2/19/26 Roundup: A Warranted Alarm Bell

Brian Cubellis | Chief Strategy Officer

Feb 19, 2026

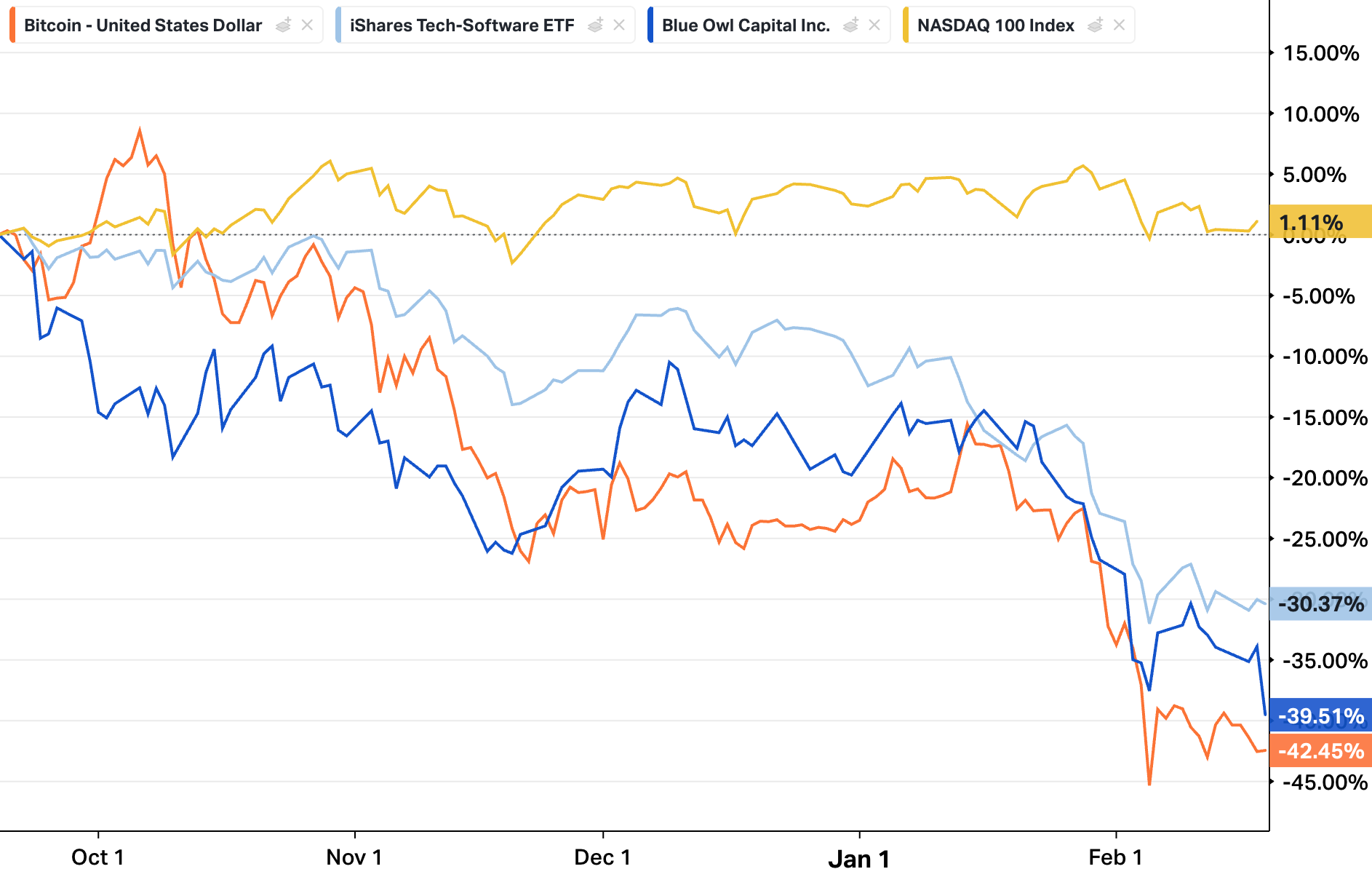

Markets are noisy by design. Price action in any single asset over any short window tells you very little. But when two assets that have historically moved together begin moving in opposite directions, the divergence becomes the data. Bitcoin and the Nasdaq have done exactly this.

Since bitcoin posted its all-time high in late 2025, equity markets have held relatively steady while bitcoin has pulled back meaningfully. Casual observers have called it a crypto-specific correction. Macro-aware investors are looking harder.

Bitcoin is the most liquid, globally accessible, freely traded asset in the world with no issuer, no earnings guidance, and no central bank managing its price. It responds, with remarkable sensitivity, to the global supply of fiat credit.

When fiat credit expands, risk appetite rises and bitcoin tends to rise with it, often faster than everything else. When the market begins anticipating a contraction, bitcoin reflects that stress early. The current divergence from the Nasdaq is the alarm going off.

What the Alarm Is Pricing

The stress the market appears to be discounting runs deeper than the familiar variety. A rate cycle gone too far, a commodity shock, a geopolitical disruption; those are legible risks with well-worn playbooks.

What is gaining traction is more structural: AI-driven productivity improvements, genuinely transformative over the long run, may displace a significant share of white-collar employment faster than the labor market or the credit system can absorb.

The transmission mechanism is worth tracing carefully. Knowledge workers account for a disproportionate share of consumer credit and mortgage debt relative to their share of the workforce. A meaningful reduction in that cohort's ability to service debt lands on bank balance sheets as credit losses, concentrated among regional and mid-market lenders whose books are far less diversified than the systemically important institutions.

Markets identify these vulnerabilities early, price the weakest credits aggressively, and trigger the depositor behavior that turns solvency concerns into liquidity crises. That sequence, credit stress to institutional distress to Fed response, is exactly what long-horizon bitcoin holders are watching for. In 2020, the Fed's emergency balance sheet expansion took bitcoin from ~$3,800 to ~$60,000 in fourteen months.

This is no longer purely theoretical. This morning, Blue Owl Capital, the $295 billion alternative asset manager whose stock trades on the NYSE, permanently halted redemptions at OBDC II, its retail-focused private credit fund, reversing a promise made just weeks ago to resume normal quarterly withdrawals. To raise liquidity, Blue Owl sold $1.4 billion in credit assets, including 30% of OBDC II's total portfolio.

Redemption pressure had been building for months. The fund's co-CEO said publicly on February 5th that he saw no red flags in the loan book. The fund's largest single industry exposure is internet software and services, exactly the segment of the credit market most directly in the path of AI-driven disruption.

Credit stress rarely announces itself cleanly. It shows up first in redemption queues and rushed asset sales, in the gap between what managers say publicly and what they do two weeks later. Bitcoin has been pricing this dynamic for months. Blue Owl is the first concrete confirmation that the alarm was warranted.

Sovereign Capital Is Reading the Same Setup

The 13F filings released this week deserve more than a passing glance. Abu Dhabi's Mubadala Investment Company increased its position in BlackRock's iShares Bitcoin Trust ETF by 46% in Q4 2025, bringing its holding to 12.7 million shares as of December 31. The Abu Dhabi Investment Council, an independently-run Mubadala unit, added to its position as well, reaching 8.2 million shares. Their combined stake exceeded one billion dollars at period end.

The timing and the framing tell the real story. These purchases were made into bitcoin price weakness. A spokesperson for ADIC described bitcoin as "a store of value similar to gold" and framed the allocation as part of a long-term diversification strategy. That language reflects the output of a multi-year asset allocation review, structural conviction, and the kind of patience that sovereign mandates uniquely allow.

Sovereign wealth funds do not chase performance. They underwrite scenarios over decade-long horizons and size positions to match conviction. Mubadala meaningfully increasing a bitcoin position during a drawdown reflects an analytical conclusion about where bitcoin fits in a world of expanding fiat supply and eroding reserve currency credibility, and they are putting capital behind it while retail investors are heading for the exits.

Patience Is the Position

The environment taking shape is the one long-term bitcoin holders have been preparing for. Fiat credit systems under stress, a Fed with limited options, and a banking system that historically gets one response when things get bad enough.

Blue Owl locking retail investors out of a private credit fund this morning, while sovereigns quietly build bitcoin allocations which they describe in the same language as gold, captures the broader picture.

The credit cracks are visible. The sequence that follows is familiar. And the most patient capital in the world is accumulating through the volatility rather than running from it.

Long-term holders who have done the same work and reached the same conclusions have no reason to behave differently. The thesis has not changed. The evidence behind it keeps compounding.

Chart of the Week

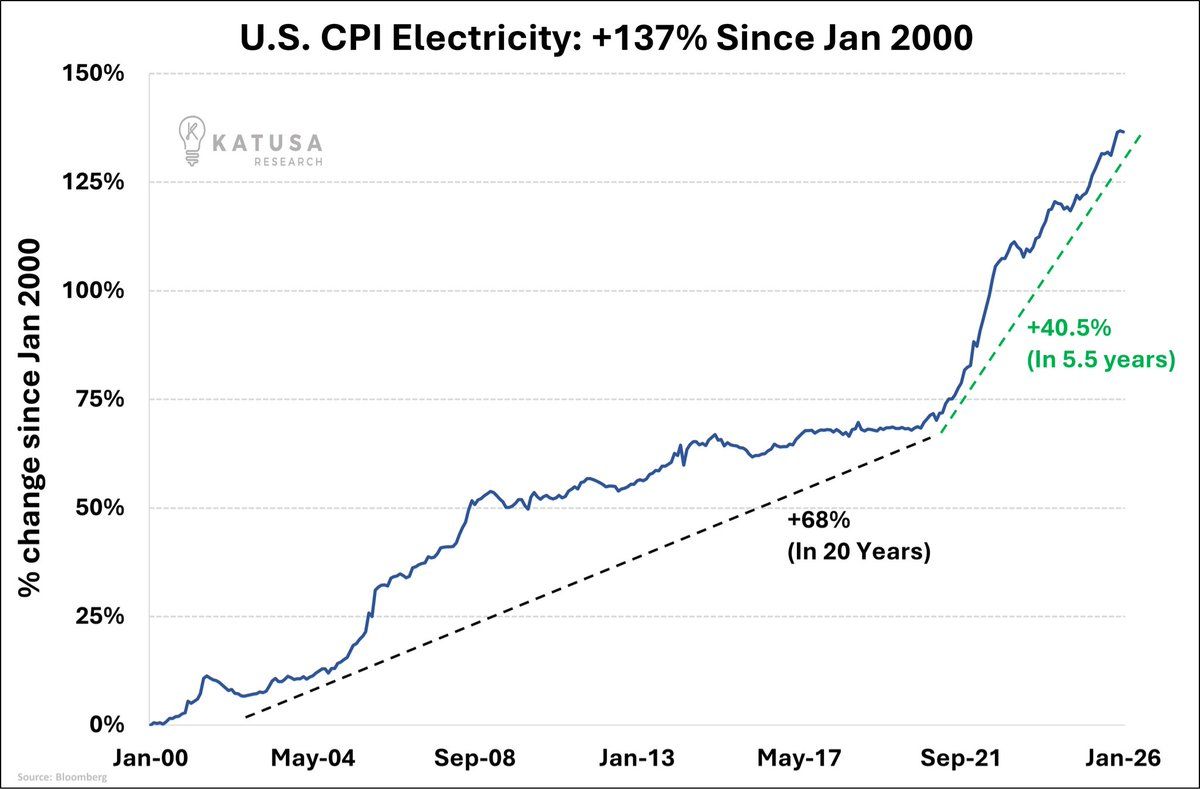

"It took 20 years for US electricity prices to rise 68%. Then it took 5.5 years to add another 40%. Now add AI data centers, EVs, and a grid built for 1985. This line probably won’t flatten."

— Katusa Research on X

Quote of the Week

"What they called the 'Nixon Shock' was really the death of economic calculation itself. By severing the last link between money and gold, Nixon didn't just close a 'window' - he obliterated the pricing mechanism that had guided human cooperation for millennia."

— Handre van Heerden on X

Podcasts of the Week

Bitcoin Is Down 50% and No One Knows Why

The Last Trade: Onramp COO Nick DeLozier joins the crew to break down bitcoin's mysterious 50% drawdown, record-high global uncertainty, the stablecoin Trojan horse thesis, and what's next for multi-institution custody.

OpenClaw Takeover & the Agentic AI Revolution

Final Settlement: OpenAI's acqui-hire of OpenClaw, why AI data sovereignty mirrors the bitcoin custody barbell, the stablecoin-first path to agentic commerce, and why Ray Dalio just described the perfect backdrop for a million-dollar bitcoin without naming it.

Bloomberg Analyst: Everyone Says Bitcoin Is Dead — Here's Why They're Wrong

The Last Trade: Eric Balchunas of Bloomberg breaks down bitcoin's brutal drawdown, why 94% of ETF investors aren't selling, the "silent IPO" of OG holders, and the macro case for what comes next.

Tether's Sovereign Empire, Collapsing Bank Barriers, & AI Bots Using BTC

Final Settlement: Tether's retreat from a $20B raise, how a stablecoin company became a sovereign-grade hard asset empire, why Palmer Luckey-backed Erebor getting a national banking charter signals the end of legacy financial rails, and what $4.6B in Visa stablecoin volume means for bitcoin-native firms.

Paper Games, DAT Reckoning & BTC's Silent Clock

In Episode 23 of The ₿roadcast: Bram Kanstein, Brian Cubellis, and Michael Tanguma break down the most important bitcoin and macro developments from the past few weeks.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis