12/18/25 Roundup: Conviction Lives in the Weighing Machine

Brian Cubellis | Chief Strategy Officer

Dec 18, 2025

Bitcoin is back under ~$90k and the near-term reaction has been predictable.

Online and mainstream coverage is treating the dip like a verdict on the thesis, as though a lower price automatically means the fundamentals deteriorated. Near-term price rarely tells you much about destination. It tells you far more about narratives, positioning, and time horizons.

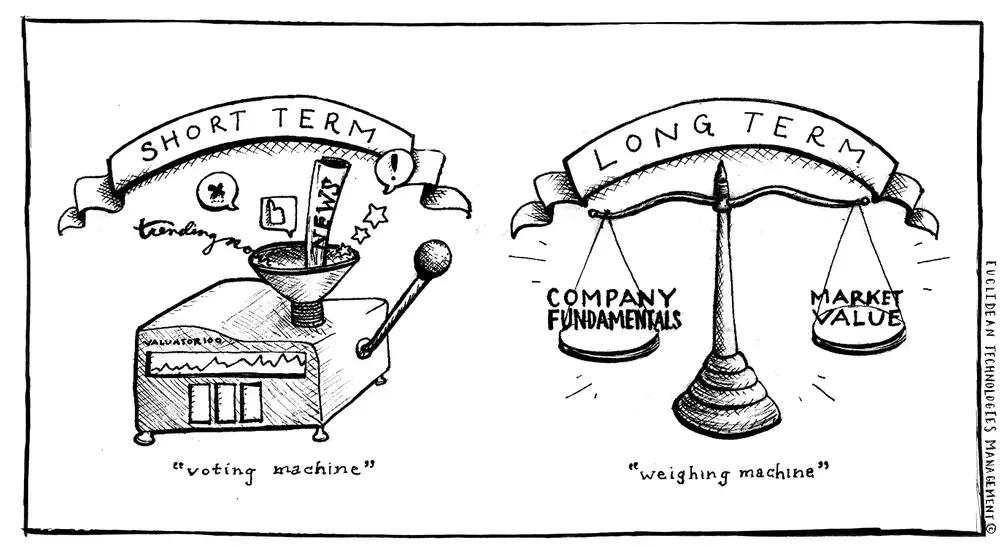

A useful reference point comes from traditional value investing. Warren Buffett, quoting Ben Graham, wrote: “In the short run, the market is a voting machine but in the long run it is a weighing machine.”

Bitcoin being roughly flat to down during 2025 is the voting machine in action. The weighing machine operates on a different timeline.

Buffett has also been blunt about what that gap does to investor behavior: “The market is a device for transferring money from the impatient to the patient.”

Bitcoin’s drawdowns do the same sorting. The only question is whether you are sized and structured to be patient.

What the market is “voting” on right now

Short-run moves tend to be dominated by forces that are orthogonal to fundamentals:

- Narrative and sentiment: price becomes a proxy for how confident or fatigued holders feel, not a clean measure of intrinsic progress

- Flows and positioning: leverage, risk limits, and rebalancing can move price quickly without changing the underlying thesis

- Recency bias: people overweight the last few weeks and underestimate the last few years

- Social amplification: the most repeated interpretation becomes the default explanation, whether it is correct or not

None of this is unique to bitcoin. The difference is that bitcoin trades continuously and sits at the intersection of macro, tech, and politics, which increases narrative volatility.

The thesis is not the chart

If you are underwriting bitcoin as a long-horizon monetary asset, the core pillars remain unchanged:

- A fixed terminal supply of 21 million

- A global, permissionless settlement network

- An environment where fiat systems have strong incentives to expand currency units over time

The macro and liquidity setup into 2026 strengthens the thesis. The tightening phase is over, the path of least resistance is more rate cuts, and the system is leaning back toward liquidity provision rather than restraint.

In parallel, the regulatory and market structure backdrop has improved meaningfully: ETFs, brokerage distribution, institutional custody, and clearer compliance frameworks have widened access and lowered friction for allocators.

If the market were perfectly efficient at weighing those realities, price would likely be higher than where it sits today. Markets do not work that way.

Another helpful reminder from Buffett: “Price is what you pay; value is what you get.”

A volatile price does not negate a thesis. It tests whether the investor’s time horizon matches the asset.

Dislocation is where conviction is defined

Many investors discover, during drawdowns, that they were anchored to a recent high rather than anchored to the underlying thesis. That is not a moral failing. It is simply how most market participants are conditioned.

If the thesis is intact, the logical actions tend to be simple: hold or add to the position. Not because the investor is indifferent to risk, but because they are consistent about time horizon.

Bitcoin’s price can fall materially even in a world where the fundamental argument is strengthening. That is not a contradiction. It reflects that price is the intersection of many forces, some structural and some short-term.

A more grounded checklist to watch than the daily candle:

- Liquidity and policy: are we moving toward easier financial conditions over time?

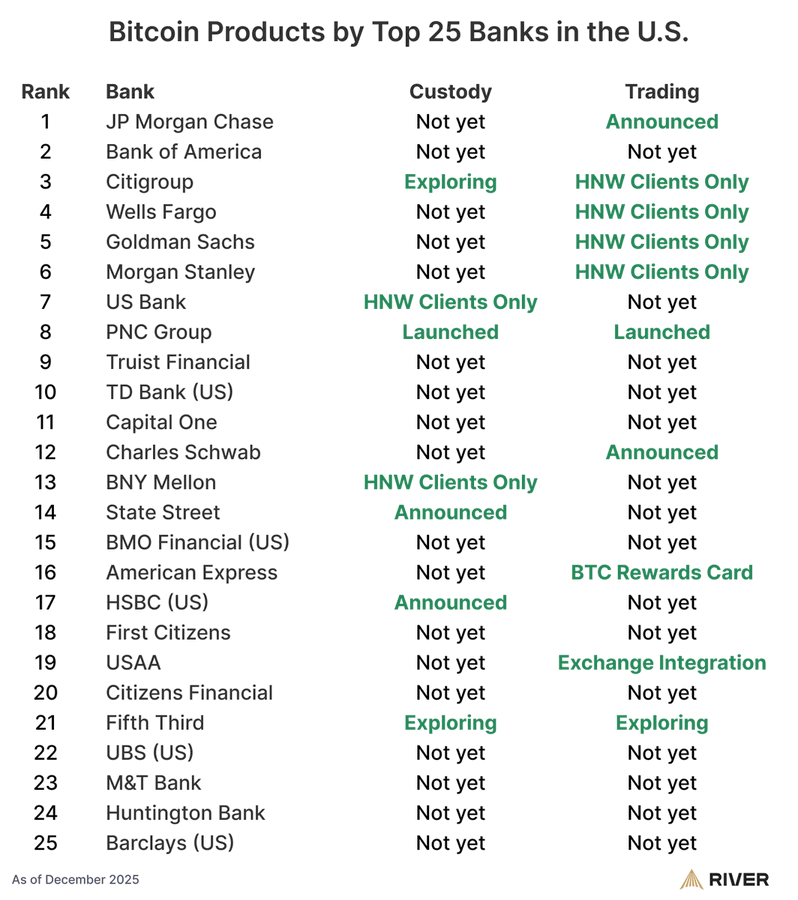

- Institutional rails: is adoption infrastructure improving, or deteriorating?

- Monetary credibility: are fiat systems becoming more disciplined, or less?

- Network fundamentals: is bitcoin operating as designed?

If your answers are unchanged, then the price move is information about the market’s current vote, not information about the long-term weight.

Closing thoughts

Bitcoin under ~$90K is a reminder that markets can be loud in the short run, even when little has changed in the underlying picture.

The destination is not determined by weekly sentiment. It is determined by scarcity, credibility of monetary rules, and whether a neutral, finite asset continues to monetize in an environment of ongoing currency expansion.

The right question is not “why is the price under $90K.” The right question is “did anything materially change in the thesis.”

As of this week, it has not.

Chart of the Week

"14 of the top 25 banks in the U.S. are building bitcoin products for their customers. First they ignore it. Then they fight it. Now they're starting to embrace Bitcoin." — River on X

Quote of the Week

"In hindsight, the counterbalance to the threat of AI will be obviously Bitcoin.

AI's Achilles heal is computational cost, and it just so happens that the world has adopted a proof-of-computational-work protocol where we treat the electro-mechanical cost of computing as a tradeable digital asset that can be used as a form of restrictive collateral: it's called Bitcoin.

Understand this, and you understand the fundamentals about how Bitcoin will become the thing that ALL computing systems rely on to defend them against the threat of AI..."digital gold" barely even scratches the surface of the importance of Bitcoin in 2030 and beyond." — Jason Lowery on X

Podcasts of the Week

Tad Smith: The Fed Pivot & AI Forces Driving Bitcoin’s New Regime

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis welcome Tad Smith back to the show to discuss bitcoin’s “disappointing” year, gold’s structural bid, Harvard, Abu Dhabi & quiet accumulation, AI + policy reshaping work & hard money, education, agency, optimism, & more!

The Banks Are Here: OCC Just Opened the Floodgates to Bitcoin

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down the arrival of banks in digital assets, distribution versus challengers, stablecoin versus bitcoin usage, quantum threats, prediction markets, key deals of the week, & more!

Bitcoin Is Quietly Replacing Land as a Store of Wealth

In this episode of Scarce Assets, Jackson Mikalic is joined by Vance Crowe, former World Bank strategist and founder of Legacy Interviews, to discuss why farmland became a SoV asset, how bitcoin reshapes land economics, inflation’s impact on families, workers, & assets, building legacies that last generations, & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis