4/17/25 Roundup: The Great Learning

Brian Cubellis | Chief Strategy Officer

Apr 17, 2025

The Great Learning

Why Now Is the Best Time to Understand Bitcoin

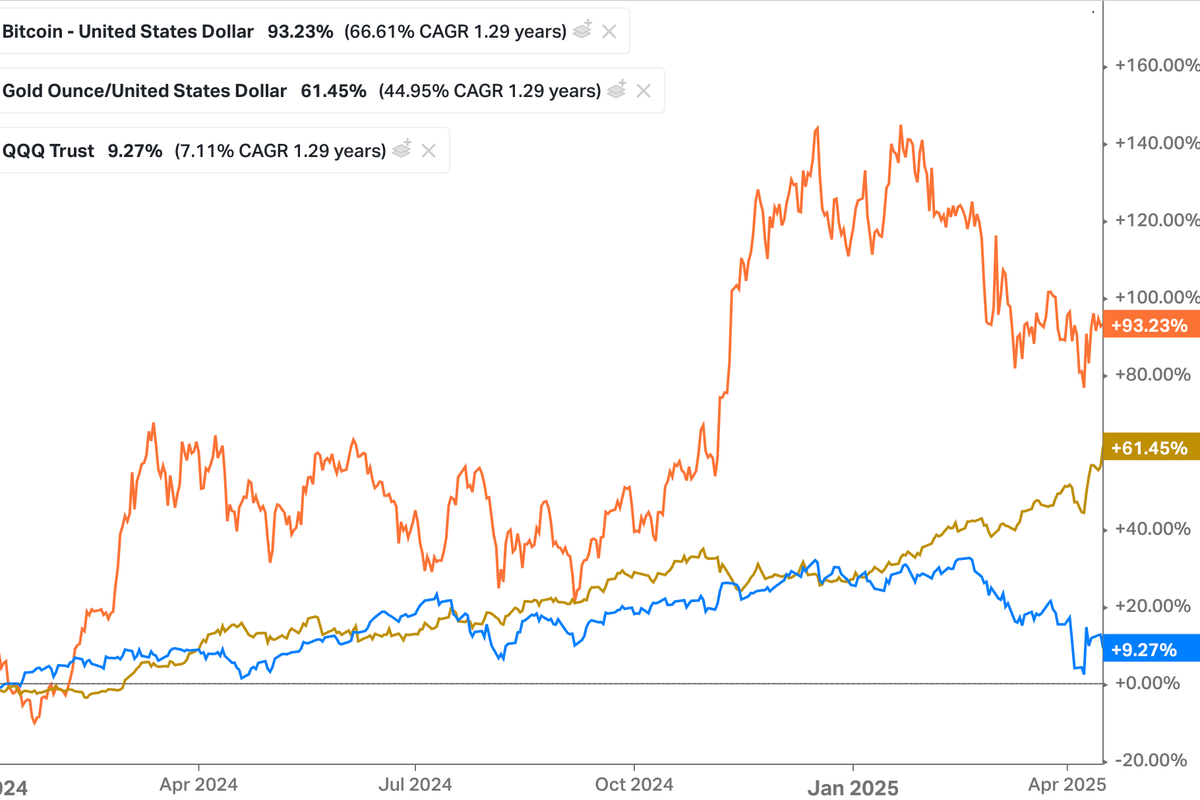

Beyond ‘The Great Decoupling’

In recent weeks, much attention has been paid to whether bitcoin is “decoupling” from conventional markets. While that conversation has merit, it arguably pales next to a more profound shift—a rapid, large-scale educational awakening about bitcoin’s true nature.

“The Great Learning” marks the beginning of a new era characterized by individuals, asset owners, and finance professionals coming to understand bitcoin’s true potential as a risk‑off store of value. Thanks to technological advances with AI tooling, the proliferation of educational resources, global monetary shifts, and increasing regulatory tolerance, there has never been a better time for anyone—novice or seasoned investor—to explore bitcoin.

Bitcoin’s Learning Curve Has Flattened

The path to understanding bitcoin was once long and steep—potentially requiring hundreds of hours trawling through forums, whitepapers, and contradictory headlines. Today, the resources are both abundant and accessible. Books, podcasts, research portals, and open courseware demystify bitcoin’s mechanics.

Where old narratives used to paint it as risky or ephemeral, new voices and data highlight its resilience and evolving utility. That means the educational runway is significantly shorter, and newcomers can grasp bitcoin’s essence faster than ever.

Bitcoin Has Been De-Risked

Government Stance Codified: Far from banning bitcoin, many nations—and especially the United States—are steadily legitimizing it. With a Bitcoin Strategic Reserve in place, America’s shift is crystal clear. Treasury Secretary Bessent, previously known as a “gold bug” from his days on Wall Street, now speaks of bitcoin in the same breath as gold. Major economies no longer treat bitcoin as an existential threat—citizens can legally save in bitcoin without fear of a blanket ban.

Environmental Myths Dispelled: The old argument that “bitcoin kills the planet” is losing steam, replaced by evidence that bitcoin mining can actually spur renewable energy innovation and reduce waste.

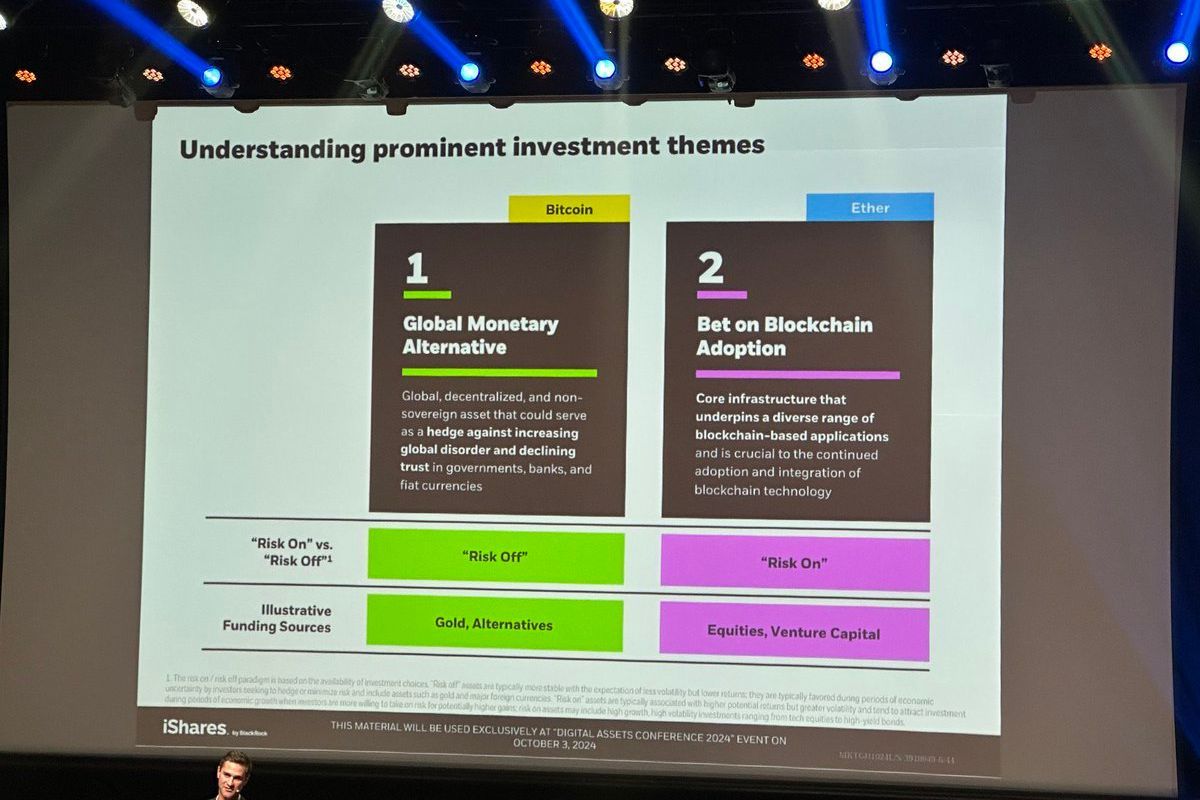

Perceived Toxicity Waning: With the largest asset managers in the world, like BlackRock, legitimizing and educating investors on the asset, the Overton Window has shifted meaningfully. Bitcoin is progressive and egalitarian in nature, a fair open-source tool for humanity and financial freedom.

Put simply, much of the fear, uncertainty, and doubt (FUD) that once clouded bitcoin has dissipated, and mainstream adoption is ramping up.

From Asset Managers to Individuals: A Universal Call

Consider the wide range of people and institutions who are now exploring bitcoin’s role as a store of value:

Savers and Families: Many everyday individuals, wary of inflation or seeing the writing on the wall post-2020, are turning to bitcoin as a savings instrument.

Asset Holders & Fiduciaries: As the debate around sovereign debt and currency debasement intensifies, multi-asset portfolios now seriously consider bitcoin.

Traditional Finance Professionals: The stigma around bitcoin’s volatility is evolving into respect for its sound money principles and growing acceptance in corporate treasuries.

In other words, The Great Learning is crossing demographic and institutional lines.

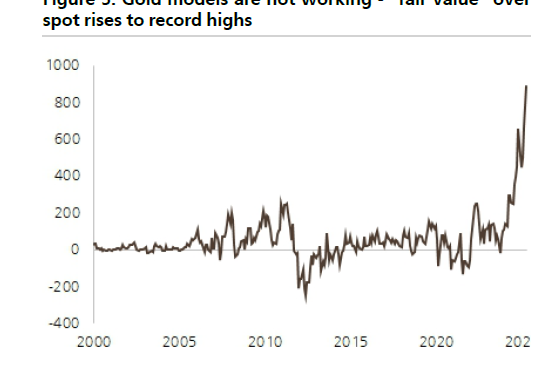

The Signal of Gold’s Continuous All-Time Highs

Gold’s unrelenting surge to new record highs provides a powerful case study in monetary properties. As the global landscape becomes more uncertain—heightened geopolitical tensions, shifting trade alliances, and waning trust in traditional currencies—gold’s neutral, debasement-resistant nature draws capital seeking safety. This highlights a broader truth: in a multipolar world with declining institutional trust, hard assets with objective monetary properties are flourishing.

But the gold rally can also hasten The Great Learning for bitcoin. If a “shiny rock” with limited utility is outperforming risk assets largely thanks to its hard money attributes, how much more potential might an infinitely more portable, divisible, and censorship-resistant protocol have? For many, contemplating gold’s appeal naturally leads them to question: If gold is winning right now, wouldn’t a ‘digital gold’ also thrive—potentially even more so?

An Apex Protocol, Distinct From ‘Crypto’

In contrast to the broader “crypto” space, bitcoin is an apex protocol built on the foundational properties of scarcity, security, and decentralization. It doesn’t vie for “killer apps” or pivot narratives weekly; it simply functions as a global, censorship-resistant store of value. This purposeful simplicity lets it outperform and outlast fleeting crypto trends, aligning more with the “digital gold” thesis that resonates with large-scale investors.

Why Now? The World Is Changing

Global Monetary Confidence Erodes: Post-2022, freezing Russia’s treasuries and the subsequent wave of currency uncertainties have shaken trust in fiat.

A Shift to Hard Assets: Gold’s resurgence illustrates the appeal of tangible stores of value. Bitcoin, as “dematerialized gold,” meets this same need with even greater scarcity, portability, and divisibility.

A Multipolar World: As globalization recedes and trust in institutions wanes, bitcoin thrives as a neutral alternative that no single nation can debase or seize.

The Great Learning Is Here

Regardless of short-term price fluctuations, the likelihood of various cohorts of capital taking the steps to deeply understand bitcoin is greater than ever before. Once dismissed as niche or speculative, it’s now supported by a tapestry of research, real-world adoption, and official sanction.

For those who once believed bitcoin was “toxic” or “a Ponzi,” the moment to revisit those assumptions has arrived. Bitcoin is severely mispriced at ~$84k if you view it as a cornerstone of future monetary systems. With educational tools abundant and FUD receding, we’re entering a new era where grasping bitcoin’s fundamentals comes more naturally than ever before.

