11/20/25 Roundup: Is the Bull Market in the Room With Us?

Brian Cubellis | Chief Strategy Officer

Nov 20, 2025

Bitcoin traded below $88K this week and sentiment reacted as if we had revisited $50K. Timeline tone is “cycle top,” “bull is over,” “see you at $40K.”

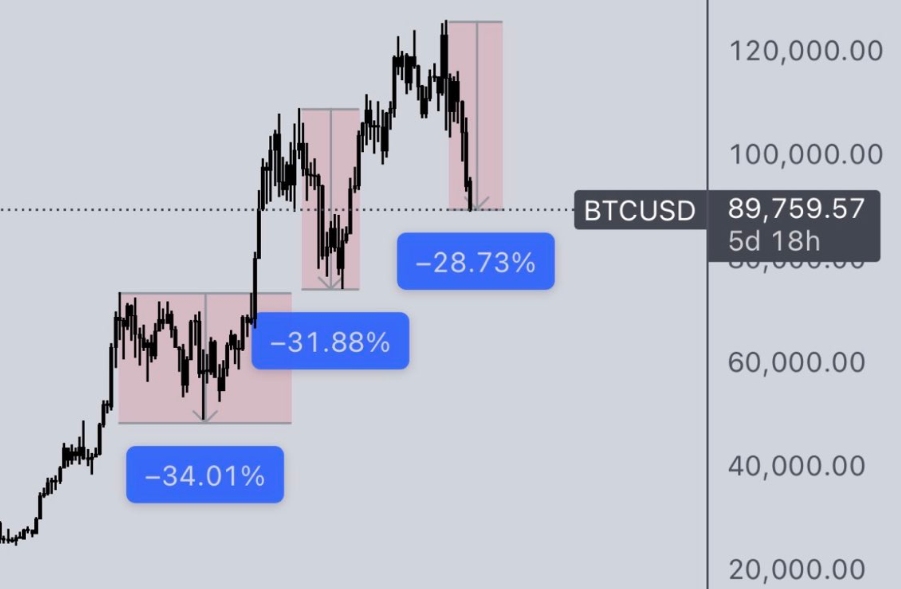

The reality on the ground is that this current drawdown is roughly 30% below the recent all-time high.

That says more about expectations than reality. People anchored to prior cycles think every move looks like 2013, 2017, or 2021. They are looking for the same script in a very different market.

We have said in this newsletter many times that market structure is not what it used to be. Spot ETFs, brokerage rails, pension mandates, and corporate treasuries have replaced a good chunk of the old retail cohorts.

Liquidity conditions and business cycle dynamics matter more today than halving lore and “cycle charts” on social media.

If you take that seriously, it becomes very hard to argue that bitcoin has “topped.”

Corrections in context

A move from the recent highs down to below $90K is uncomfortable, especially for anyone who sized too aggressively or layered on leverage. It is also routine in the context of bitcoin’s history.

Past secular advances have included drawdowns of 20 to 60 percent that did not mark the end of anything. They were pauses, handoffs from weak hands to stronger ones, and opportunities for new cohorts to enter.

There is a simple way to think about it: If a thirty percent drawdown at roughly six figure prices feels like a full-blown crash, you are probably thinking in short horizons and fiat terms, while the underlying regime is being driven by money creation and liquidity.

In other words, the emotional volatility is outpacing the price volatility.

Cycle stories vs fundamental drivers

Old “four-year cycle” thinking came out of a different era. Supply shocks around halvings, reflexive retail mania, and shallow institutional participation gave people a clean pattern to point to. That pattern was never a natural law. It was a byproduct of who owned bitcoin and how they bought it. Today looks different:

- ETFs and brokerage channels pipe flows from model portfolios and committees.

- Corporate, RIA, and family office allocations phase in over years, not weeks.

- Sovereign and quasi-sovereign actors are experimenting with both reserves and mining.

That does not mean price moves in a straight line. It does mean the old idea of “this cycle is over, see you next halving” is less useful.

What has always mattered, and matters even more now, is the business cycle: growth, inflation, liquidity, and fiscal behavior. Those are the variables that drive discount rates and appetite for outside money, not arbitrary date bands.

Money printer warming up

Look at the bigger backdrop instead of the last candle.

- The rate hiking campaign is behind us. Forward guidance leans to cuts, not hikes.

- QT has an expiry date and balance sheet policy is already softening. Fiscal needs have not shrunk.

- Debt rollover continues and interest costs are rising in nominal terms.

- Political incentives favor support, transfers, and programs over austerity.

That combination is not neutral for an asset with a fixed supply. A rational allocator, looking at a future of structurally easier money and persistent fiscal pressure, would not conclude “this is definitely the top.”

They would more likely conclude that the path of least resistance is more debasement over time and that scarce, non-liability assets are still under-owned.

The micro price pattern of the last few weeks sits on top of that macro picture. The macro picture has not improved for fiat, it has improved for bitcoin.

Was this even a “bull market” yet?

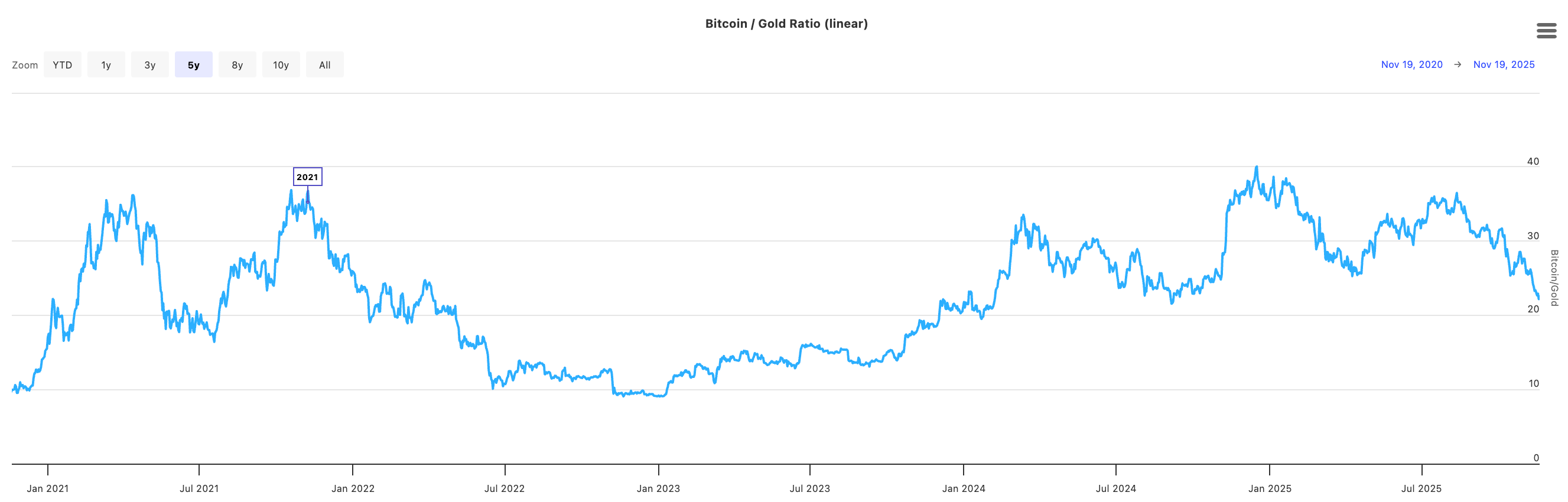

There is another way to frame the past year that rarely shows up in the online commentary: bitcoin in gold terms.

If you think in sound money pairs, not just in dollars, you realize that bitcoin has not yet made new highs relative to gold. In other words, bitcoin has not decisively repriced the incumbent monetary asset. In that sense, we have not yet entered a true “bitcoin versus gold” repricing phase.

For many long-term allocators, that is when the real bull market begins. Not when bitcoin makes new highs in a debasing unit like USD, but when it starts to make fresh highs relative to the old reserve asset.

Until that happens, you can reasonably describe the last year as a reset and re-rating period, not an exhausted cycle top.

What has actually changed?

It is helpful to separate price from structure. Over the last twelve to eighteen months:

- Bitcoin integrated into mainstream brokerage accounts via ETFs.

- A new class of buyers began building positions on schedules and model weights.

- Large holders from prior eras realized gains and redistributed coins.

- The public conversation around dollar debasement and “outside money” moved into the center.

These are structural shifts. They are not undone by a thirty percent drawdown. They are the conditions under which future price discovery happens.

At the same time, the monetary and fiscal environment has flipped from “emergency tightening” toward “quiet support.” That is the environment in which a fixed supply asset should flourish.

Find signal amidst the noise

If you want useful signals, ignore technical price analysis and focus on:

- Liquidity: central bank balance sheets, bank reserves, global dollar liquidity.

- Fiscal pressure: debt growth, interest expense, and the political story around funding.

- Inflation mix: not just headline CPI, but the persistence in services, housing, insurance, and wages.

- Bitcoin versus gold: new relative highs would mark a real phase shift in how markets treat digital versus analog reserves.

- Ownership structure: growing long-term holder share, ETF flows, and the spread of institutional mandates.

Those tell you far more about the future path of value than whether an anonymous account has declared “cycle top” on social media.

Closing thoughts

Bitcoin at ~$88K feels different depending on your frame. If you bought last month on margin, it feels catastrophic. If you have been watching the arc of policy, liquidity, and institutional adoption, it looks like another step in a much longer repricing process.

The key ideas are simple. Market structure has changed. Cycles, at least in the old sense, matter less than the business cycle. Liquidity and money printing are still leaning in one direction. Bitcoin has not yet taken out its prior highs in gold terms, so the real contest with the legacy reserve asset is still ahead.

Viewed through that lens, this does not look like the end of a bull market. It looks like a noisy chapter before the main act.

Bitcoin’s time as a serious, strategic asset is just getting started.

Chart of the Week

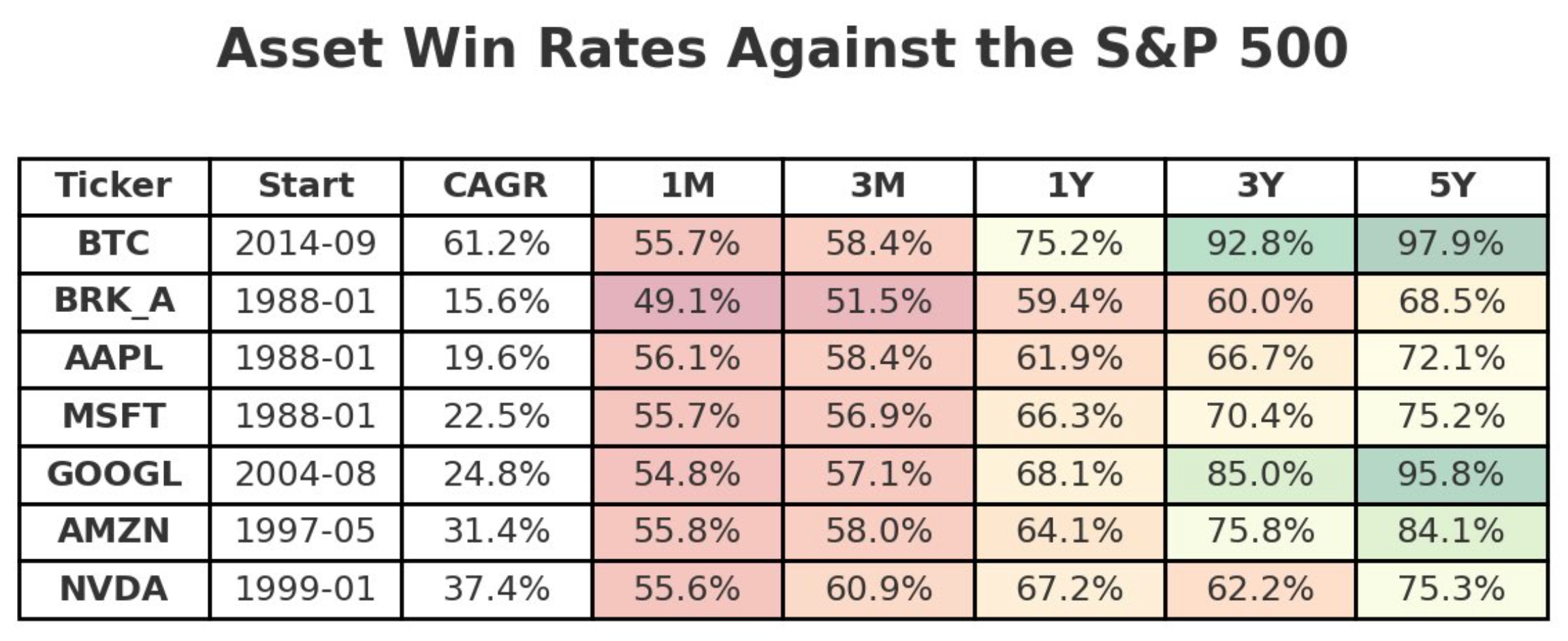

"All great assets *underperform* the market for extended periods. NVIDIA has trailed the S&P 500 a third of the time over one-year periods, and still a quarter of the time over five-year periods, despite clocking nearly 40% CAGR since its IPO. Bitcoin is no different. Stop whining about short-term performance and start stacking."

Quote of the Week

"We see Bitcoin playing an increasingly important role alongside gold, both assets contribute to diversifying our portfolio, and we expect to hold them as part of our near and long-term strategy.”

— Abu Dhabi Investment Council

Podcasts of the Week

Global Liquidity Just Bottomed — Mel Mattison Says Bitcoin Will Rip Next

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis are joined by writer–investor Mel Mattison to break down why sub-$100K BTC could be the launchpad for a +50% move, driven by a liquidity flip, fiscal stimulus, and central banks cornered by debt. We also explore market dyanmics across gold, bitcoin, and the debasement trade.

The U.S. Shutdown, Stimmies & Bitcoin’s Next Move

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down impacts of the government shutdown, Ledger’s IPO, Ripple’s $40B valuation, Coinbase’s new token launch platform, OpenAI’s call for a federal backstop, key deals of the week & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis