10/2/25 Roundup: Capital Destruction & the Bitcoin Standard

Brian Cubellis | Chief Strategy Officer

Oct 2, 2025

Einhorn’s Warning

Last week, hedge fund manager David Einhorn offered a blunt reminder about what happens in periods of technological euphoria:

“I’m sure it’s not zero, but there’s a reasonable chance that a tremendous amount of capital destruction is going to come through this cycle.”

He was speaking specifically about artificial intelligence, where hundreds of billions of dollars (if not trillions) are being deployed into infrastructure with little clarity about eventual returns. Investors are chasing the promise of growth, but with little assurance of long-term durability.

Cycles of Waste

This is not new. Infinite fiat money fuels speculative waves. The dot-com boom rewarded "internet" companies with no profits. The ICO rush in 2017, the NFT mania in 2021, and today’s repackaged “crypto” DATs and ETFs all reflect the same pattern: abundant liquidity invites projects that consume capital but fail to generate lasting value.

When these waves recede, the outcome is familiar: wasted resources, distorted incentives, and disappointed investors.

Fiat Incentives & Austrian Economics

Austrian economists described this dynamic decades ago. When credit is artificially cheap and money supply unconstrained, price signals lose meaning.

“The essence of the credit-expansion boom is not overinvestment, but investment in wrong lines, i.e., malinvestment.” — Ludwig von Mises (Human Action, 1949)

“Evidently, the longer the boom goes on the more wasteful the errors committed, and the longer and more severe will be the necessary depression readjustment.” — Murray N. Rothbard (America’s Great Depression, 1963)

Entrepreneurs pursue growth at all costs because capital feels free. Headcount expands, free cash flow evaporates, and the justification is always “scale first, discipline later.” The result is malinvestment on a grand scale. Fiat systems do not just allow it; they encourage it.

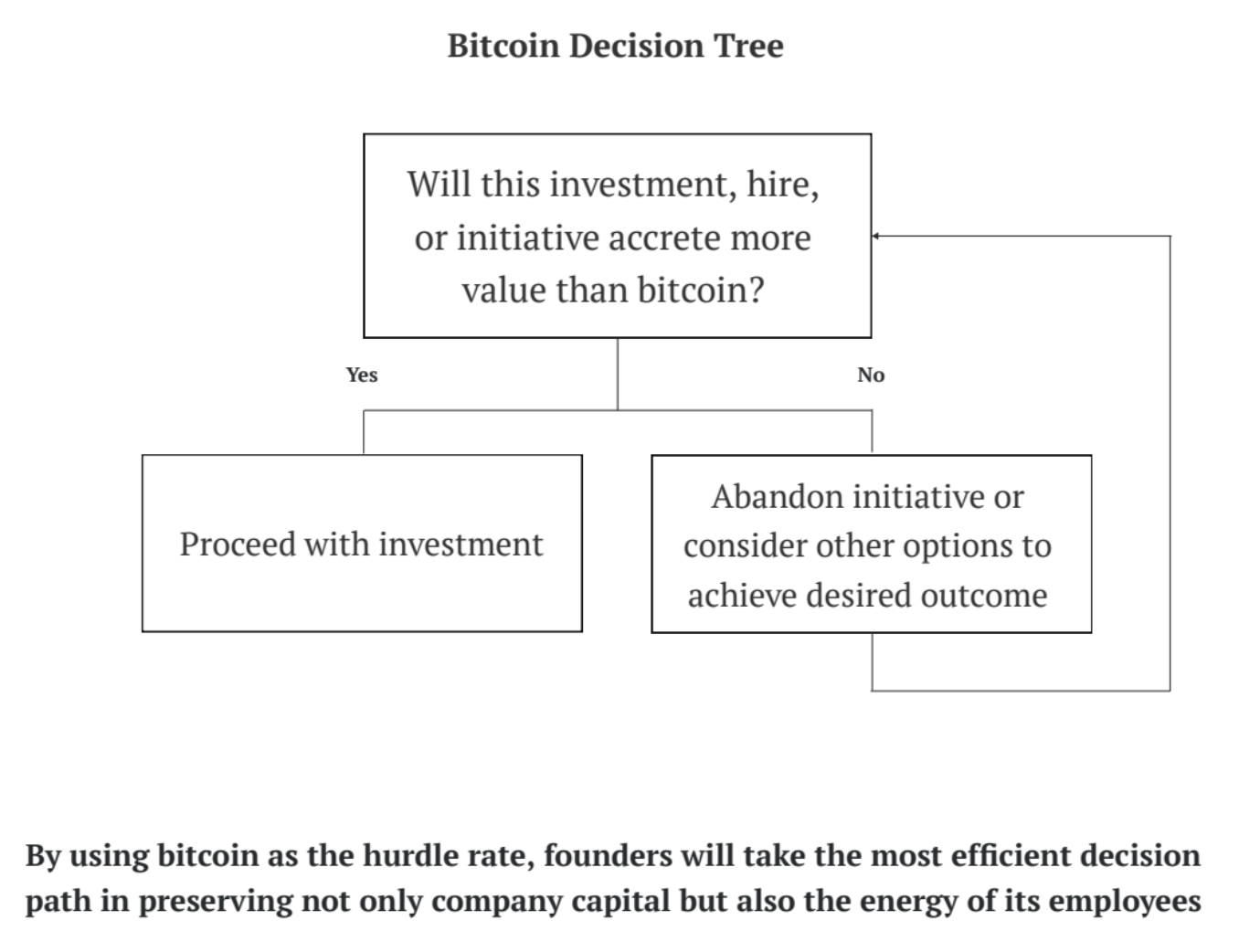

Bitcoin as a Lens for Allocation

Bitcoin changes the denominator. If returns are measured in dollars, investors chase nominal appreciation. If returns are measured in bitcoin, the bar rises dramatically. Only projects capable of producing sustainable free cash flow and sweeping it into bitcoin reserves show true strength.

On a bitcoin standard, scarcity imposes discipline. Every allocation decision must pass the test of long-term value creation. This is not a thought experiment. It is already shaping how certain capital allocators (like Early Riders) evaluate businesses: by their ability to generate real value in bitcoin terms.

Constraint as Catalyst

Capital destruction is inevitable when money is free and discipline is scarce. Bitcoin doesn’t eliminate business risk, but it reorients the system: rewarding real cash flows, punishing frivolous speculation, and preserving wealth for those who think in sound money terms.

Michael Dell captured the idea in a simple phrase:

“Constraints drive innovation.”

Bitcoin is the hardest constraint in monetary history. It forces discipline on capital allocators, rewards efficiency, and makes waste harder to justify. It pushes capital toward productive ends, away from hype, and toward what endures.

In a world addicted to cheap credit, that constraint is not a burden. It is the catalyst for real progress.

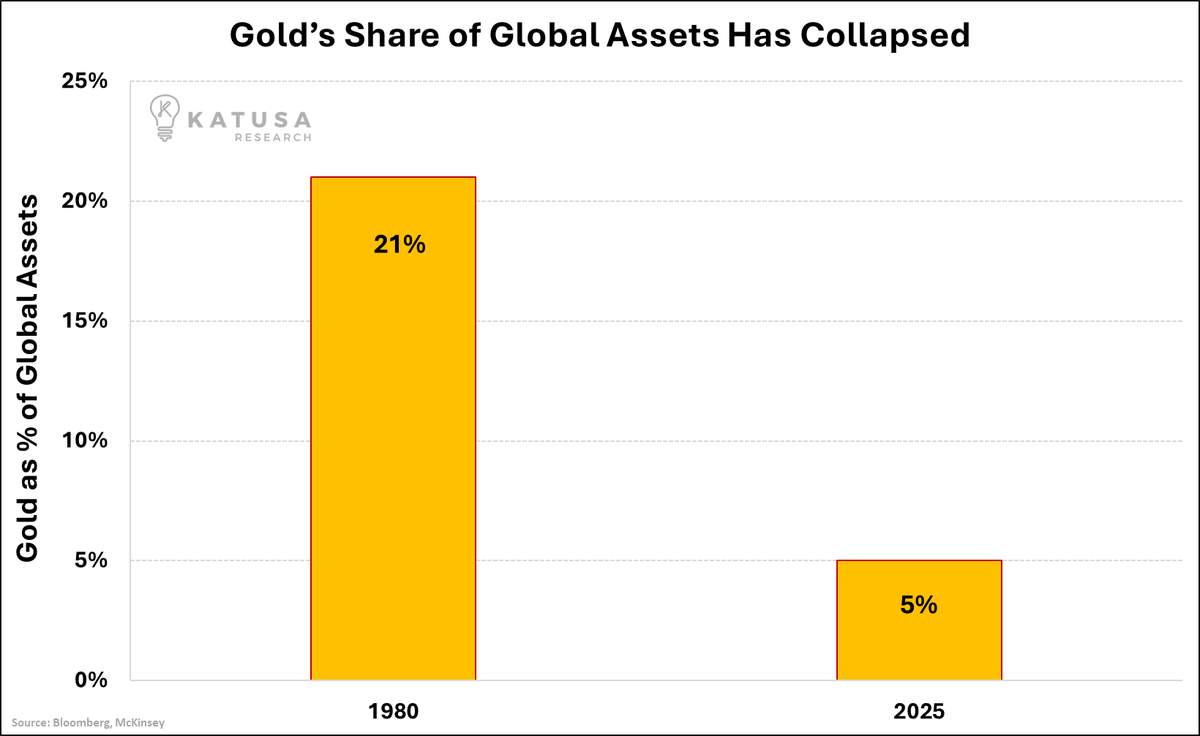

Chart of the Week

"Gold was 21% of global assets in 1980. Today it's 5%. The financial universe got 4X bigger. Stocks, bonds, derivatives, crypto. Sometimes the denominator is the story."

Quote of the Week

"Demands for senseless spending on top of multi-trillion dollar deficits leading to a government shutdown should give you a pretty good idea why US debt is no longer AAA-rated."

Podcasts of the Week

The Sovereign Shift: Bitcoin, Gold, & Nation-State Game Theory

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis are joined by Onramp’s new CMO, Blake Killian, to discuss Blake’s path to BTC & Onramp, education-led adoption, nation-states stacking reserves, Tether’s $500B valuation, custody as the battleground, ETFs vs treasury firms & more!

The Hidden Truth About Tether's $500B Valuation: What Wall Street Isn't Telling You

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down central banks’ move toward gold & BTC, AI agents & instant settlement, Vanguard caving to BTC, BTC billionaires surpassing fiat billionaires, key deals of the week & more!

Chasing Yield: Bitcoin Is Money, Everything Else Is Credit

In the second episode of Onramp Media's new podcast 'Bitcoin for Businesses', hosts Chase Palmieri, Michael Tanguma, Liam Nelson, & Matthew Ball discuss yield mirages versus operational focus, bitcoin corporate treasury strategies, mainstream custody views versus non-consensus, credit versus money, business risks, & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis