12/11/25 Roundup: The Printer Is Back On

Brian Cubellis | Chief Strategy Officer

Dec 11, 2025

Yesterday the Fed delivered its third rate cut of 2025, another 25 basis points, and then tried very hard to pretend nothing structural had changed.

Key moves in plain language:

- Policy rate cut by 25 bps, the third cut this year

- Language about “timing” of further moves, but a hint that cuts may pause here

- Announcement that the Fed will begin buying Treasury bills on December 12

- Plan to purchase 40 billion dollars of T-bills over the next 30 days

- A note that they can go out to three-year notes if needed

- Powell saying that 20 to 25 billion dollars of monthly balance sheet expansion is now the baseline for “ample reserves,” with 40 billion as the current run rate

TLDR: The Fed is expanding its balance sheet again through Reserve Management Purchases (RMP). In practice that means buying T-bills (and, if needed, up to three-year notes) and crediting the banking system with new reserves.

They will insist it is temporary and that it is not QE, but the Fed is expanding its balance sheet again. Liquidity is being added. The printer is humming.

Why reserves and T-bills matter more than the headline

It is worth slowing down for a second on what these operations actually do.

The Fed will buy T-bills from primary dealers and others and credit the banking system with new reserves. That is an asset swap: assets on the Fed’s balance sheet rise and bank reserves on the liability side rise as well.

For now, the stated goal is to offset TGA and tax-season drains and keep reserves “ample,” not to run a full-scale stimulus program. But the direction of travel has changed: we are no longer shrinking the balance sheet, we are growing it to keep the plumbing comfortable.

Reserves are the lubricant for modern financial plumbing:

- When reserves are tight, banks pull back from repo, dealer balance sheets shrink, and market making gets stingy

- Hedge funds finance leverage through prime brokers, who in turn finance through repo

- Tight reserves echo through everything from Treasury market depth to basis trades to credit spreads

Traditional QE is framed as “pulling duration out of the market” by buying longer-dated Treasuries and MBS, pushing investors out the risk curve. Here, the focus is short paper and reserves, but the effect is similar:

- More reserves

- Less stress in funding markets

- A bit of duration removal if they step into up-to-three-year notes

- A friendlier backdrop for anything that depends on leverage and liquidity

Call it what you like. The Fed is back to growing the balance sheet.

Bitcoin just survived the hardest part

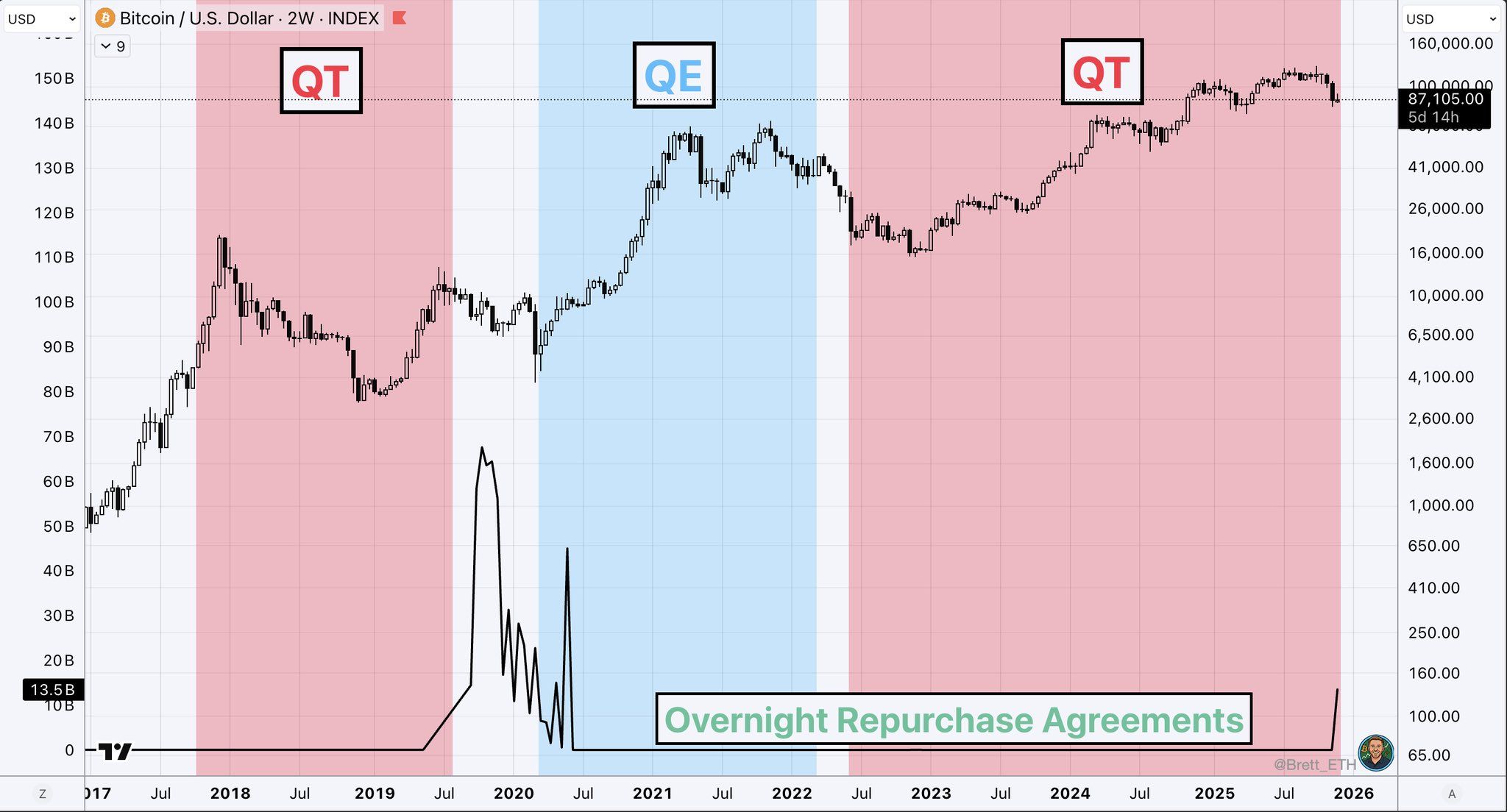

Step back and look at the last three years.

Bitcoin has been grinding higher through:

- The fastest rate-hiking cycle in modern Fed history

- Quantitative tightening and shrinking reserves

- A hostile liquidity environment where many risk assets struggled

That is the hard mode regime for anything perceived as a speculative asset. Funding costs jumped, leverage got more expensive, and central banks were actively draining liquidity.

Despite that, bitcoin re-rated from the doldrums and pushed into six-figure territory.

Now the regime is shifting:

- The hiking cycle is behind us

- We have three cuts in the books

- The Fed is openly expanding reserves and quietly admitting that the balance sheet will grow again

Bitcoin’s entire post-2021 recovery has unfolded with a headwind from tightening. The Fed is now turning that headwind into a breeze at its back.

Bitcoin as both a “risk asset” & debasement hedge

Most of the market still treats bitcoin like a high beta tech stock. That framing is incomplete, but you should use it to your advantage.

On one hand, when reserves rise and balance sheets expand, risk assets usually respond well:

- Cheaper funding

- More leverage capacity

- Better liquidity in everything from equity index futures to credit spreads

If bitcoin is still perceived as a risk asset by most allocators, then the return of balance sheet expansion is a tailwind for that narrative. A lot of portfolio models will simply see “liquidity up, risk assets up” and lump bitcoin into that bucket.

On the other hand, balance sheet expansion is also balance sheet debasement:

- More dollar claims

- More pressure to fund large deficits smoothly

- More expectation that “temporary” operations tend to become habits

That is exactly the environment where bitcoin’s risk-off side shows up:

- Fixed supply

- Programmatic issuance

- No direct link to any government balance sheet

RMP is not designed to blow the doors off financial conditions. It is there to keep the pipes from freezing as tax payments drain reserves into the TGA. That still removes a key downside risk for leverage and funding markets and sets a baseline expectation that, when liquidity is at risk, the Fed will grow its balance sheet instead of letting reserves run tight.

For bitcoin, that looks like a modest but durable tailwind. Most allocators still treat it like a high-beta risk asset, so a friendlier funding backdrop helps. At the same time, every new program that relies on balance sheet growth to “stabilize” the system reinforces the core debasement thesis. Bitcoin lives in both worlds: it trades like risk in the short term and functions as a monetary hedge when you zoom out.

“Not QE” & the credibility problem

The Fed will label it “reserve management,” call it “temporary,” and insist it is not QE. Technically, these are QE-like operations: large, quantity-targeted purchases financed with new reserves. Functionally, the Fed is trying to stabilize reserves around tax season rather than deliberately flood the system.

That still matters for bitcoin because the balance sheet is no longer shrinking, and there is a clear path from “stabilizer” to full-blown QE if conditions change.

The problem is that investors have seen this movie before:

- 2019 “temporary” repo operations morphed into ongoing balance sheet support

- Pandemic emergency programs grew the balance sheet by trillions

- Every time the system runs into funding stress, the solution is the same: grow reserves

At some point the label stops carrying weight. Markets watch what the Fed does to its balance sheet and the banking system, not what it calls the program.

For bitcoin, this credibility erosion is not a bug. It is the thesis:

- If the only reliable solution to funding stress is more reserves and more assets on the central bank balance sheet, then fiat dilution is structural, not episodic

- A finite-supply monetary asset exists precisely for this environment

The more often the Fed has to say “this is not QE” while doing things that look, feel, and act like QE, the stronger the case for a neutral, rule-based alternative.

Closing thoughts

The Fed cut again. The balance sheet is pointed up again. Reserves are being topped up again. The branding is different. The mechanism is familiar.

Bitcoin lived through the fastest tightening cycle in modern history and came out the other side stronger, more integrated into institutional rails, and more widely understood as a monetary asset.

If that was the outcome with the wind in its face, you should think carefully about what happens when liquidity, narrative, and math all start leaning in the same direction. The printer is back on.

Charts of the Week

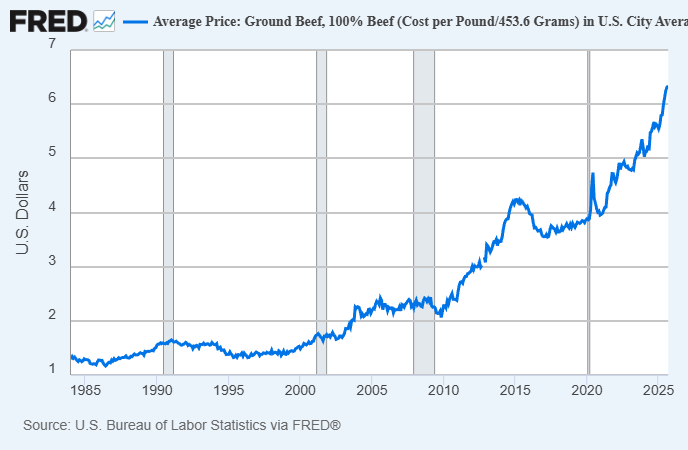

"Beef prices look like a memecoin chart lately." — Lyn Alden on X

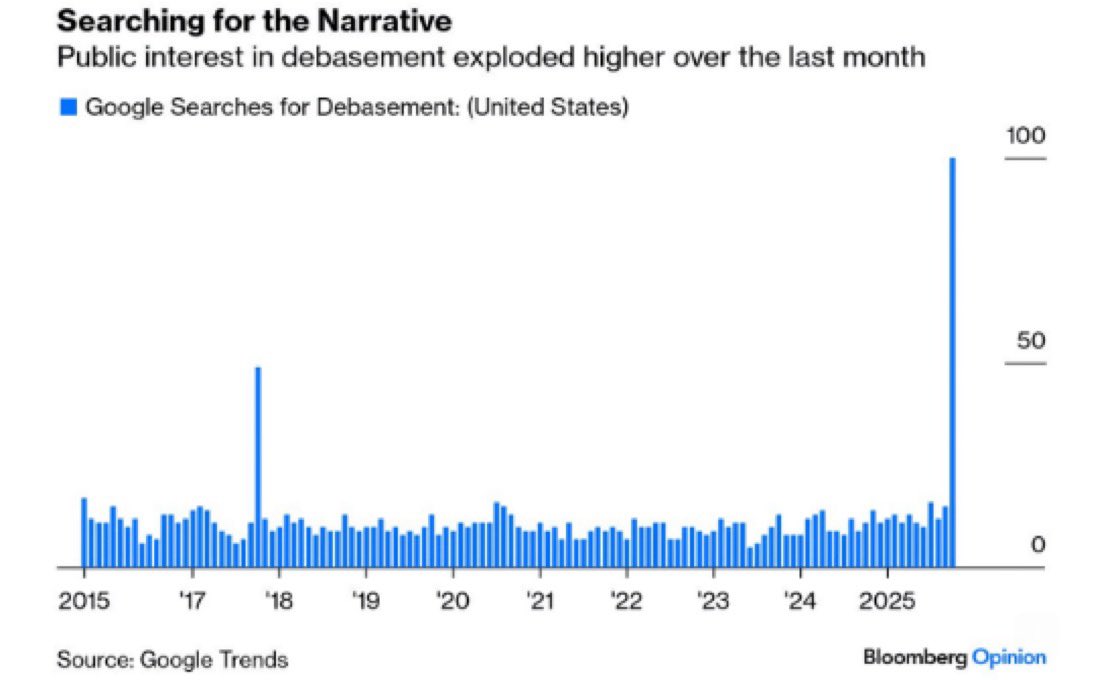

"Google Searches for Dollar "Debasement" soared this quarter to the highest level in history." — Barchart on X

Quote of the Week

"The Fed will label it 'Reserve Management', they will say it is 'Temporary', and they will insist it is 'NOT QE'. But the reality is that this is a pivot to expansion of the Fed balance sheet, adding liquidity to markets, and is in fact, Quantitative Easing." — James Lavish on X

Podcasts of the Week

Mark Yusko: Everyone Says the Cycle Is Dead — Here’s Why They’re Wrong

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis are joined by Mark Yusko to unpack bitcoin’s 2025 reset & what comes next, why the halving cycle still matters, how futures & index flows “tame” BTC, bitcoin vs gold & oil as true benchmarks, endowments quietly buying the future, & more!

Larry Fink & Stanley Druckenmiller Describe the Bitcoin Endgame

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down sovereigns adding BTC alongside gold, endowments signaling hard-asset framing, UAE turning policy into infrastructure, spot venues & lending expansion, custody risk as the next big narrative, key deals of the week & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis