You don’t start with a product — you start with fit.

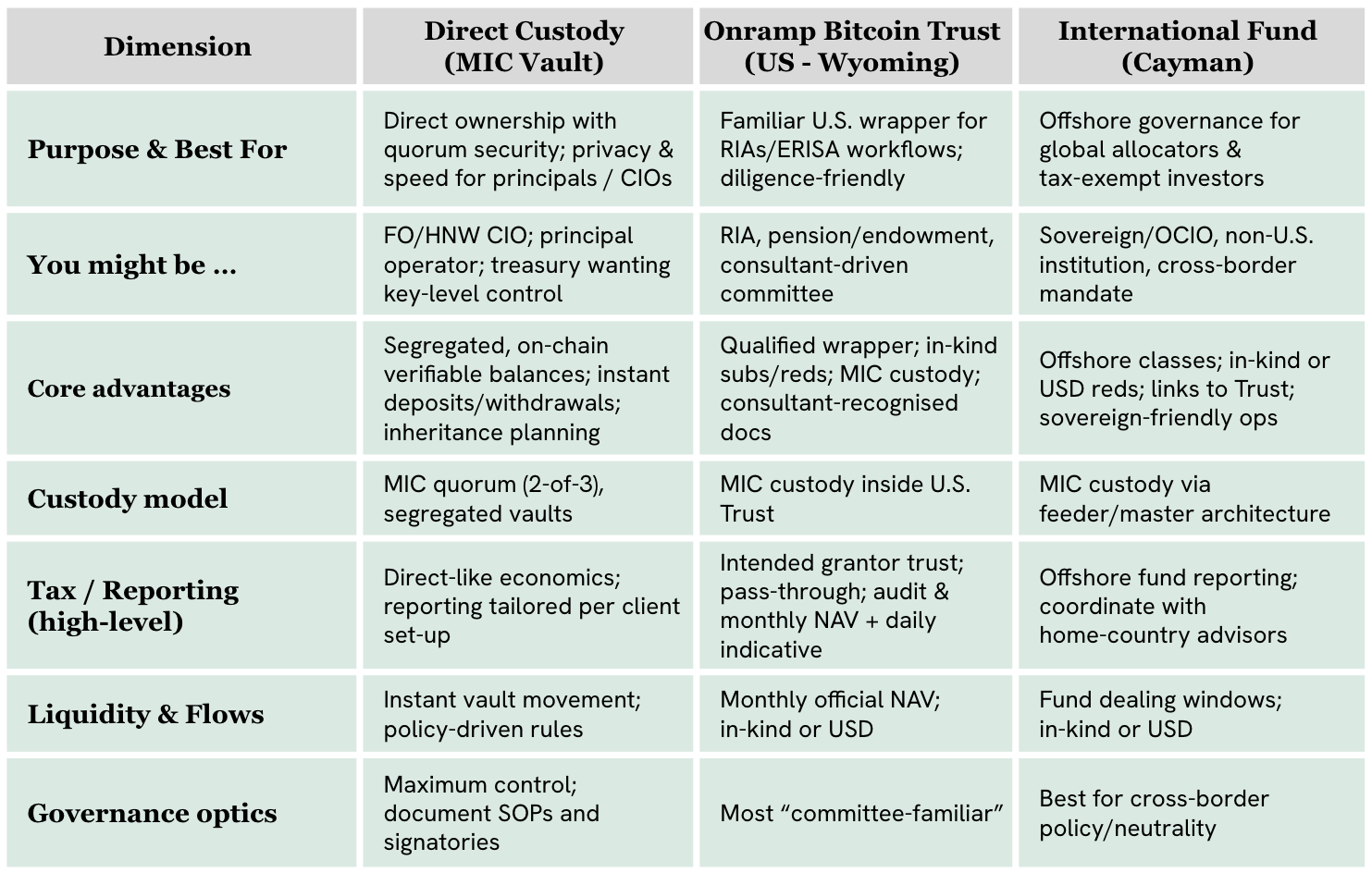

Compare Access Models

Which structure fits your mandate?

Use this side-by-side to see which structure aligns to your governance, tax, and operational needs.

Choose your Bitcoin access path

Pick the path that fits your mandate.

Direct Custody Vault (MIC)

Best for: Family offices / HNW; allocators prioritizing operational control and on-chain auditability with a quorum model.

You might be … a CIO / principal who wants direct control, ability to instantly instruct, inheritance tooling, and possible to link with a dynasty trust.

U.S. Statutory Trust (Wyoming)

Best for: RIAs, pensions / ERISA-sensitive mandates, U.S. institutions needing a qualified wrapper with in-kind flows and MIC custody.

You might be … an RIA / plan sponsor who needs a familiar U.S. wrapper that flies with consultants and auditors.

International Fund (Cayman)

Best for: Non-U.S. institutions, tax-exempt investors, global allocators needing offshore classes and redemptions in BTC or USD.

You might be … a global allocator / sovereign / OCIO with cross-border constraints or tax neutrality goals.

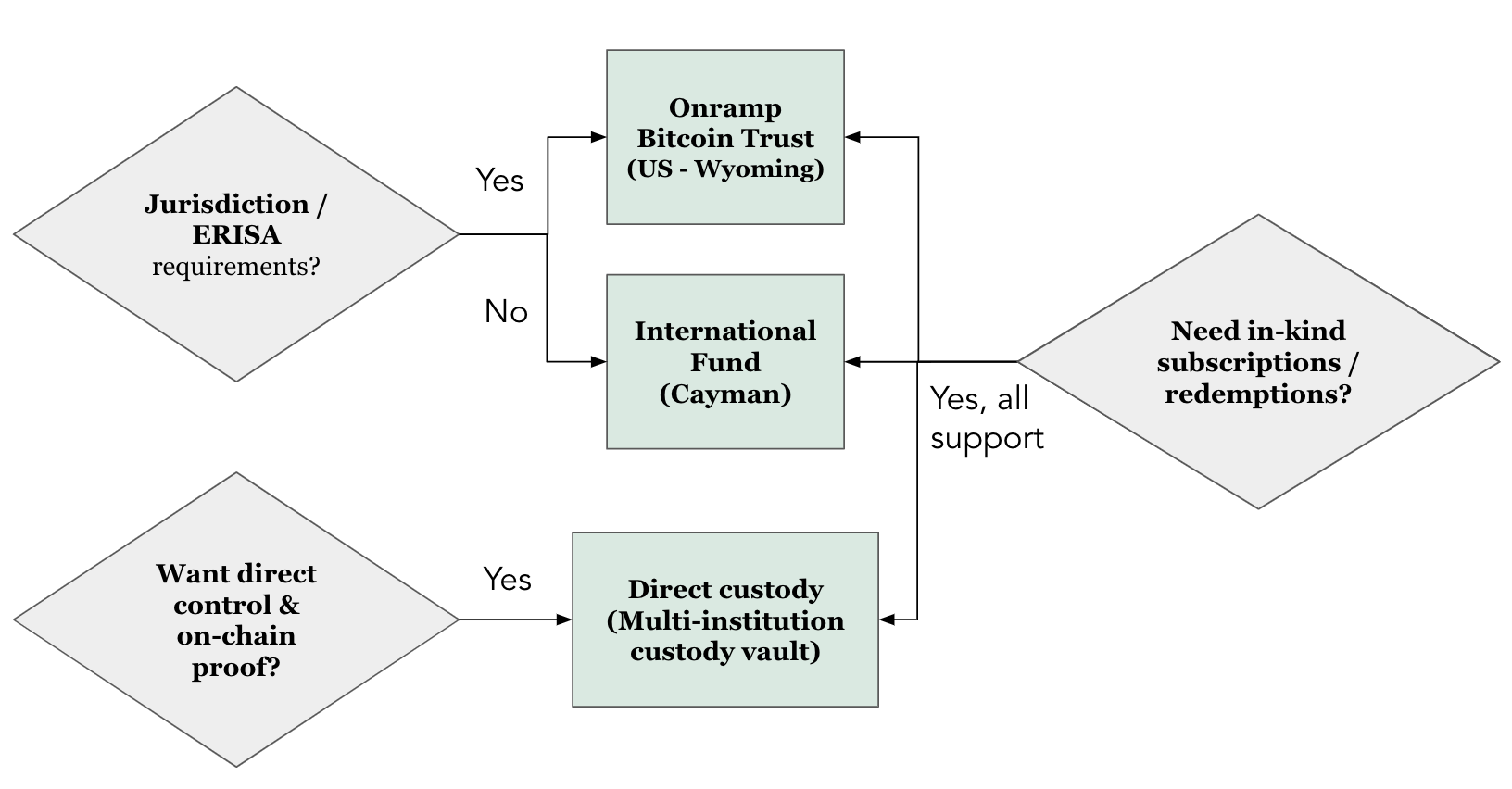

Decision helper

A starting point for understanding your options

Detailed breakdown of Bitcoin access vehicles

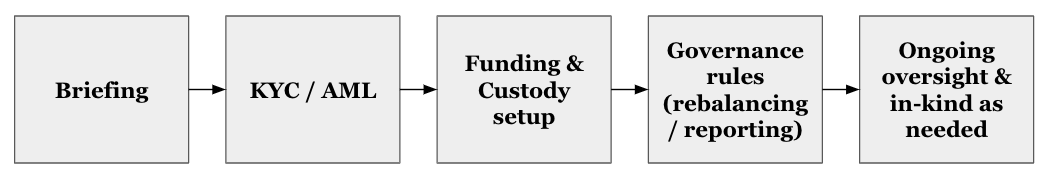

Our implementation process

FAQs

We get it, there's a lot to consider when starting an institutional Bitcoin journey.

Ready to implement a proven process?

Start your institutional Bitcoin journey with Onramp.