Roundup: Summer End Macro Musings

Mark Connors | Managing Director, Head of Global Macro Strategy

Sep 5, 2024

Fall Back to School, Fall Behind Financially

For our annual labors, every year in the U.S. and beyond many are gifted a four-day week to help take the sting out of summer’s end and the return to school or a more regular work load. Not fun, but no way around it.

However, this juncture applies another turn of the painful screw of transition to a specific segment of society. The college graduate.

This cohort must endure a double transition…out of summer and out of student life. I remember that period well. Like many graduates that had experienced a relatively guided path through the narrow channels of school, in 1988 I was “all revved up with no place to go” (thank you Meatloaf), because the economy’s growth trajectory dipped just as my employment needs rose.

With the fallout of Black Monday’s 21% decline (Oct 19, 1987) still reverberating through the canyons of Wall Street, limiting the appetite for campus interviews and a recession looming, jobs for the class of 1988 were scarce…at least that’s how I reasoned it. But I was not alone.

During one of my breaks from the job search, I attended my good friend’s graduation from Williams College. As part of the ceremony, some of her fellow graduates shared a song they penned just for the occasion. The catchy refrain has stuck with me to this day.

Williams College, place of knowledge,

Sixty thou…to live with cows.

First, some perspective.

Williams College is nestled in the Berkshire mountains. Not a lot around it today, so can’t imagine the size of the town when it was established by Col. Ephraim Williams, by leaving a tidy sum to establish a ‘free school’ in 1791. The free school only lasted two years, giving rise to the Williams College we know today that charges tuition. To help secure the school financially, an endowment was created which now stands at $3.5 billion, ranking as the 10th largest endowment in terms of dollars per student.

Their enrollment is small at ~2,000 students, and based on my sample at the time, the student body intelligent. So maybe I shouldn’t be surprised by the introspective nature of her fellow graduates.

Williams College, place of knowledge,

Sixty thou…to live with cows.

A reasonable question and the type of critical thinking you would expect from a top liberal arts school. These four chaps said the quiet part out loud. Was Williams worth it?

Worth $15,000 a year in tuition…to live with cows? My friend who was graduating thought so, as did her friends, as far as I could tell.

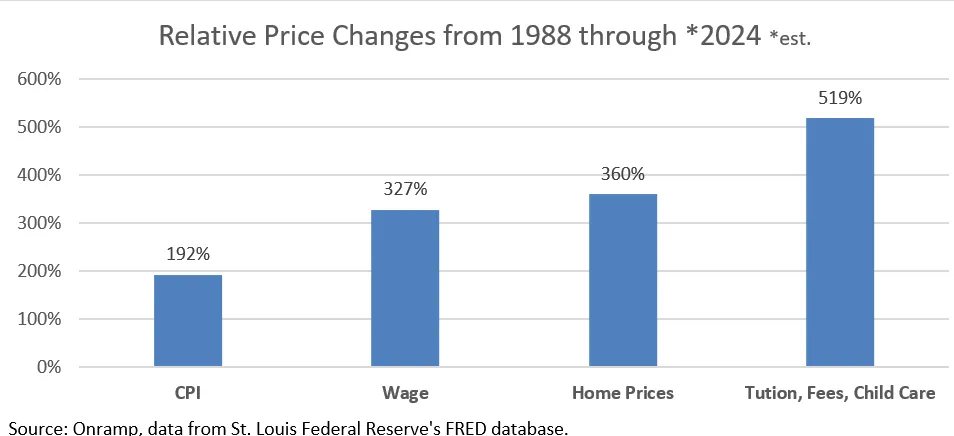

But the below data suggests this was a worthy query.

Contextualizing the ‘$60 thou’ required for the four-year experience at Williams, we compare it to another benchmark investment. A home.

In 1988, that $60,000 in tuition equated to about 43% of the price of the average home as defined by the St. Louis Federal Reserve.

Some 30 years earlier, the estimated cost of a 4-year Williams tuition is estimated to have been ~$6,000, which equated to approximately 25% of the price of a home.

So a Williams degree almost doubled relative to the price of home prices over their lifetime. Tuition at Williams and many colleges continues to grow, closing the gap on the average cost of a new home.

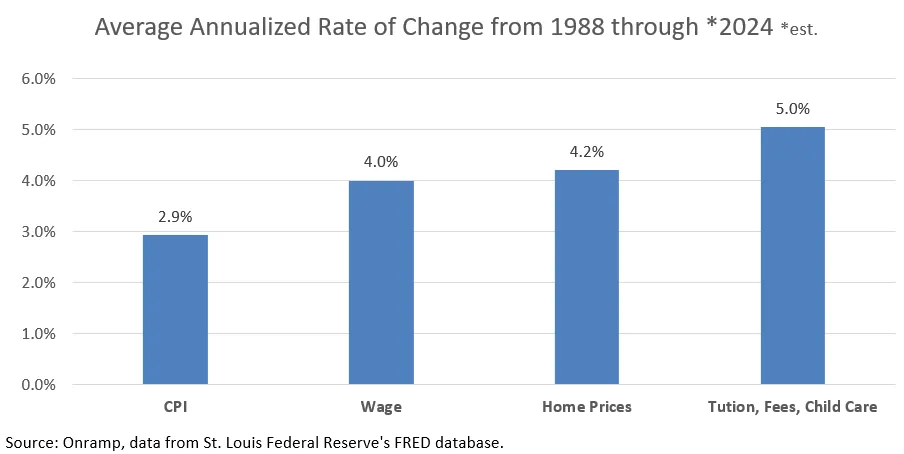

Sometimes I like to see price changes converted to average annual rates of change. Normalizing it this way allows you to compare across different periods and to today’s rates of change. The below graph illustrates this.

At a minimum, it is this strategist’s hope that you dismiss the CPI, full stop. It has demonstrated zero utility to us average joes in terms of financial planning.

2.9%?

Education, housing, and child rearing costs have grown a lot faster. So if you wonder why some people are dazed and confused, such gaslighting is a major contributor.

The Bards of the Berkshires were barking up the right tree. College tuition was not just a lot…it had GROWN a lot.

What is truly ironic is that your chance of making a wage that could buy the same college education for your children, or a home similar to you parents was low. Wages were NOT growing as fast as the cost of tuition and home prices.

The destabilizing force of price distortions that these graduates were speaking to, singing to, had started when they were just aspiring Ephettes, in the late 1960s and early 1970s.

Their song captured the economic concept of cost-benefit analysis through the medium of music to share their existential angst of what next? Was it worth entering the ring? Playing the game?

As noted above, this was a well-placed angst as this talented group tapped into a shift in the economy. A shift that limited their ability to convert their time, and creativity into buying power. Wages bought less. Less homes, less education.

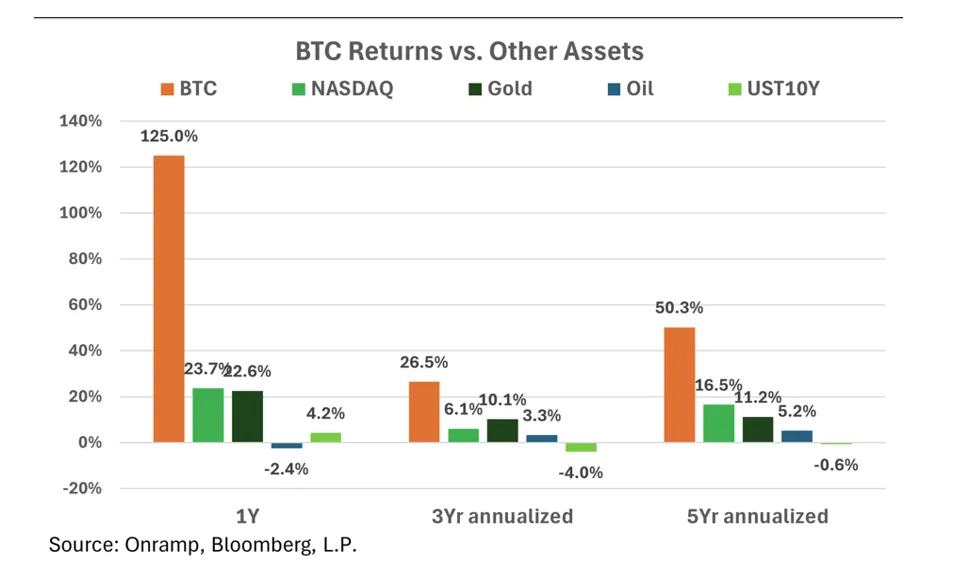

So, if you are concerned about housing, college or other ways to store your wealth, consider the below graph.