The Great Learning is upon us. The only question is whether you—be it as an individual saver, a professional investor, or an institution—are ready to make the most of it.

Chart of the Week

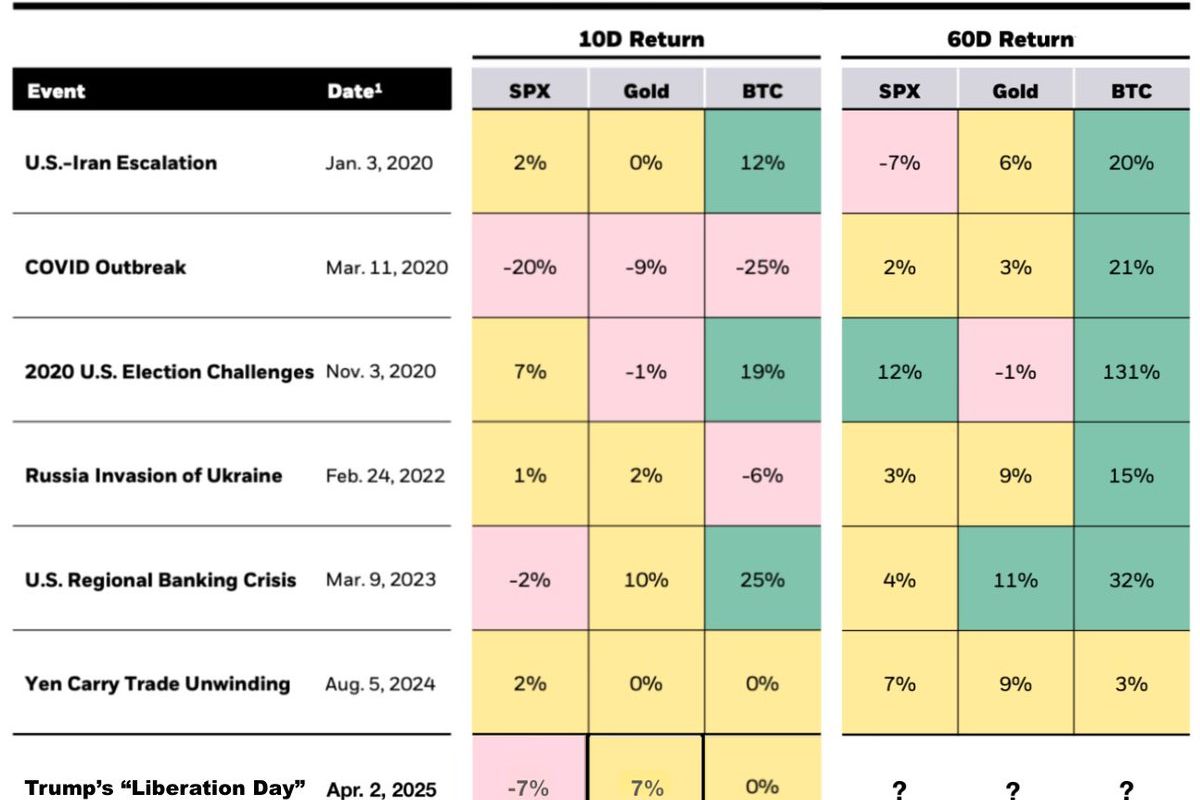

"Updated this table from BlackRock. Bitcoin has held up relatively well amid the uncertainty. Let's see where things stand at Day 60."

Quote of the Week

"BITCOIN IS AN ASYMMETRIC OPPORTUNITY BASED ON PUBLICLY AVAILABLE INFORMATION."

Podcasts of the Week

The Great Reset Is Underway: Trade War, Treasury Risk, & Bitcoin's Ascent

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, Brian Cubellis, & Tim Kotzman are joined by Peruvian Bull to to recap a volatile week across markets, his recent trip to Japan, debt, global liquidity & more!

The New Ponzi Stack? Solana Treasuries, Stablecoins, & Crypto Exit Games

In this episode of Final Settlement, hosts Brian Cubellis, Michael Tanguma, & Liam Nelson discuss the latest deals and news items of the week across bitcoin, technology, and venture capital.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis