11/13/25 Roundup: The Certainty Premium

Brian Cubellis | Chief Strategy Officer

Nov 13, 2025

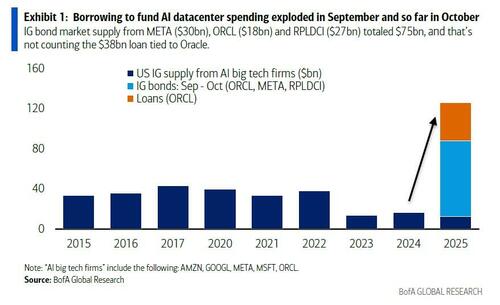

Uncertainty keeps piling up. Tariff whipsaws. Stubborn inflation. AI disrupting labor markets. Tension over rare earths and supply chains. Global conflicts and cold wars heating up. Stocks at record highs propped up by circular AI infrastructure spending.

Financial markets are increasingly driven by an interconnected web of risky variables, where a tug on any strand shakes the whole apparatus.

Price signals aren’t clean. Capital moves on press conferences and committee language as much as on cash flows. Liquidity and rates dominate the conversation. The move toward a multipolar world adds one more layer of noise.

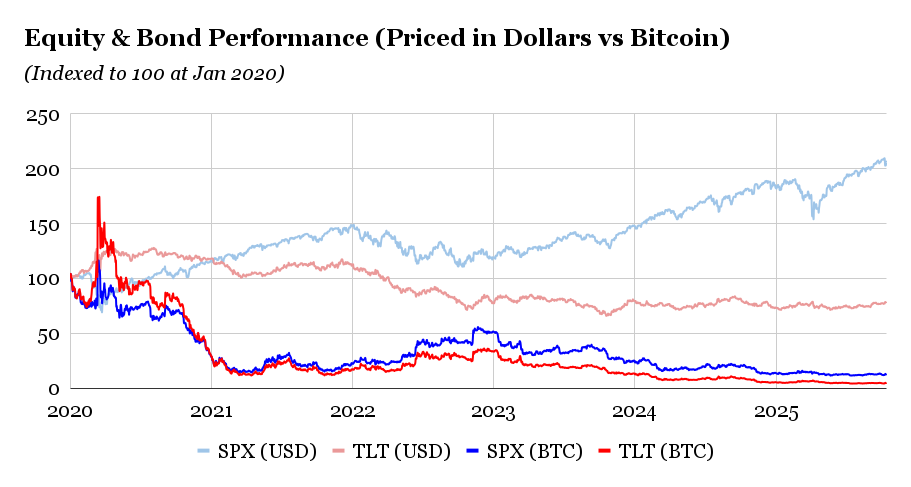

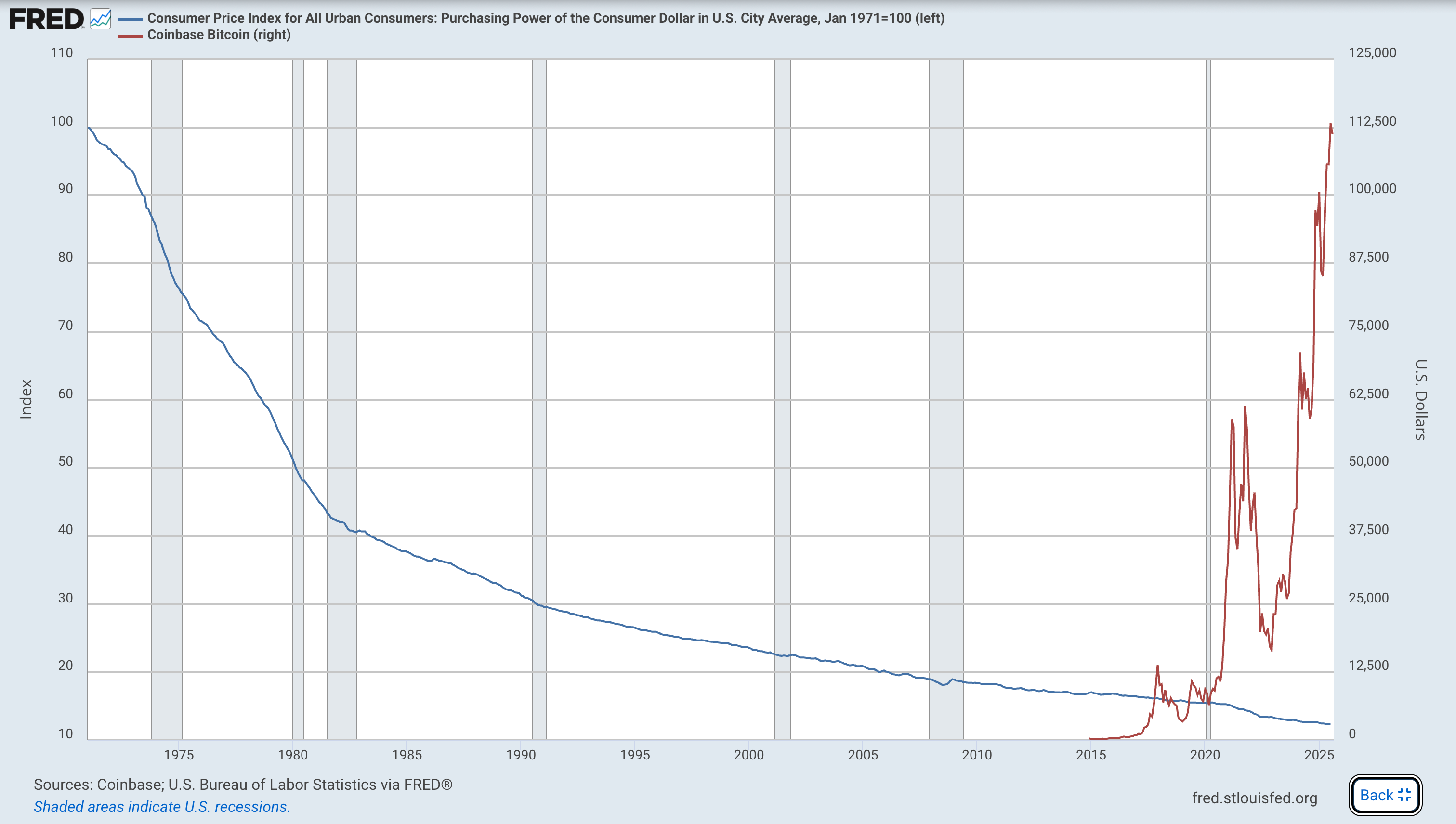

You can feel the shift in everyday language too. “Fiat” is no longer a fringe word. People openly describe a "debasement trade" that explains why prices of relatively scarce assets drift higher over time. Your house did not become twice as useful. The dollar's purchasing power eroded.

Scarcity explains the world you know

Scarcity has carried value across centuries. Gold served as money because humans could not conjure more of it at will. Housing appreciated because new units lagged while the money supply kept growing. Businesses with real pricing power command premium multiples since volume and cost curves do not always protect margins.

The same logic shows up everywhere you look. Scarcity is the root driver of fundamental value in a world where the measuring stick (USD) is increasingly distorted and unreliable.

Certainty deserves a premium

In a high-variance world, certainty becomes valuable in its own right. Certainty of rules. Certainty of supply. Certainty that purchasing power is not at the mercy of a vote or an emergency meeting. The ability to project value forward without guessing what a handful of officials will say next has a price. Investors around the globe are waking up to this reality.

Call it the certainty premium. As headline risk multiplies, investors will seek assets where the rules do not shift midstream and where supply cannot be expanded to solve a political problem.

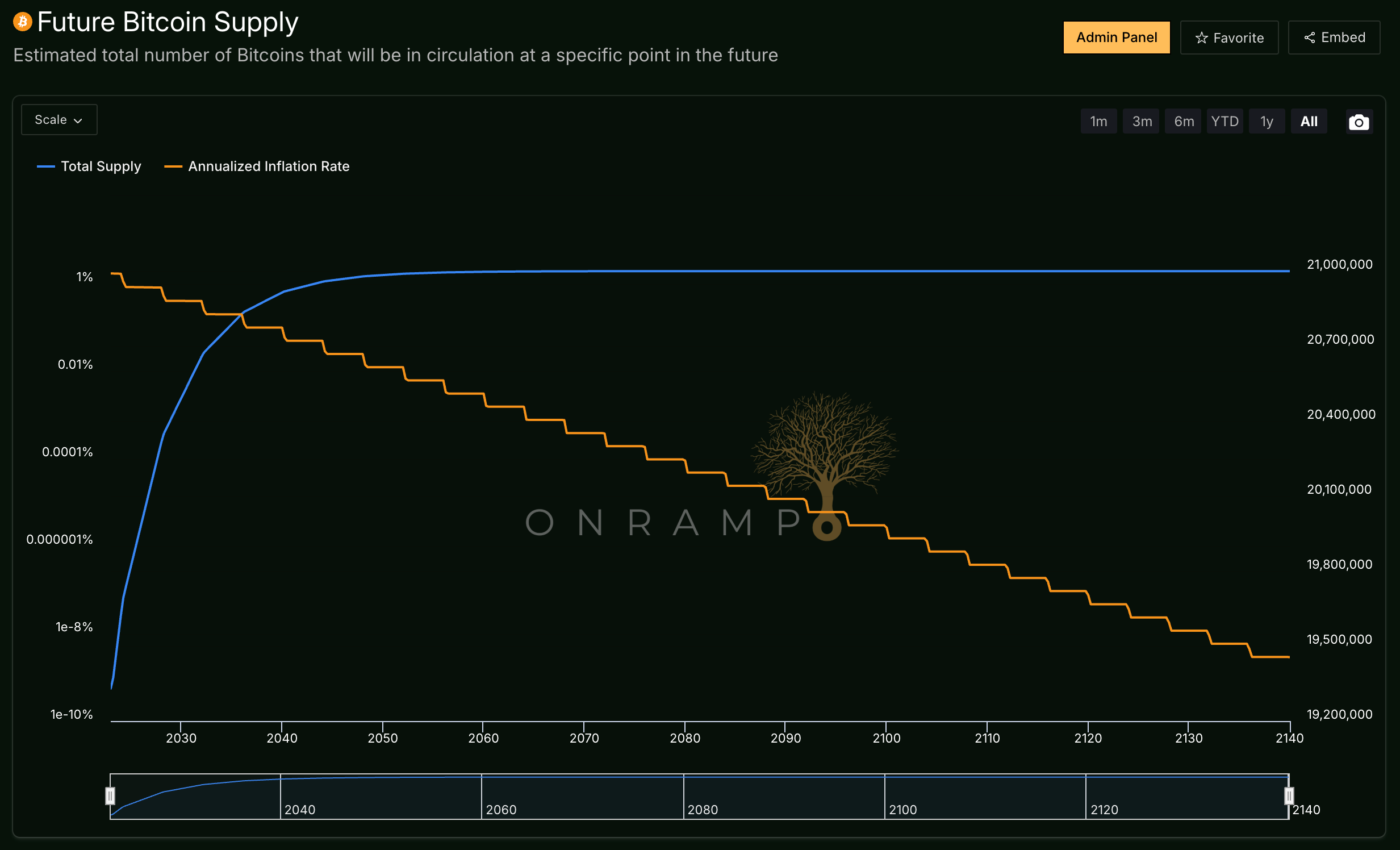

Bitcoin’s credible monetary certainty

Bitcoin is built around rules that do not bend. Supply is capped. Issuance follows a schedule everyone can verify. Settlement is neutral and global. Ownership can be proven without permission. There is no board to lobby and no ministry to petition.

While bitcoin's price may be volatile, its rules are certain. In a market steered by policy headlines and press conferences, that certainty is an edge. You still have to master custody, governance, and time horizons. Those are learnable. They are also preferable to guessing which way the wind will blow at the next podium.

Why this matters right now

➤ Signals are distorted: When funding conditions drive returns, fundamentals become background noise. Scarce, neutral, hard assets stand out because they sits outside the policy loop.

➤ Debasement is lived, not theoretical: Households see it in groceries, rent, insurance, and services. The vocabulary has migrated from niche forums to dinner tables.

➤ The world is plural: Parallel commodity networks, reserve experiments, and trade blocs complicate the dollar’s path. Planning gets harder. Assets with fixed rules grow more useful.

➤ AI introduces fresh volatility: If adoption lags, the unwind needs support. If adoption hits, labor displacement invites more money printing. Either path asks for more currency creation.

Closing thoughts

Uncertainty is not going away. Tariffs, inflation, great-power competition, and an AI transition will keep the tape lively and the headlines noisy. When signals blur, scarcity clarifies. When policy dominates, certainty earns a premium.

That is why bitcoin’s time is here. It is not a bet on one index heavyweight or a single interest rate path. It is an unwavering claim on a set of rules that do not change.

Chart of the Week

"We are looking at $2 trillion in new debt. You think Trump calling the Fed to cut is bad, wait until every AI CEO joins the chorus."

Quote of the Week

"We will also create a Bitcoin digital reserve at the Bank of England. Bitcoin is scarce, secure and impossible to inflate away. Unlike paper money, Bitcoin cannot be printed into worthlessness. Every transaction is permanent, every token verifiable. It is liquid, divisible, global and unstoppable. It is the ultimate store of value for the digital age."

— UK Reform leader, Nigel Farage

Podcasts of the Week

Bullish Selling: Why Bitcoin is Going Much Higher with Galaxy's Alex Thorn

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis are joined by Alex Thorn, Head of Research at Galaxy, to discuss Treasury “slop” & ETF momentum, the hand-off from hobbyists to institutions, Wall Street & market plumbing M&A, stablecoins, debasement, the 2026 outlook, & more!

The U.S. Shutdown, Stimmies & Bitcoin’s Next Move

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down impacts of the government shutdown, Ledger’s IPO, Ripple’s $40B valuation, Coinbase’s new token launch platform, OpenAI’s call for a federal backstop, key deals of the week & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis