10/23/25 Roundup: From Thesis to Practice: Argo & Aureo

Brian Cubellis | Chief Strategy Officer

Oct 23, 2025

In a week full of noise, two signals: the bitcoin-denominated venture firm Early Riders backed Argo to expand best-in-class access to sound money, and Aureo to bring Multi-Institution Custody to LATAM. One reinforces the denominator shift described in our recent research report, 'Demystifying the Debasement Trade'. The other removes operational friction so more people can hold bitcoin with durable safeguards.

Argo & the Sound Money Thesis

Why gold still matters

Gold remains the analog benchmark of scarcity. Bitcoin is its digital counterpart—finite, portable, verifiable. Treating them as substitutes misses the larger point: they’re complements within the “outside money” sleeve that competes with fiat-linked assets.

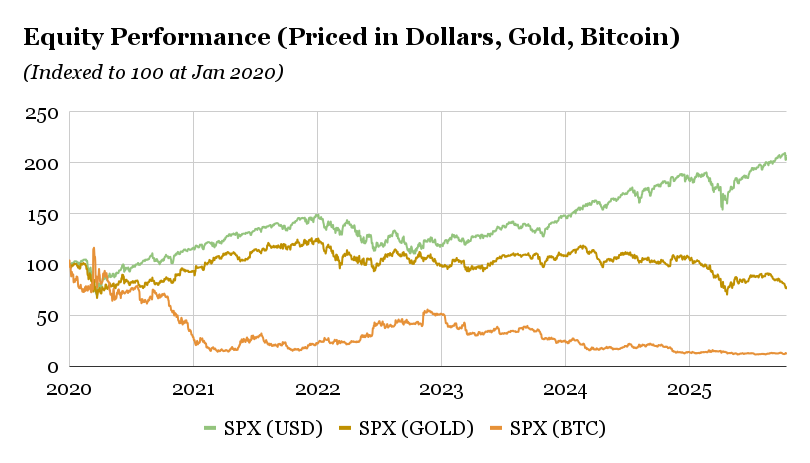

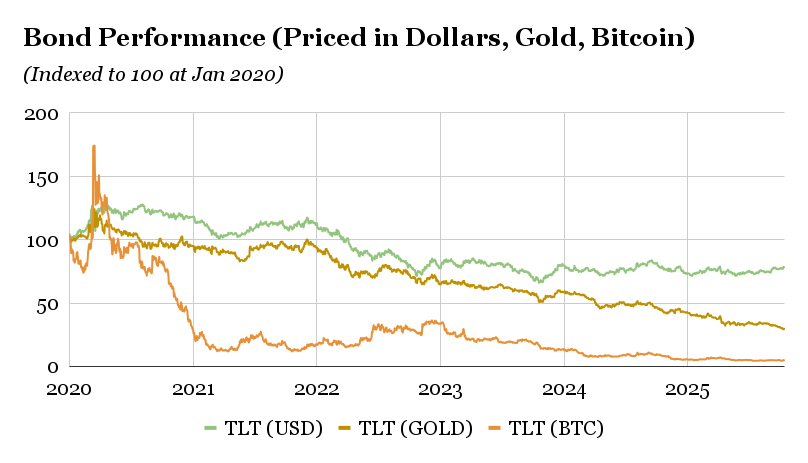

From ‘debasement trade’ to portfolio construction

The report’s core claim stands: measure returns in sound money to see real performance. The world is slowly shifting the denominator. Gold’s persistence shows the demand for monetary assets outside the fiat system.

Bitcoin improves on gold’s constraints (auditability, portability, programmability, finite nature), but gold’s role as the legacy reserve asset will persist longer than most expect. Argo fits here: it broadens access to a scarce monetary asset and pairs cleanly with bitcoin in a modern reserve mix.

Download the full report: Demystifying the Debasement Trade

For stewards of capital, the question isn’t gold or bitcoin—it’s what ratio of each best protects purchasing power through policy cycles. Argo is an operating vector for that allocation.

Why this theme persists

The sound money bid will run on two rails for a long time. Today’s gold demand is led by central banks and sovereign balance sheets. They will not pivot entirely to bitcoin in the near or medium term. Gold’s thousand-year track record, depth, and liquidity matter at that scale. Bitcoin is superior in terms of its monetary properties, but it does not yet match gold’s tenure, size, or global settlement footprint.

The result is an enduring interplay: gold anchors the legacy reserve system while bitcoin grows into its role as the digital counterpart. As the debasement story unfolds, allocators will use both, with weights shifting over time as bitcoin’s liquidity and institutional comfort rise.

Aureo & the MIC Adoption Curve

MIC as the end-state for serious holders

Multi-Institution Custody replaces single-custodian fragility with a multisig quorum across independent entities. That means segregated assets, client-titled vaults, fault tolerance, and verifiable control. It collapses the biggest blockers to adoption: single points of failure, operational risk, and governance anxiety.

Why LATAM first-principles matter

Regions with outsized currency volatility adopt “outside money” fastest. Aureo reduces onboarding friction where the need is urgent. MIC lets families, SMEs, and institutions hold long-term bitcoin with policy-based withdrawals, role separation, audit-ready reporting, and survivorship planning—without giving any one party unilateral control.

Allocator takeaways

If bitcoin is the reserve asset of the digital age, MIC is the operating system for holding it long term. Aureo is a proof point that this custody pattern is going global.

Cheap credit distorts price signals and funds waste. Scarcity restores discipline. Gold and bitcoin transmit that discipline differently, but they rhyme: both impose a real cost of capital.

The Sound Money Renaissance is here.

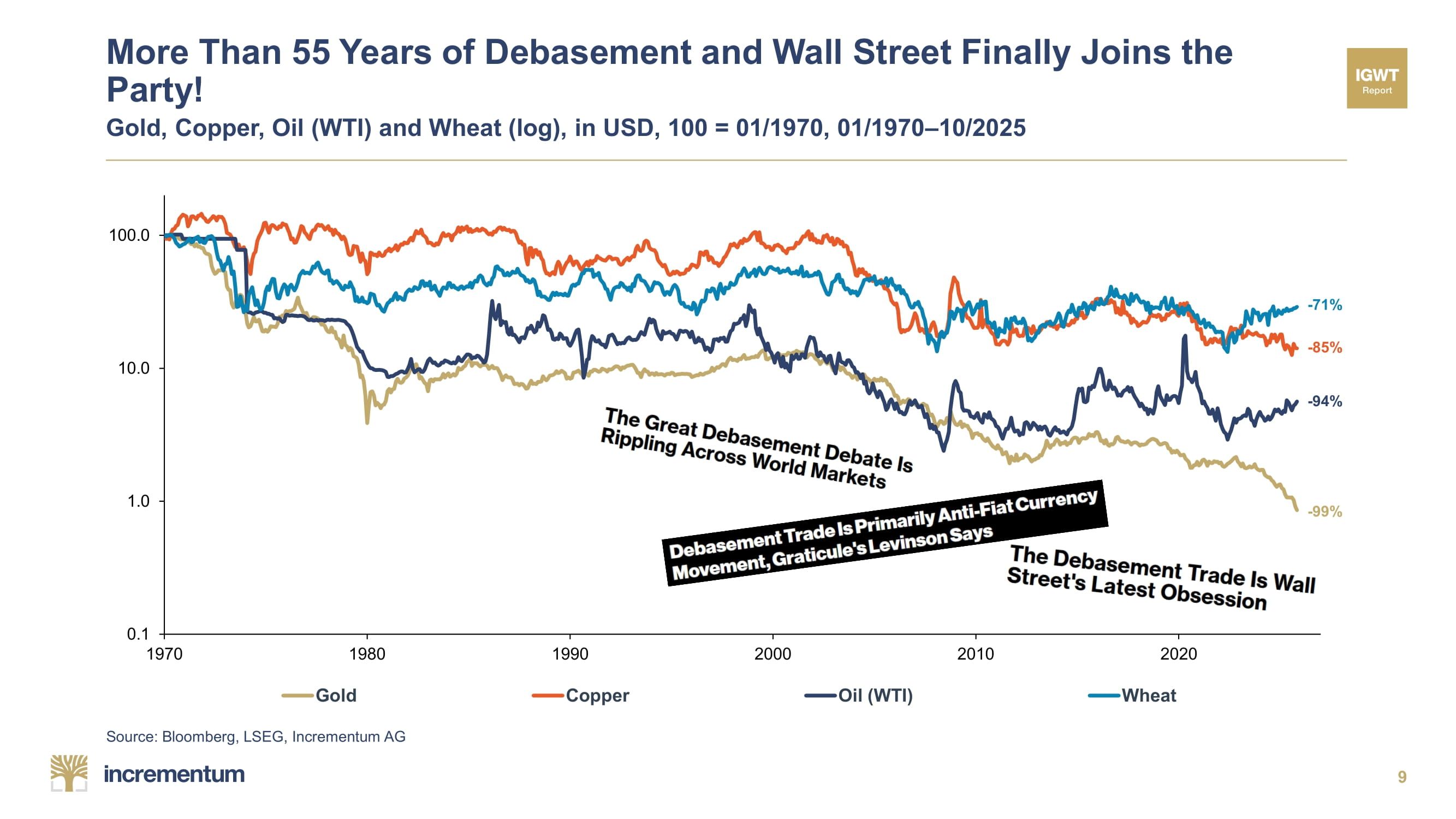

Chart of the Week

"More than 5 decades of debasement! Since 1970, fiat currencies have lost massive purchasing power, with the USD down 99% vs. gold! While Wall Street just caught on, gold has proven to be the ultimate safe haven and true inflation hedge."

— Incrementum, In Gold We Trust

Quote of the Week

"Gold is overbought, not because it is overvalued and will crash soon, but because the fiat system is starting to show serious cracks. Smart and conservative investors are fleeing to safety (Gold), less conservative ones are increasing their Bitcoin positions. This is a sign, ignore it at your own peril."

Podcasts of the Week

Gold Is Pumping, Bitcoin Is Next — Inside the Debasement Trade with James Check

In this episode of The Last Trade, hosts Jackson Mikalic, Brian Cubellis, & Michael Tanguma are joined by James Check to discuss gold pumping, why BTC is next, inside the “debasement trade”, why 4-year cycles may be dead, treasury company reckoning, retail flows & ETF demand, altcoin crash, BTC dominance & more!

Citi, Schwab, Nubank, & Aureo: The Global Bitcoin Race for 21 Million

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis are joined by Gustavo Flores, founder of Aureo Bitcoin, to discuss Aureo's launch and backing from Early Riders, UK ETPs & Japanese bank stables, Citi & Schwab 2026 custody plays, MIC benefits & LATAM adoption, key deals of the week & more!

From Gold Rush to Bitcoin Standard: Inflation’s Coming for Your Balance Sheet

In the third episode of Bitcoin for Businesses, we discuss Square’s BTC payments rollout, custody risk & tax realities, inflation & the “debasement trade”, education & continuity planning, why durable businesses choose BTC, & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis