Roundup: Post Tariff Stress Disorder

Brian Cubellis | Chief Strategy Officer

Apr 3, 2025

Post Tariff Stress Disorder

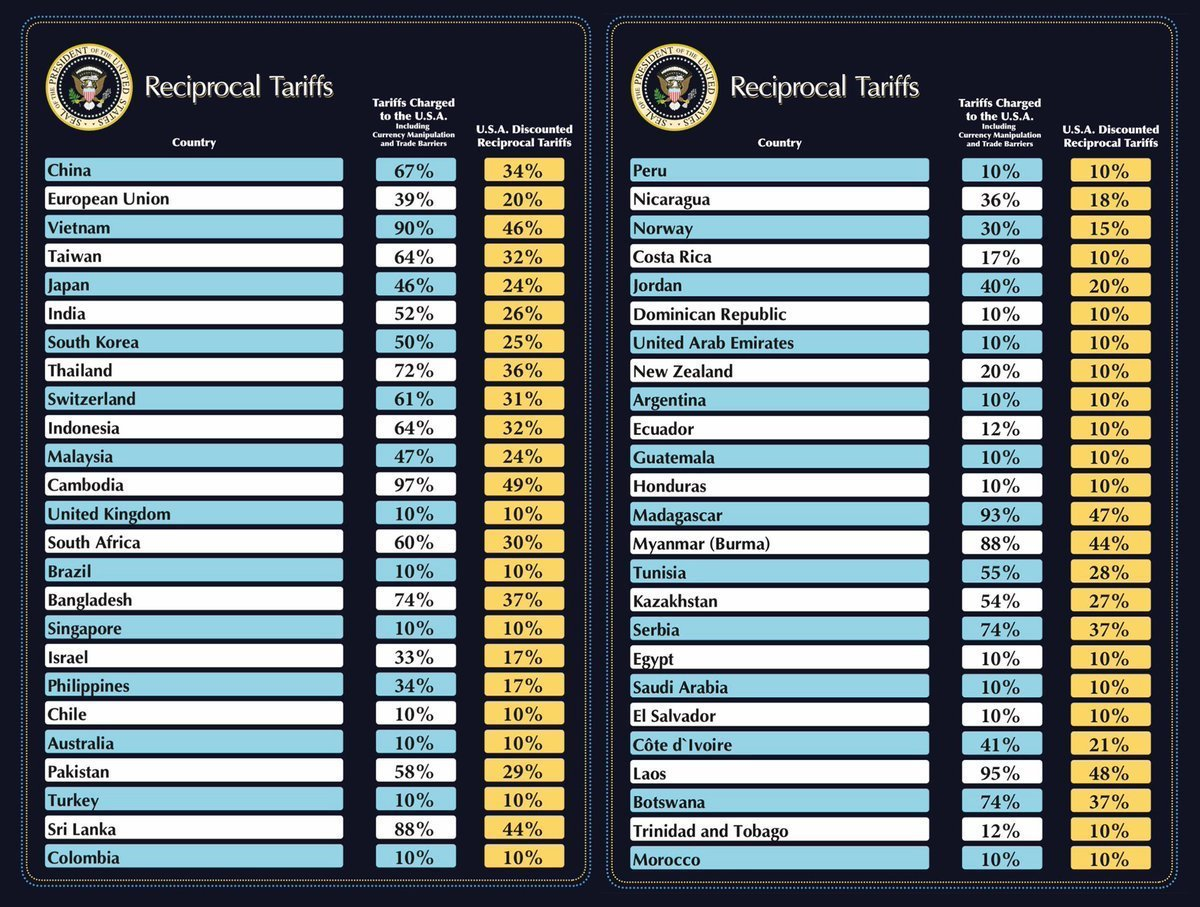

President Trump’s newly unveiled tariffs have further extended the uncertainty and volatility that had been building in anticipation of these measures, as investors now grapple with potential retaliation, disrupted supply chains, and evolving economic data.

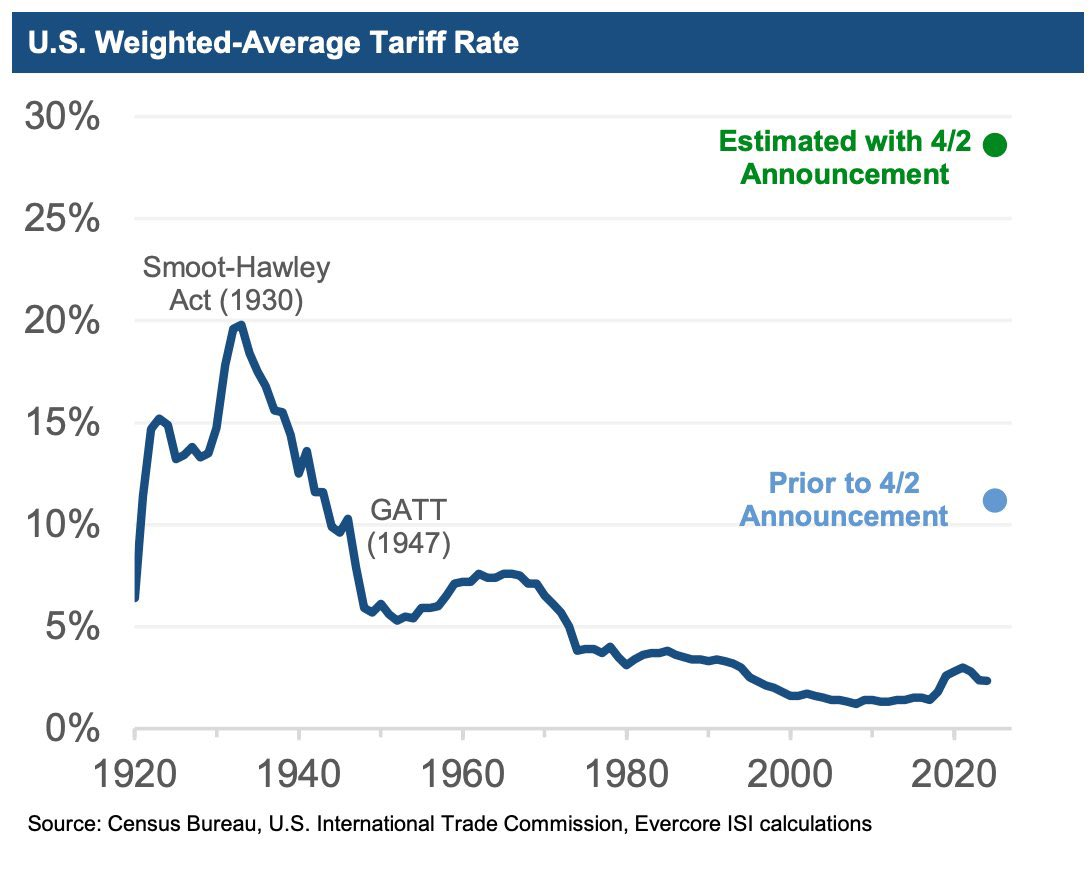

The U.S. has embarked on one of its most sweeping protectionist policies since the 1930s, with the stated goals of reshoring manufacturing in America and raising external revenues to offset the need for income taxes (plus perhaps the unstated goal of causing enough economic disruption to force the Federal Reserve’s hand to cut interest rates).

Anyone who insists they fully know how these moves will play out isn’t being intellectually honest—the economic, political, and monetary conditions are vastly different now than during past tariff regimes.

While the Fed’s next moves may hinge on inflation signals, the broader consensus among policymakers—both in the U.S. and overseas—remains inclined toward monetary easing whenever growth or financial stability is threatened.

Unlike fiat currencies (and most traditional assets) entangled in these geopolitical frictions, bitcoin remains a stateless asset with a finite supply—operating as a global settlement layer free from direct political control or devaluation. In fact, when trade barriers and competitive devaluations intensify, bitcoin’s value proposition only strengthens: it stands outside the system, insulated from currency wars that diminish purchasing power.

Regardless of whether these measures end up fueling inflation or suppressing growth (or both, i.e. stagflation), central banks’ inevitable liquidity interventions remain the deeper story—solidifying the appeal of hard, non-sovereign assets like bitcoin.

Tariffs and the Liquidity Feedback Loop

Tariffs may drive up production costs and could dampen economic activity, prompting central banks to offer liquidity and credit support. While the timing is uncertain, the Fed stands ready to shore up markets even if reported inflation numbers remain elevated.

This might appear counterintuitive—typically, higher inflation deters rate cuts—but in a scenario where cost-push inflation collides with growth fears, the Fed (and other central banks) may still opt to increase liquidity rather than risk a deeper contraction.

Retaliatory tariffs from other nations raise the specter of competitive devaluations. If major economies resort to quantitative easing to sustain export competitiveness or mitigate financial stress, global fiat creation surges. In such a climate, bitcoin’s 21-million cap becomes an even stronger anchor for those seeking a monetary asset free from political manipulation.

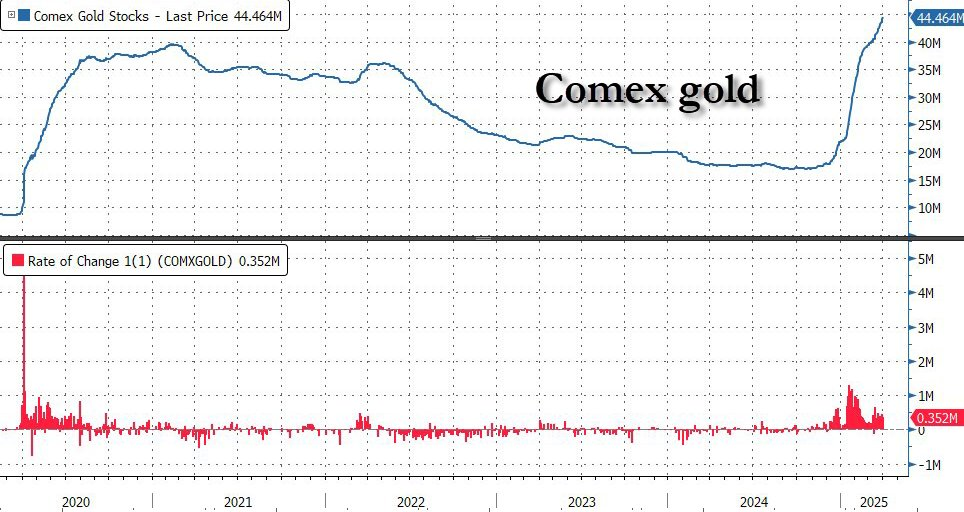

Gold as the Early Signal

Gold’s recent climb to all-time highs highlights broader market concerns over currency stability. Historically, gold’s movement has foreshadowed major bitcoin rallies by a matter of weeks or months. As gold remains the first-line safe haven, bitcoin follows suit—increasingly recognized as “digital gold” that offers mobility, divisibility, and minimal counterparty risk.

Bitcoin’s Asymmetric Opportunity

An ever growing cohort of nation-states, corporates, and individuals view bitcoin’s finite supply and global neutrality as strategic advantages in an era of debt-laden fiat systems. In a tariff-fractured global economy leaning on repeated liquidity interventions, this scarcity endows bitcoin with an appeal unmatched by politically governed monetary units.

Regardless of whether tariffs produce higher or lower official inflation, central banks frequently err on the side of monetary expansion to safeguard growth and financial stability. Gold’s rise to new records signals investors’ hedging instincts against ongoing fiat debasement. Bitcoin, the next evolution of safe-haven assets, stands to follow and potentially amplify gold’s trajectory.

In a world of fluid trade barriers and relentless money printing, bitcoin’s non-sovereign, capped supply anchors its role as a compelling store of value—unshackled from the policy decisions and fiscal experiments that leave fiat in an ever-weakening position.

Chart of the Week

“Gold is exploding higher, blowing past all records as dollar disintegrates in thin Asian trading on global recession panic (dollar smile reversion will kick in soon but not just yet). Meanwhile, panic hoarding of physical won’t stop with record 44.5mm oz delivered to the Comex.”

Quote of the Week

“The U.S. has benefited from the dollar serving as the world’s reserve currency for decades. But that’s not guaranteed to last forever. The national debt has grown at three times the pace of GDP since Times Square’s debt clock started ticking in 1989. This year, interest payments will surpass $952 billion—exceeding defense spending. By 2030, mandatory government spending and debt service will consume all federal revenue, creating a permanent deficit.

If the U.S. doesn’t get its debt under control, if deficits keep ballooning, America risks losing that position to digital assets like Bitcoin.”

— Larry Fink’s 2025 Annual Chairman’s Letter to Investors

Podcasts of the Week

Meme Meets Macro: GameStop Eyes a Bitcoin Treasury Strategy

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, Brian Cubellis, & Tim Kotzman discuss GameStop’s bitcoin strategy, corporate adoption trends, realities of inflation & debasement, the flurry of stablecoin launches & more!

Are Bitcoin Treasury Companies the New Altcoin ICOs?

In this episode of Final Settlement, hosts Brian Cubellis, Michael Tanguma, & Liam Nelson discuss key deals of the week, bitcoin treasury company proliferation, nation-state hashrate accumulation, stablecoins, traditional banking & more!