Roundup: America Embraces Bitcoin

Brian Cubellis | Chief Strategy Officer

Mar 13, 2025

America Embraces Bitcoin

On March 6, 2025, President Donald Trump issued an Executive Order creating a U.S. Strategic Bitcoin Reserve (SBR)—a move that instantly catapults bitcoin into the realm of national reserve assets.

Under the order, seized bitcoin from criminal and civil forfeiture proceedings will seed the reserve, while the Treasury and Commerce Departments explore budget-neutral ways to acquire more bitcoin. In doing so, the United States—the world’s foremost economic power—has placed an emphatic stamp of legitimacy on bitcoin.

Why This Announcement Is Monumental

- From Speculation to Sound Money: For years, bitcoin was viewed through the lens of high-risk, “tech-driven” speculation. Now, the U.S. government explicitly recognizes bitcoin as a strategic reserve asset—positioning it alongside gold and other risk-off assets. This shift aligns with what many investors have long argued: that bitcoin is fundamentally sound money, not merely a “risk-on” technology play.

- Defining Bitcoin vs. ‘Crypto’: The executive order also creates a separate Digital Asset Stockpile to handle other seized cryptocurrencies—implying the government may sell those assets while it plans only to acquire and hold bitcoin. This distinction was echoed by White House AI & Crypto Czar, David Sacks’ commentary suggesting that bitcoin’s special status (no issuer, digital commodity, store of value) sets it apart from the myriad of altcoins. In short, the White House is signaling that bitcoin is uniquely qualified as a “risk-off reserve asset,” whereas other cryptos remain speculative technology experiments.

- A Path to Broader Trust and Adoption: By endorsing bitcoin at the highest level of government, the administration effectively lowers the barrier for everyday people who might otherwise be wary of “crypto.” The SBR initiative provides a credible, government-backed narrative: bitcoin is an asset one can hold with confidence, distinct from the uncertainty plaguing the broader crypto sector.

- Reinforcing Bitcoin’s Credibility: Sovereign-level endorsement underscores bitcoin’s core properties—finite supply, decentralized governance, robust security—making it more palatable for mainstream finance.

While short-term market reaction was mixed (some traders expected the U.S. to begin buying immediately), the longer term horizon is incredibly positive for institutional acceptance and broad-based adoption of bitcoin as a safe-haven asset.

Recapping the 'Bitcoin for America' Summit in Washington D.C.

One week after the executive order, the Bitcoin Policy Institute hosted its “Bitcoin for America” summit in the nation’s capital. The event—attended by policymakers, industry leaders, and legal experts—provided fresh insights into how lawmakers aim to integrate bitcoin into the U.S. financial system.

Key Speakers & Announcements

- Senator Cynthia Lummis: A longtime advocate for bitcoin, she reaffirmed her commitment to bipartisan legislation clarifying bitcoin’s status as a digital commodity. Her remarks echoed the administration’s emphasis on treating bitcoin as fundamentally different from other tokens.

- Legislative Enthusiasm: Multiple panels spotlighted rising bipartisan support for bitcoin-focused bills, such as the BITCOIN Act. Attendees expressed optimism that 2025 will see a wave of pro-bitcoin policy, possibly including simplified tax rules and stablecoin oversight.

- Industry & Policy Alignment: Representatives from major financial institutions, tech companies, and mining operations signaled strong support for the White House’s SBR initiative. Many predicted that formal government backing would draw in new waves of conservative capital—chiefly from pension funds and corporate treasuries—further legitimizing bitcoin’s role in the broader economy.

A New Era for Bitcoin

The U.S. Strategic Bitcoin Reserve marks a pivotal point in bitcoin’s evolution from edgy digital experiment to sovereign-grade asset. By openly distinguishing bitcoin from the rest of crypto—and articulating strategies to acquire it at no taxpayer expense—the federal government has made it easier for ordinary investors, as well as institutions, to view bitcoin through a “sound money” lens.

At Onramp, we’ve always stood behind a bitcoin-only approach—emphasizing the only digital asset that meets the strict criteria of credible neutrality, finite supply, and global acceptance. This executive order, coupled with the upbeat sentiment at “Bitcoin for America,” only strengthens our conviction that bitcoin is poised for mainstream, long-term adoption.

As Washington’s enthusiasm aligns with market realities, the foundation is laid for more robust, transparent, and secure participation in the digital age of sound money.

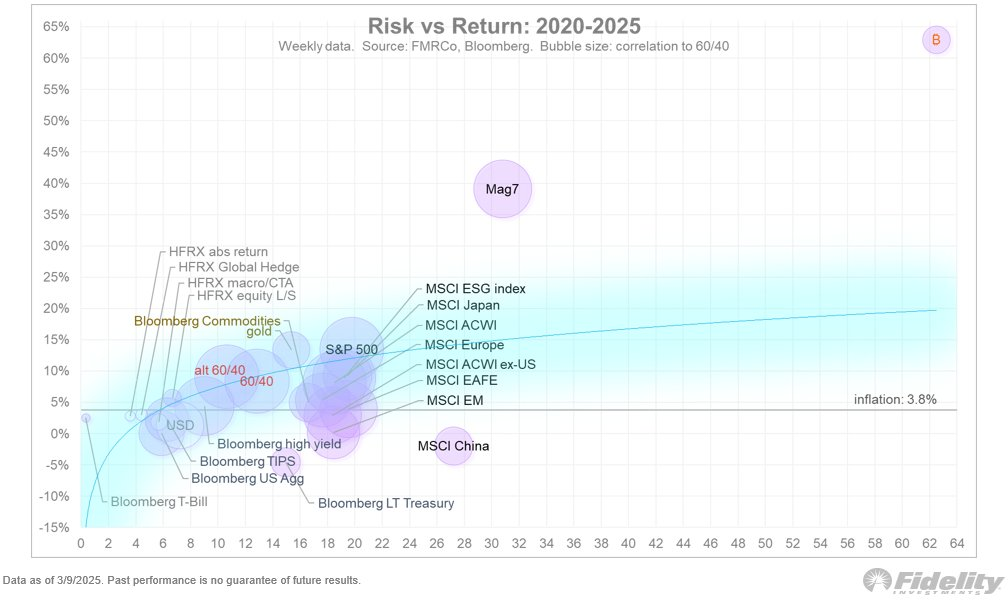

Chart of the Week

“The following chart (showing annualized volatility vs annualized return since 2020) shows just how outsized the Mag 7 and Bitcoin’s returns have become during the past 5 years.”

— Jurrien Timmer, Director of Global Macro at Fidelity

Quote of the Week

“It is the most powerful force in the world right now, it’s growing nearly 60%, it’s become the 8th largest asset in the world, it’s about to become the largest asset in the world in the next 48 months.”

— Michael Saylor at the Bitcoin for America summit in DC

Podcasts of the Week

Everything’s Bigger in Texas: Front Running the U.S. SBR with Lee Bratcher

In this episode of The Last Trade, we’re joined by Lee Bratcher, President of the Texas Blockchain Council to discuss strategic bitcoin reserves, federal & state legislative processes, the status of the Texas SBR bill, education & custodial challenges & more!

The Hurdle Rate Has Changed: Why America is Embracing Bitcoin

In this episode of Final Settlement, we’re joined by Chase Palmieri, CEO of Acroplis, & Tim Kotzman, to discuss last week’s SBR Executive Order, Acropolis & corporate adoption, the Bitcoin for America conference, stablecoins & bitcoin banks, bitcoin as the hurdle rate & more!