Bitcoin Inheritance: Shipwrecks, Treasure Maps, & Generational Riches

Jackson Mikalic | VP, Business Development

May 13, 2024

For the first fifteen years of bitcoin’s history, people have had to consider significant tradeoffs with their bitcoin inheritance plan.

The two dominant forms of custody, third-party custody and self-custody, both introduce significant risks to creating a sound inheritance plan.

Shipwrecks: Traditional Third-Party Custody

Trusting one exchange to secure your bitcoin on your behalf has historically been a terrible idea. Centralized custody of bitcoin has resulted in hundreds of billions of dollars of lost, stolen, and hacked bitcoin. Remember 2022?

In theory, having an account with an exchange should allow your beneficiaries relative ease in accessing your bitcoin should anything happen.

But in reality, there is no shortage of risks that threaten your bitcoin held on an exchange. All bitcoin you saved could easily be shipwrecked and lost at sea.

Trusting one institution introduces significant counterparty risk that could result in a single point of failure and a permanent loss of capital.

Remember, there’s no printing more bitcoin.

There’s a non-zero probability that the exchange that holds your bitcoin will not exist when your beneficiaries are set to receive the bitcoin.

Not only that, but there’s a possibility that you or a relative could fall victim to a social engineering attack. Just this week, a podcast made its rounds of a hacker describing how he is accessing people’s exchange accounts and draining hundreds of thousands or even millions of bitcoin.

Don’t leave your bitcoin on an exchange.

Treasure Maps: Self-Custody

The other dominant form of custody is self-custody. Taking ownership of your hardware wallets and private keys. Many people have done this out of necessity knowing that leaving their bitcoin on an exchange carries too much risk.

While self-custody eliminates counterparty risk, it introduces risk of human error managing and using hardware wallets and backing up seed phrases.

However, the biggest challenge with self-custody is inheritance planning.

Many individuals who own bitcoin are the only people in their family who have knowledge of hardware wallets and seed phrases. Even if you show your spouse where they are and how to use them, that’s another language in most cases.

Trying to leave these devices and seed phrases to your family is essentially leaving them a treasure map to riches that may never be recovered.

As bitcoin continues on its monetization path and becomes a larger portion of one’s treasure chest, it’s increasingly imprudent to rely on a treasure map to pass down the wealth to your heirs.

Not only could there be challenges with accessing the funds, but just because someone is able to access the funds does not give them legal ownership of the assets. One should consider the proper legal structure to protect the privacy of their beneficiaries and ensure a smooth transition of wealth.

Passing private keys could make bitcoin a probate asset, which could become public court record, compromising your beneficiary’s privacy and security.

I am a fan of self-custody, don’t get me wrong, but there are significant tradeoffs that must be considered, especially when thinking about inheritance planning.

Securing Generational Riches

Bitcoin is a multi-generational pursuit. Previously, it’s been a challenge to successfully secure your family’s riches, but the good news is there are now solutions that can provide security of the asset while you’re alive and a seamless transition of the wealth to your beneficiaries when that time comes.

Not all solutions are built the same, and while some may allow your beneficiaries to access the private keys more easily, they do not address the legal title transfer of the asset.

As far as I know, Onramp is the only firm that offers secure custody and a stress-free transfer on death process that also ensures legal title transfer.

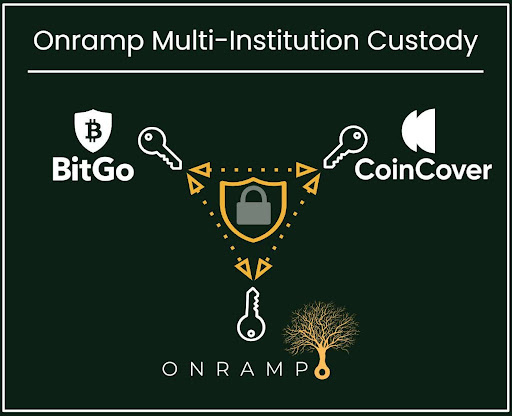

During your life, your bitcoin is secured in a multi-institution vault, where three independent institutions participate in the custody of your assets utilizing industry best practices, eliminating a single point of failure and increasing the security of your assets.

Notably, two of three keys must be signed to move bitcoin out of the vault, meaning any one institution cannot control the bitcoin, nor does it matter if the company goes under.

But what if something happens to you? Your family is protected.

You can designate beneficiaries directly on your vault to ensure a seamless transfer of the title of the bitcoin from your name to theirs, addressing both the transfer of keys and the legal title transfer. Here’s a video demonstrating.

This solution ensures that your bitcoin legacy is preserved and passed on to your family for future generations. No shipwrecks or treasure maps.

Full disclosure: I am an employee of Onramp, but for good reason. We have the best Private Client solution in the industry and are helping people secure their bitcoin legacy. — Jackson Mikalic