1/8/26 Roundup: Morgan Stanley Crosses the Rubicon

Brian Cubellis | Chief Strategy Officer

Jan 8, 2026

Earlier this week, Morgan Stanley filed with the SEC to launch the Morgan Stanley Bitcoin Trust. On the surface this looks like just another filing in a crowded room. The reality is much more meaningful.

The most telling detail isn’t in the S-1’s mechanics; it’s in the name. Morgan Stanley is not an ETF factory hunting for assets. They are one of the most powerful distribution engines in global finance.

The firm manages roughly 20 ETFs, but almost all of them sit behind sub-brands like Calvert, Parametric, or Eaton Vance. This bitcoin product will be only the third ETF in history to actually bear the "Morgan Stanley" brand.

When a firm with that specific DNA decides to stake its own brand reputation on a bitcoin wrapper, it provides some important signals:

- Client demand is durable.

- “Renting access” to competitors’ products has become too expensive to justify.

- The reputational risk of not having a bitcoin strategy is now greater than the risk of having one.

- This is not an experiment. You do not put the flagship brand on an experiment. You put it on a permanent revenue pillar.

From Distributor to Issuer

Morgan Stanley is arriving late to a commoditized market. You do not enter a race like this two years late unless the prize is massive.

This filing is an admission that the asset class has graduated. In October 2025 Morgan Stanley expanded crypto access across their client base. Filing as an issuer is the logical next step in that sequence. It moves them from a gatekeeper that tolls the bridge to an architect that owns the bridge.

They watched the flows. They watched the fees leave the building. Now they want to internalize the economics.

The Numbers That Forced Their Hand

If you want to understand why a conservative wealth giant would file for a spot bitcoin product in 2026 you simply have to look at the scoreboard.

BlackRock’s IBIT proved that the market was orders of magnitude larger than the skeptics believed.

- The Scale: IBIT currently holds approximately $71.9 billion in net assets.

- The Peak: In October 2025 the fund flirted with $100 billion in AUM.

- The Speed: It reached these milestones faster than any ETF in history.

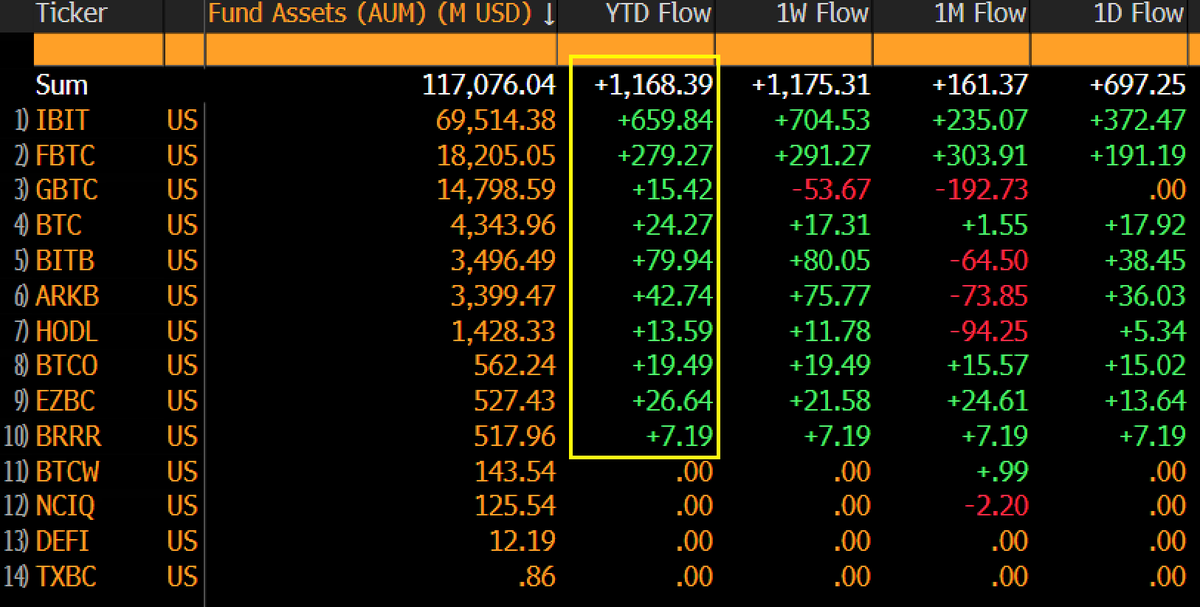

The broader complex tells the same story. With total category assets hovering near $124 billion and net inflows still hitting ~$700 million on strong days like we saw on Monday, the revenue pool is too large for a bank like Morgan Stanley to ignore.

"The spot bitcoin ETFs are coming into 2026 like a lion, +$1.2b in flows in first two days of year w/ everyone eating. That's a $150b/yr pace. Told ya'll if they can take in $22b when it's raining, imagine when the sun is shining." — Eric Balchunas, Bloomberg Senior ETF Analyst

Why "Still Early" Is Accurate

The numbers are large but the structural integration is young.

The ETF wrapper solved access. It made bitcoin legible to the brokerage account. But wealth platforms move at committee speed. Approvals, model portfolio inclusion, and house views lag behind product launches by years. We are only just beginning to witness the shift from access to solicitation.

For the first two years, the story was about major platforms grudgingly allowing clients to buy these products if they asked. Now, the walls are coming down.

- Bank of America / Merrill: As of this week, advisors can actively recommend allocations (1-4%) to bitcoin ETFs. This shifts the dynamic from “unsolicited only” to active sales.

- Vanguard: Even the most stoic holdout has quietly opened the gates, allowing crypto ETFs on the platform after years of resistance.

- Goldman Sachs: While not issuing a retail ETF yet, they are deeply embedded in the plumbing, acting as an Authorized Participant for the major funds.

- Wells Fargo: Like Morgan Stanley, they dropped restrictions on advisor recommendations in late 2025.

This is the distinction that matters. Having a product on the shelf is one thing; having 15,000 wealth advisors actively pitching it to model portfolios is another. That machinery is only just turning on.

Morgan Stanley filing its own S-1 may be the loudest signal yet that the wirehouses are moving from passive accommodation to active competition.

The Onramp Lens

Spot ETFs have been a massive net positive for market structure. They compress friction and standardize exposure.

But as bitcoin matures into a permanent macro asset the conversation for serious allocators shifts. The question changes from “How can I get exposure?” to “How do I truly own this?”

ETFs are financial products; price exposure vehicles with layers of counterparty risk. For high-conviction capital the priority eventually moves toward governance, ownership assurances, and eliminating single points of failure.

Charts of the Week

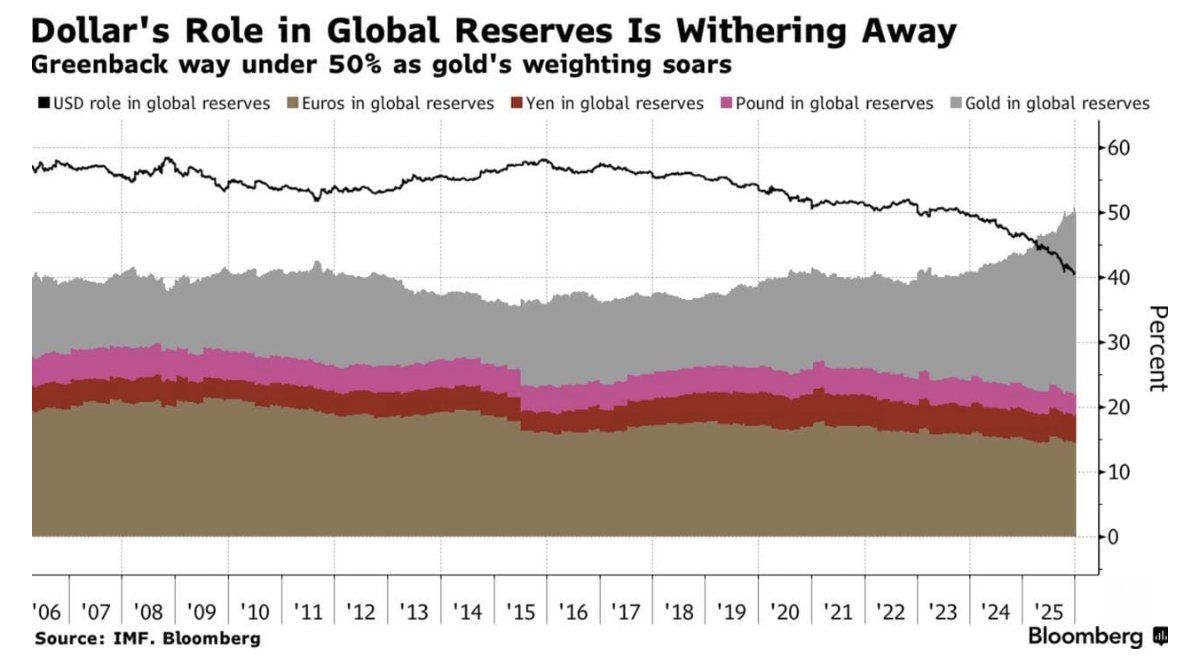

"Gold has overtaken the U.S. Dollar as the largest Global Reserve Asset."

— Barchart on X

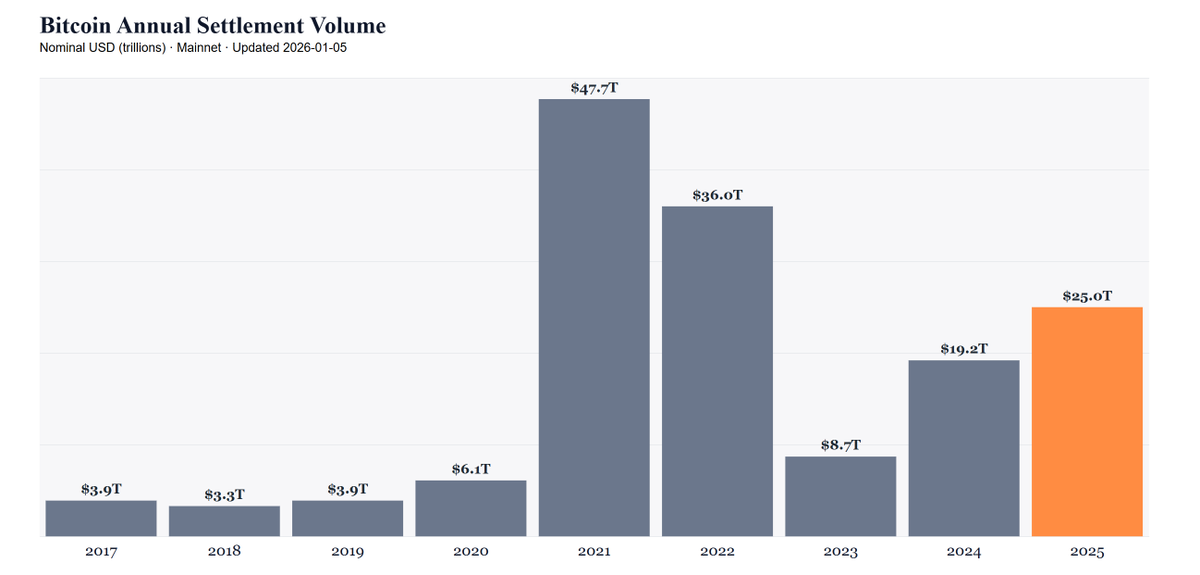

"Bitcoin network total gross settlement was $25 trillion in 2025. An astonishing achievement for monetary software technology that is only 17 years old. The experts said it was going to zero."

— Pierre Rochard on X

Quote of the Week

"Nothing produced limitlessly and for free can ever, eventually, have value. Fiat is always and everywhere a ponzi phenomenon with seigniorage the State’s irresistibly silent Madoff-like pitch. Bitcoin, its kryptonite, will never take the meeting."

— Ross Stevens, Stone Ridge 2025 Shareholder Letter

Podcasts of the Week

2025 Recap w/ Matt Odell: Gold's Run, DAT Reckoning, Quantum FUD + 2026 Predictions

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis welcome Matt Odell for a 2025 postmortem: why BTC lagged gold, how DATs wrecked sentiment, what the quantum debate gets wrong, and what changes when institutions take the wheel.

2025 Recap + 2026 Predictions: Real Signals, Fake Noise, & BTC's Path to $250K

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis recap the year of 2025, including the biggest deals & updates, real "signal" vs fake "noise", ETFs, stables, sovereigns, & market structure shifts. Plus some 2026 predictions!

Why Saving Died, Markets Became Casinos, & Young People Are Trapped | Jeff Deist

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis welcome Jeff Deist (former President of the Mises Institute) to explain why “saving” died in the fiat era, how markets morphed into a casino, why gold is quietly re-monetizing, and what bitcoin’s financialization gets dangerously wrong as younger generations face a broken denominator.

Inside Venezuela's Regime Change, Global Asset Seizures, Dollarization & Currency Wars

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down stablecoins going geopolitical, seizures + custody risk, banks & TradFi turning on rails, inflation persisting + gold signaling, AI + proof-of-value in the "slop" era, key deals of the week, & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis