10/16/25 Roundup: Leverage Purge, Sound Money Surge

Brian Cubellis | Chief Strategy Officer

Oct 16, 2025

What actually broke

Last Friday’s selloff was the largest liquidation event this market has seen by dollar value, by a pretty wide margin.

Derivatives books unwound in a hurry and perps drove the cascade; estimates peg liquidations near ~$19B within roughly a day. The proximate spark came from fresh tariff headlines, but the fuel was crowded leverage across altcoins and perpetual futures.

Why this wasn’t about bitcoin

Bitcoin fell with the tape, then largely stabilized as pipes cleared. The real dysfunction showed up in the long tail: vaporware assets, synthetic dollars used as collateral, and shallow-float tokens that depend on market-maker scaffolding. Ethena’s USDe stablecoin printed ~$0.65 on Binance at the depths, and several "major" altcoins plummeted ~60-90% in a matter of minutes.

A large share of non-bitcoin “market cap” sits on thin float, derivatives-driven demand, and market makers who widen or step back when volatility spikes. Once perps start auto-deleveraging, collateral quality deteriorates, spreads gap, and forced selling feeds on itself. Many market participants learned what bitcoiners have known for a while, there is no such thing as a "blue chip" altcoin.

Sound money kept doing its job

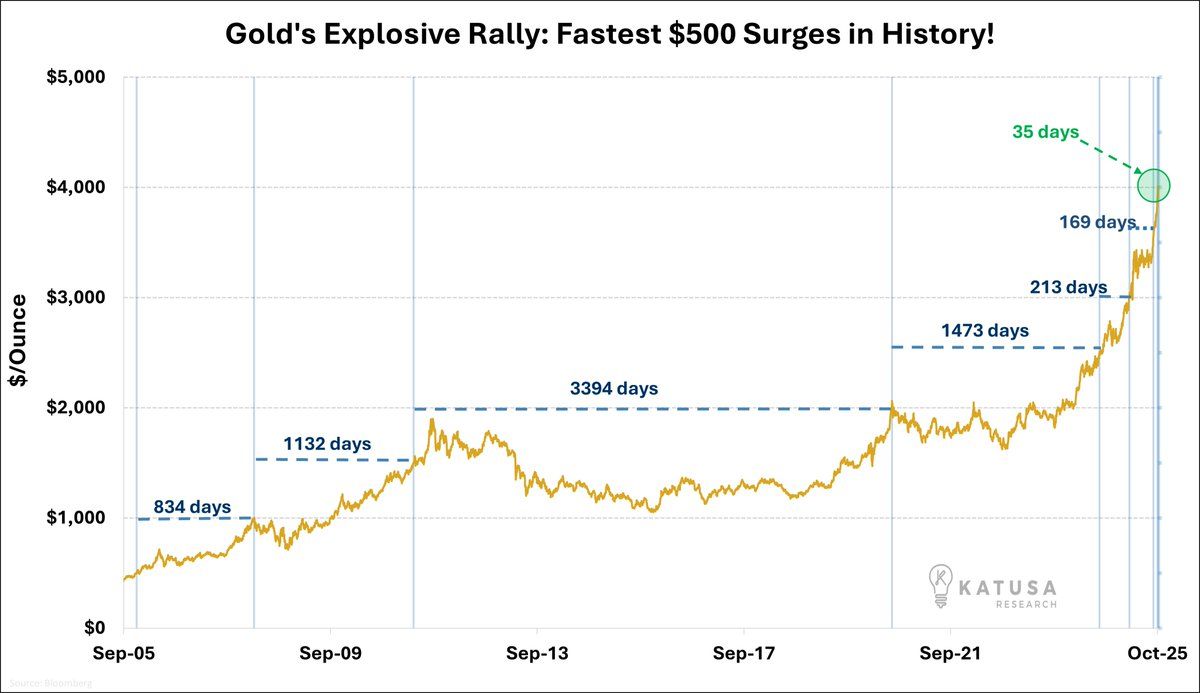

While crypto’s pipes were clearing, gold pushed through $4,300/oz to new records this week, supported by safe-haven demand, softening real-rate expectations, and ongoing macro tension. Bitcoin remains near its highs despite the purge.

Call it the “debasement trade” if you like, but the impulse predates this cycle; it has been present since convertibility ended in 1971, and it became much more visible after the post-COVID surge in broad money.

Recent history shows a simple rhythm: gold starts the move, bitcoin amplifies it. As more investors rediscover gold for the debasement story, they tend to find its digital counterpart next. Scarcity is the constant. Bitcoin is the digital, programmable, and perfectly finite expression of the thesis.

Bottom line

If “crypto exposure” meant a basket of venture tokens and perps, Friday was a harsh lesson in collateral quality. If your exposure was spot bitcoin held in some form of cold storage, you lived through some mild volatility without much concern. If you held gold, you benefited from the same scarcity bid that has pushed it to fresh highs.

The takeaway is simple: get exposure to sound money and make sure you own the underlying asset directly, without any single point of failure.

Friday’s crash was a leverage purge in altcoins and venue plumbing, not a referendum on bitcoin’s monetary properties. At the same time, gold’s breakout reinforced the broader pattern: investors keep moving toward credible scarcity. The Sound Money Renaissance didn’t begin last week. It has been the baseline for decades, with a louder chorus since the post-COVID money wave.

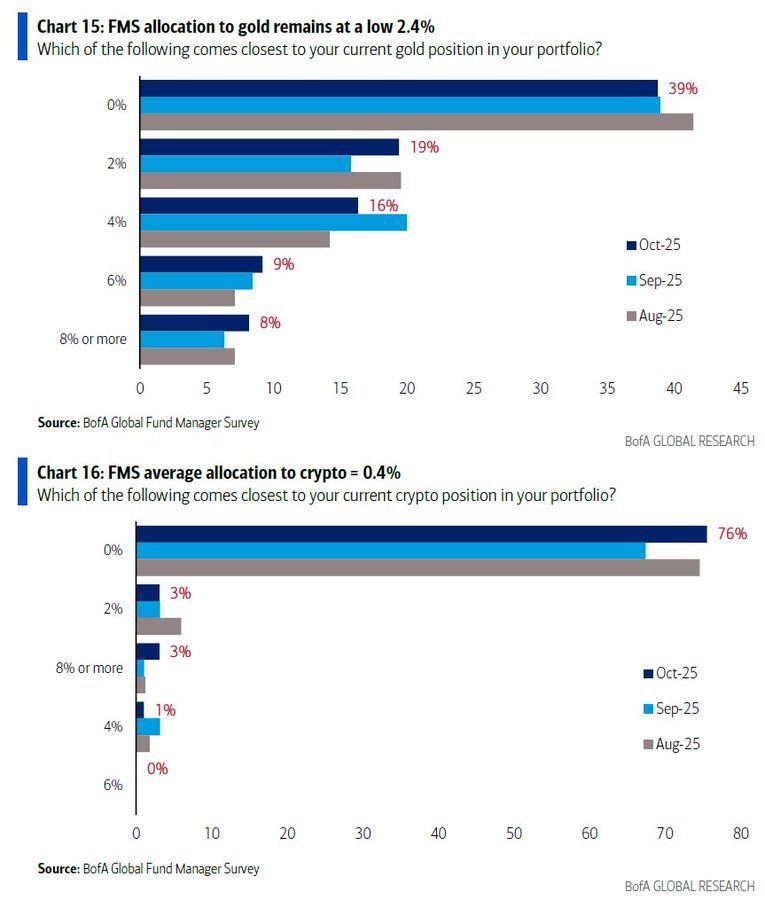

Chart of the Week

Wall Street avg. allocation to gold: 2.4%

Wall Street avg. allocation to crypto: 0.4%

Quotes of the Week

"The money is not the problem: AI is the new global arms race, and capex will eventually be funded by governments (US and China). If you want to know why gold/silver/bitcoin is soaring, it's the 'debasement' to fund the AI arms race. But you can't print energy."

"True. That is why bitcoin is based on energy: you can issue fake fiat currency, and every government in history has done so, but it is impossible to fake energy."

Podcasts of the Week

Altcoins Implode, Bitcoin Stands Strong: A Masterclass in Signal vs Noise

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down last week's crypto flash crash, the perps purge and BTC bid, RWAs wobbling and pegs breaking, TradFi & sovereigns moving in, key deals of the week & more!

Broken Money with Lyn Alden: The Technological Arc of Money and Power

In this episode from the Onramp Media Archives, Lyn Alden breaks down the monetary arc from shells to bitcoin, how tech shapes monetary power, fiscal dominance, hard assets & more!

Wall Street Joins the Sound Money Renaissance

In this episode of The Last Trade, hosts Brian Cubellis, Michael Tanguma, Liam Nelson, & Cam Stromme discuss gold at ~$4K & BTC ATHs, big money embracing hard money, the denominator shift (USD → gold & BTC), ETFs for access; MIC for ownership, the sovereign shuffle, & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis