8/14/25 Roundup: The Quiet Sound Money Renaissance

Brian Cubellis | Chief Strategy Officer

Aug 14, 2025

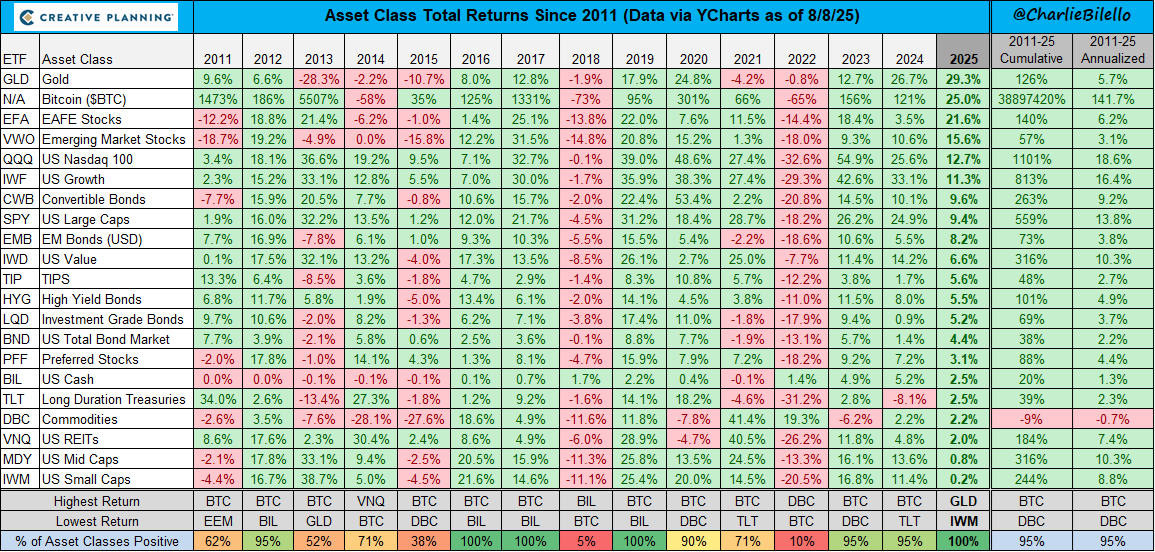

2025 has been a bull market for nearly every major asset class outside of bonds. But two have quietly defined the year’s performance story: bitcoin and gold. Both have broken repeated all-time highs. Both have outpaced equities, commodities, and real estate on a year-to-date basis.

source: Charlie Bilello on X

Their leadership is not a short-term quirk. It reflects a deeper realignment in the global monetary order—one Zoltan Pozsar outlined in 2022 when he described a coming shift toward “outside money” such as gold. Bitcoin, while not central to his framework, fits the same profile: a bearer asset free from the liabilities of a sovereign or central bank.

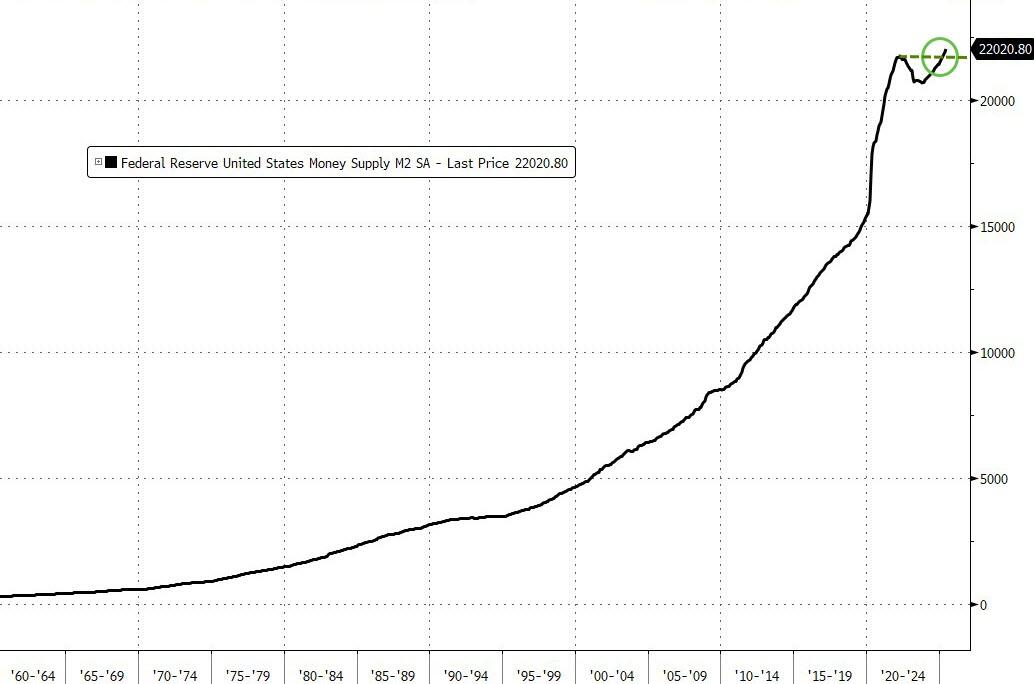

The macro backdrop is increasingly difficult to ignore. Deficits continue to expand faster than GDP. Debt service is crowding out fiscal flexibility. Inflation has not returned to the pre-pandemic range. M2 money supply in the U.S. is pressing against record highs, and global liquidity is turning upward after a brief post-COVID contraction.

These forces are restoring monetary scarcity to the center of the investment conversation—though you won’t hear much about it outside of gold and bitcoin circles.

source: ZeroHedge

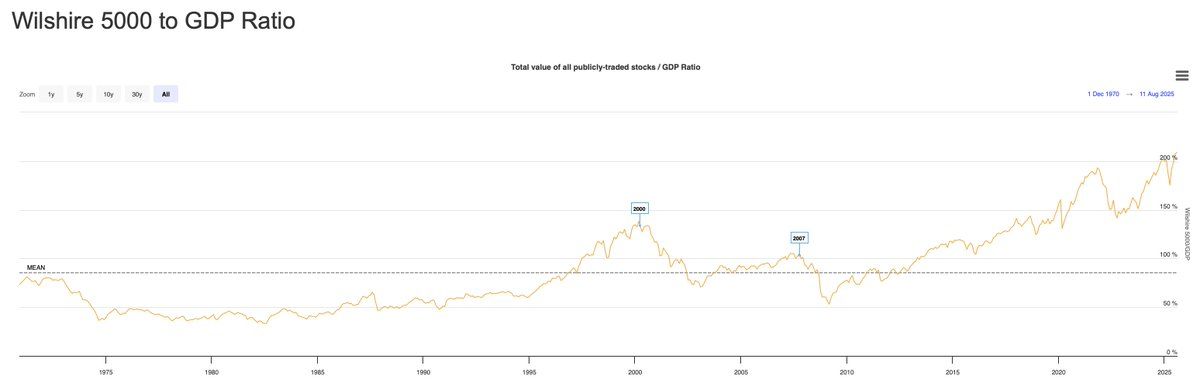

Mainstream financial coverage still revolves around an equity market at record valuations, with leadership concentrated in a handful of mega-cap tech and AI names. The Buffett Indicator hovers near historic highs. Equity index performance is more concentrated than at any point in decades.

source: Barchart on X

Gold’s role is familiar: a neutral reserve asset with a multi-thousand-year track record, now reinforced by record central bank accumulation. Bitcoin’s role is more recent, but no less important. With a perfectly inelastic supply, it cannot be diluted. It also cannot be valued in the traditional sense through cash flow or earnings models.

Price is determined only by demand—and demand often rises as its thesis is validated in real time. In this way, bitcoin exhibits traits of a Veblen good, where higher prices attract more buyers, feeding the cycle.

Gold had millennia to earn its place as the monetary base of choice. Bitcoin is doing so in decades. Both now stand as core beneficiaries of an environment where monetary trust is migrating away from the promises of institutions and toward assets defined by scarcity and incorruptibility.

The sound money renaissance is not a marketing slogan. It is happening quietly, in real time, beneath the noise of quarterly earnings reports and equity market narratives. It is visible in central bank gold flows, in bitcoin’s growing institutional footprint, and in the monetary plumbing of a multipolar world.

In a cycle where everything seems to be going up, the most important story may be that the best-performing assets are those with no counterparty, no yield, and no central authority—only a fixed supply and global demand.

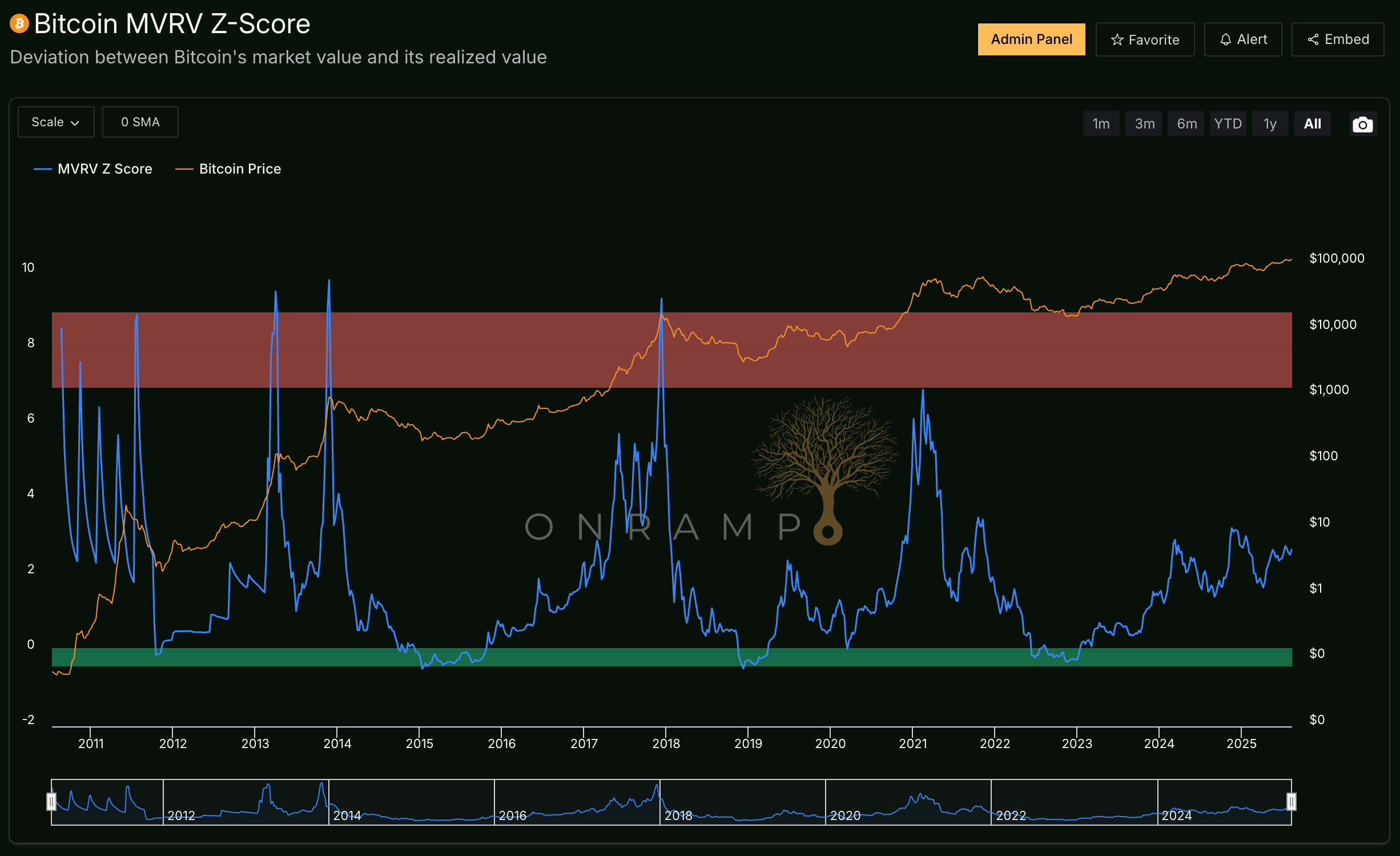

Chart of the Week

MVRV Z-Score measures the deviation between bitcoin’s market value and its realized value (the aggregate cost basis of all coins). High Z-scores indicate overheated markets, while low scores point to undervaluation.

Insight: Despite strong YTD performance, bitcoin’s MVRV Z-Score remains well below historical blow-off top levels, signaling the market is not yet overheated by past cycle standards.

Find this data and more on the Onramp Terminal.

Quote of the Week

"Any attempt to increase BTC issuance beyond the 21 M cap faces an immediate veto from full nodes because a non‑hardforking minority can keep a viable chain running by default.

With ETH, a non‑hardforking minority cannot finalize by default, so monetary policy changes are feasible when the major stakers agree."

Podcasts of the Week

Trump Opens the Floodgates: 401K Bitcoin Supercycle

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis break down Trump opening 401Ks to BTC, Brazil eying a bitcoin reserve, U.S. quietly floating gold revaluation, Tether threatening alt L1 narratives, Onramp launching Dynasty Trusts & more!

Bitcoin Dynasty Trusts Launch: Generational Wealth & Legacy Planning

In this special episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis, are joined by Paul Hoilman, Partner at First Covenant Trust & Advisors, to unveil Onramp's newly launched Bitcoin Dynasty Trust Services. We break down why South Dakota trust law matters, how to shield your BTC from taxes & lawsuits, and the custody breakthrough that makes it all possible.

Bitcoin & Gold Are Money, Everything Else is Credit

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down Harvard’s $117M BTC buy, gold + BTC as the hard asset trade, Tether’s reserves rival nations, banks building BTC products, key deals of the week & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis