry he earned in the previous decade as the top foreign exchange regulator.

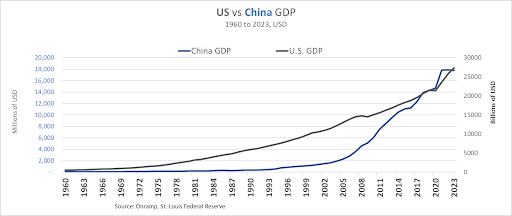

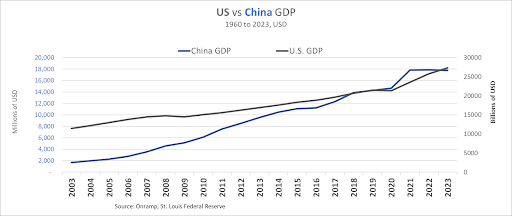

Slow growth can test the mettle of any man, woman or central banker…and China’s declining growth has done just that to Pan. The hockey-stick growth trajectory that characterized China’s growth after their 2002 inclusion in the World Trade Organization is over. It has been over for some time.

source: Onramp, St. Louis Federal Reserve

Chinese GDP is virtually flat in USD terms since COVID-19 and has been experiencing declining growth through Q2 2024, potentially breaching the psychologically significant 5% levels by YE 2024.

The Yuan appreciated from 7.1 Yuan to the USD in Q1 2020 to 6.4 in Q2 2022 as aggressive Fed cuts devalued the USD relative to the Yuan. But when the Fed started to raise rates, the Yuan was less attractive. Since July that has again reversed, seeing the Yuan drop from about 7.3 to 7.0, as the Fed’s messaging changed and rate cuts began.

Point being, even though China is a command economy, it is a global player subject to the vagaries and costs associated with currency volatility on trade.

Managing shifting global currency rates as interest rate policy changes, on top of their domestic property bubble, will invite the use of the almighty printing press. We will be watching for evidence of debt forgiveness and money printing (maybe like the 50% increase in debt the U.S. has posted since COVID-19), to help buttress nominal GDP.

M2 & Bitcoin

The Rising Water Table of Global Liquidity Lifts All Boats…Especially the ‘SS BTC’

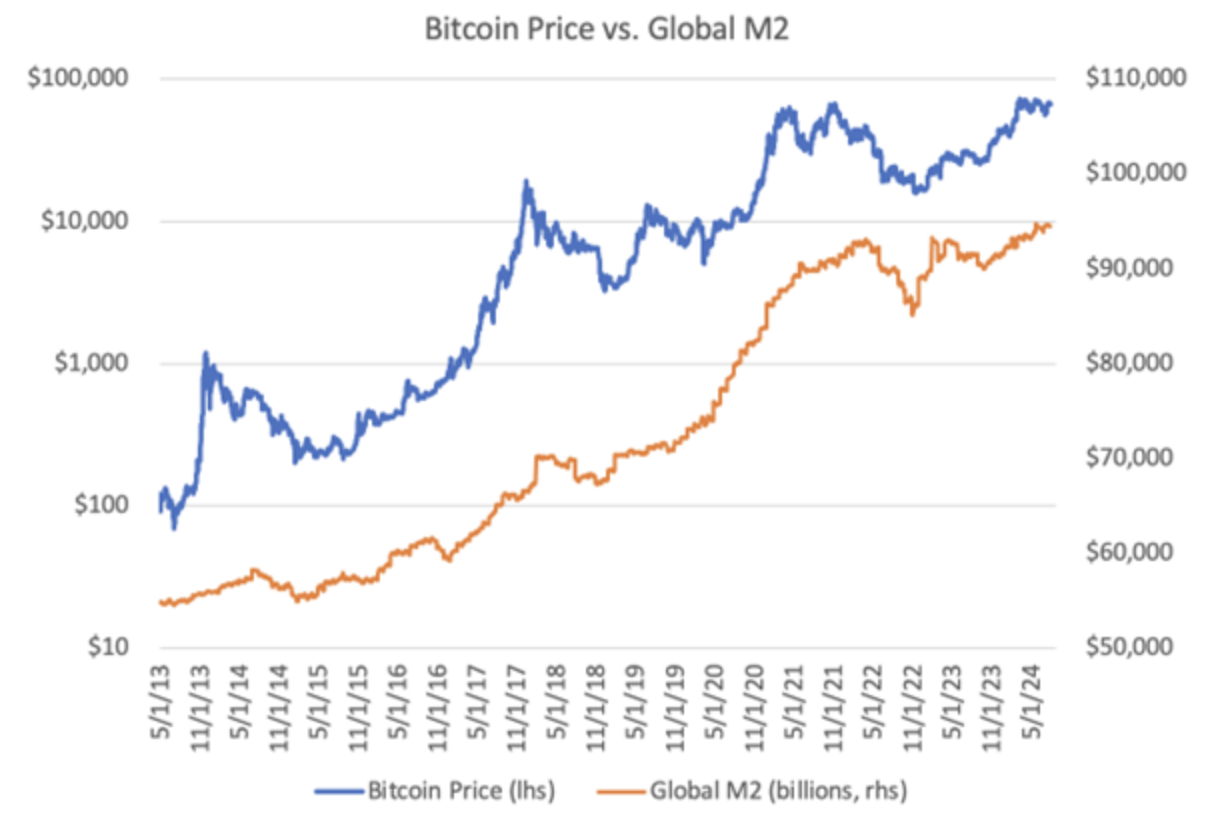

It is the supply of money, not the cost, that drives opportunity and risk in this post-Covid world. In a piece Lyn Alden commissioned with Sam Callahan, we are shown the clear direct relationship between global liquidity (M2) and the price of bitcoin (first chart below), and not surprisingly, the S&P 500 Index (second chart below) as well.

These visuals support our intuitive understanding of the tight relationship between M2 growth (read: debasement) and BTC price appreciation; one that also influences stocks and gold. But Sam digs deeper with his analysis, relating on-chain metrics such as MVRV and more nuanced and segmented studies of the relationship between global liquidity and bitcoin price movements.

The major takeaway is that BTC exhibits the highest sensitivity to the direction of M2 relative to most equity segments, gold or bonds. A relationship that is constructive for bitcoin’s go-forward price, given the large ramp-up in global liquidity we expect over the next 9 to 36 months.

Interplay of Tech & Energy

As Central Bankers cut rates and print, key September headlines suggest that the enduring theme of productivity in the private sector and profligacy in the public sector will drive the trajectory of investment opportunity in 2025.

- Microsoft contracts power from the Three Mile Island Nuclear power plant

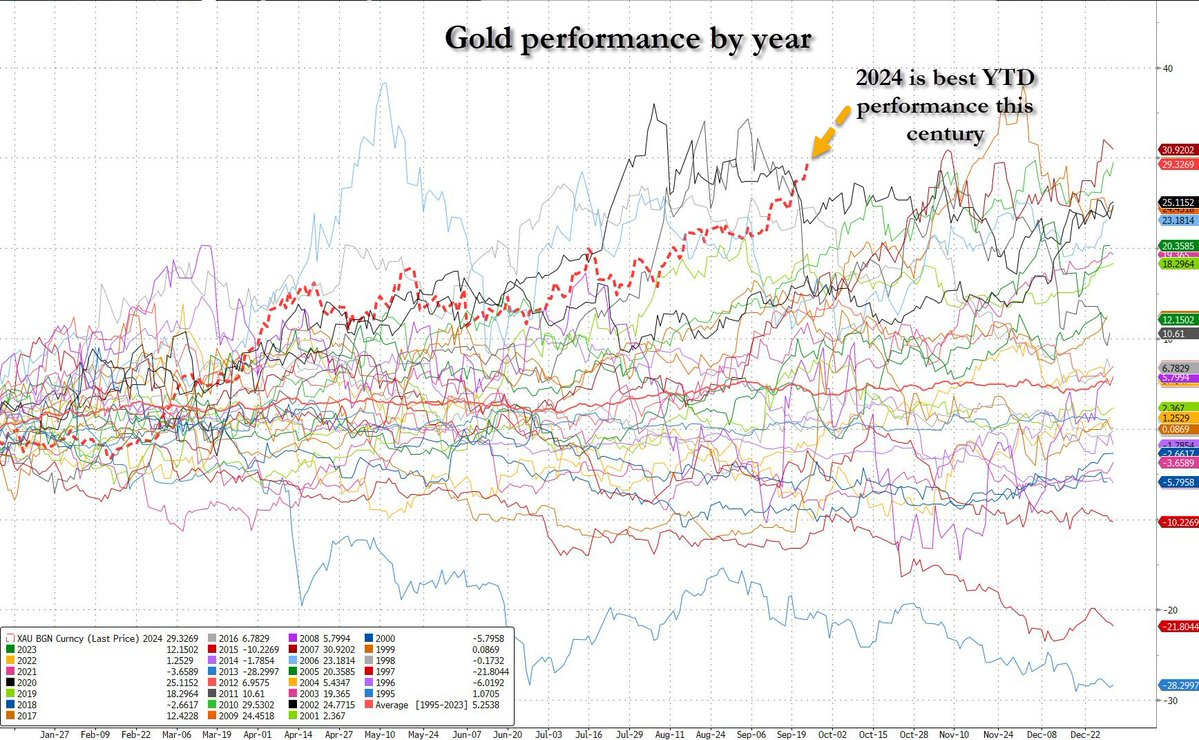

- Gold pushes to another all-time high, +29.5% YTD to $2,684

Microsoft partnered with Constellation Energy to reopen Three Mile Island. That was not on most people’s bingo card last year…maybe ever. But there were signs.

Nuclear power to better drive a new souped up search engine called ChatGPT? Maybe something more as the stakes for tech dominance advance rapidly.

From the market cap and performance concentration of the U.S. magnificent seven Mega Cap tech stocks to NVIDIA’s more recent ascent to best performing S&P 500 stock since Covid, software is clearly the Killer App.

So it isn’t about Tech, its about software that needs a robust tech platform and now energy as table stakes. NVIDIA only took off after integrating software into its hardware offering. If Cisco had done the same 25 years ago, maybe it would not still be below its March 2000 peak, underperforming the S&P 500 along the way.

The changing of the guard in industry is upon us as both consumers and taxpayers.

Last month NASA was forced to commission Elon Musk’s SpaceX to retrieve astronauts stranded by the failure of a craft manufactured by old-economy Boeing. The reliance on commercial providers by NASA has been a long time in the making, but the rapid emergence of SpaceX over the embattled incumbent Boeing indicates the concentration of value and power is pan-market, both public and private.

Some may see Microsoft’s alliance with Constellation as a key move in the battle for AI dominance. We think it raises a new concern. A warning of the potential for mega cap tech’s dominance to migrate from private markets to the public realm if rockets and nuclear power are now the domain of shareholders instead of voters and legislators. Later this quarter we will share a deeper dive into how bitcoin miners fit into this fast changing, data-driven energy renaissance.

But back to markets…

Global liquidity is being conspicuously noticed by one corner of the market, gold.

The largest liquid asset in the world at ~ $18 trillion in market value hit another all-time high, +29.5% YTD to $2.684, but still not piercing $2,700. Not surprising given the growing probability of Chinese stimulus in the form of more money supply, on top of the lower ‘price’ via this week’s rate cuts and reserve ratio reductions noted above.

We’d also note that the above link listing assets by market capitalization lists bitcoin as number 10, at $1.3 trillion, behind Meta and ahead of Warren Buffet’s Berkshire Hathaway. The irony is rich.

The convergence of technology, energy, and financial markets is reshaping investment opportunities, with the private sector’s innovation and dominance (particularly in tech and energy) driving significant shifts in both market dynamics and geopolitical influence as we head into 2025. This evolution signals a blurring line between private enterprise and public policy, impacting everything from AI to commodities like bitcoin and gold.

Chart of the Week

Gold continues to make new all-time highs; this trajectory represents gold’s best YTD performance this century.

source: zerohedge on X

Quote of the Week

“Most (if not all) governmental restrictions targeting bitcoin have failed to account for the fact that, under bedrock First Amendment principles, bitcoin activity is entitled to First Amendment protection. First, bitcoin consists entirely of the creation and transmission of information, which is speech protected by the First Amendment. Second, bitcoin activity is at minimum protected expressive conduct. And third, participation in the bitcoin network is expressive association separately safeguarded by the First Amendment.”

— NYDIG, Bitcoin’s Protection under the First Amendment

Podcasts of the Week

The Last Trade E066: Tracking Business Bitcoin Adoption with River’s Sam Baker

In this episode of The Last Trade, Sam Baker, Research Analyst at River, joins to discuss leaving TradFi for bitcoin, River’s business adoption report, corporate treasury adoption, market structure & yield, proof-of-reserves standards, & more.

Final Settlement E013: Bitcoin is the Real Fintech with Abubakar Nur Khalil

In this episode of Final Settlement, Abubakar Nur Khalil, bitcoin core contributor and CEO of Recursive Capital, joins the pod to discuss bitcoin as the real ‘fintech’, funding bitcoin developers, monetizing innovation, energy sovereignty in Africa, & more.

Wake Up Call (9.23.24): Krista Edmunds, Founder of Access Tribe

In this episode of Wake Up Call, hosts Rich Kerr & Mark Connors are joined by Krista Edmunds, Founder of Access Tribe, to discuss her journey to bitcoin from TradFi, the importance of education, & spearheading a community for women in bitcoin.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Mark Connors & Brian Cubellis