7/31/25 Roundup: A Foundation, Not a Finale

Brian Cubellis | Chief Strategy Officer

Jul 31, 2025

The White House’s latest report on digital assets arrived this week, and reactions have been mixed. For some, it was a letdown—another glossy document heavy on stablecoin policy and digital asset frameworks, but a noticeable lack of focus on the one asset that towers above the rest: bitcoin.

No update on the Strategic Bitcoin Reserve. No audit of the government’s current BTC holdings, despite earlier commitments. No disclosure of accumulation plans.

The same placeholder language about exploring “budget-neutral mechanisms” to acquire bitcoin remains, untouched since the original Executive Order. To critics, this looks like backpedaling. Promises made, some kept, some not.

But that view, while understandable, risks missing the broader arc.

Zoom out, and the administration’s posture toward digital assets has been one of the few policy domains where rhetoric has translated into real action. Operation Choke Point 2.0 was halted. Gary Gensler is out. The GENIUS Act—targeting stablecoin oversight and innovation—was signed into law. Key legislation continues to advance through Congress.

Even the symbolic gestures have weight: Ross Ulbricht was freed. Bitcoin was affirmed as a legitimate asset worthy of strategic study. And notably, the administration has stated, unambiguously, that the U.S. will not sell its bitcoin.

The strategic importance of this domain is no longer in question. That is the message between the lines.

This report may have focused on stablecoins and the classification of other digital assets, but not because bitcoin is being ignored. On the contrary, bitcoin’s regulatory status is largely settled. Its infrastructure is maturing. Institutional pipelines are now open. From the SEC’s approval of spot ETFs to CFTC oversight of non-security spot markets, bitcoin’s position in the regulatory landscape is firmer than it has ever been.

And while some may interpret the silence on the SBR as a lack of commitment, another read is plausible: you don’t announce an accumulation strategy in the middle of executing it. Nor do you voluntarily disclose holdings if they fall short of expectations or reveal gaps in strategic posture.

As time passes without an audit, it’s reasonable to assume this has become a sensitive issue internally—which only reinforces the idea that bitcoin is being treated as a real reserve asset, not a political soundbite.

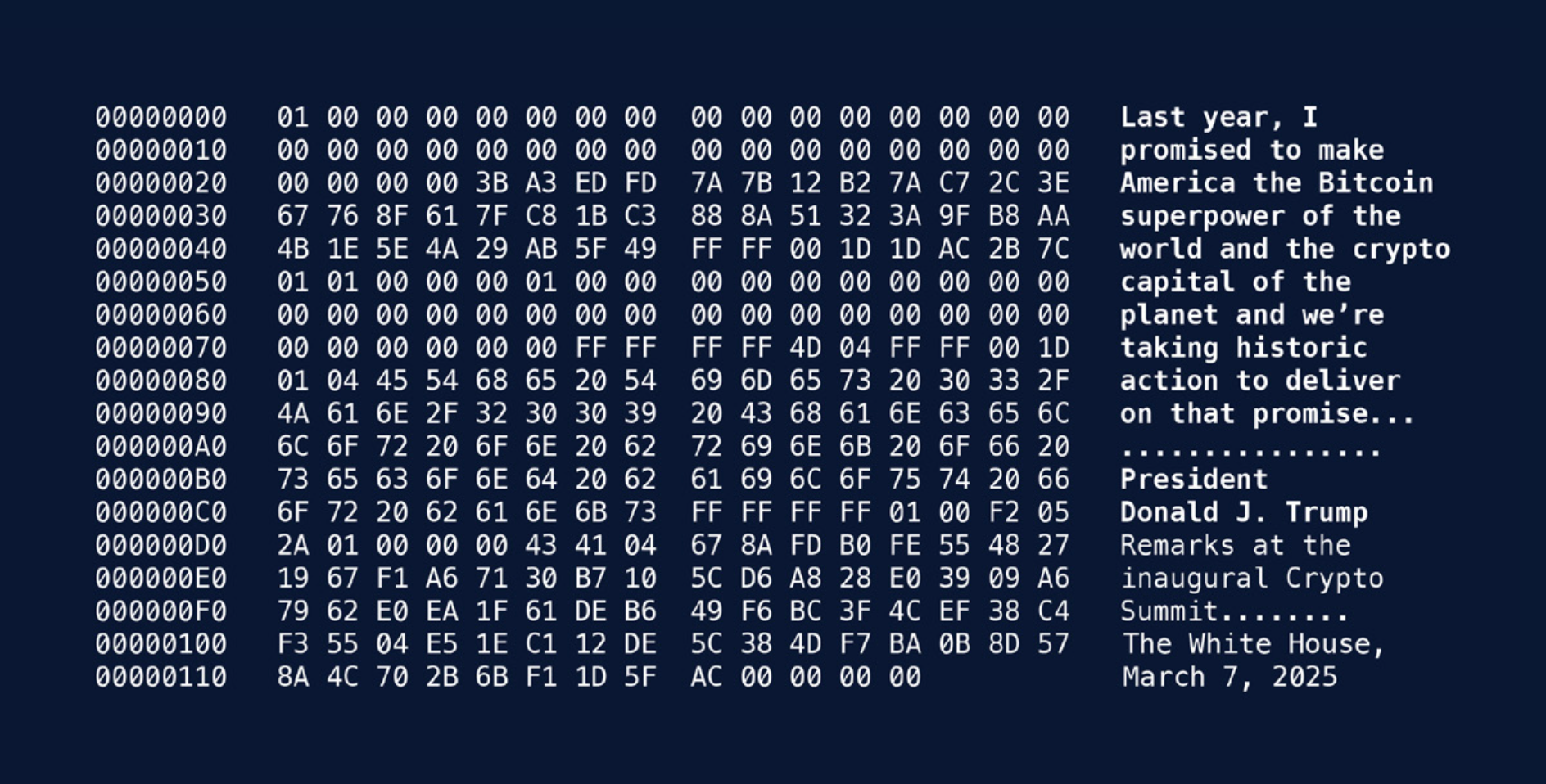

Then there’s the symbolic shift. The report cites Satoshi Nakamoto by name—multiple times. It explains bitcoin’s consensus mechanism in detail. It draws a clear distinction between decentralized networks and permissioned ledgers. It frames retail CBDCs, both domestic and foreign, as threats to U.S. sovereignty.

That a federal document treats bitcoin with intellectual seriousness, even reverence, reflects a level of normalization that would have been unthinkable just a few years ago.

It’s easy to fixate on what’s missing. But the presence of bitcoin in the heart of U.S. policy infrastructure—mentioned 129 times—is not a minor development. Satoshi is mentioned 36 times and is quoted at the beginning of nearly every section of the report. It’s a quiet repositioning of the Overton window, one that future reports, regulations, and strategic efforts will build on.

The disappointment from some corners of the industry is understandable. But it’s also a function of rising expectations. That in itself is evidence of progress.

Bitcoin’s place in U.S. policy is no longer hypothetical. It’s operational. This report isn’t the end of that story. It’s the baseline for what comes next.

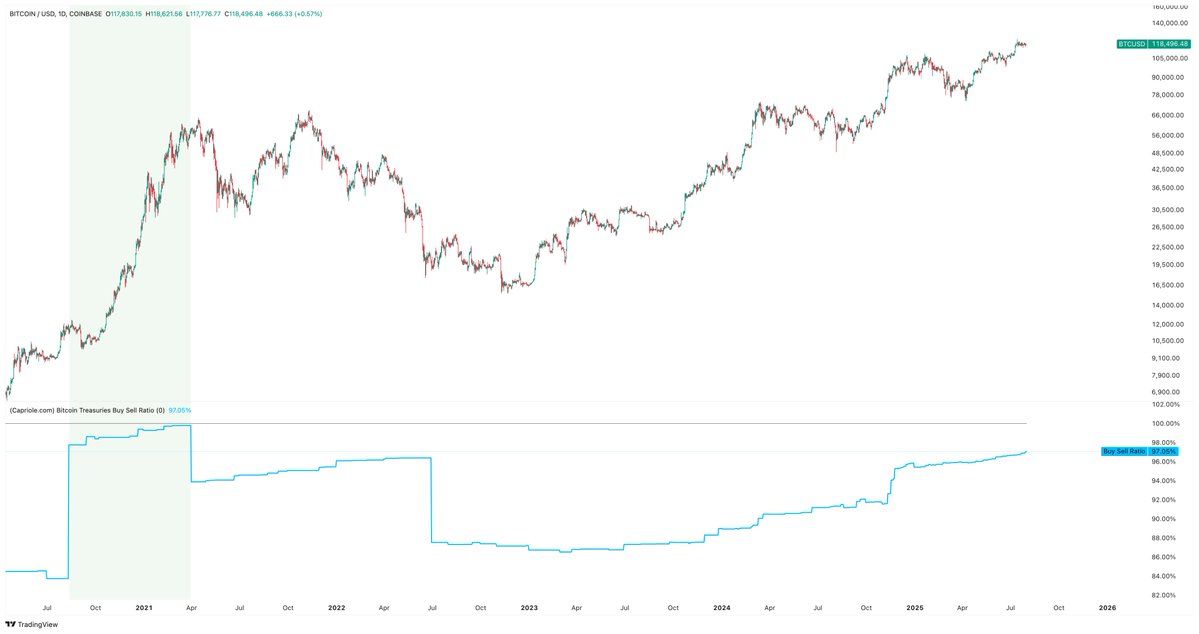

Chart of the Week

"Institutional net buying just breached 97% of all transactions. The last time net buying by the pros was this high was August 2020."

Quote of the Week

"Prudent investors recognize the perpetual issue of USD inflation and the continuing risks of USD hyperinflation and add bitcoin to their treasury balance sheets accordingly."

Podcasts of the Week

Bitcoin’s Wall Street Takeover: ETFs, BlackRock & The New Era

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis, are joined by Eric Balchunas, Senior ETF Analyst for Bloomberg, to discuss IBIT, the fastest-growing ETF ever, why Larry Fink became bitcoin’s biggest ally, ETFs bringing legitimacy & new risks, bitcoin’s uniquely sound nature & more!

$9B in Satoshi-Era BTC Sold—Why The Market Barely Flinched

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down how the market shrugged off a $9B BTC sale, Tether’s U.S. pivot and stablecoin turf wars, gold + bitcoin taking over the alt bucket, key deals of the week & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis