2/5/26 Roundup: Nobody Controls Bitcoin

Brian Cubellis | Chief Strategy Officer

Feb 5, 2026

Before we get started…

On Thursday, February 12th at 12pm EST, we are hosting a webinar focused on individuals: Bitcoin Ownership for the Long Term: Custody, Inheritance, and Financial Services.

We will walk through the full range of ways Onramp supports individual bitcoin holders, from multi-institution custody to IRAs, bitcoin-backed loans, dynasty trusts, inheritance planning and more. Whether you are evaluating custody solutions or helping family members think through long-term bitcoin ownership, this session will cover the landscape.

[Register for the Webinar]

Lastly, find this newsletter valuable? Please forward it to someone in your personal or professional network.

And now, for the weekly roundup…

A Note on Price

Bitcoin dove below $70k this morning. Drawdowns like this are never comfortable. But this is the deal. Volatility is the price of admission. Nothing about the network has changed. The protocol is intact. The supply schedule still holds. The same 21 million coins. Your dollars just buy more of them now. Low time preference is easy to talk about when the price is going up. It is defined by what you do when the price is going down.

Nobody Controls Bitcoin

Every so often the narrative cycle produces a new version of the same old question: who really controls bitcoin?

The specifics change. Sometimes the question is about who Satoshi was. Sometimes it concerns who funded early development. Sometimes the focus shifts to which companies employ core developers, or which mining pools dominate hashrate. But the implication is always the same: that bitcoin is secretly controlled by some hidden hand, and that you should be worried.

The concern is understandable. If bitcoin is going to function as the foundation of a new monetary system, the question of control matters. But the answer, once you understand how bitcoin actually works, is definitive.

Nobody controls bitcoin. And that outcome was engineered deliberately from the very beginning.

Bitcoin Is a Protocol, Not a Product

Bitcoin has no CEO, no board of directors, no headquarters, and no customer support line. It is a protocol: a set of rules that computers follow to reach consensus on the state of a shared ledger.

Bitcoin belongs to the same category as language, mathematics, or the internet. No one owns the English language. No one controls arithmetic. No government granted permission for the internet to exist. These are tools and systems that emerged, spread, and became embedded in civilization because they are useful, open, and neutral. Bitcoin is an open protocol for transmitting and storing value that anyone can use, anyone can verify, and no one can commandeer.

The Code Is Open

Every line of bitcoin's code is publicly available for anyone in the world to read, audit, and scrutinize. This was a design requirement from day one. As Satoshi wrote in the earliest days of the project:

"Being open source means anyone can independently review the code. If it was closed source, nobody could verify the security. I think it's essential for a program of this nature to be open source."

No single developer, company, or funding source can unilaterally change the protocol. Proposed changes must survive extensive peer review and achieve overwhelming consensus among the network's node operators before activation.

The history of bitcoin is littered with failed attempts to force changes that lacked this consensus. The most famous example is the 2017 SegWit2x effort, which was backed by the largest mining companies and exchanges in the industry and still failed because the node operators rejected it.

The developers write the code. The nodes enforce the rules. And the nodes answer to no one but the individuals who run them.

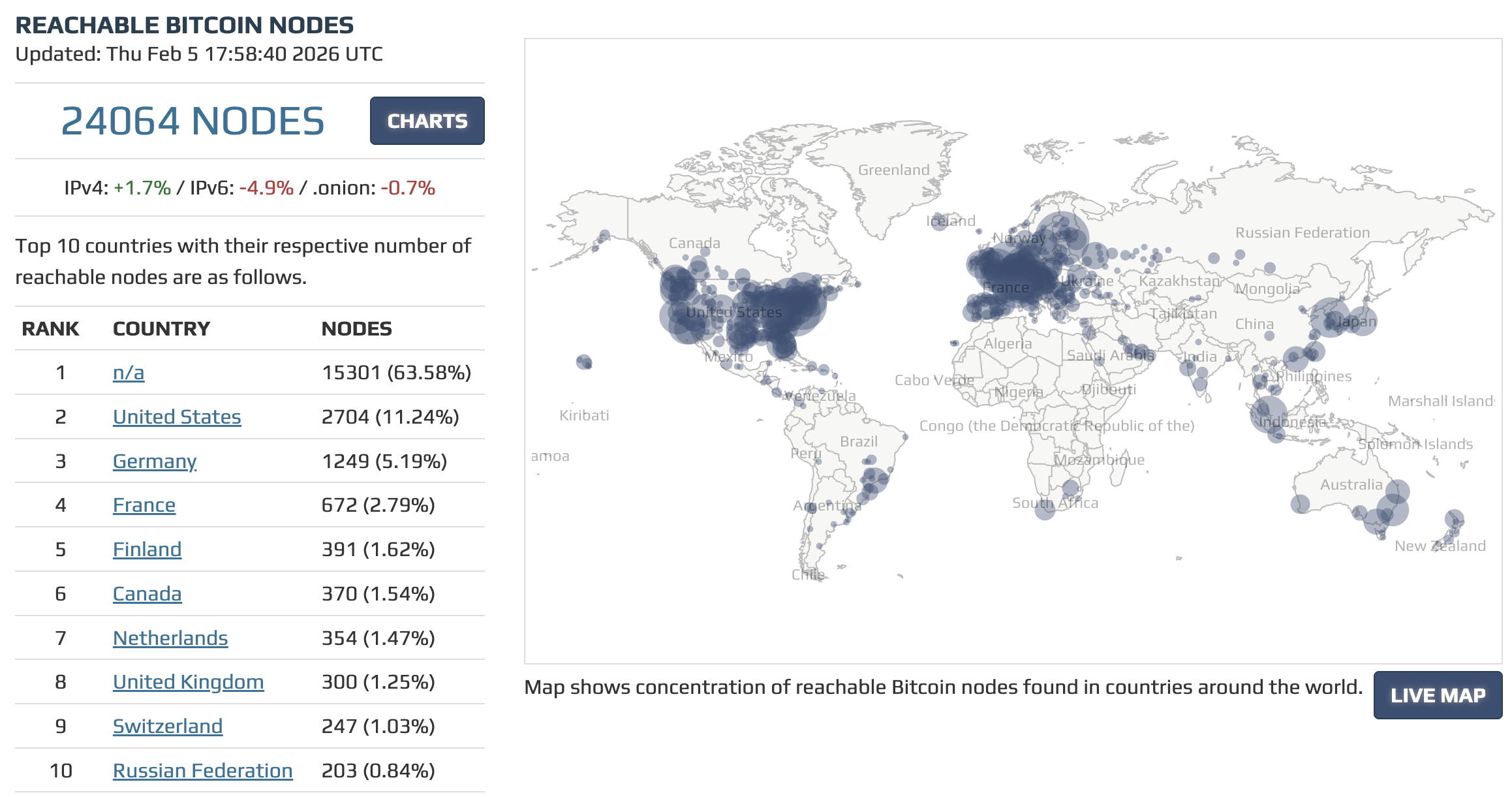

24,000 Independent Referees

As of early 2026, there are approximately 24,000 reachable bitcoin nodes operating across more than 150 countries. Each node independently validates every transaction and every block against the protocol's consensus rules. If a miner produces a block that violates the rules, every node on the network will independently reject it. No committee decides which transactions are valid. No authority can change the rules. There is no backdoor.

You can run a bitcoin node on a device that costs less than $200. When you do, you are not trusting anyone. You are verifying everything yourself. This is the meaning of the phrase "don't trust, verify." It is a literal description of how the system works.

Mining Is Global and Competitive

Bitcoin's proof-of-work mining network is the largest deployment of computational power dedicated to a single purpose in the history of the world. Mining operations span dozens of countries, from the United States and Canada to Russia, China, Kazakhstan, and across Latin America and Africa.

No single mining pool controls a majority of hashrate. The competitive dynamics of mining ensure that no single actor can maintain dominance for long. If any pool approaches a concentration that threatens the network, miners defect. The incentives are aligned to preserve decentralization.

More importantly, miners do not set the rules. Miners propose blocks. Nodes validate them. A miner who attempts to produce an invalid block wastes enormous amounts of energy and capital with nothing to show for it. The economic incentive to play by the rules is overwhelming, and the cost of attacking the network is astronomical, currently requiring tens of billions of dollars worth of specialized hardware and energy that would be rendered worthless in the attempt.

The Identity of the Creator Does Not Matter

One of bitcoin's most elegant features is that its creator's identity is completely irrelevant to its function. Satoshi Nakamoto could be a single individual, a group of researchers, or a government project. The code is open. The rules are transparent.

The value of the dollar depends on the credibility and decisions of the Federal Reserve. The value of gold depends on the geology of the earth and the economics of extraction. Bitcoin's value proposition is encoded in mathematics and enforced by a distributed network that no single entity, including its creator, can alter.

Satoshi understood this, and it is almost certainly why they chose to remain anonymous and eventually disappear from the project entirely. The system was designed to function without a leader. The creator's departure was the ultimate proof of concept.

Early Funding Does Not Equal Control

A related misconception is that whoever funded early bitcoin development somehow controls the protocol. This misunderstands the nature of open-source software at a fundamental level. Funding a developer's salary does not give you control over what they build when the code is public, the review process is open, and deployment requires network-wide consensus.

Hundreds of individuals and organizations have contributed resources to bitcoin development over the years, from academic institutions and nonprofits to venture-backed companies and anonymous donors. The funding landscape has only grown more diverse over time. Today, organizations like Brink, Spiral, OpenSats, the Human Rights Foundation, and dozens of companies independently fund bitcoin developers with no ability to dictate protocol outcomes.

But even if every funder had malicious intent, an absurd hypothetical, the protocol's open-source, consensus-driven architecture would prevent them from exerting control. The code is auditable. Changes require consensus. The nodes enforce the rules. There is simply no vector for a funder to compromise the system through financial influence alone.

Think of it this way: various governments, corporations, and institutions have funded research into the mathematics of cryptography for decades. That does not mean they control cryptography. The same principle applies to bitcoin. The protocol's integrity does not depend on the virtue of its contributors. It depends on the transparency of its code and the decentralization of its enforcement.

Fire Does Not Have a Board of Directors

There is a class of human discoveries and inventions that, once released into the world, belong to no one. Fire. The wheel. Language. Writing. Mathematics. The printing press. The internet.

These are technologies and systems that are too fundamental, too widely distributed, and too deeply embedded in human civilization to be controlled by any single entity. Bitcoin is the latest addition to this list. It is a protocol for finite, digital, bearer value, a concept that, once invented, cannot be uninvented. You cannot put this genie back in the bottle any more than you can uninvent the written word.

The network has operated with near-perfect uptime since January 3, 2009. More than seventeen years. It does not require permission. It has no kill switch. By design, it is the most neutral, apolitical monetary infrastructure ever constructed.

The Real Question

The question of who controls bitcoin is settled. No one does. The system was architected specifically to eliminate vectors of control and influence. Its security model does not depend on trust in any individual, organization, or government. It depends on mathematics, transparency, and distributed consensus.

The better question is whether you understand what that means.

For the first time in human history, it is possible to store and transmit value without requiring permission from or trust in any third party. The 21 million supply cap is not a promise made by a company that could break it. It is a mathematical certainty enforced by tens of thousands of independent nodes across the globe. No scandal, no revelation, no personnel change, and no funding controversy can alter the protocol's fundamental properties.

Bitcoin is neutral infrastructure. It does not care who created it, who funded it, or who uses it. It enforces its rules, equally and transparently, for everyone.

Chart of the Week

Reachable Bitcoin Nodes (Bitnodes)

Quote of the Week

"Once every 4 years, bitcoin crashes & fiat casino traders trot out a chart of the last month to gloat, hoping it'll erase the pain of spending years trading & staring at charts only to be down 80% in bitcoin terms, underperforming all hodlers who live their life chart-free."

— Saifedean Ammous on X

Podcasts of the Week

Gold Is Running Ahead — Bitcoin Is Next (The Great Rotation Explained)

The Last Trade: Gold and silver surge while bitcoin stalls — Mel Mattison unpacks the macro divergence, the Clarity Act's failure, and why the fundamental case for non-USD assets is only getting stronger.

Elon Says the Singularity Is Here — Why That Sends Bitcoin to $1M+

Final Settlement: We welcome back Cam Doody (Brickyard VC) to connect the dots between AI deflation, self-replicating robots, stablecoins, and why bitcoin may be the only rational savings vehicle in a post-singularity world.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis