BlackRock Creates Bitcoin Vehicle: Half Good, Half Terrible

Jesse Myers | Chief Operating Officer

Jun 19, 2023

On June 15th, BlackRock filed an S-1 with the SEC, a registration statement detailing its intended Bitcoin Trust product. This is not technically an ETF, but it is functionally equivalent to an ETF because it allows for daily subscriptions and redemptions.

Part of what makes this development notable is that BlackRock is so interconnected with regulators and insiders that they don’t tend to make moves without being sure of the outcome. In fact, the SEC has approved 575 out of 576 of BlackRock’s ETF applications over the years.

As such, there’s reasonable cause for excitement.

The SEC has yet to allow for a Bitcoin ETF that is spot-based, rather than futures-based. A “spot” Bitcoin product is one that holds actual Bitcoin on behalf of investors; a “futures” Bitcoin product holds derivative contracts (bets on the future price of Bitcoin) without ever holding the actual asset. A “spot” product generates demand for the finite supply of actual Bitcoin and is therefore inherently bullish for the asset; a “futures” product does not and is inherently neutral, though it is especially useful for betting against the manic sentiment of retail investors during bull markets (and dampening that mania via sell pressure).

Because of this set of facts, it has been generally understood that the SEC’s refusal to allow a spot-based ETF while greenlighting futures-based ETFs indicates the US Gov’s desire to not aid in Bitcoin’s ascent as a competitor to the US Dollar.

But that hasn’t stopped demand for Bitcoin, while Wall Street firms have watched from the sidelines.

Evidently, the big boys don’t want to miss out on the next bull market.

Improving on Grayscale

BlackRock has designed its new Bitcoin Trust/ETF specifically to improve on Grayscale’s incumbent Bitcoin exposure vehicle, Grayscale Bitcoin Trust (GBTC). The biggest problem with GBTC is that the Trust does not allow for in-kind redemptions. In other words, investors can purchase shares of the Trust and own a representative slice of the underlying spot Bitcoin, but they can’t ever withdraw that Bitcoin. All they can do is sell their shares to someone else, take those dollars, and go buy spot Bitcoin with that money.

That transaction creates a taxable event, which can mean taking a 30% hit. Brutal. But it doesn’t need to be that way.

There’s nothing strictly preventing Grayscale from allowing in-kind redemptions — instead, it’s very much in the interest of Grayscale’s founder, Barry Silbert, to maintain this structure that allows dollars to flow into GBTC, get turned into Bitcoin, and never allow that Bitcoin to leave.

In doing so, Barry gets to collect his 2% management fee every year. Since GBTC has absorbed 600,000 BTC over nearly a decade of operating, that means Barry collects 12,000 BTC every single year ($300m). The golden goose. Great for Barry, awful for clients long-term.

Onramp’s innovation

In 2022, I partnered with Michael Tanguma from Unchained Capital to set up Onramp Bitcoin. Our goal was to create a better Bitcoin Trust, one that enabled investors to withdraw their coins when ready to take on self-custody without creating a taxable event.

In early 2023, Onramp launched the Onramp Bitcoin Trust. This vehicle leveraged the little-known “grantor trust” regulatory path for single-commodity investment trusts, best represented by gold investment trusts like $GLD.

This made Onramp Bitcoin Trust the first ever Bitcoin grantor trust, to my knowledge. Despite pioneering this model, Onramp’s greatest value proposition is its other innovation (more on this later).

BlackRock’s proposed product

In all likelihood, BlackRock didn’t copy Onramp’s precedent. They know the ETF business better than anyone, so they almost certainly realized the grantor trust model was viable on their own. But at any rate, BlackRock’s proposed Bitcoin Trust is the second of its kind.

In some ways, BlackRock’s new Trust is a good product that is bullish for the Bitcoin price. (BlackRock oversees ~$10T in assets, which is 20x more than Bitcoin’s total value at $500B. A portion of BlackRock AUM may soon be pointed towards purchasing Bitcoin.)

In other ways it’s a terrible product that seriously jeopardizes the rights of its clients & threatens to attack Bitcoin’s core values.

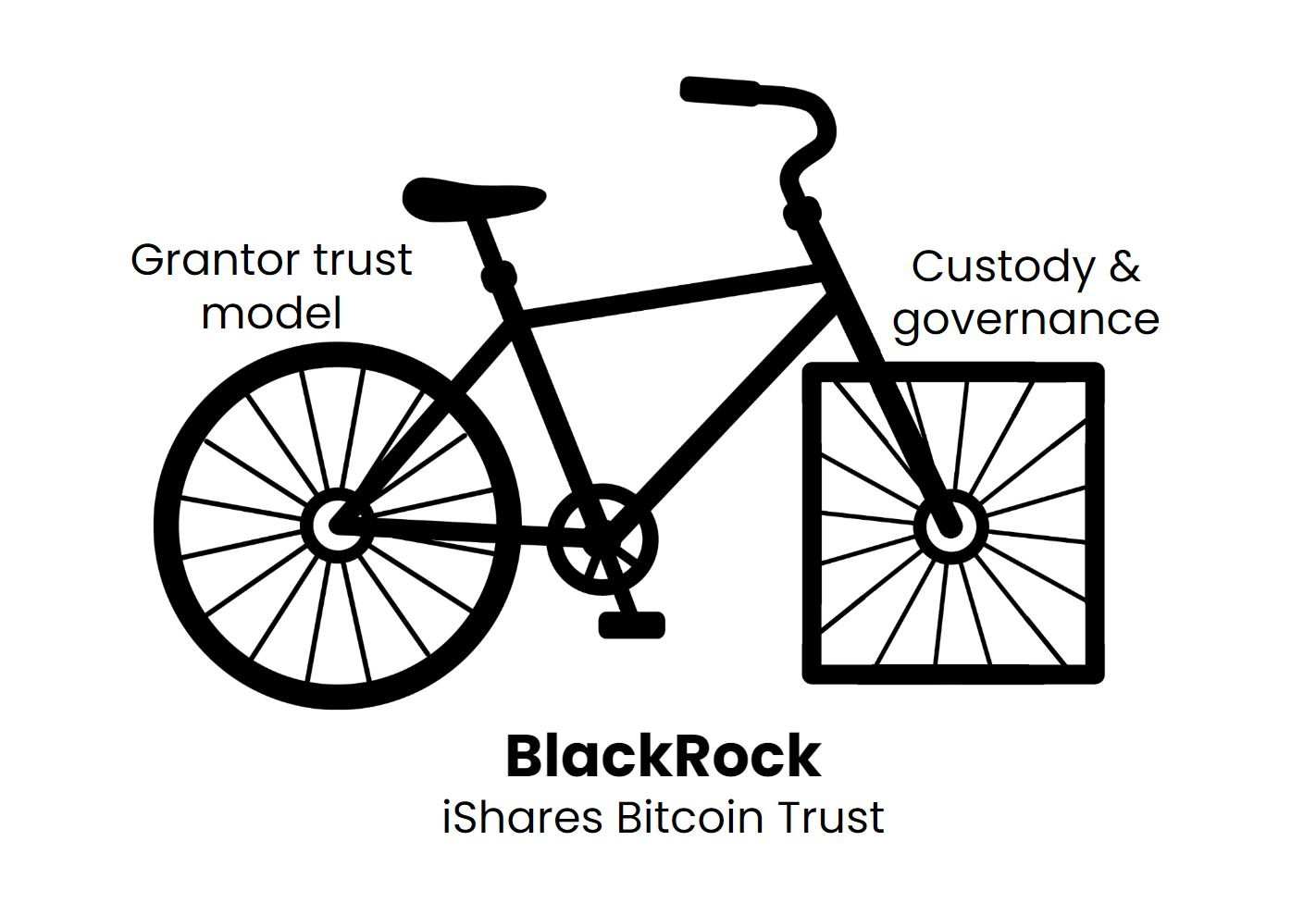

The BlackRock Bitcoin Trust is an investment vehicle, and its overall quality for investors is dependent on two essential components: the Trust’s mechanics & the Trust’s custody and governance. Like two wheels on a bicycle, these essential halves can be evaluated on their own merits but must combine suitably to serve the interests of users.

Here’s the BlackRock Bitcoin Trust as an investment vehicle:

The good: grantor trust model

In short, the grantor trust model fairly nicely suits clients’ interests. BlackRock specifically highlights two of the main benefits for investors:

- Tax considerations

- “Owners of Shares will be treated, for U.S. federal income tax purposes, as if they owned a corresponding share of the assets of the Trust.”

- This means that, for tax purposes, owning shares of the BlackRock Bitcoin Trust is equal to owning the underlying asset, Bitcoin.

- In-kind redemptions

- In several sections of BlackRock’s Trust proposal, various language refers to in-kind redemption policies & procedures.

- In-kind redemptions ensure that any premium or discount to NAV can be arbitraged away, eliminating one of the major pain points that GBTC investors have suffered from.

Overall, these are better terms than Grayscale and similar funds, specifically because the grantor trust model makes it possible to withdraw Bitcoin without a taxable event.

That was the good side of things – the normal, round wheel. Here’s the wonky, square wheel…

The bad: BlackRock custody & governance

The overarching problem with BlackRock’s proposed Bitcoin Trust is that it’s run by BlackRock. In particular, this means that the Trust is managed in ways that are typical of the traditional asset landscape & the politicized brand of permissioned finance that BlackRock is known for.

- In-kind redemptions – the catch:

- Deep in the S-1 filing, there’s this specific description: “the Trustee will deliver to the order of the redeeming Authorized Participant the amount of Bitcoin corresponding to the redeemed Baskets… Shares can only be surrendered for redemption [of whole Bitcoin integers].”

- Only registered broker-dealers who enter into a separate contract with BlackRock are designated as “Authorized Participants.” In other words, the privilege of being able to withdraw Bitcoin from the Trust is reserved for investment firms who are in the good graces of BlackRock, a list which can shift at any time.

- In-kind redemptions of Bitcoin can only be submitted (via “Authorized Participants”) for whole Bitcoin, and fractions thereof cannot be withdrawn from the Trust.

- Deep in the S-1 filing, there’s this specific description: “the Trustee will deliver to the order of the redeeming Authorized Participant the amount of Bitcoin corresponding to the redeemed Baskets… Shares can only be surrendered for redemption [of whole Bitcoin integers].”

- Rehypothecation

- The norm with ETFs in the traditional asset landscape is to take the pool of assets they’re responsible for and lend those assets to market participants (for example, to short sellers). This is a practice that BlackRock would naturally extend to its Bitcoin Trust, as nothing in the proposed filing prohibits rehypothecation.

- Obviously, the problem here is that investors in the BlackRock Bitcoin Trust will have claims to Bitcoin that should be sitting in BlackRock’s custody but have actually been lent out. In this case, investors in the Trust only own a paper claim to Bitcoin that BlackRock no longer holds.

- This means that BlackRock’s Bitcoin Trust will become a massive source of paper Bitcoin creation. When FTX went under, they had $1.4B in paper Bitcoin claims owed to their customers, but no Bitcoin to distribute to these accounts.

- I’m not sure about you, but I’d rather invest in a Bitcoin Trust that cannot rehypothecate its Bitcoin because the assets remain in an on-chain vault.

- Forks

- BlackRock’s filing specifies, “In the event of a fork, [BlackRock] will… determine which network it believes is generally accepted as the Bitcoin network and should therefore be considered the appropriate network, and the associated asset as Bitcoin, for the Trust’s purposes.”

- To be fair, this is the kind of language that one would include to innocently address the possibility of a fork (i.e., when a splinter group changes the Bitcoin code and attempts to convince enough people to follow that altered version of the code as the “real” Bitcoin).

- However, this language also allows for BlackRock to impose its view of what is the “real” Bitcoin.

- This is particularly concerning because of the combination of Bitcoin’s history of corporate-led forks & BlackRock’s history of politicized finance. In 2017, the Bitcoin Cash fork was pushed forward by a cabal of large corporate interests in the Bitcoin landscape – some have speculated that government interests spurred this effort. Similarly, BlackRock is the originator of the “ESG score,” a type of corporate social credit score undoubtedly crafted and promoted in partnership with government interests.

- Together, this creates a plausible scenario where BlackRock’s de facto ETF could become a very successful investment vehicle for institutions to gain exposure to Bitcoin and swell to encompass a very large portion of the total Bitcoin supply. Suddenly, BlackRock could be in a position to dictate that it will back a new ESG fork of Bitcoin, and will disregard the existing Bitcoin network as not the “real” Bitcoin.

- While I don’t believe that this kind of attack would be sufficient to convince well-informed and hardened Bitcoiners to fall in line with BlackRock’s political objectives, it could mean countless clients of BlackRock’s Bitcoin Trust becoming unwilling hostages in a BlackRock power play. Ultimately, BlackRock clients could suffer the same fate as Bitcoin Cash investors.

There are more concerns to be wary of. Allen Farrington lays out the case for eight reasons to worry about BlackRock’s intentions in Bitcoin.

All of this serves to highlight how it could be different, better. And that is why we built Onramp and the Onramp Bitcoin Trust, to help HNWI and Institutions get started in Bitcoin the right way.

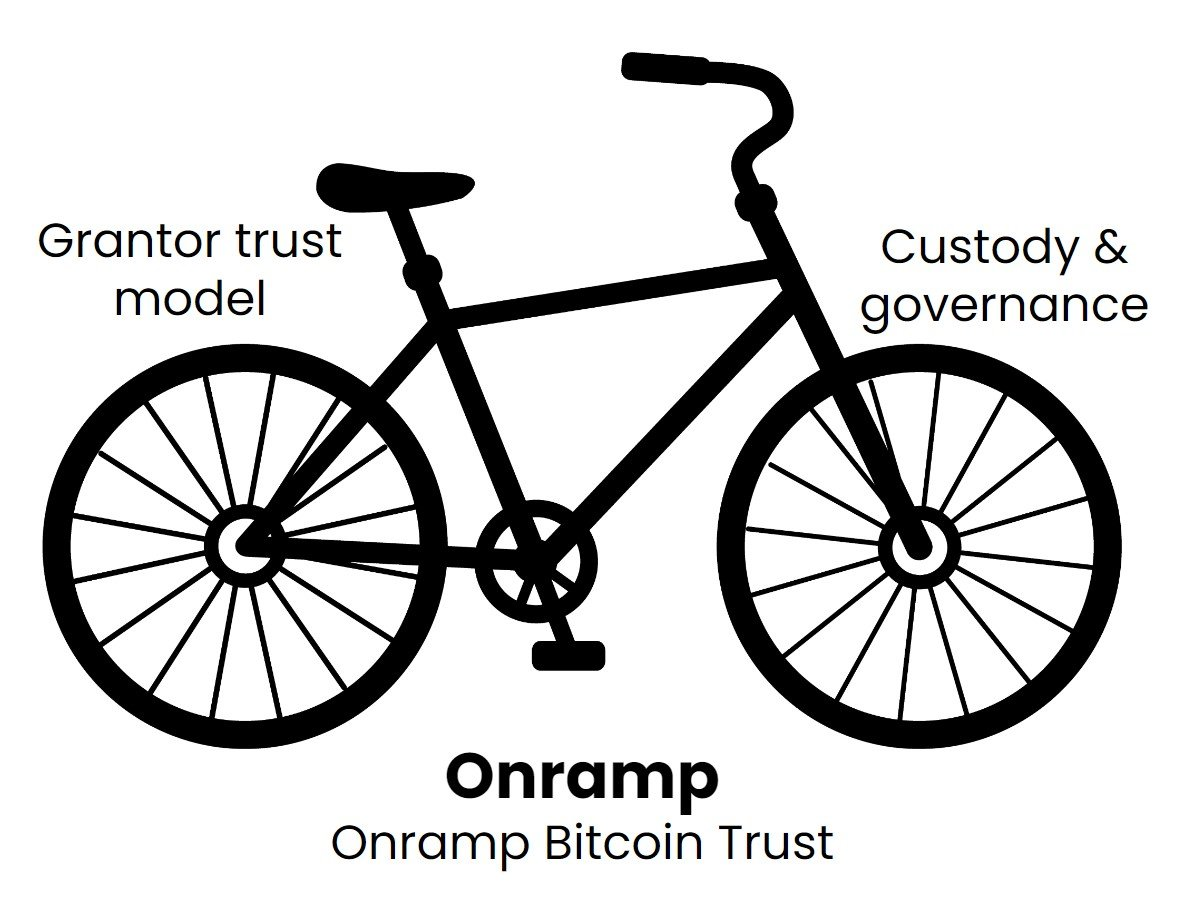

Onramp: a better Bitcoin Trust

Onramp leverages the same grantor trust model as BlackRock, which enables us to offer in-kind redemptions without a taxable event. However, we don’t limit access to these in-kind redemptions to registered broker-dealer “Authorized Participants” & don’t limit in-kind redemptions to whole integers of Bitcoin. We believe that your Bitcoin is yours to access and control.

Where Onramp really differentiates itself is in its custody & governance model.

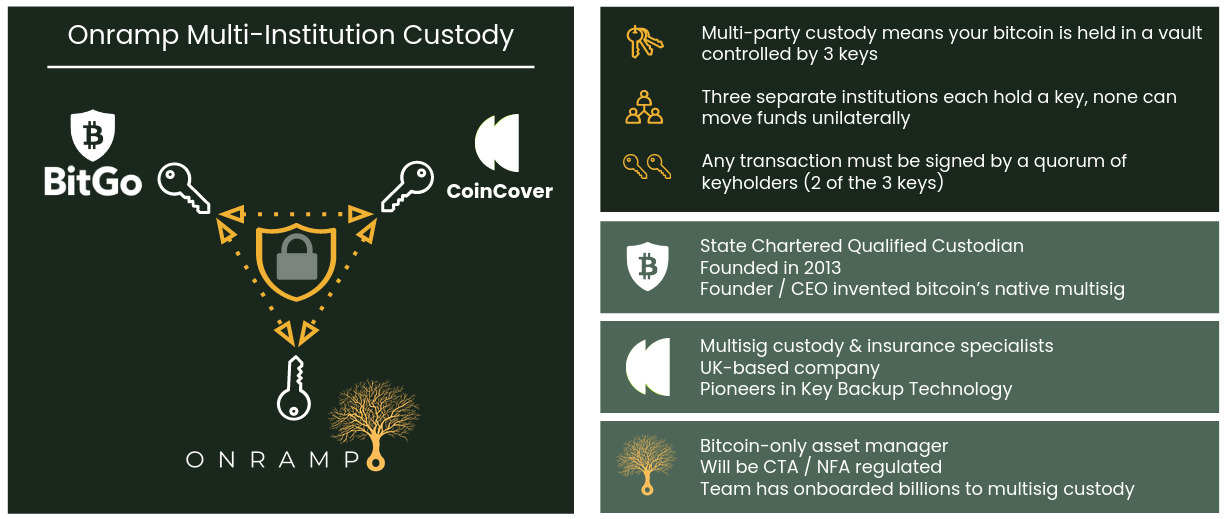

Onramp leverages Bitcoin’s native properties to deliver best-in-class custody via the Onramp Multi-Institution Custody solution. Onramp Bitcoin Trust assets are held in multisig vaults where three different institutions each hold a key: Onramp, BitGo (a qualified custodian), and CoinCover.

In this arrangement, no individual entity can control the assets held on-chain in the multi-party vault. Beyond eliminating single points of failure in the custody model, this setup ensures that Trust assets can never be rehypothecated. Instead, they live in an on-chain vault, visible and auditable 24/7.

Furthermore, Onramp was setup by Bitcoiners in the interest of advancing Bitcoin by providing a better way for individuals and institutions to get exposure to Bitcoin. That’s why Allen Farrington concludes his takedown of BlackRock with a call to support Onramp instead.

When selecting between Trusts to get exposure to Bitcoin (Grayscale, BlackRock, or Onramp), pay attention to the front wheel of the bicycle.

Choose your investment vehicle wisely.