12/4/25 Roundup: The Quiet Endowment Awakening

Brian Cubellis | Chief Strategy Officer

Dec 4, 2025

Institutional Investor ran a revealing piece this week titled:

“Crypto Is the Secret Sauce University Endowments Don’t Want to Talk About.”

Beneath the spicy headline, some concrete facts provide real signal:

➤ Harvard has made BlackRock’s IBIT its largest disclosed public position, more than tripling its stake to about 6.8m shares in Q3 (~$442.9m, ~0.8% of its $56.9b endowment).

➤ That puts IBIT ahead of Harvard’s other top public holdings, including Microsoft (~$322.8m, ~0.57% of the endowment), Amazon (~$235.2m, ~0.41%), and SPDR Gold (GLD) (~$235.2m, ~0.41%).

➤ Brown reported ~$13.8m in IBIT, on the order of ~0.2% of its ~$8b endowment. Emory showed a smaller ETF position alongside ~$52m in the Grayscale Bitcoin Mini Trust, putting its disclosed bitcoin exposure just under ~0.5% of its ~$11.4b endowment.

But no one on campus, or elsewhere, is talking much about it.

“You’re not going to see anyone shouting about investing in crypto, even if it gives them a 20 percent return,” says Michael Markov, chairman and co-founder of Markov Processes International, a provider of research and analysis covering opaque investments, such as endowment portfolios.

“There are too many political risks — differing opinions on whether to invest in crypto, and endowments don’t want to create controversy among its investment managers, students, trustees, alums. They say nothing, you hear nothing.”

For the average observer, bitcoin still gets thrown into the same bucket as broader “crypto", which for most people means:

- FTX, BlockFi, Celsius, Terra Luna and a graveyard of retail blow-ups

- Tokens and vaporware that go to zero

- Insiders and VCs dumping on their own "communities"

If that is your frame, “crypto” is obviously a scam, and bitcoin is just the oldest scam in the pile.

You can see this in public commentary too. Michael Burry, of The Big Short fame, went on a podcast this week and, when asked about bitcoin, called it tulips used by criminals. In the same breath he described the Fed as evil and reminded listeners that he has held gold for twenty years.

That is a perfect snapshot of where most of the market still sits:

- Fiat debasement is real

- Gold is legitimate

- Bitcoin is still filed under “tulips and crime”

Endowment offices are not immune to that framing. Most investment committees still conflate bitcoin with the broader crypto zoo. If they have reached the point Harvard, Brown, and Emory seem to be at, where bitcoin is understood as something different and worth owning, they also know they are early to that realization.

The last thing many CIOs want is to be “the crypto person” in a room full of peers who still map IBIT exposure to meme tokens and Ponzi schemes. Quiet accumulation becomes the path of least resistance.

Bitcoin & gold as the quiet sound-money sleeve

A pattern is emerging.

➤ Harvard, Brown, Emory and others are using ETF and trust structures to build bitcoin (and gold) exposure.

➤ The State of Texas, whose university system already holds roughly a billion dollars in physical gold, passed strategic bitcoin reserve legislation over the summer and purchased $5m of IBIT in late November.

➤ MIT, Stanford, Michigan, Yale and Cornell have histories of backing digital asset ventures, accepting bitcoin donations, or seeding blockchain startups.

➤ MPI attributes a ~2.9% boost to Michigan’s annual returns from digital asset exposure and hints at “steadily increased” positions at MIT and Stanford.

On paper these are all separate stories. In practice they are one story: large, sophisticated, conservative, long-horizon investors are building sound money allocations that pair gold and bitcoin.

Gold gives them:

- A familiar store of value

- A long historical track record

- Political cover, since everyone accepts gold as “serious”

Bitcoin gives them:

- A finite supply curve

- Programmatic, auditable issuance

- Modern settlement rails and global liquidity

- Asymmetric upside relative to gold

You can see the irony when you put this next to Burry. He is right about debasement and the central bank problem, so he owns gold. Endowments are following that same logic, then taking one extra step and recognizing that, in a digital world, the portfolio probably needs both forms of sound money.

They are not trying to become crypto traders. They are building a structural outside-money position and letting it run.

Fiduciary duty is shifting

Todd Ely, who studies endowments and education finance, captures the core tension: “Are we acting as fiduciaries by investing in crypto, or are we violating our duty by ignoring it?”

A decade ago, ignoring it was easy to defend. Bitcoin traded below ten thousand, most infrastructure was amateur, and the headlines were mostly hacks and exchange blow-ups. Calling it a bubble, or a Ponzi, felt like the cautious stance.

Today the landscape looks different:

- Spot ETFs exist and function like any other exchange-traded exposure.

- Institutional custody, multi-institution vaults, and real insurance are available.

- Market cap is in the trillions, not the billions.

- Bitcoin has lived through multiple rate cycles, policy regimes, and scandals around it.

In that setting, staying at zero starts to look less like prudence and more like a blind spot. The portfolio risk from a half-percent bitcoin allocation is modest. The opportunity cost of never engaging, if bitcoin continues to monetize, is not.

On a percentage basis these allocations remain small, but that is exactly why they matter. No CIO wins political points for buying bitcoin at a half-percent weight. You do it anyway when you believe three things:

- The asset has a non-trivial chance of becoming a durable part of the monetary system.

- The expected payoff, if that happens, is large relative to the risk at small size.

- The cost of continuing to ignore it is rising.

A small position that survives internal debate and makes it into public filings is a stronger signal than a loud blog post. It tells you someone in the building ran the numbers and concluded that a zero allocation made less sense than a tiny one.

Closing thoughts

Do not confuse silence with inaction: Most endowments still avoid public crypto commentary. Their 13Fs and performance attribution tell a different story.

Recognize that stigma is part of the opportunity: The more peers still treat bitcoin as tulips for criminals, the more room there is for early, sober adoption by people who actually do the work.

For years, people said “wait until the endowments come in,” as if there would be a single announcement and a ringing bell. The reality looks different. Slow and quiet is what real institutional adoption looks like.

The loudest takes on bitcoin still come from people who either hate it on principle or think of it as another tech stock. The most important takes are now embedded in portfolios run by teams who plan in decades.

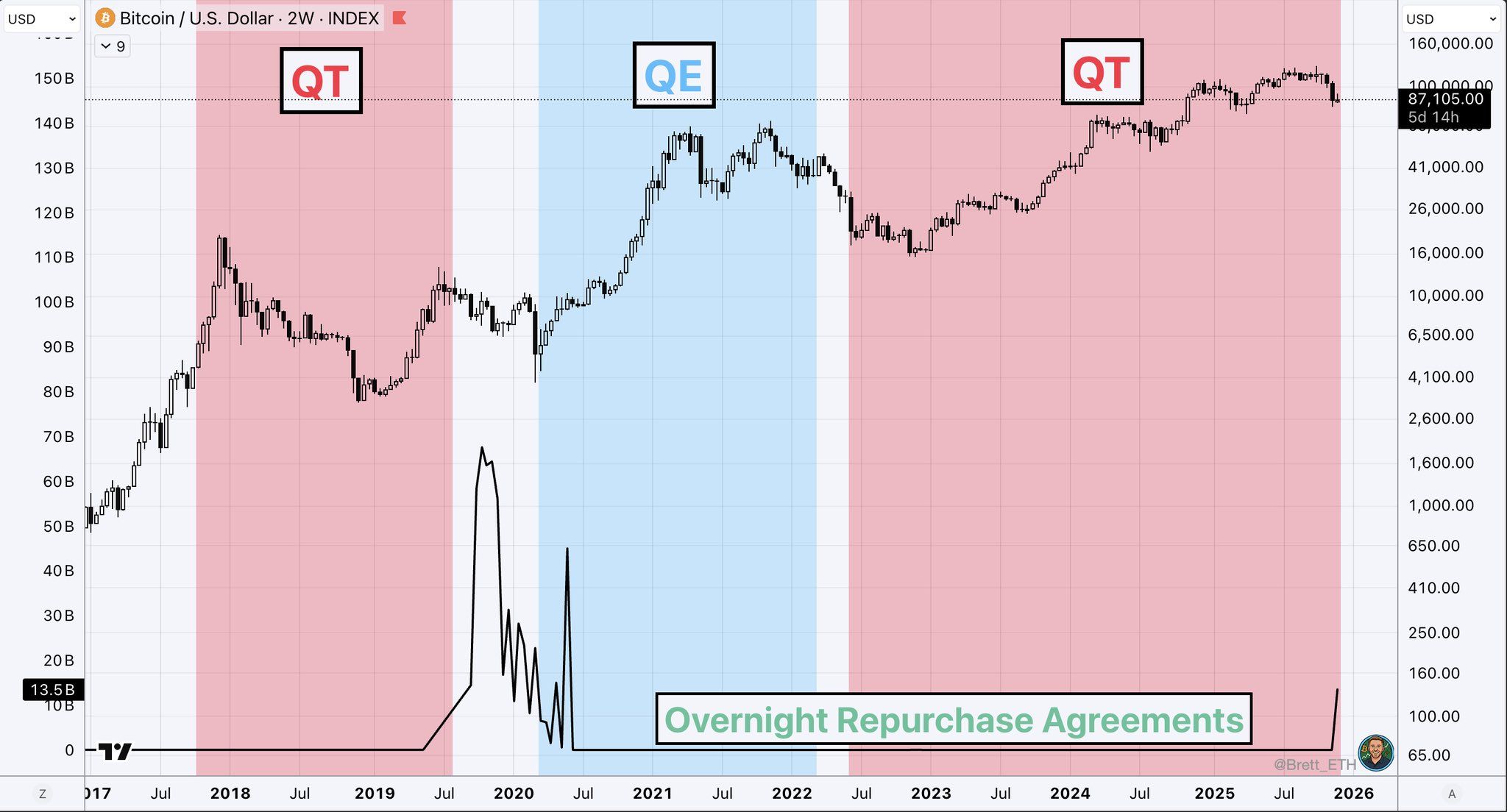

Chart of the Week

"A reminder that this entire “bull market” has occurred in a vastly different liquidity environment than the prior bull market."

— BitPaine on X

Quote of the Week

"It took approximately 205 years for the US Treasury to accumulate its first trillion dollars of debt. The 38th trillion? Just 71 days."

— James Lavish on X

Podcasts of the Week

Former Blackstone Partner: The Reset Already Started — And Washington Knows It

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis are joined by former Blackstone partner David Thayer to discuss why liquidity is the key driver for BTC, AI, fiscal dominance & national security, debasement, stablecoins & demand for Treasuries, Texas’ ETF buy, JPM’s BTC note & more!

The Truth About Tether, Stablecoins & JPMorgan’s Quiet Bitcoin Bet

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down why Tether’s reserves scare S&P, MPC hacks vs BTC-native multisig, stablecoin wars with Stripe & Klarna, JPM’s BTC note & Wall Street’s conviction, key deals of the week & more!

Former Sprott CEO: Gold Has Now Replaced Bonds — A New Monetary Order Is Here

In this episode of Scarce Assets, host Jackson Mikalic is joined by former Sprott CEO Peter Grosskopf joins to break down gold’s 2025 breakout, and why it’s replacing bonds as the “safe asset.” We cover central banks reloading gold, the debasement trade in real time, direct-to-vault gold with Argo, & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis