Bitcoin Overton Window Lurches Forward

Jesse Myers | Chief Operating Officer

Aug 7, 2023

On July 18th, Presidential candidate RFK Jr. spoke at a fundraising event for Heal-the-Divide, a PAC founded (and funded) by early Bitcoiners beginning to flex their considerable Bitcoin wealth to shape political policy.

In the speech, RFK Jr. announced his administration’s plan to “exempt the conversion of Bitcoin to the U.S. dollar from capital gains taxes.”

Additionally, he announced his intent to back a small portion of the US National Debt with hard assets (including Bitcoin): “My plan would be to start very, very small, perhaps 1% of issued T-bills would be backed by hard currency – by gold, silver, platinum, or Bitcoin.”

As for his reasoning for this unorthodox proposal, he elaborated, “Backing dollars and U.S. debt obligations with hard assets could help restore strength back to the dollar, rein in inflation and usher in a new era of American financial stability, peace and prosperity.”

This is a big deal. Let’s unpack what it all means.

Shifting the Overton Window

First of all, make no mistake, this proposed policy will not happen. Not yet. RFK is too fringe of a candidate to have a shot at the presidency (or is he?). Even if he won, this is the kind of campaign trail promise that stands no chance of being implemented. But that’s not the point.

What matters is the trend. A few years ago, politicians would never have hitched their wagon to Bitcoin. Now, fringe politicians are embracing the Bitcoin community and receiving tremendous attention and support for doing so. Every other politician is seeing this. Some are thinking “maybe I should tap into this too.”

Years ago, no politician would advocate for Bitcoin. Now, fringe politicians are advocating for Bitcoin. In a few years, mainstream candidates will do the same.

What began with Cynthia Lummis winning a seat in the Senate with support from the Bitcoin contingent has grown to politicians like RFK Jr, Vivek Ramaswamy, Ted Cruz, and even Ron DeSantis courting Bitcoiner support.

In this sense, what we’re witnessing is not a proposed policy that will succeed or fail. Instead, we are witnessing the shifting of the Overton Window — what policy points are viewed as legitimate options to talk about in the mainstream arena. This RFK Jr. announcement is a big milestone in that ongoing process.

Bitcoin is now a part of the national policy conversation.

This particular proposal will fail, but this moment is already a big win for Bitcoin because it sets the precedent for a proposal like this to succeed in the future. But what exactly would a policy like this mean?

Capital gains taxes for Bitcoin

Although this was a minor part of RFK Jr.’s remarks, removing capital gains taxes on Bitcoin transactions would be a major leap forward for Bitcoin adoption. (Admittedly, RFK Jr. only specified this policy for Bitcoin to USD transactions, but that would effectively remove capital gains tax considerations for all US Bitcoiners.)

Currently, any transactions in Bitcoin must be booked against the tax basis of those assets, creating a realized gain or loss. This information must be dutifully logged and captured in any individual or organization’s tax filings.

This status quo is a hassle for users and a major impediment to Bitcoin adoption. For now, most people interact with Bitcoin as a buy-and-hold portion of their investment portfolio. In my opinion, this continues to be the wisest and most valuable way to use Bitcoin — a savings vehicle, not a spending currency.

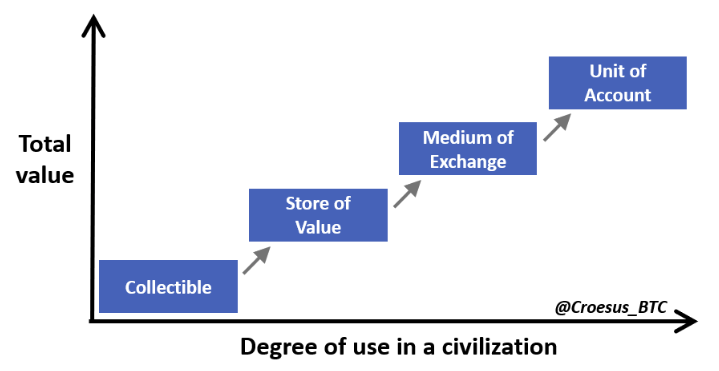

However, Bitcoin can and will also grow to be a preferred medium-of-exchange. This is part of the path-dependent process when any fledgling asset takes on the emergent properties of money. First, it is simply a collectible, then it grows to become a reliable and trusted store-of-value asset. Only once a large group views it as a preferred store-of-value asset will it then be used as a currency between parties in trade — a medium-of-exchange.

The current classification of Bitcoin requires the logging of taxable events whenever it is exchanged. This new proposal would remove that major inconvenience and barrier to Bitcoin’s adoption as a medium-of-exchange in the United States.

While this idea is radical in the United States still, it has already been implemented in smaller jurisdictions with considerable success, most notably in El Salvador. Although it will surely be quite a few years before the United States follows suit, the idea is now officially part of the national political conversation.

Backing US Government debt with Bitcoin

The splashier part of RFK Jr.’s statement was the proposal to back a portion of the US National Debt with hard assets. It will come as no surprise that I think he is right — such a move would restore strength to the US Dollar and usher in an era of greater financial stability. This is because the alternative is business as usual — deficit spending and unbacked money printing — which will continue to erode the United States’ fiscal strength and ultimately decimate bondholders.

Again, RFK Jr.’s proposal won’t happen. Not yet. But it may happen in the future as Bitcoin continues to become a more mainstream topic. For now, the S.S. Fiat System is only listing to the side a bit, so few feel a need to rush to the Bitcoin lifeboat. But unfortunately, ignoring the problem of incessant deficits and escalating national debt will not right the ship. At some point, the Bitcoin lifeboat may look extremely attractive.

And again, while the US won’t be engaging in such a strategy of central bank Bitcoin purchases anytime soon, El Salvador already has, and other nations ostensibly will too.

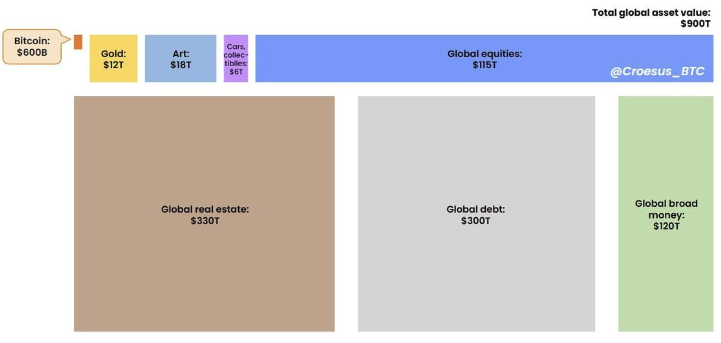

But what if it were to happen? The US National Debt is now $32T. 1% of that is $320B. Bitcoin is a tiny $600B asset class. Obviously, if that amount of buying pressure was pointed towards Bitcoin, it would send Bitcoin’s price soaring.

And it doesn’t even have to be the US, necessarily. Several mid-size countries could adopt an El Salvador strategy to create the same ~$320B of buying pressure. And the positive signal of this would generate even more global demand for Bitcoin.

All-in-all, any kind of shift towards sovereign purchasing of Bitcoin to incorporate into national treasuries could very quickly ignite a scramble for Bitcoin that dwarfs everything that has occurred so far in Bitcoin’s 14-year history.

Going forward, things could get pretty crazy, pretty quickly for Bitcoin.