Our story

In April 2023, Onramp launched the first security-like vehicle for Bitcoin exposure, the Onramp Bitcoin Trust. This trust provides 1:1 exposure to spot Bitcoin, held in a 2-of-3 multisig vault across three institutions—Onramp, BitGo, and Coincover (UK). It allows in-specie redemptions without taxable events, offering an improvement over existing bitcoin trust structures and ETFs.

In response to rising demand, Onramp relaunched in Fall 2023 to create a global Bitcoin asset management platform for institutions and high-net-worth individuals, built on multi-institution custody. In partnership with BitGo, Onramp introduced the first solution requiring independent verification from multiple financial entities for withdrawal requests. BitGo, a leader in Bitcoin infrastructure for 10 years, was the ideal partner, and deepening ties with Coincover strengthened our global security offering.

Multi-institution custody is the future

At Onramp, we see a better path to unlock the trillions in idle institutional capital. By leveraging bitcoin's multi-signature capabilities, we reduce counterparty risk by distributing key control across distinct financial entities rather than a single custodian. This multi-institution multisig approach eliminates single points of failure, minimizes trust requirements, and provides a secure, auditable on-chain custody solution—the foundation of our bitcoin asset management platform for institutions and HNWIs.

The Onramp advantage

Experience:

Our team brings diverse expertise from investment management, private wealth, venture capital, technology, and management consulting, with backgrounds at Bain & Co, Brown Brothers Harriman, Stifel, Google, and Unchained. Our expanded executive team bridges traditional finance and bitcoin, and we're excited to welcome David Thayer, executive advisor at Blackstone, to our strategic advisory board.

Expertise:

Serving HNWIs, Family Offices, and Institutions, Onramp has developed an ideal multisig bitcoin custody solution that combines bitcoin's native strengths with traditional institutional-grade security, addressing common self-custody challenges.

Bitcoin education & advisory:

More than an asset management firm, Onramp is dedicated to education. We provide a comprehensive suite of high-quality bitcoin resources—including in-depth research, engaging video content, and analytic tools—to support investors at every stage of their bitcoin journey.

Our philosophy

Bitcoin-only:

At Onramp, we believe bitcoin is the foremost asset for 21st-century portfolios. Its robust decentralization and dominant network effect make it the only digital asset fit for sophisticated portfolios. We align with regulators, viewing bitcoin as a commodity—unlike other crypto assets, which we see as unregistered securities.

Why education matters:

High-quality bitcoin education is crucial to unlocking its full potential. While exposure is easy, long-term holding and success require a deep understanding of bitcoin's fundamentals and trust-minimized custody. Onramp is dedicated to building the knowledge and conviction needed to navigate bitcoin's volatility and avoid common pitfalls.

Why custody matters:

Bitcoin's early years have been marred by custodial failures, from lost keys to exchange hacks. Most institutions and HNWIs are ill-prepared for the responsibilities of self-custody, making third-party custodians essential. However, relying on a single custodian risks irreversible loss or misuse, contradicting bitcoin's trust-minimized nature and deterring broader capital adoption.

Leadership team

The Onramp team consists of industry experts and tech innovators.

Our key partners

Our key partners consists of industry experts and tech innovators.

BitGo was founded in 2013 by Mike Belshe. Belshe is a technologist and entrepreneur whose 25+ year background spans Hewlett-Packard, Netscape, and Google. Given Belshe's background at the forefront of other technologies in Silicon Valley, when he came across bitcoin in 2012, he was impressed by the technology. He began building storage solutions for himself and many prominent angel investors in Silicon Valley. With his background in computer science and pioneering early internet companies, he understood the risks and shortcomings of the nascent industry and sought to build the necessary solutions.

Belshe is credited with the first implementation of the bitcoin multi-signature wallet to secure large sums of bitcoin for individuals and businesses. Multi-sig's early appeal with enterprises led to BitGo gravitating toward commercial and institutional markets. Now BitGo is a leader in institutional-grade bitcoin security, custody, and liquidity, providing the operational backbone for over 1,500 institutional clients in over 50 countries. BitGo also processes approximately 20% of all global bitcoin transactions by value.

Under the BitGo umbrella are two state trust companies, chartered to safeguard digital assets and funds on behalf of customers. BitGo Trust Company, Inc ("Trust Co.") was chartered in 2018 by the South Dakota Division of Banking, and BitGo New York Trust Company LLC (the "New York Trust Co.") was chartered in 2021 by the New York Department of Financial Services. BitGo has also expanded its regulatory footprint overseas after being granted custody licenses by both the German Federal Financial Supervisory Authority (BaFin) and the Swiss Financial Market Supervisory Authority (FINMA).

BitGo has been ahead of the curve in regulation – consistently setting and achieving specific, rigorous standards such as including SOC2, which evidences that BitGo has designed and implemented comprehensive controls over its multi-signature wallet services to mitigate security risks. Importantly, Onramp's partnership with BitGo leverages BitGo's deep cold storage, 100% offline keys, and guarded vaults. Onramp is proud to point out that this is the first time BitGo has used BitGo's cold storage process for an external partnership. We view this as a strong signal of support for our business model and BitGo's ability to foresee the next iteration of custody – multi-institution.

Multi-institution custody with Onramp means your bitcoin is held in a vault controlled by 3 keys, each held by separate institutions (Onramp, BitGo, and Coincover), ensuring that no single entity can move funds unilaterally. For any transaction to occur, it must be signed by a quorum of keyholders, specifically 2 of the 3 keys, ensuring a higher level of security and consensus before any funds are moved.

Founded in 2018, Coincover is the Blockchain Protection Company, providing additional protection for over 450 High Net Worth Individuals (HNWI) and businesses. Coincover features a protection platform that contains advanced threat detection, risk mitigation and recovery solutions, all reinforced by an insurance-backed warranty to ensure the protection of Bitcoin. Coincover exists to address the main barrier to mainstream Bitcoin adoption: trust. Coincover has already mitigated over $30bn of transaction risks, protecting over 5m wallets.

Coincover offers industry-leading protection reinforced by an insurance-backed warranty. This assurance provides clients with unparalleled security and peace of mind, ensuring their Bitcoin is protected against theft and other security breaches.

Multi-party custody with Onramp means your Bitcoin is held in a vault secured by three keys, each held by separate institutions, Onramp, BitGo, and Coincover. This ensures no single entity can move funds unilaterally, removing single points of failure. For any transaction to occur, it must be signed by a quorum of keyholders, specifically 2 of the 3, ensuring a higher level of security and consensus before any funds are moved.

As a key partner, Coincover helps companies and individuals mitigate risks associated with Bitcoin transactions, offering an additional layer of protection through transaction screening and recovery solutions. Coincover offers 24/7 protection, ensuring clients are confident in their Bitcoin transactions.

In an ever-evolving digital asset landscape where threats are increasing daily, Coincover and Onramp stand as your allies, offering peace of mind and protection against risks associated when transacting in Bitcoin.

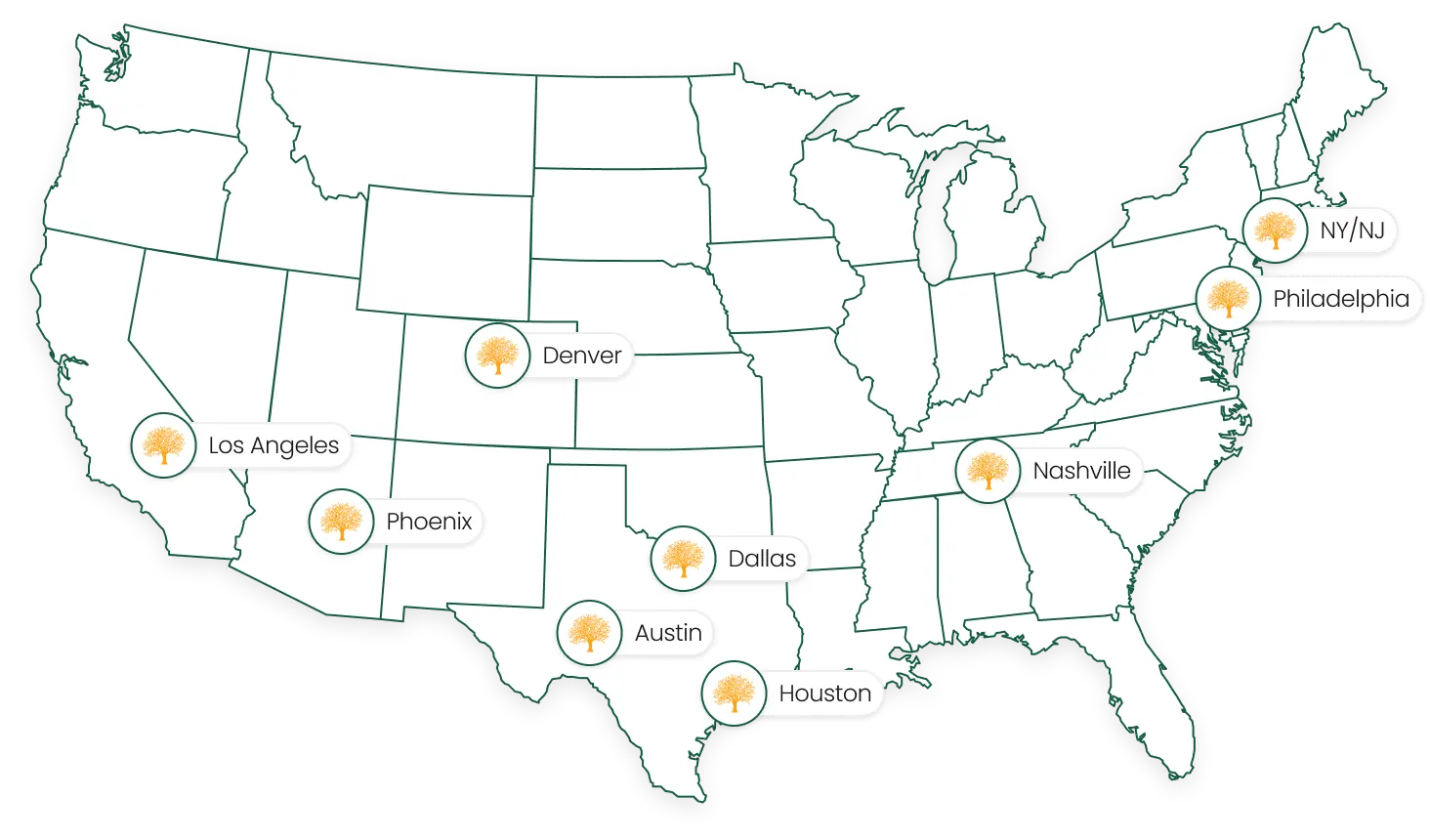

Our branches

Meet our team in-person at one of our locations!

Are you ready?

The best security available for your Bitcoin without the technical burden. It’s time to upgrade.