11/6/25 Roundup: The Great Migration to Stronger Hands

Brian Cubellis | Chief Strategy Officer

Nov 6, 2025

Earlier this week, bitcoin slipped under $100K for a moment and the timeline panicked. That reaction says more about positioning than fundamentals. Plenty of investors do not hold unlevered spot bitcoin. They carry basis trades, BTC-adjacent equities, financed exposure, or other crypto tokens.

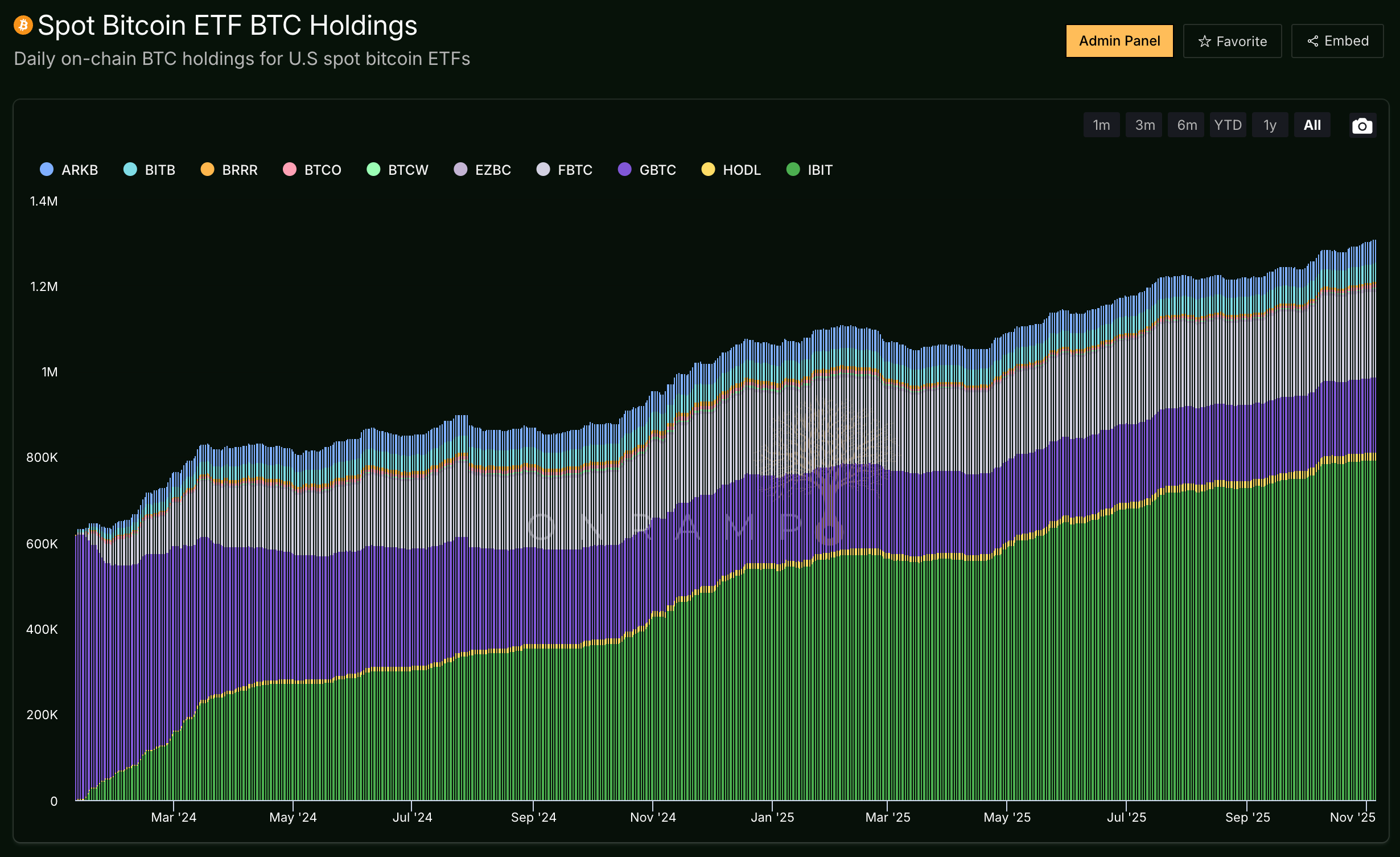

A year of quiet, upward-tilting price action has lulled investors to sleep and trained them to read every dip as a cycle top. That frame keeps missing what changed after the ETFs launched. This is no longer a retail sprint. It is an allocator driven market with deep demand that can absorb supply.

Market structure realities

Post-ETF, a different class of demand is showing up. Brokerage pipes, model portfolios, and creation baskets now feed pension plans, endowments, OCIOs, RIAs, insurers, corporates, and a few sovereign entities. These are mandate-driven allocators building positions, not day-traders chasing candles.

- Price-agnostic accumulation. Committees fund sleeves on a schedule, run TWAPs, and add on rebalance dates. Dips are welcomed, not feared.

- Creations on weakness. When price pulls back, creations rise as models and glidepaths top up. The flow is mechanical.

- Depth and digestion. Large clips of coins from 6–12m and 1–2y sellers are clearing without cascade liquidations.

- Patience by policy. Investment policy statements, not timelines, set behavior. Capital builds quietly and keeps buying meaningful dips.

So who is actually selling?

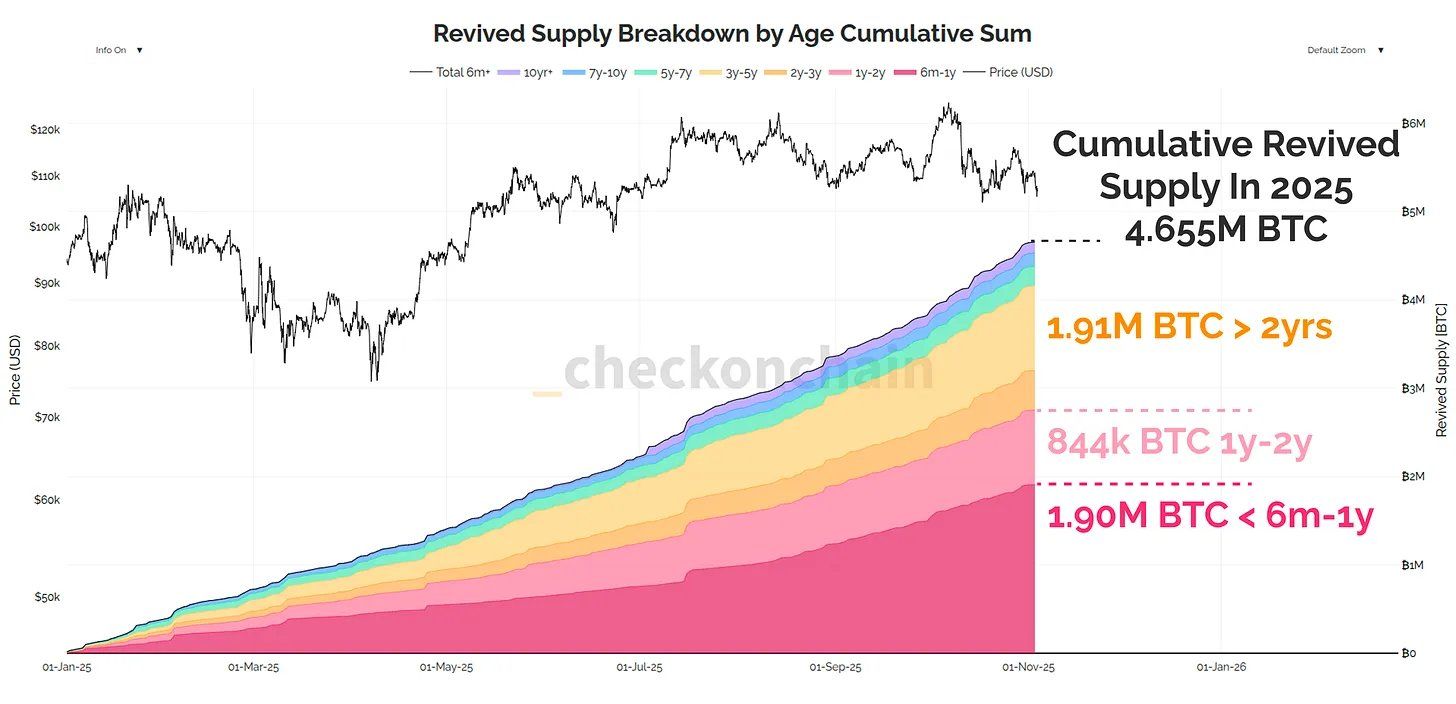

On-chain revived supply in 2025 is about 4.65M BTC at a round 100K mark. The mix matters (per James Check):

- ~1.90M BTC (~41%) from 6–12 month cohorts. Trader capital and tourists rotating or de-risking.

- ~844k BTC (~18%) from 1–2 year holders. Many banked 2–3x since 2023–2024 and took it.

- ~1.91M BTC (~41%) from 2+ year holders. A meaningful slice from 3–5+ years, but far from an “OG whale capitulation.”

Translation: coins are moving from weaker hands to stronger hands, and from earlier retail cohorts to new buyers inside ETFs and brokerage accounts.

Revived Supply Breakdown by Age, Cumulative 2025.

Source: James Check (@_Checkmatey_) on X

Contextualizing drawdowns

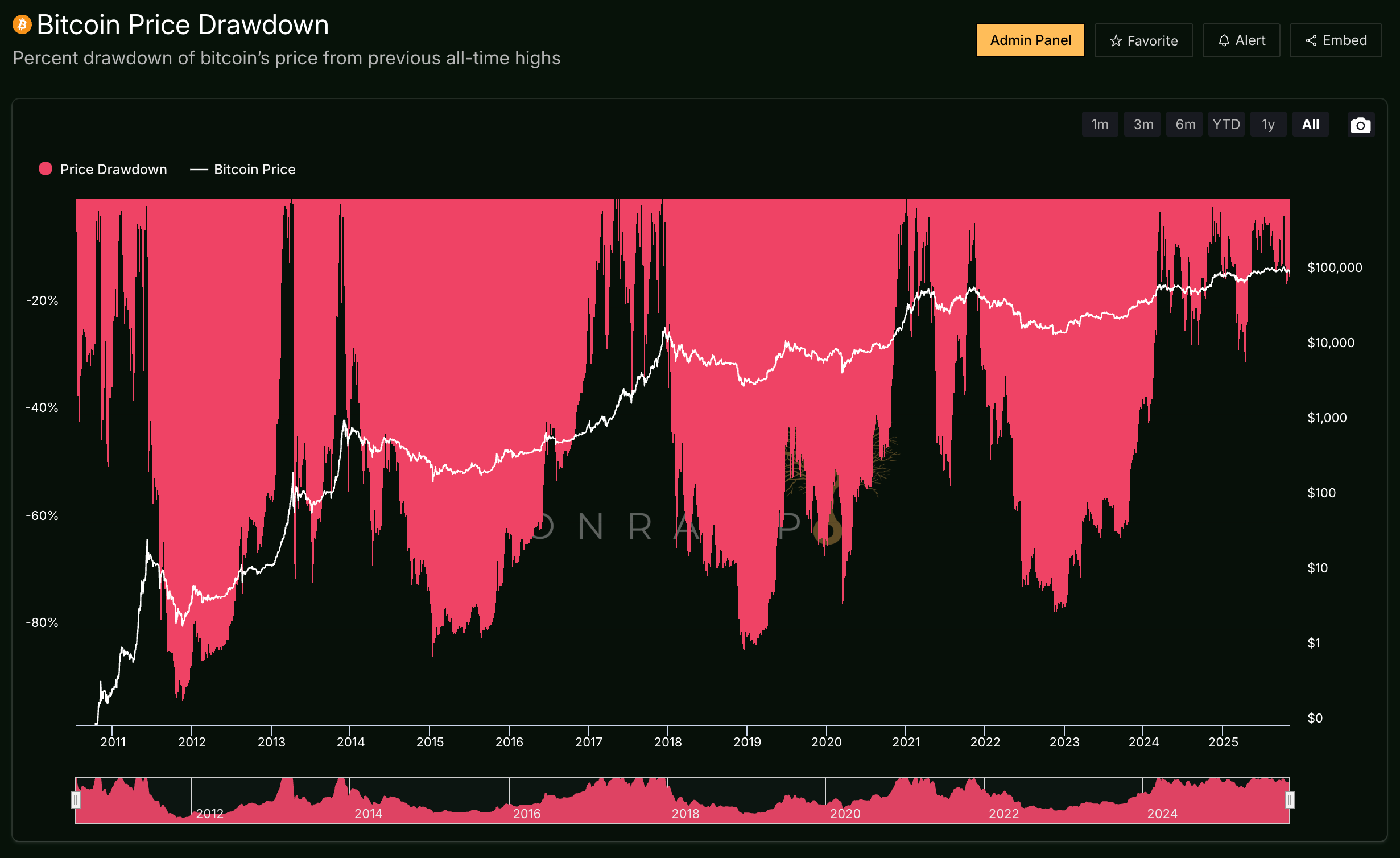

We are about 20% off the highs. In prior secular advances, resets of 20–60% were normal. We've already seen multiple ~20-30% drawdowns over the past 12 months, most recently a ~30% shakeout in April before printing new highs.

Classic bull-bear labels are losing usefulness in a world of daily ETF flows and new cohorts of demand. The better frame is "chopsolidation" with a slow upward drift while ownership improves.

The bitcoin thesis is only strengthening

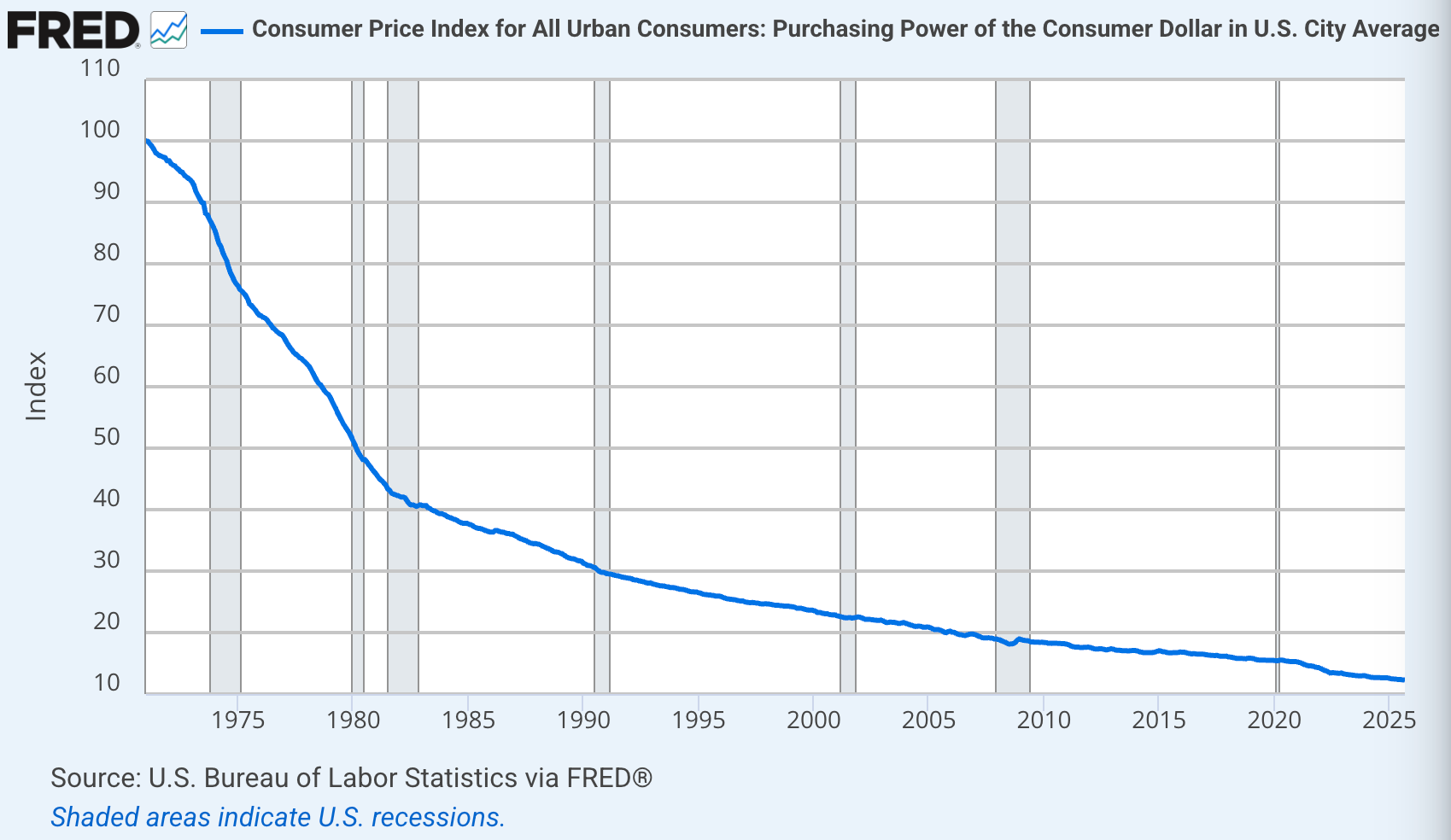

Dollar debasement is no longer a fringe topic. The hiking cycle that moved at record speed is giving way to a visible easing shift. QT has an end date. Term premia are being coaxed lower. Funding needs are setting the tone more than month-to-month inflation prints.

Culturally, the narrative moved too. Senior officials praise a stronger gold bid. Extend the logic to bitcoin as the digital counterpart. If the objective is to refinance the state, spread dollar stablecoins worldwide, and let outside money reprice higher, gold and bitcoin are not threats. They are release valves.

The bigger picture (inflation)

Inflation is now lived experience. It shows up in rent, insurance, groceries, and medical bills. The housing market is a policy maze with high prices, scarce supply, and mortgage costs that trap both buyers and sellers. The labor picture is worsening, layoffs are accelerating, real wages are thin, and multiple-jobholding keeps rising. Sentiment feels bleak for a reason.

When daily life gets harder, people reach for simple answers. In parts of the U.S., that has meant a louder turn toward redistribution and state solutions. The impulse is understandable. It does not fix the root cause. The root cause is broken money.

We are not going to vote our way to austerity. There is no durable political will to cut spending or slow monetary inflation. The path of least resistance is more issuance, more programs, and friendlier funding. That is why the answer is opting out at the margin and storing work, time, and energy in sound money.

Gold remains the legacy reserve that institutions understand. Bitcoin is the modern counterpart with fixed supply, verifiable ownership, and global portability. If the system is geared to dilute, the rational response is to hold an asset that cannot be printed.

Zooming out from the latest "dip"

Heavy revived supply hit the market and price held the range. That means real demand is present. The investor base is broadening inside traditional accounts with audit trails, policy documents, and multi-year mandates. Sellers exhaust. New hands are sticky. Education compounds. The short-term chart matters less than the migration of ownership.

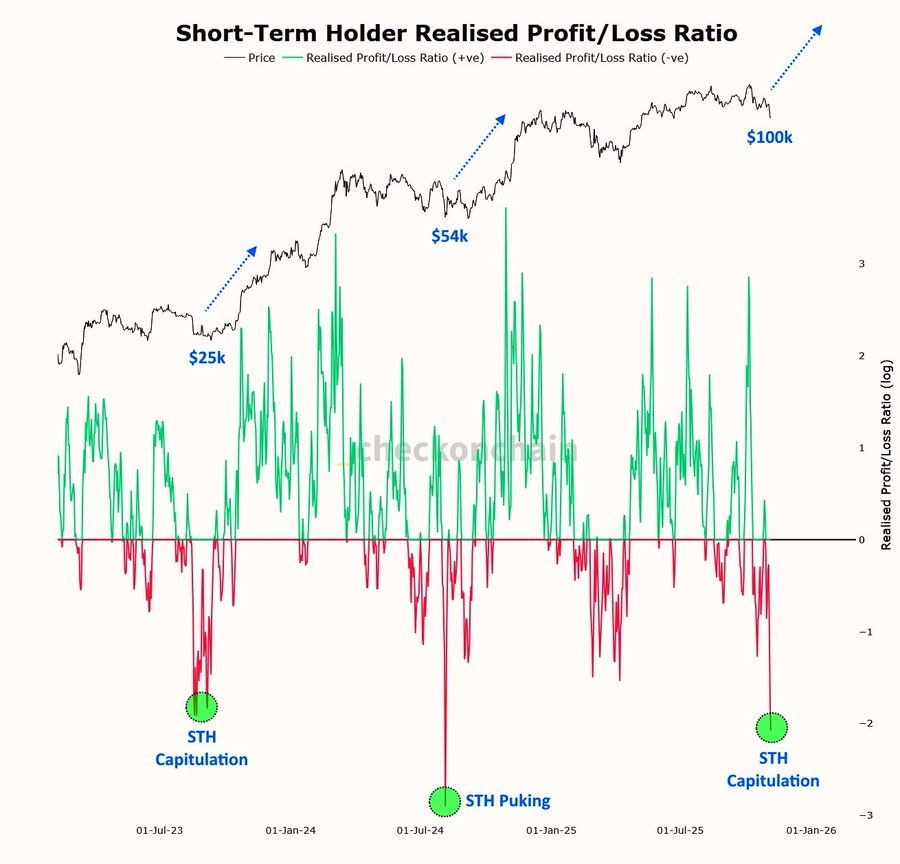

Chart of the Week

"Top buyers capitulating at exactly the wrong time is how bottoms form."

— @FrankAFetter & @_Checkmatey_

Quote of the Week

"17 years after the white paper, the Bitcoin network is still operational and more resilient than ever. Bitcoin never shuts down. @SenateDems could learn something from that."

— Treasury Secretary, Scott Bessent on X

Podcasts of the Week

100,000 Tech Layoffs This Week: Why Bitcoin Is Your Only Escape | Zuby

In this episode of The Last Trade, hosts Jackson Mikalic & Michael Tanguma are joined by rapper, author, coach, podcaster & bitcoiner ZUBY (@ZubyMusic) to discuss his journey from Oxford to bitcoin, inflation, pain, & conviction, capitalizing on generational opportunities, AI, automation, agency, & more!

Everyone’s Short Bitcoin — Wall Street Is Buying the Plumbing

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down Mastercard’s $2B Zerohash deal, Coinbase–Citi–Apollo partnerships, the coming custody reckoning, AI layoffs & the need for sound money, key deals of the week & more!

Oil & Gas Veteran: Why Energy and Bitcoin Must Go Higher

In this episode of Scarce Assets, Jackson Mikalic is joined by Matthew Montgomery, oil & gas veteran and founder of Maevlo Company, to discuss why U.S. energy is becoming scarce, LNG exports & AI power demand, turning oil & gas cashflows into BTC, preserving value through hard assets & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis