1/29/25 Roundup: Bessent & Co.'s Implicit Instruction

Brian Cubellis | Chief Strategy Officer

Jan 29, 2026

Before we get started…

On Thursday, February 12th at 12pm EST, we are hosting a webinar focused on individuals: Bitcoin Ownership for the Long Term: Custody, Inheritance, and Financial Services.

We will walk through the full range of ways Onramp supports individual bitcoin holders, from multi-institution custody to IRAs, bitcoin-backed loans, dynasty trusts, inheritance planning and more. Whether you are evaluating custody solutions or helping family members think through long-term bitcoin ownership, this session will cover the landscape.

Lastly, find this newsletter valuable? Please forward it to someone in your personal or professional network.

And now, for the weekly roundup…

Bessent & Co.'s Implicit Instruction

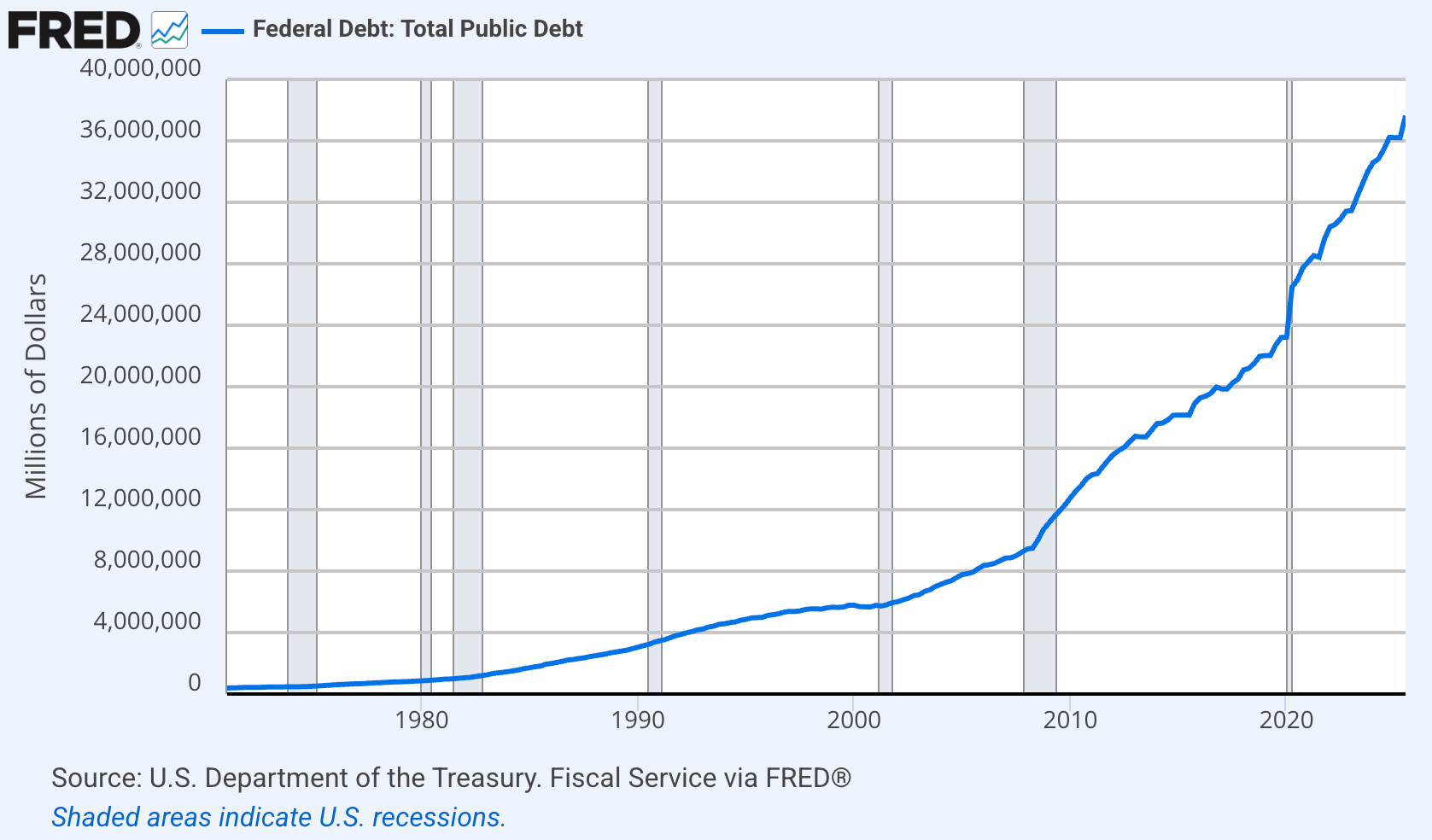

The administration has laid out a policy framework that points in one direction: dollar devaluation. They have provided the playbook. They cannot say it explicitly, but the logic is straightforward. The debt is unsustainable. The dollar is too strong. The path forward requires debasement. You had better own hard assets.

The Strategic Case for a Weaker Dollar

Stephen Miran, now Chair of the Council of Economic Advisers, published a paper in November 2024 titled "A User's Guide to Restructuring the Global Trading System." The document has become something of an intellectual blueprint for the administration's economic strategy.

The central thesis is this: the dollar's role as the global reserve currency has caused persistent overvaluation, which has hollowed out American manufacturing and made U.S. exports uncompetitive on the world stage.

According to Miran's framework, the manufacturing workforce has declined by more than a third since its peak, and America's share of world manufacturing production has fallen by 40%. The reserve function of the dollar forces the U.S. to run structural trade deficits so that foreigners can accumulate dollar assets.

Covid exposed the consequences. Supply chains collapsed. Critical goods could not be sourced domestically. The United States found itself dependent on China for equipment essential to keeping its population safe.

The remedy, in Miran's view, is a deliberate weakening of the dollar. A cheaper currency would make American exports competitive again, encourage reshoring, and reduce dependence on foreign supply chains. The goal is to preserve the dollar's reserve status while clawing back the benefits that other countries derive from American monetary hegemony.

This is the theoretical foundation. Treasury Secretary Scott Bessent appears to share this framework.

"Run It Hot"

In a recent interview, Bessent addressed the administration's approach to the debt burden:

"There is the potential growth of the debt, but what's more important is we grow the economy faster. I inherited a 6.7% deficit as a percentage of GDP, and we're trying to bring that down by decreasing spending, increasing revenue and growing the GDP faster than the debt."

The strategy has a name. Run it hot.

The idea is to sustain elevated nominal growth so that the debt-to-GDP ratio stabilizes through the expansion of the denominator rather than through fiscal austerity. In practice, this means tolerating inflation, suppressing real rates, and allowing the currency to weaken. Financial repression becomes the mechanism for managing an otherwise unmanageable debt load.

The administration cannot come out and declare that they intend to devalue the dollar. Such a statement would destabilize markets and undermine confidence in U.S. Treasuries. But the policy framework speaks for itself. Tariffs to rebalance trade. Reshoring to rebuild industrial capacity. Nominal growth to outpace debt accumulation. All of these objectives require a weaker dollar.

The Hard Asset Signal

Against this backdrop, consider what the policymakers themselves believe about stores of value. In an interview with Tucker Carlson, Bessent was asked whether he was anti-gold. His response: "Oh, no. When I had my fund, people might have called me a gold bug."

He continued: "Gold can't have a fiscal problem. Gold cannot have a gigantic budget deficit. Gold cannot have a war."

On bitcoin, Bessent was equally direct: "Bitcoin is becoming a store of value. Gold has historically been a store of value."

The Treasury Secretary is telling you that both gold and bitcoin function as stores of value. He is also implementing a policy that will erode the purchasing power of the dollar over time.

The administration is positioned accordingly. The Trump family has built a substantial crypto empire through World Liberty Financial, a bitcoin mining operation, and various related ventures. Eric Trump and Donald Trump Jr. have become prominent advocates for digital assets.

The implicit instruction is clear:

Own hard assets.

Gold Validates the Bitcoin Thesis

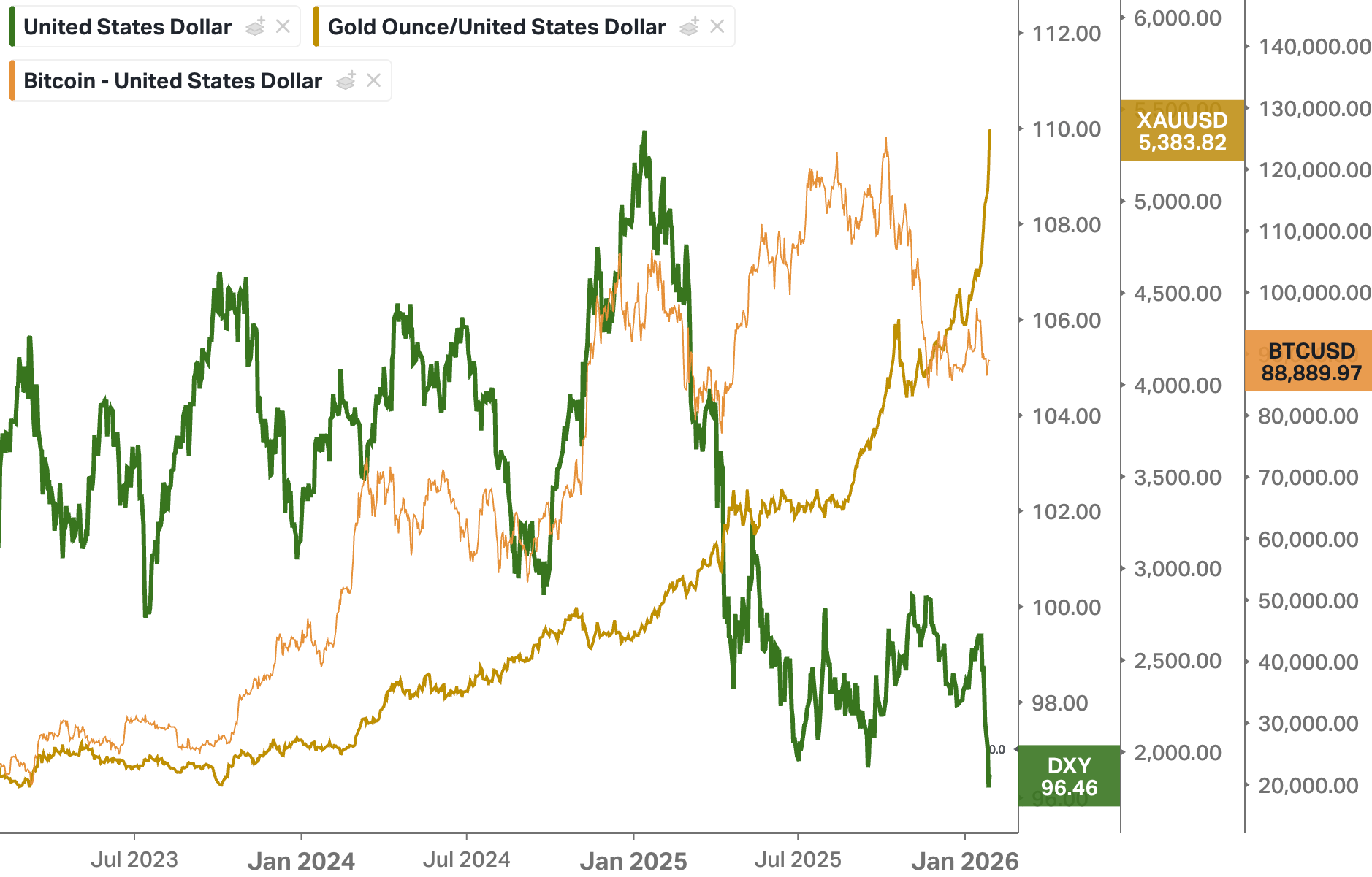

Over the past year, gold has outperformed bitcoin on a relative basis. This has led some to question the digital gold narrative. But the correct interpretation is the opposite: gold's performance validates the thesis that hard assets will reprice against debasing fiat currencies.

The disconnect between gold and bitcoin is not about which asset is superior. The disconnect is about understanding. Gold has thousands of years of history. Central banks hold it. Institutions allocate to it. The mental model is already in place. Bitcoin requires a new framework. Most people do not yet understand what it is or why it matters.

That gap in understanding is the asymmetry. That is the opportunity.

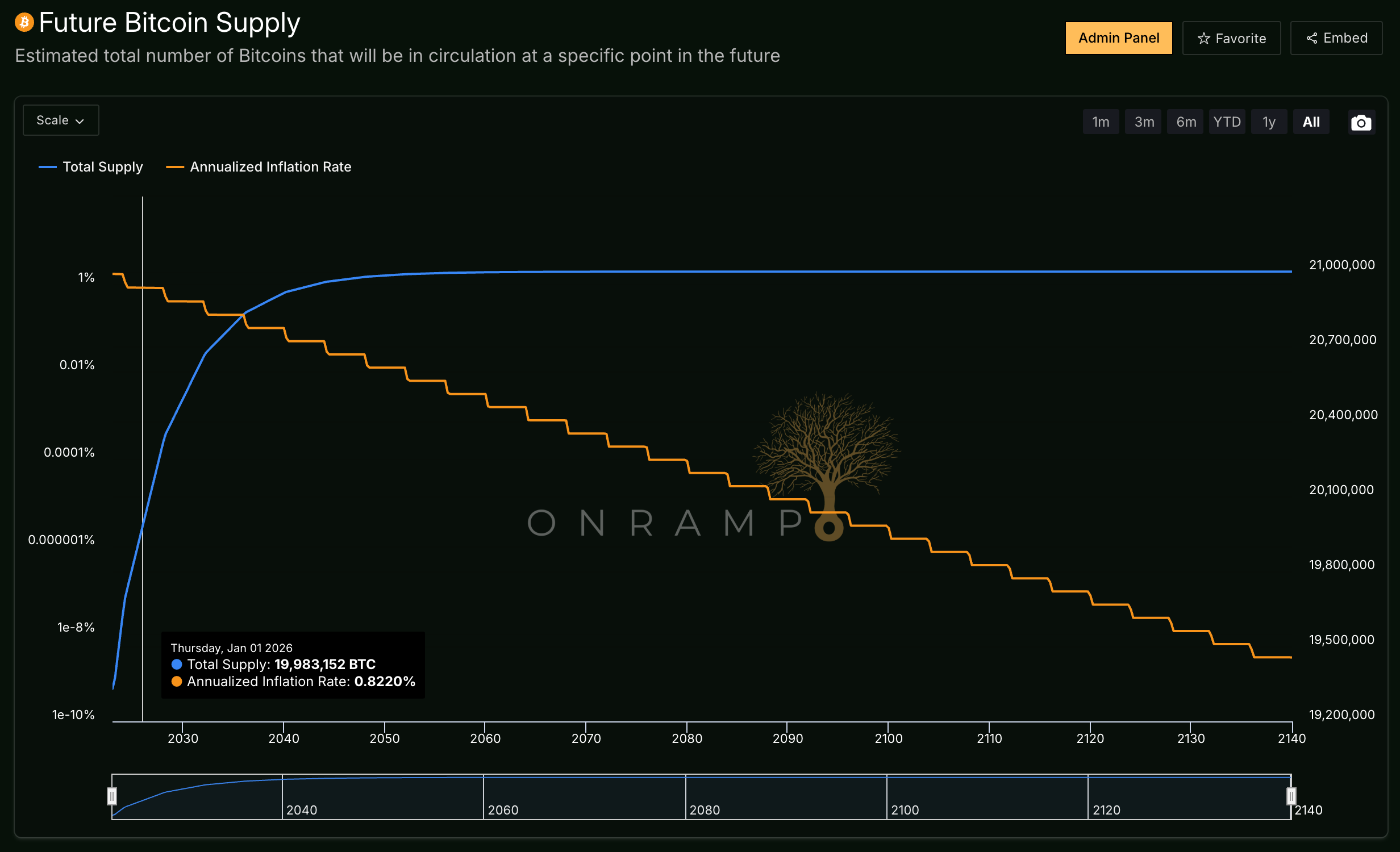

We know bitcoin's monetary properties are superior to gold in every dimension except track record. Bitcoin is perfectly scarce, perfectly divisible, perfectly portable, and perfectly verifiable. Gold is none of these things.

More importantly, gold will face a supply response as prices rise. More miners will come online. The technology to extract and refine gold will continue to improve. New deposits will be discovered. Perhaps one day we mine asteroids. The incentive to increase supply is permanent, and there is no mechanism to constrain it. Gold has no difficulty adjustment.

Bitcoin is different. There will only ever be 21 million. No amount of demand, no increase in price, no improvement in technology can change that. The supply schedule is fixed and enforced by consensus. This is not a design feature that gold can replicate.

Moreover, consider the world we are building. Finance is increasingly digital. Commerce is increasingly digital. Communication is increasingly digital. A store of value native to that environment has structural advantages that a physical commodity cannot match. Bitcoin is money for the internet age.

Gold is doing exactly what it should be doing. It is repricing against a debasing currency. Bitcoin will follow the same path, with a longer runway and a higher ceiling.

The relationship is playing out in real time.

Since mid-2023, the pattern has been consistent. The dollar weakens. Gold and bitcoin strengthen. The remonetization of hard assets is accelerating.

Gold has added several trillions in market cap over the past eighteen months. Central banks are accumulating at a pace not seen in decades. For those who understand the setup, bitcoin represents the logical extension of the gold thesis for a networked age.

Chart of the Week

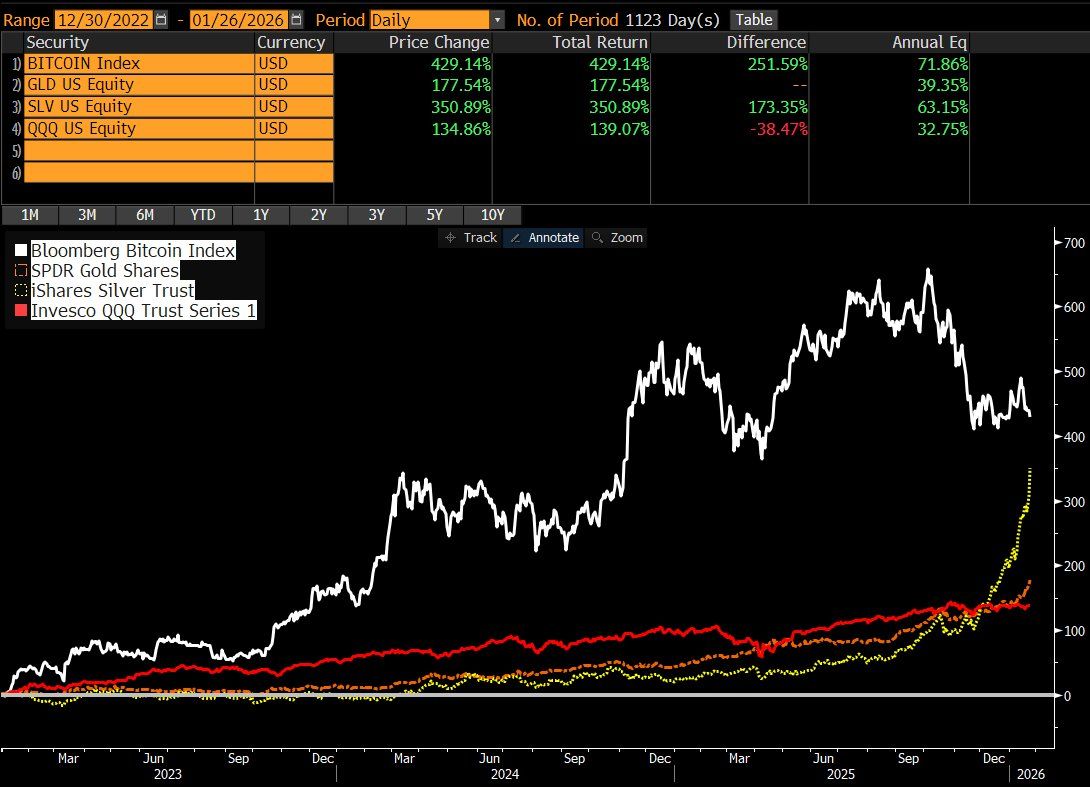

"The dread I see from bitcoiners (and the football spiking from the haters) is very short-sighted to me given that since 2022 (right before the BlackRock ETF filing) Bitcoin is up 429%, gold 177%, Silver 350%, QQQ 140%. In other words bitcoin spanked everything so bad in '23 and '24 (which ppl seem to forget) that those other assets still haven't caught up even after having their greatest year ever and btc being in a coma."

— Eric Balchunas on X

Quote of the Week

"It's hard to tell that Bitcoin protects against debasement from just its price, since most of the price rise since the pizza purchase has been due to the learning curve, not to debasement (fiat has fallen, but not by nearly as much as Bitcoin has risen!). To understand why Bitcoin has and very likely will protect in the long-term against debasement, better than gold has and will, requires deep understanding of the underlying respective technologies that are gold and Bitcoin, especially in terms of their respective extents and qualities of trust minimization, and it requires knowing why trust minimization is valuable. These kinds of understandings are still uncommon."

— Nick Szabo on X

Podcasts of the Week

Why Gold's $20 Trillion Rally Is Actually Bullish For Bitcoin

The Last Trade: Davos signals a shift in the monetary order as sovereign debt cracks, gold leads, and bitcoin emerges as a neutral alternative.

Gold at $5,000 Is Just the Beginning | Jeroen Blokland

Scarce Assets: Jeroen Blokland explains why bonds have destroyed wealth for 20 years, how $124 trillion in generational wealth will reshape portfolios, & why gold at $5,000 is just the beginning.

BitGo's $2.1B IPO & Silver's Surge: The Sound Money Reset Is Just Starting

Final Settlement: BitGo IPO breakdown: what a crypto custody / infrastructure company going public means for banking, custody, M&A, and the next wave of digital asset IPOs. Also, Ledger IPO rumors, UBS crypto trading plans, Ford/GM banking charters, and why silver’s surge may be a “sound money rotation” signal.

Davos Laughs at BTC, Crypto Dies, & Gold Adds $20 Trillion

In Episode 22 of The ₿roadcast, Bram Kanstein, Brian Cubellis, and SPECIAL GUEST Jackson Mikalic break down the most important Bitcoin and macro developments from the past few weeks.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis