Why IRAs at Onramp are unique

The Most Secure Way to Hold Bitcoin in Your IRA

Onramp makes it easy to securely hold bitcoin in a tax-advantaged retirement account.

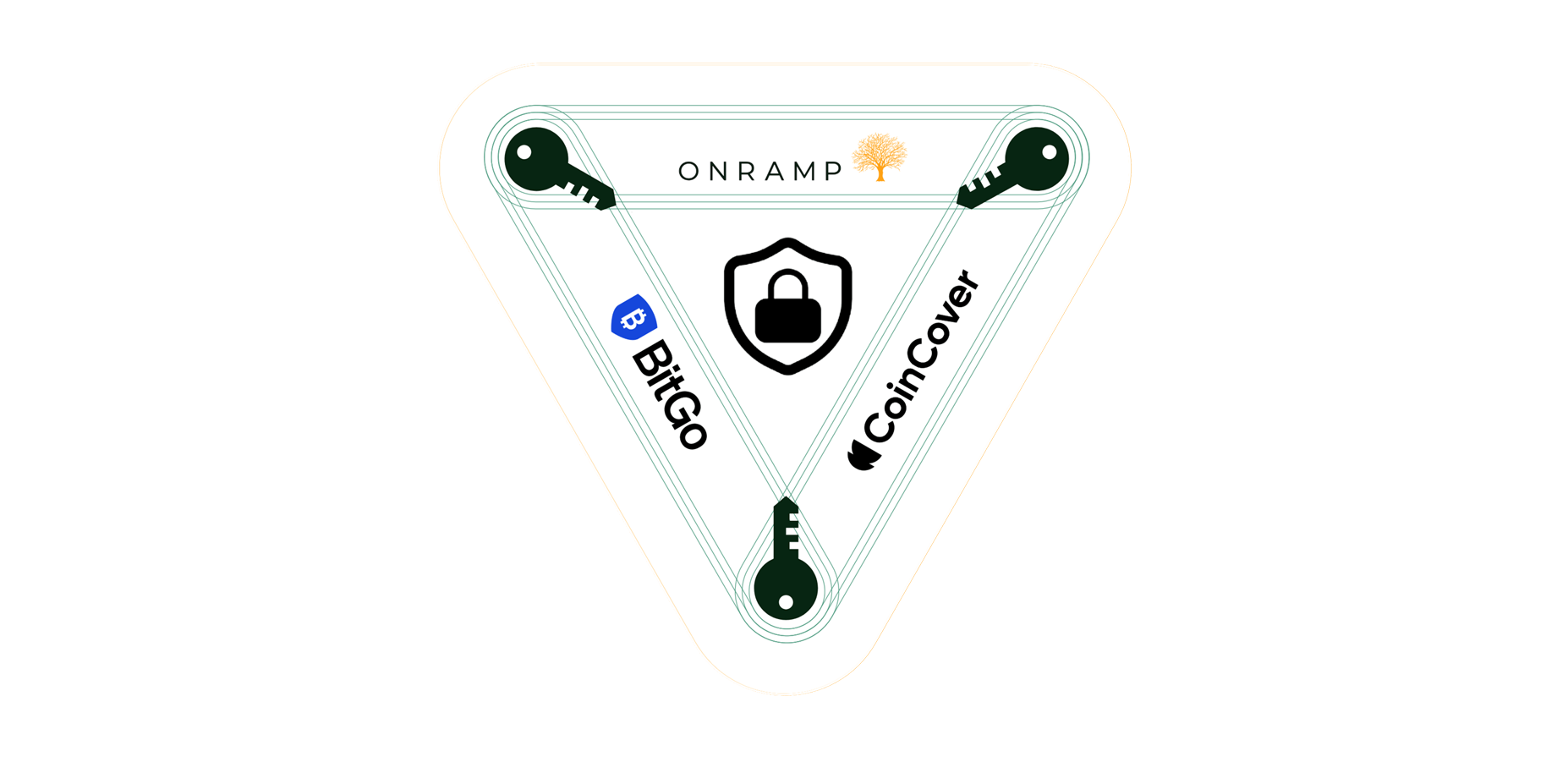

Onramp now offers IRA accounts, secured by Multi-Institution Custody.

With Multi-Institution Custody, three distinct regulated institutions each hold one key: no single institution can move or lose funds alone. Transactions require approval from at least two of the three key holders. This removes single points of failure and aligns with regulatory expectations for retirement accounts.

We've combined our best-in-class Multi-Institution Custody model with the structure of a qualified IRA.

You get unmatched security, compliance, and peace of mind-without managing private keys or wallets yourself.

Unique Benefits of the Bitcoin IRA

Assets are off-exchange, in deep cold storage. No keys are held by the IRA account owner.

IRS compliance, in partnership with a regulated third-party administrator

Gain tax-advantaged bitcoin exposure.

In-Kind transfers and withdrawals

Deposit bitcoin into the vehicle, withdraw bitcoin when ready.

No technical setup or key management

No need to setup or maintain software or hardware devices.

Resilient long-term storage

Ideal for retirement savings that require a robust custody framework for the long term.

Integrated inheritance planning

Seamless setup, ensures assets are directed according to your wishes.

Institutional-grade liquidity and low trade fees

Manage your assets for preservation and growth.

Multi-Institution Custody for IRAs

With Onramp IRAs, your bitcoin is held in a vault protected by three independent institutional key Agents:

Active Keyholder

- Multi-institution custody market leader

- Experience onboarding $ billions to multisig

Active keyholder

- Qualified custodian, founded 2013

- Founder/ CEO invented Bitcoin's multisig

Passive keyholder

- Bitcoin custody & Insurance specialists

- UK-based built for recovery & resiliency

We make it easy to fund your account

Get started with a Bitcoin IRA

Transfer

Move money directly from an existing IRA (Traditional, Roth, SEP, or SIMPLE).

Rollover

Move money from a Qualified Plan, such as an IRA, 401(k) or 403(b), with no taxes or penalties.

Conversion

A taxable movement of assets from a tax deferred account to a tax-free account, for example from a Traditional IRA to a Roth IRA.

Contribute USD

Start fresh with new USD via bank wire.

Deposit BTC in Kind

Deposit Bitcoin directly from an existing IRA.

Common IRA Questions

Multi-institution custody is a new model for securing your Bitcoin IRA.

Open your IRA today

Start securing your retirement with the most resilient bitcoin custody available.