Data through July 25th 2024.

Not shown is BTC’s 10Y average annualized return of 60%.

Rewind to a Pivotal August

Toto, I don’t think we’re in Kansas anymore.

Like Toto and Dorothy, last month global markets were unhinged by a series of unexpected events that released a storm of volatility leaving markets still swirling in a state of uncertainty shared in detail during August 5th’s Wake Up Call segment.

Let’s start with the Bank of Japan’s (BoJ) surprise rate hike announcement on July 31st, which lifted its overnight rate to the highest level since the global financial crisis and reduced the amount of its government purchasing program. The reaction was immediate and broad based, dropping the Nikkei by over 9%, and the S&P 500 by over 3% at one point.

The July 31st shift to raise interest rates by the BoJ was exacerbated by an expected policy shift in the opposite direction by the Federal Reserve at the annual Jackson Hole Economic Symposium on August 23rd.

Maybe it is fitting that the annual event is sponsored by the Federal Reserve Bank of Kansas City, a bank with a rich history of lending to businesses with collateral subject to the vagaries of changing weather and storms. Maybe.

But risks, like Dorothy and Toto, are no longer in Kansas. They are less about funding a local farm or stocking a storm cellar. It’s about funding the growing pile of $35 trillion in U.S. debt, growing 2-to-3x faster than the U.S. economy with an annual price tag of over $1 trillion in interest expense.

So little surprise when the expectations of a pivot in Fed policy to lower interest rates spiked on August 21st, when the U.S. Department of Labor announced the largest revision lower in U.S. jobs since the global financial crisis.

Just days before Fed Chair Jerome Powell was to announce a potential shift in policy, the government said that there were actually 818,000 less jobs created between March 2023 and April 2024.

Chair Powell took the air cover provided by the newly revealed hit to employment by stating that “The time has come for policy to adjust.”

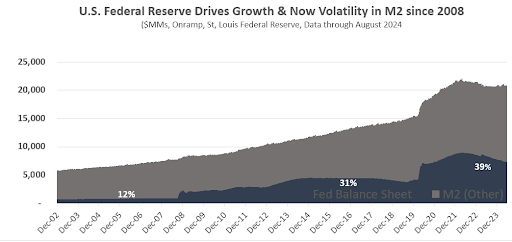

But Fed policy has already been adjusting, with information for investors on asset allocation.

Last August the Fed was tightening the money supply by selling close to $100 billion in bonds to member banks, thus pulling $100 billion in cash out of circulation. In recent months that number has been cut in half, to less than $50 billion.

A less restrictive policy that we believe will shift to accommodative, characterized by MORE asset purchases.

There are two takeaways for investors from the breakout of M2. First, the Fed’s role in the creation of money has more than tripled since 2008. A trend that will likely continue later this year. Second, M2 has already shifted, up 2.1% year-over-year from other government related actions.

For signs of when the Fed will act, keep eyes on the MOVE index, an indication of Treasury volatility as the Federal reserve needs to keep markets functioning properly. If the MOVE spikes, the Fed often intervenes, forced to stabilize the market as we saw in March 2023.

Looking forward, it is not the price of money that should inform investment decisions. Rather it is an appreciation for the impact that an ever growing supply of money will have on an investment portfolio. This is one reason we think U.S. Treasury bonds have seen their best days and bitcoin remains a core consideration for investors.

Chart of the Week

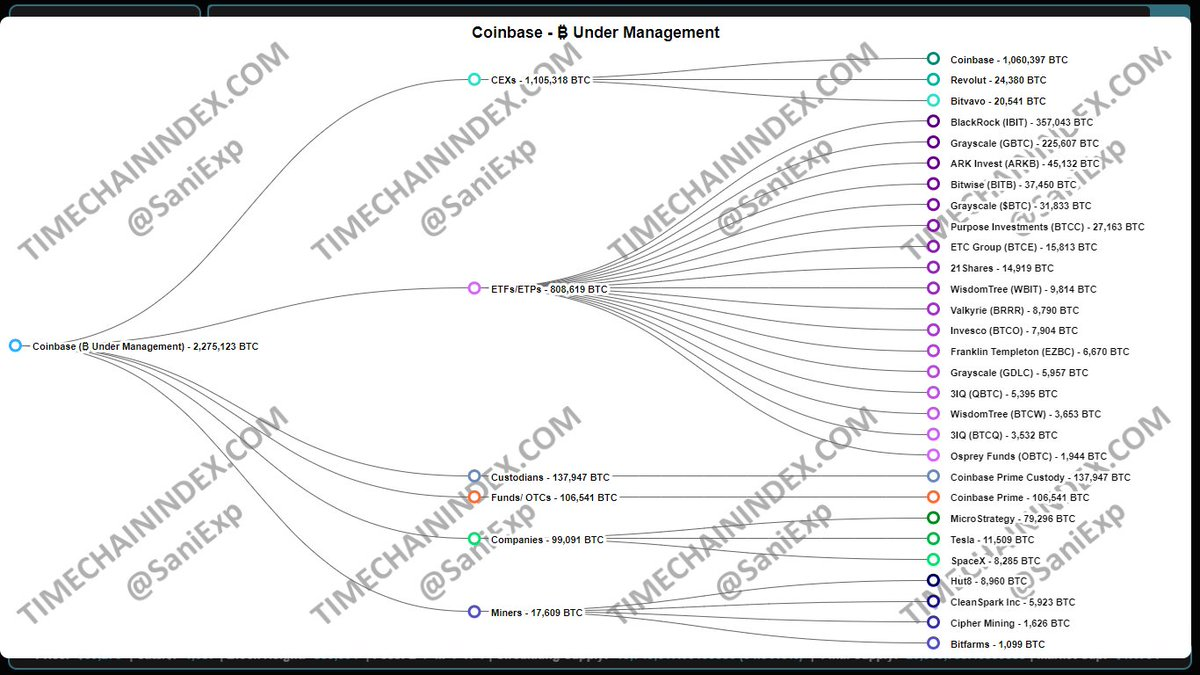

“No one is ready for the biggest hack in history.”

— Sani (Timechainindex) on X

Over 10% of the cumulative supply of bitcoin (2,275,123 BTC) now sits with one custodian. This centralization of the asset from a custodial perspective is incongruent with bitcoin’s distributed nature and core value proposition of decentralization. Onramp was designed to ameliorate this situation by distributing the ownership of bitcoin private keys across multiple distinct entities, eliminating single points of failure and minimizing counterparty risk.

Quote of the Week

“Deficit spending will not end, federal debt will forever grow, and currency debasement will always follow. This is the life of a fiat currency.”

— James Lavish on X

Podcasts of the Week

The Last Trade E063: Soft Sovereign Default with Peruvian Bull

In this episode of The Last Trade, macro analyst & author Peruvian Bull joins to discuss the aftermath of the Yen carry trade, global liquidity dynamics, the soft default playbook, fiscal dominance, key macro indicators to watch, & more.

Scarce Assets E017: Avik Roy – Then They Fight You

In this episode of Scarce Assets, hosts Andy Edstrom & Jesse Myers are joined by Avik Roy, President of The Foundation for Research on Equal Opportunity (FREOPP) to discuss bitcoin adoption outlook, regulatory scenario analysis, getting people off zero, strategic bitcoin reserves, & more.

Wake Up Call (9.3.24): Jackson Mikalic, VP of Strategy & Business Development at Onramp

Wake Up Call is a weekly show that will be streamed live on LinkedIn every Monday morning. To catch the premier of each episode, follow Onramp’s LinkedIn page and add Wake Up Call events to your calendar. Hosted by Mark Connors, Onramp’s Head of Global Macro Strategy, and Rich Kerr, Onramp’s President of Managed Wealth, this show seeks to provide financial professionals the “wake up call” they need, prompt them to have an open mind with respect to bitcoin, rethink their prior assumptions, become more educated on the topic, and learn from others who are already farther down this path.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Find this valuable? Forward it to someone in your personal or professional network.

Until next week,

Mark Connors & Brian Cubellis