10/30/25 Roundup: The Pivot Has Landed, AI Keeps Dancing

Brian Cubellis | Chief Strategy Officer

Oct 30, 2025

A cut that tells the real story

The Fed cut 25 bps this week and said QT ends on December 1. After that, MBS redemptions will go into T-bills. That is a clear turn toward easier policy.

What makes it interesting is when it happened. Stocks are still near highs. AI names are still strong. The signal is that the real economy and the federal balance sheet are more fragile than the S&P suggests. Powell reiterated the notion that inflation remains “somewhat elevated,” so they are easing while inflation is sticky.

The writing is on the wall. Once you stop shrinking the balance sheet and start cutting, it is very hard to reverse. The pivot has landed.

Debt math made this decision

Federal debt is above 38 trillion dollars. A lot of that has to be refinanced at today’s rates. Interest expense has started to crowd out everything else. If interest keeps growing, something else has to give. The simple way to slow that squeeze is to bring rates down and stop draining liquidity. That is exactly what the Fed just did.

So even if the official story is “softening labor” or “uncertainty about the outlook,” the deeper story is funding. The government needs money to be cheaper. That is why this pivot is going to continue. More cuts. More liquidity. More debasement over time.

Stocks are telling a different story

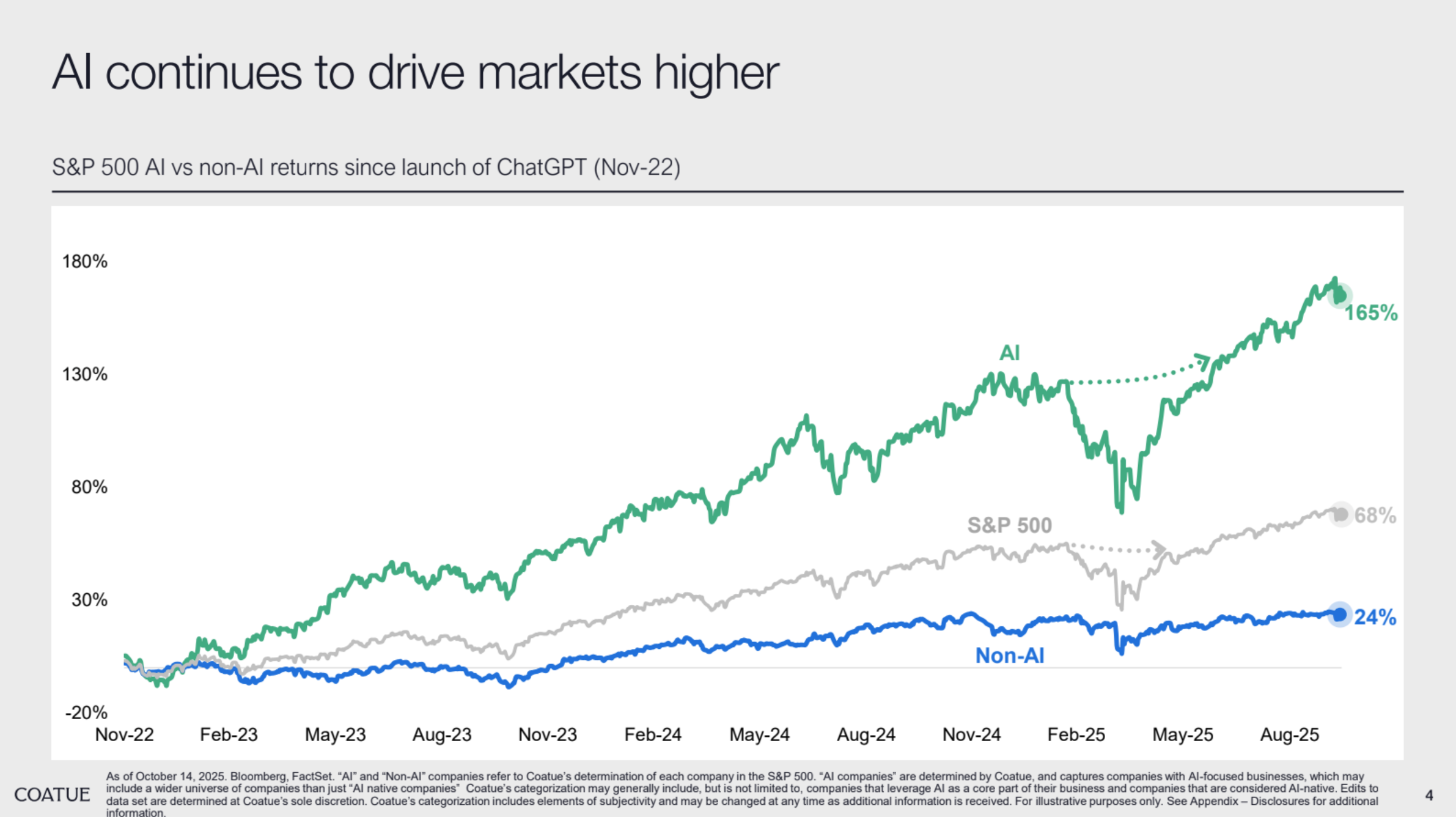

While the Fed is moving toward easier money, the equity market is still being held up by the AI trade. AI, chips, data centers, model infrastructure. That complex is driving most of the gains.

Source: Coatue Public Markets Update

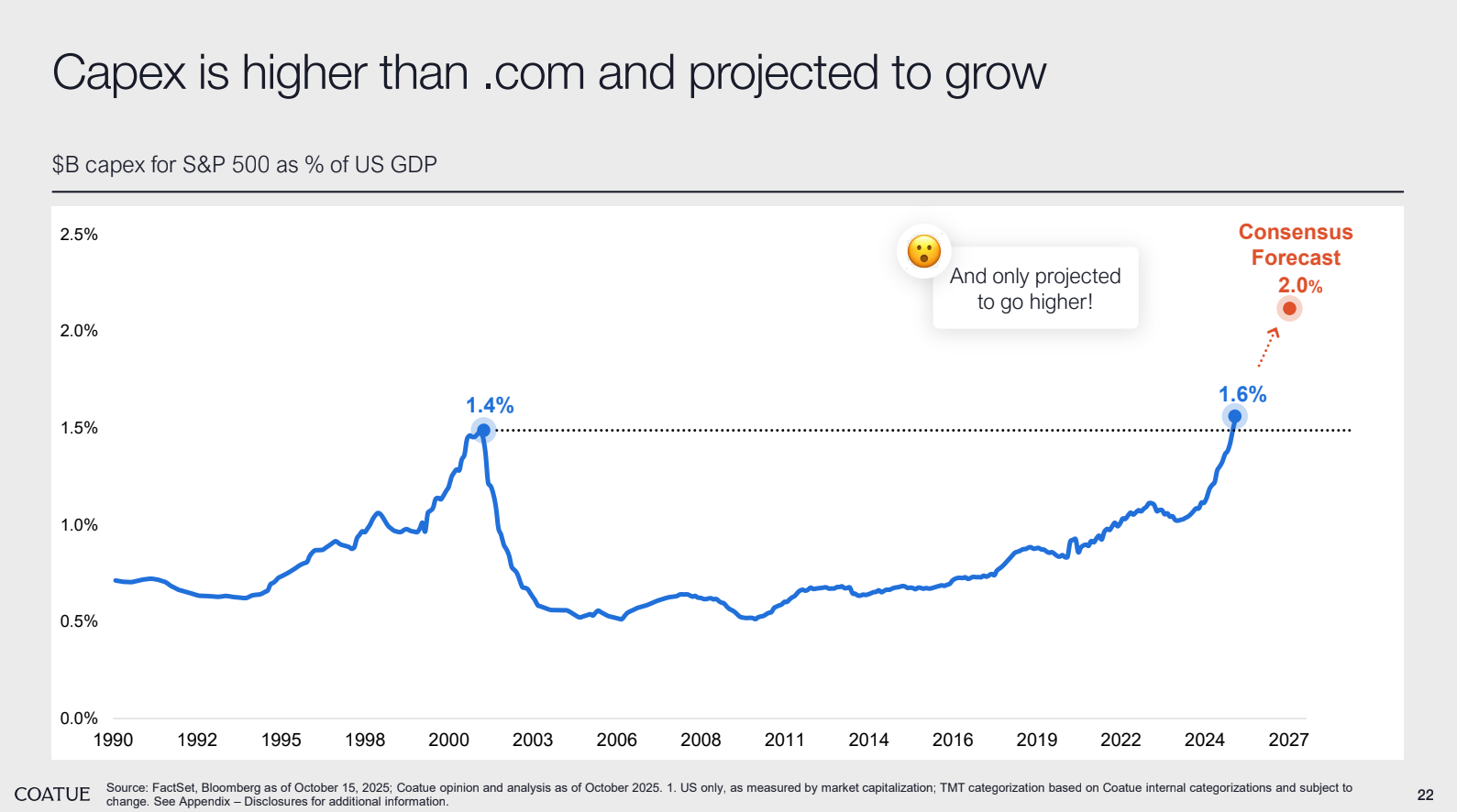

Capex in this area is already bigger than the dot-com period as a share of the economy. Company leaders are basically saying the same thing. They cannot afford to miss the AI wave, so they will spend whatever it takes.

Source: Coatue Public Markets Update

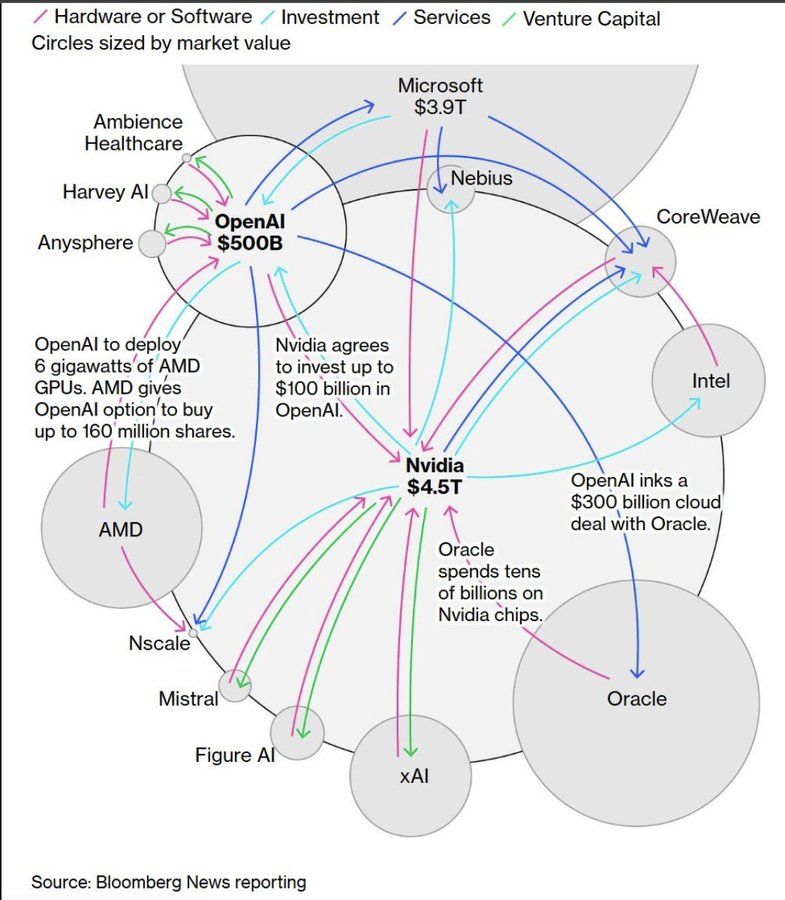

Part of the issue here is encapsulated by the image below. The same handful of firms are paying one another. OpenAI lines up enormous GPU buys. Nvidia turns around and commits up to $100B into OpenAI. Microsoft feeds OpenAI, runs it on its own cloud, and needs more Nvidia. Oracle signs a $300B cloud deal with OpenAI, then spends “tens of billions” on Nvidia chips to serve that demand. AMD is pulled in to backstop GPU supply.

Most of the cash is circulating inside that loop instead of flowing out to the wider economy. That’s coordination around a prize, not yet a broad-based productivity gain.

When growth is this narrow and this expensive, the central bank cannot keep squeezing liquidity. Policy will bend toward accommodation. We just saw the first sign of it.

Two possible futures, same monetary outcome

Think about the next couple years in two simple paths.

Path one: AI spend runs ahead of real adoption. Earnings miss. The most crowded names cool off. Credit feels it. Policy steps in to cushion the fall. That means more support, more money printing, and more debasement.

Path two: AI actually delivers. Models get good enough, cheap enough, and reliable enough that companies really can replace a lot of work. That is the version everyone is cheering for, but it has a problem. Real productivity at that scale is deflationary. It means fewer workers needed for the same output. It means some skills become worth less in a hurry. It means job loss shows up faster than new roles get created.

Deflation sounds nice until you remember who owes the money. A country with 38 trillion dollars of debt cannot sit back and let prices fall and incomes fall with them. That makes the debt heavier. It also makes people angry. So the response is almost automatic. Bigger transfers. Wage support. New benefits. Some form of UBI in everything but name. All of that has to be funded. That is more issuance. The Fed will be asked to make room for it. That is more liquidity.

So whether AI disappoints or AI flourishes, the end of the story is the same. To keep a leveraged, highly digital, partly automated society from breaking, you print. You do it to keep the debt light and to keep people from rioting. That is the part the “productivity miracle” crowd skips.

Allocator takeaways

If the Fed is now easing into a market that looks fine on the surface, and if the fiscal side is locked into high debt and high interest, you want assets that do not depend on this AI story going perfectly, and insulate you from the inevitable financial repression stemming from the fiscal dilemma.

That’s the outside-money bucket. Gold still serves the sovereign crowd and anyone who prefers analog sound money. Bitcoin adds what gold can’t: a fixed supply, provable ownership on-chain, and digital programmability. This isn’t a quick trade. It’s how you stay solvent through a long stretch of repression and quiet debasement.

Charts of the Week

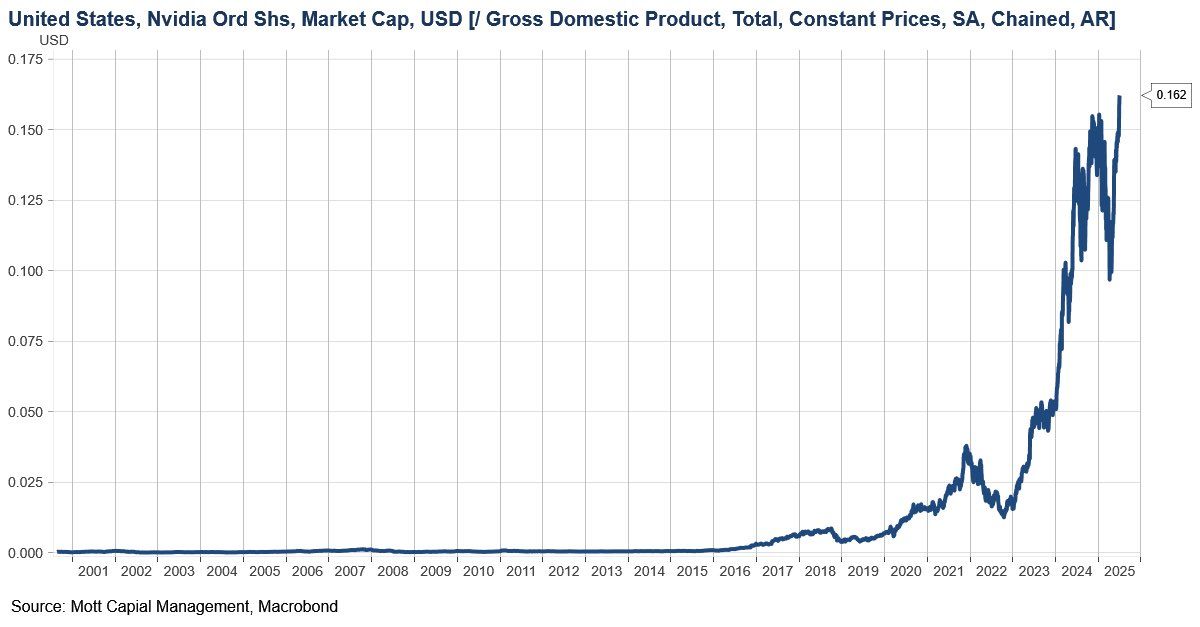

"Nvidia is now 16% of U.S. GDP."

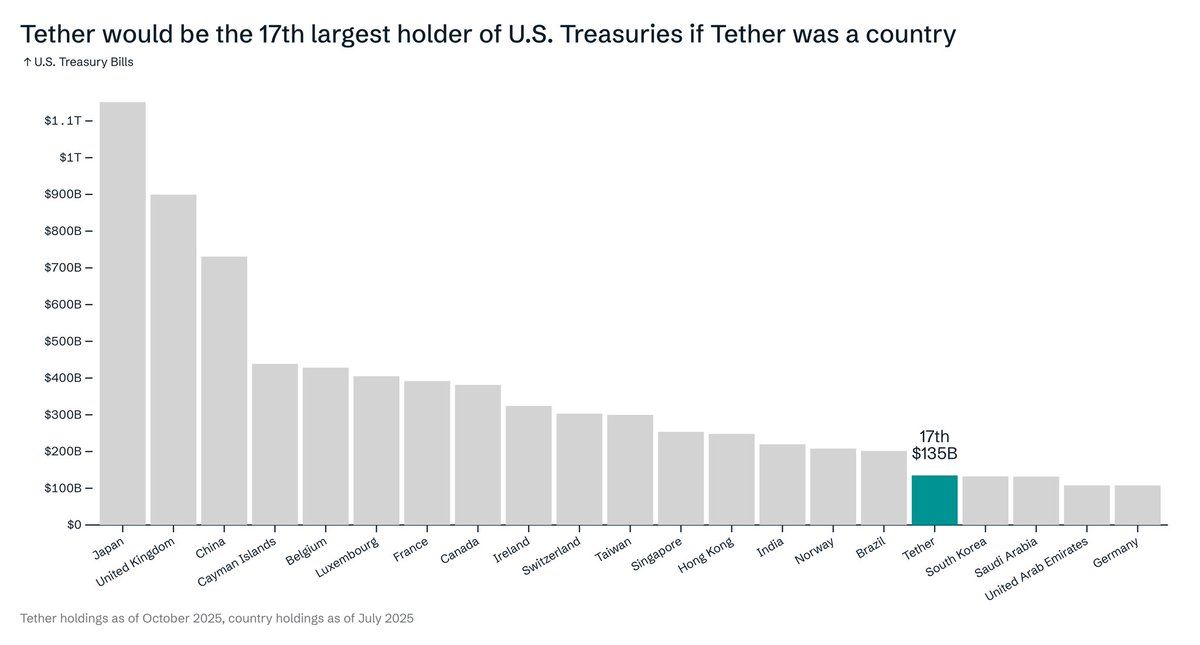

"With 135 billion of U.S Treasuries, Tether is now the 17th largest holder of U.S debt, passing also South Korea. Soon Brazil!"

Podcasts of the Week

Liquidity Flood Incoming: Bitcoin’s About to Explode

In this episode of The Last Trade, hosts Jackson Mikalic, Brian Cubellis, & Michael Tanguma are joined by Gustavo Flores, CEO of Aureo Bitcoin, to discuss debasement as structural (not a trade), BTC’s strength through QT (ahead of QE), Aureo & adoption across LatAm, Gold × BTC: the sound money axis, MIC as the new standard & more!

The Banks Are Here — JPMorgan Just Made Bitcoin Collateral

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down JPMorgan making BTC collateral, Zelle & Western Union moving into stables, the Fortress Trust insolvency, counterparty risk, key deals of the week & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis