1/22/26 Roundup: The Macro Trio Meets Davos

Brian Cubellis | Chief Strategy Officer

Jan 22, 2026

This week we're highlighting several items: a new institutional research report from Glenn Cameron, our 2025 Shareholder Letter, and an upcoming webinar on custody and inheritance planning.

We also couldn't ignore the scenes from Davos, where bitcoin, debt, and the future of the monetary order took center stage in ways that would have been unthinkable just a few years ago.

New Research: Bitcoin's Macro Liquidity Cycle

Glenn Cameron, Head of Onramp Institutional, has released a comprehensive Q4 2025 update: Bitcoin's Macro Liquidity Cycle: Why M2, the Dollar, and Real Rates Now Dominate the '4-Year Cycle'

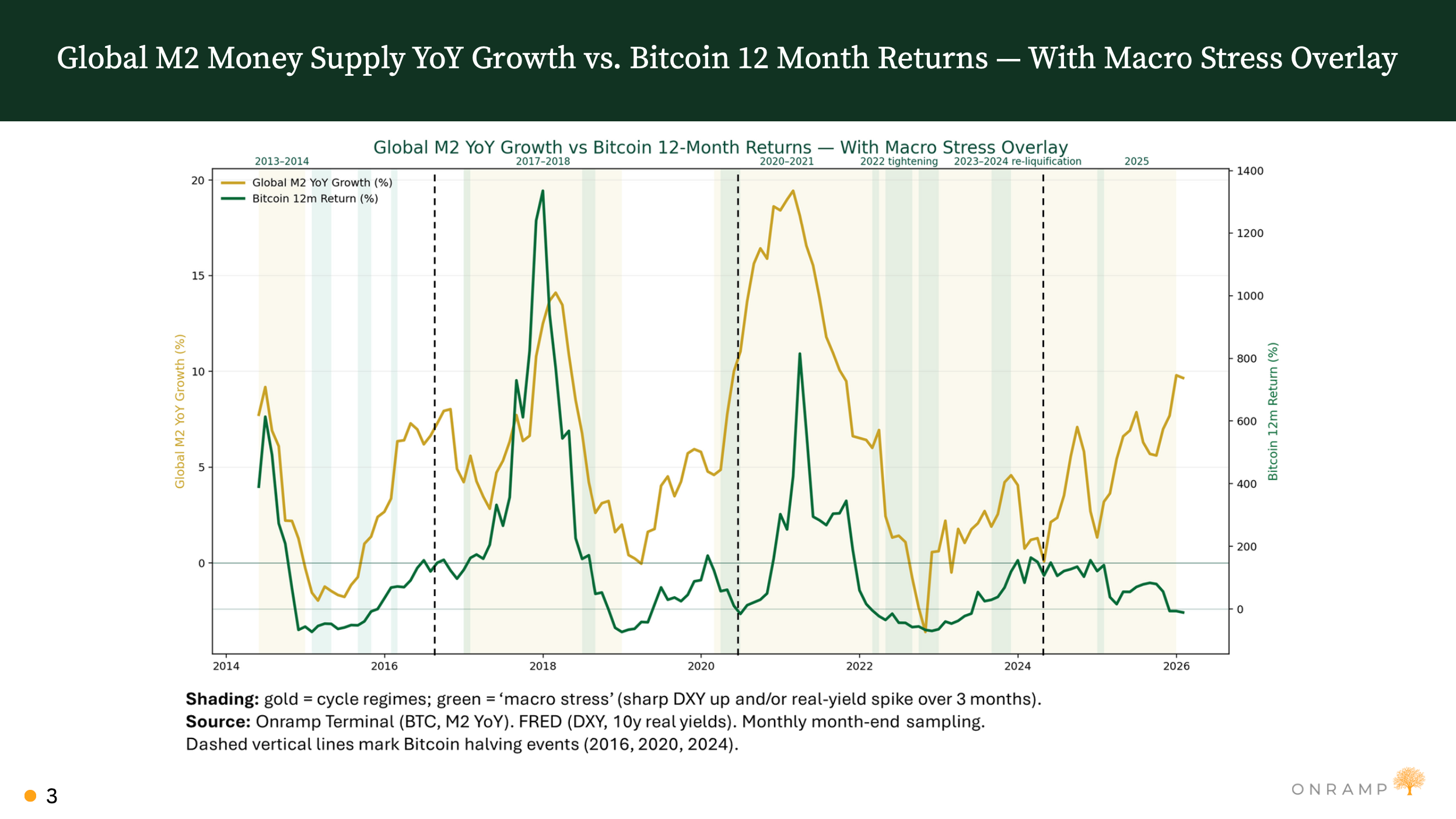

The core thesis: Bitcoin's major cycles align more closely with macro liquidity regimes than with the four-year halving calendar. The halving remains a structural tailwind and powerful narrative catalyst, but investors who rely on it as a timing signal are missing the broader picture.

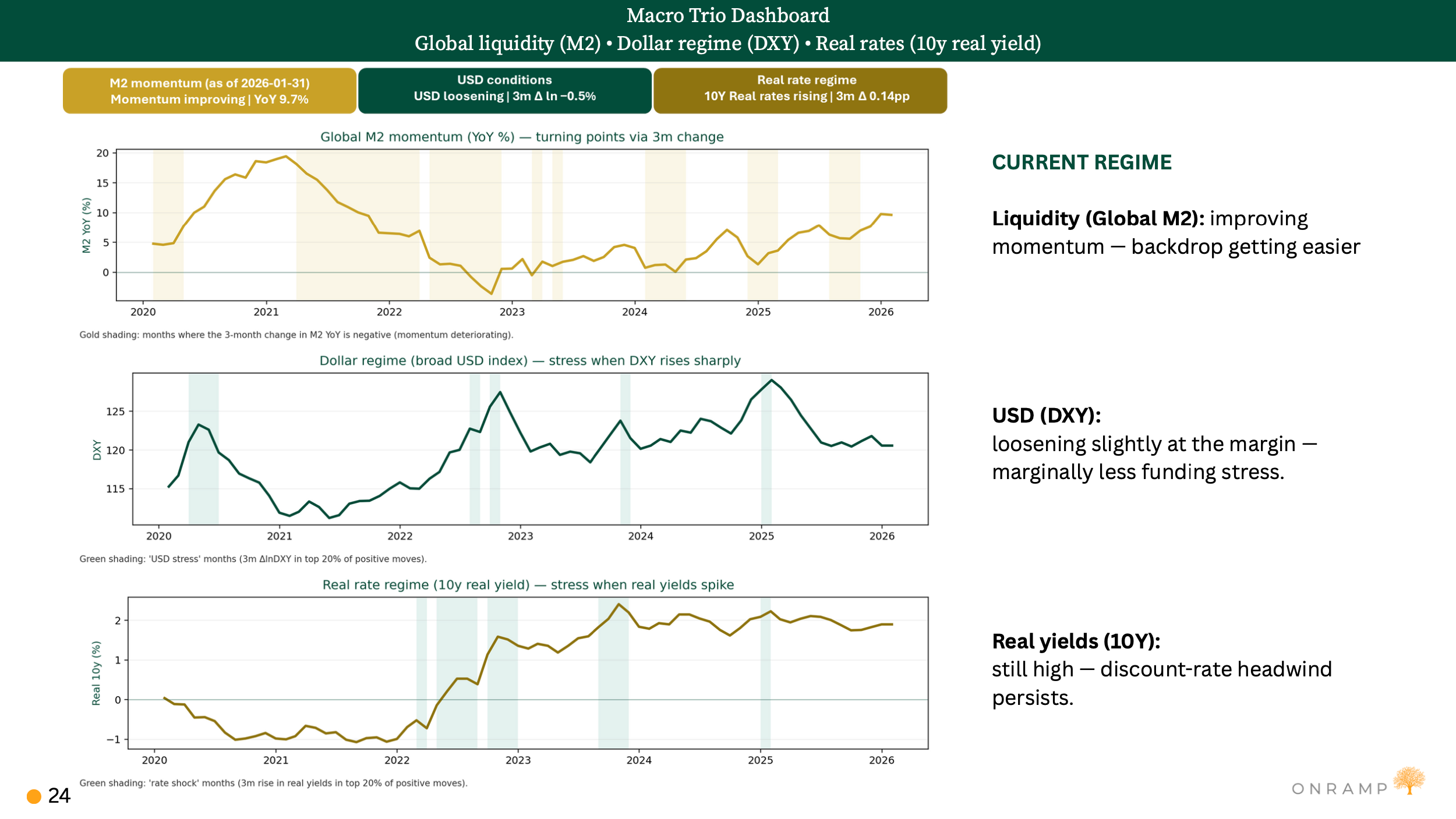

Glenn identifies a "Macro Trio" of indicators that together define whether bitcoin is operating in an expanding or contracting liquidity environment: global M2 money supply, the U.S. Dollar Index (DXY), and real interest rates.

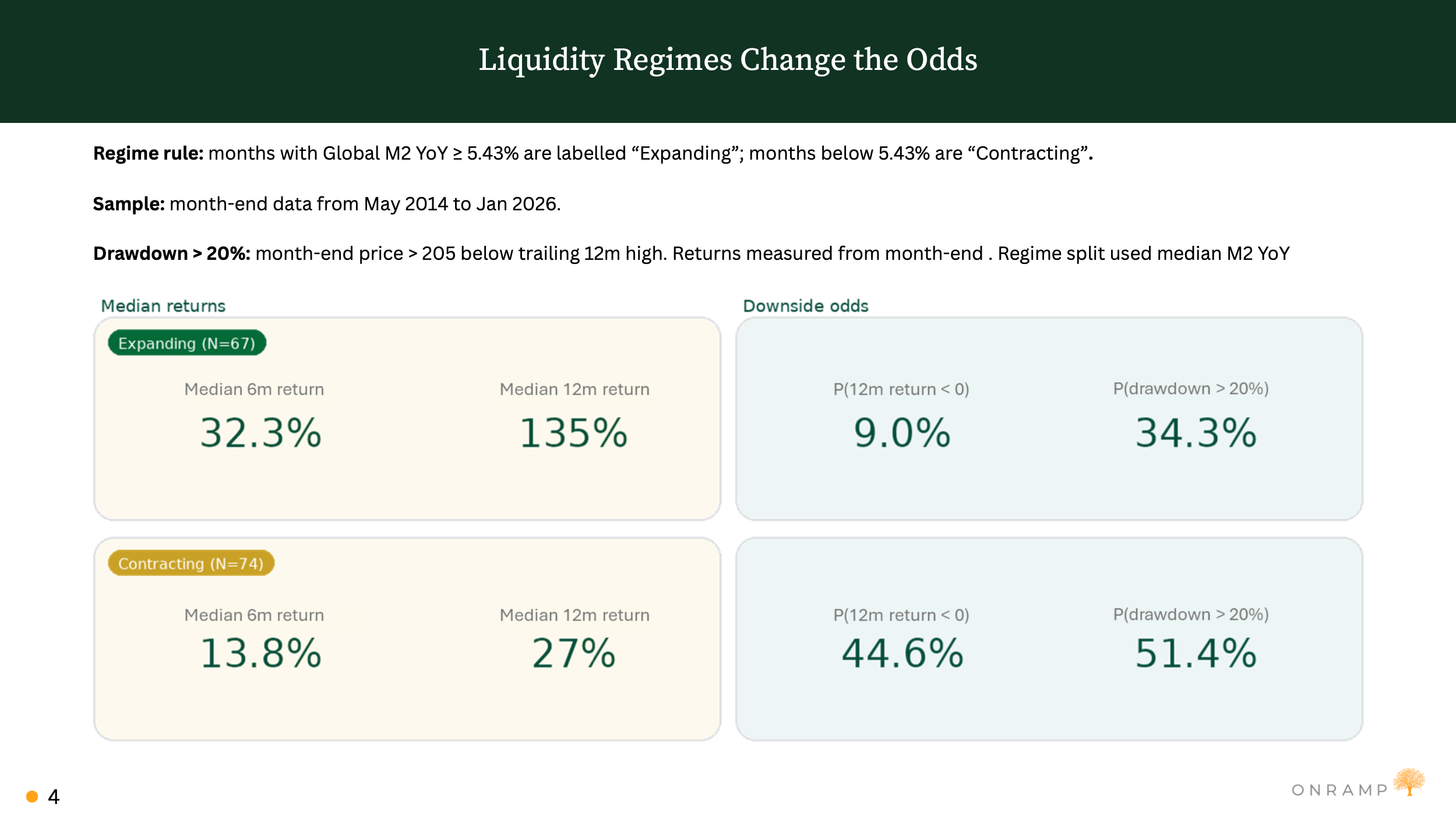

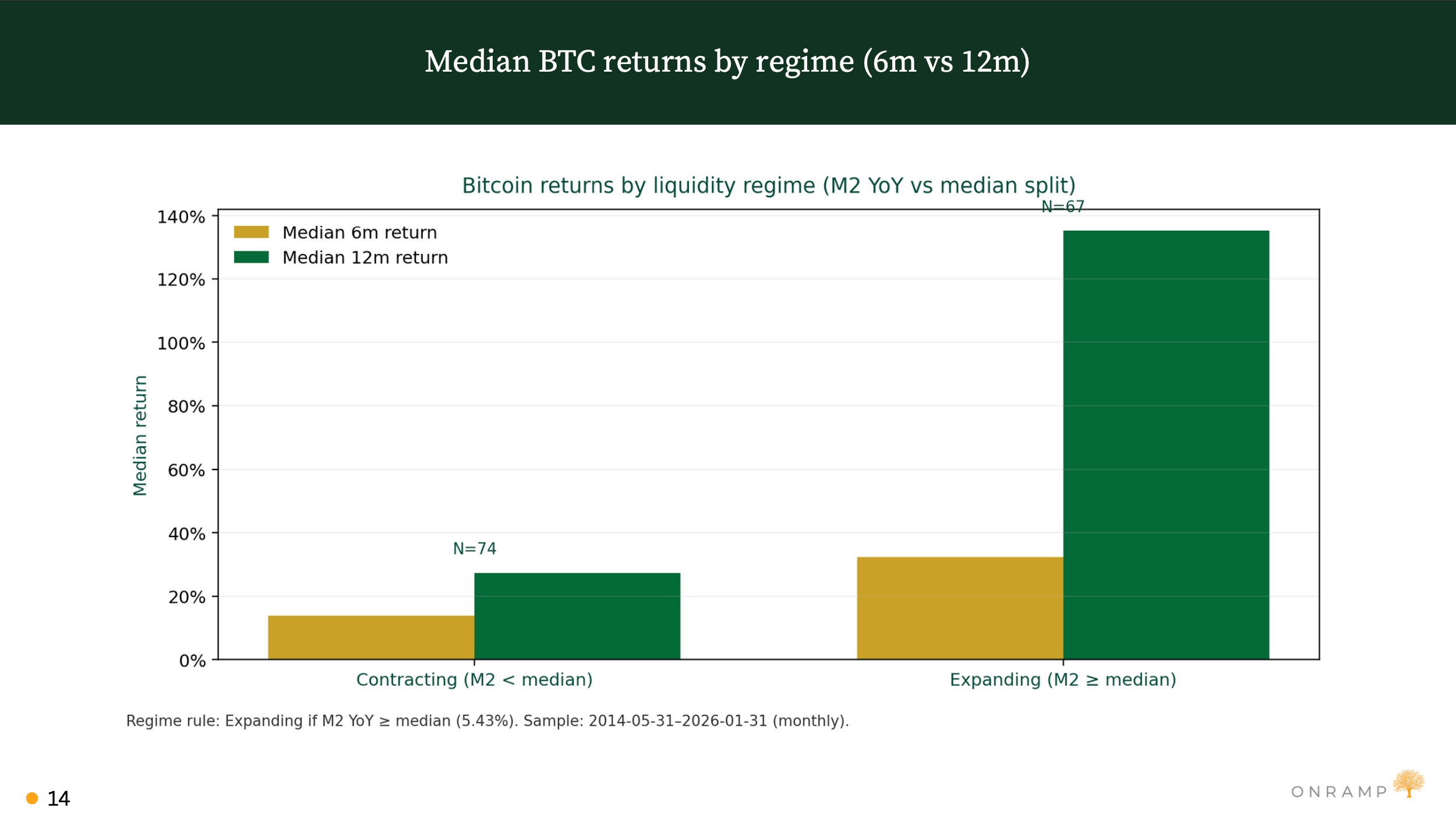

The historical data is striking.

In expanding liquidity regimes, bitcoin has delivered a median 12-month return of 135%, with only a 9% probability of a negative outcome. In contracting liquidity regimes, the median return drops to 27%, and the probability of loss rises to 45%.

These correlations don't show up immediately. Bitcoin responds to liquidity shifts with a delay, typically 6 to 24 months, as monetary conditions transmit through credit markets, risk appetite, and eventually into asset prices. This lag explains why bitcoin can appear to defy macro conditions in the short term while ultimately respecting them over longer horizons.

The 2021-2022 period illustrates the framework in action. Global M2 rolled over, the dollar strengthened, and real yields climbed out of negative territory. Bitcoin's repricing followed. The report includes additional historical analysis, a breakdown of transmission mechanisms, and a practical tool called the Macro Trio Dashboard for quarterly regime monitoring.

For investors focused on the long term, the takeaway is straightforward: the macro regime matters more than the halving schedule. Fiat currencies backed by sovereign debt have one inevitable trajectory:

More units. More liquidity. More debasement.

[Read the full Q4 2025 Update here]

Davos Dispatch

The World Economic Forum in Davos produced a remarkable set of exchanges this week. Bitcoin, sovereign debt, and the stability of the monetary order featured prominently in conversations among central bankers, hedge fund managers, and heads of state.

A few moments worth noting...

Armstrong vs. France's Central Banker

During a panel on tokenization, Bank of France Governor François Villeroy de Galhau offered a familiar defense of the status quo: "I trust more independent central banks with a democratic mandate than private issuers of bitcoin."

Coinbase CEO Brian Armstrong corrected the framing: "There's actually no issuer of it. So, in the sense that central banks have independence, bitcoin is even more independent. No country, company, or individual controls it in the world."

It was a rare moment. Bitcoin itself, not blockchain infrastructure or regulated stablecoins, was debated head-on at Davos. Armstrong added that bitcoin "doesn't have a money printer" and that people move to it during times of uncertainty, "similar to how they historically turned to gold."

Griffin on Fiscal Fragility

Citadel's Ken Griffin pointed to this week's violent selloff in Japanese government bonds, where 30- and 40-year yields spiked more than 25 basis points in a single session, as an "explicit warning" to U.S. lawmakers.

"What happened in Japan is a very important message to the House and to the Senate: You need to get our fiscal house in order."

Griffin noted that governments are, "with little exception, all spending beyond their means," and that the current administration is making a "major bet" by hoping to grow its way out of the fiscal situation.

Dalio on the Monetary Order

Ray Dalio offered his characteristic bluntness: "The monetary order is breaking down."

He explained that fiat currencies and sovereign debt are "not being held by central banks in the same way," pointing to gold's outperformance last year as evidence of shifting reserve behavior. "The biggest market to move last year was the gold market, far better than the tech markets and so on."

Dalio warned that in times of geopolitical conflict, "even allies do not want to hold each other's debt. They prefer to go to a hard currency."

Trump on Market Structure

President Trump, speaking to a packed audience, reiterated his desire for America to remain "the crypto capital of the world" and said he hopes to sign the market structure bill "very soon, unlocking new pathways to reach financial freedom."

The legislation, which would clarify jurisdiction between the SEC and CFTC, hit a snag last week when Coinbase withdrew support over concerns about banking lobby influence. Armstrong acknowledged "there was a little bit of a blow-up last week" but said discussions remain constructive.

Connecting the Dots

What stood out from Davos wasn't any single statement. It was the convergence of themes. Griffin warning about fiscal sustainability. Dalio describing a breakdown in the monetary order. Armstrong making the case for bitcoin as a neutral, issuer-less alternative. Central bankers defending their independence while acknowledging the political pressures bearing down on them.

These conversations would not have happened at Davos five years ago. That they're happening now tells you something about where we are.

2025 Shareholder Letter

Earlier this week we released our 2025 Shareholder Letter, which uses Benjamin Graham's "voting machine vs. weighing machine" framework to examine why 2025 disappointed by sentiment but delivered by substance. The letter covers the psychology of the casino, the costly lesson of the Digital Asset Treasury trade, and the broader erosion of trust that makes bitcoin's value proposition more urgent than ever.

Bitcoin Ownership for the Long Term

On Thursday, February 12 at 12pm EST, we're hosting a webinar on what happens to your bitcoin over decades, not just market cycles.

"Bitcoin Ownership for the Long Term: Custody, Inheritance, and Financial Services for Individuals" will cover how to build a custody setup that eliminates single points of failure, how inheritance planning actually works for bitcoin, and how to access financial services like IRAs and liquidity without giving up control.

As bitcoin moves from speculative asset to generational wealth, your custody decisions need to match that timeline. Whether you're planning for the next decade or the next generation, this session will help you think through what ownership looks like when bitcoin becomes part of your financial foundation.

[Register for the Webinar]

Podcasts of the Week

Bitcoin Supercycle: The Last Trade Is Here | Marty Bent

The Last Trade: Marty Bent joins to break down bitcoin’s 2026 setup, Fed vs Treasury tension, and why the denominator is breaking.

Goldman, State Street, NYSE: The TradFi-Crypto Takeover Is Underway

Final Settlement: Clarity Act stablecoin-yield showdown, TradFi’s tokenization push (State Street/Goldman), distribution vs niche in Bitcoin infrastructure, stablecoin adoption paths, new infrastructure fundraises, and how AI is reshaping entrepreneurship.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis