8/21/25 Roundup: The New Normal of (Upward) Chopsolidation

Brian Cubellis | Chief Strategy Officer

Aug 21, 2025

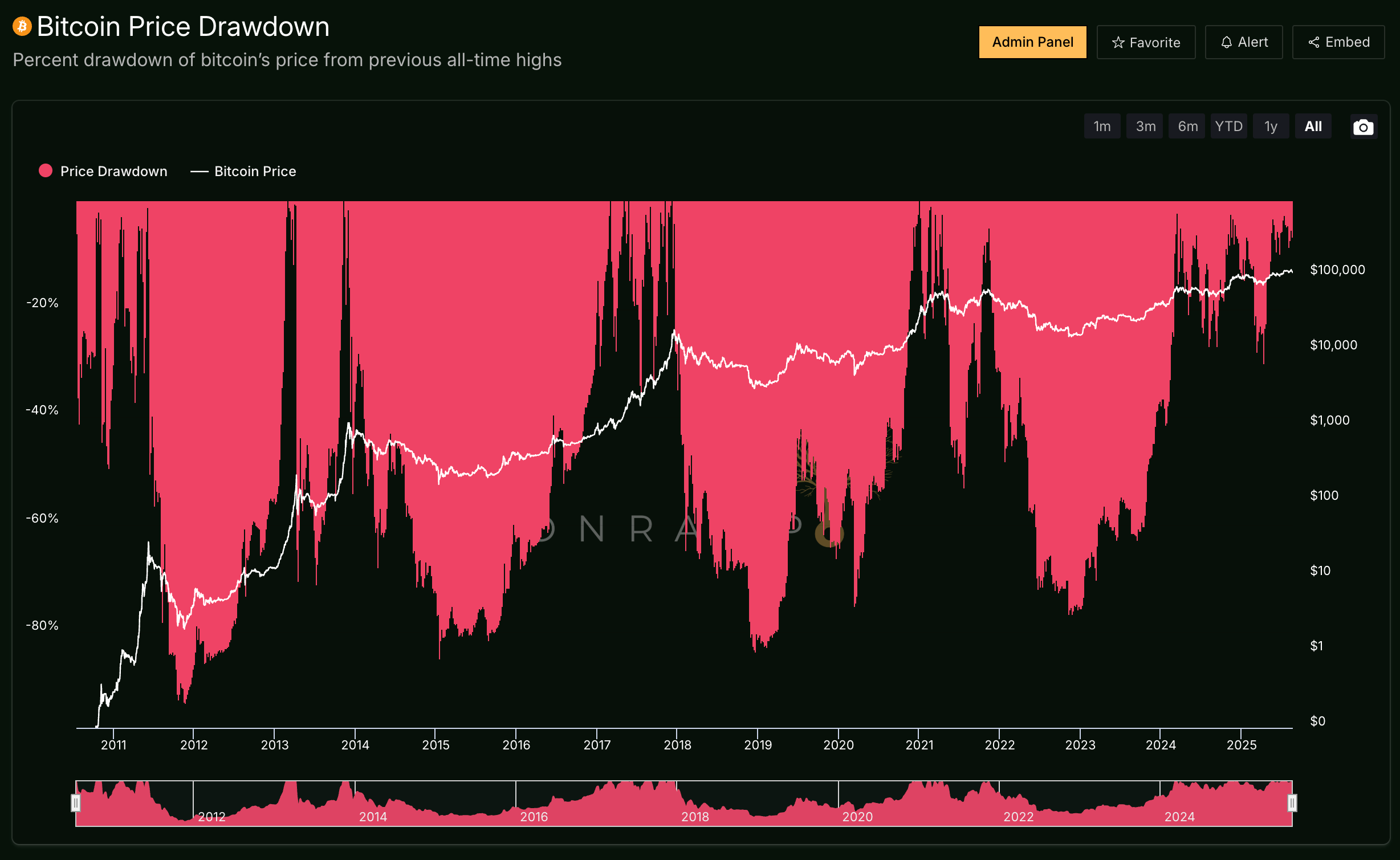

Bitcoin briefly dipped below $113K this week after touching new ATHs around $124K just seven days ago. For a market that has lived through multiple 80% drawdowns, this is barely a blip. Yet if you scrolled social media, you’d think the sky was falling.

That disconnect is telling. It highlights three important shifts in how we should think about bitcoin "cycles" going forward.

1. Zooming Out

Volatility is relative. Bitcoin’s short-term drawdowns often look catastrophic in isolation, but when measured against its long-term trajectory, they barely register.

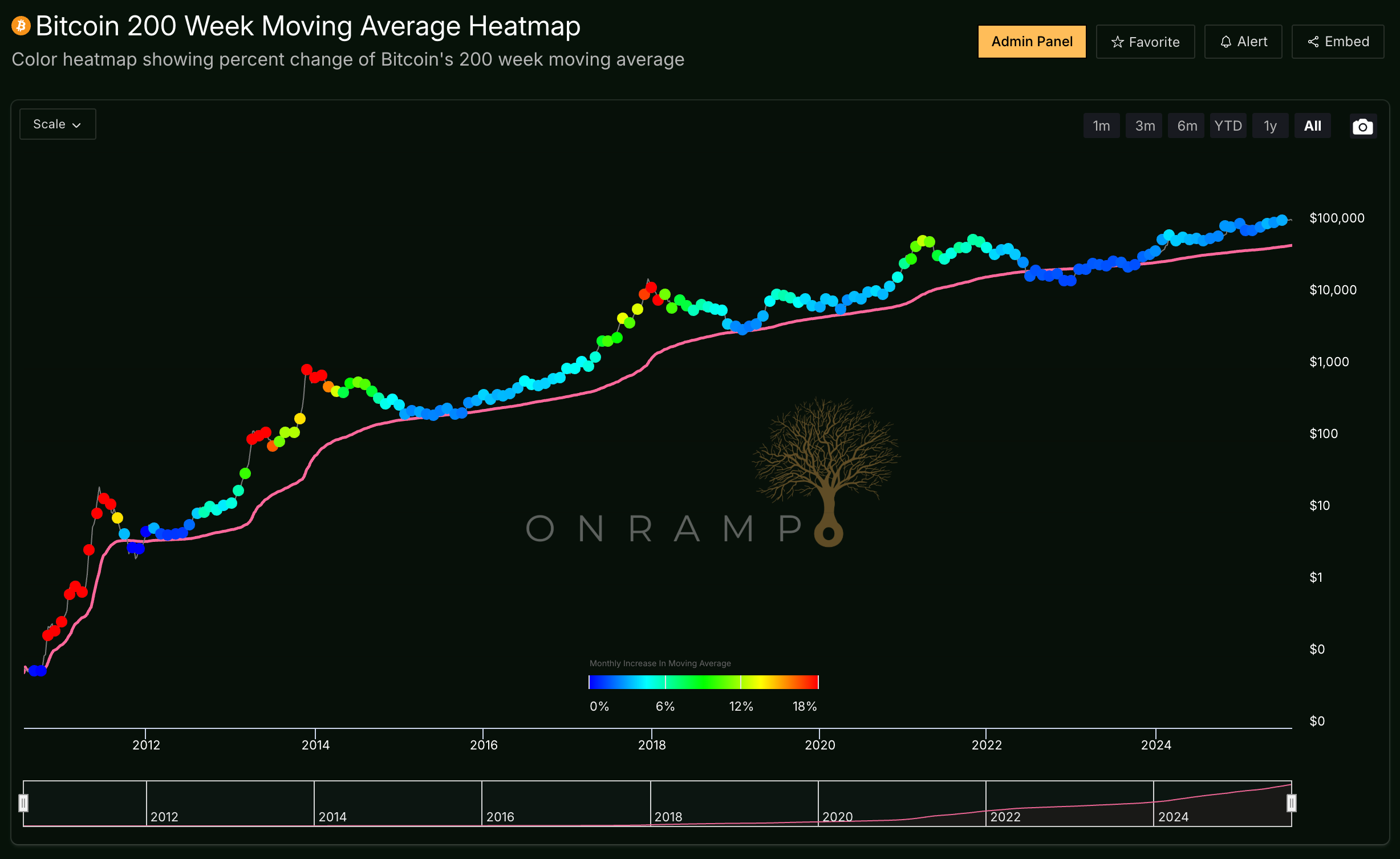

Longer-term moving averages remain firmly upward. On a multi-year view, bitcoin has steadily compounded—outpacing equities, bonds, and gold—through a mix of explosive upside and periods of sideways consolidation.

The lesson is simple: zoom out. Bitcoin’s path is jagged, but the slope of the line remains positive.

2. Market Structure Has Evolved

The “four-year halving cycle” that once dominated investor thinking may no longer be the right framework. Bitcoin’s market structure has changed profoundly in the last few years:

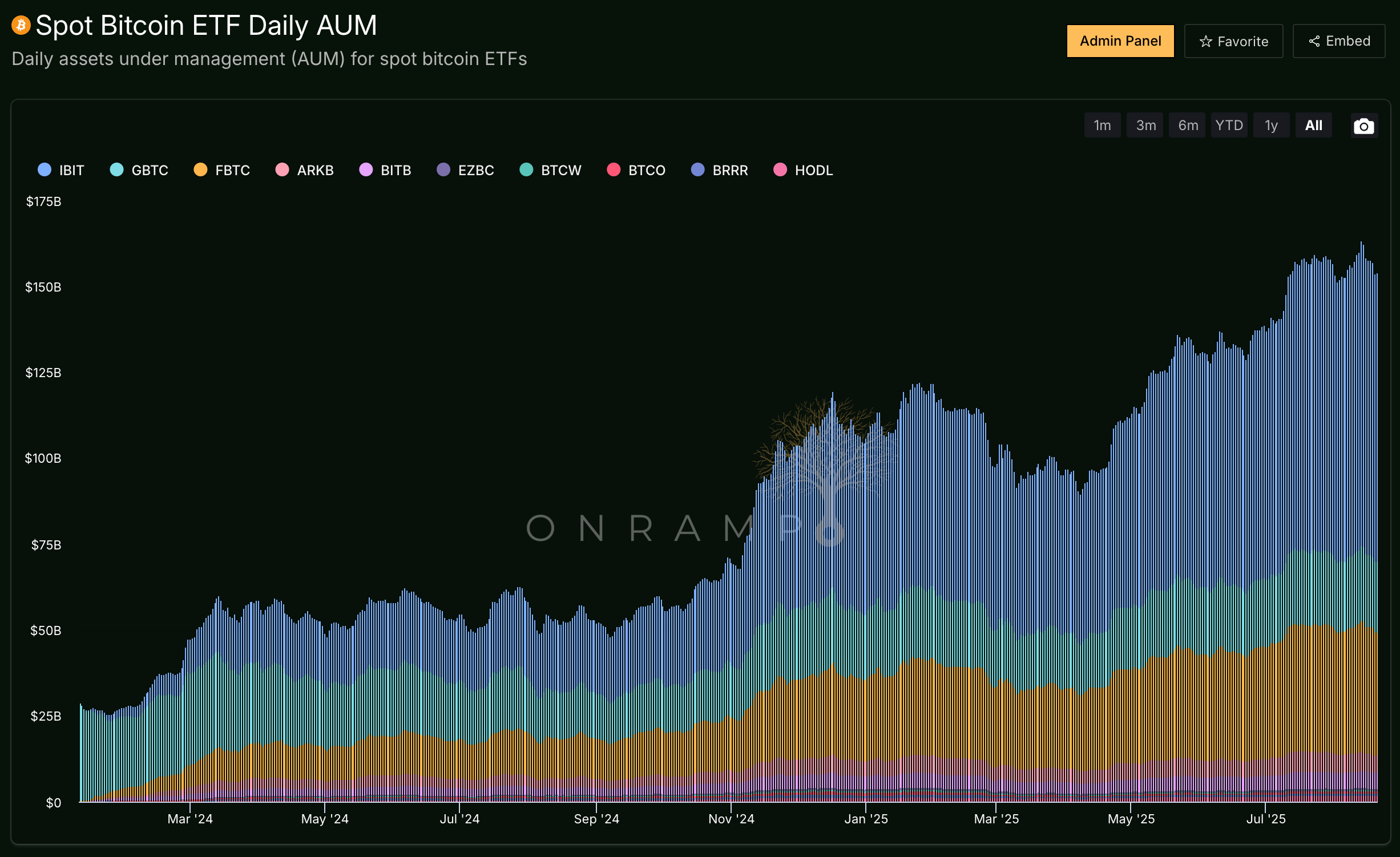

- Institutional Flows: ETFs are pulling in billions, providing consistent demand.

- Corporate Treasuries: Companies are allocating strategically, creating long-dated structural bids.

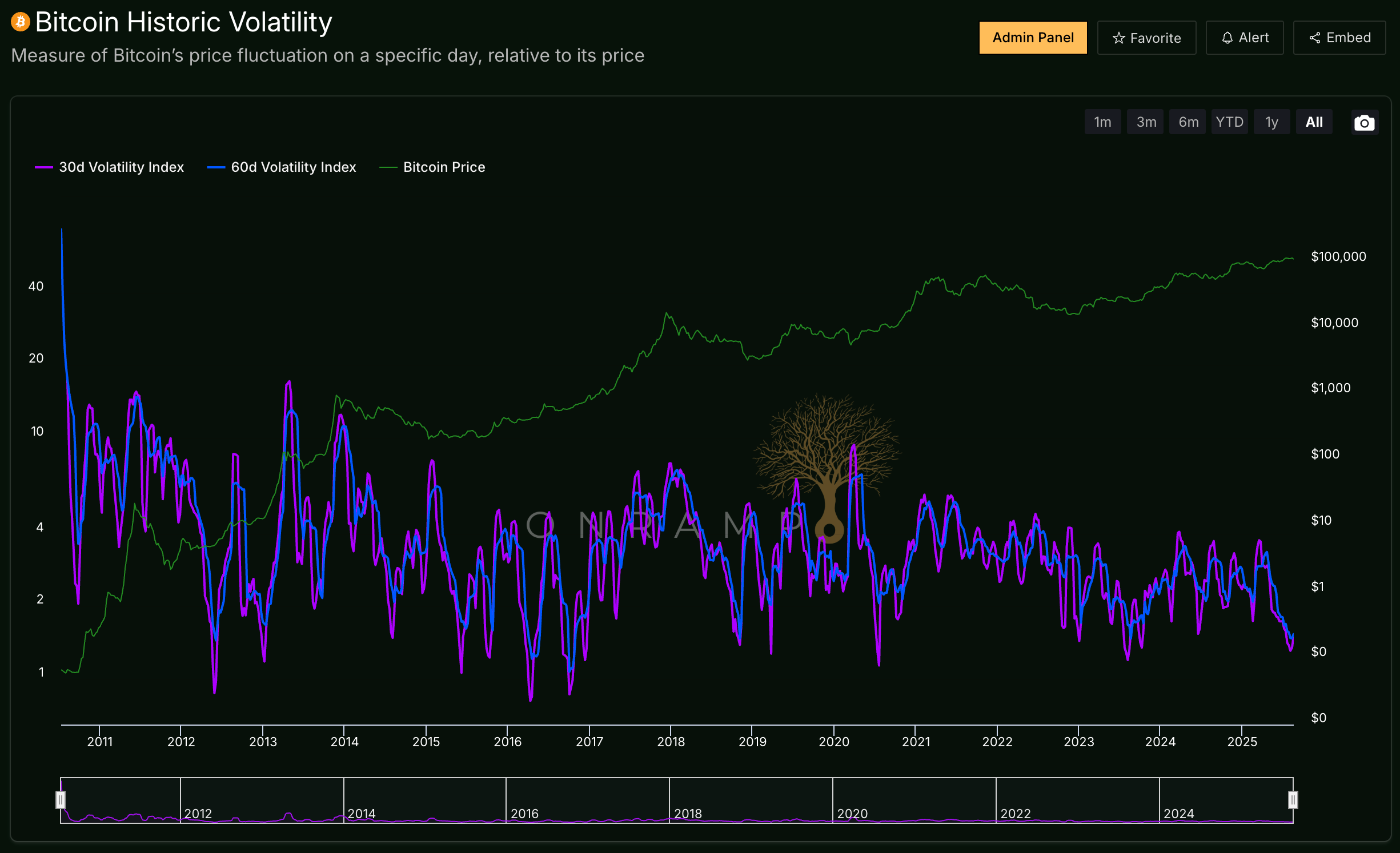

- Derivatives Markets: A more robust options and futures landscape is dampening extremes and smoothing volatility.

- Retail Absence: Unlike past peaks, retail speculation is muted. The marginal buyer today looks more like a pension or endowment than a day trader.

The result is a grind higher, punctuated by moderate corrections—far removed from the boom-and-bust character of early bitcoin. Volatility continues to trend downward, a hallmark of asset class maturation.

3. Sentiment and Allocation

Why does a mere ~10% move feel like panic? In part because many investors aren’t actually holding bitcoin directly. They’re exposed via proxies—corporate treasury vehicles, leveraged positions, or altcoin tokens—that will swing harder than bitcoin itself.

For those properly allocated—cold storage BTC with a long-term horizon—this week’s move is just sideways chop before the next leg higher. But for those underexposed, every pullback feels existential.

Tailwinds at Bitcoin’s Back

Despite the noise, the structural conditions remain overwhelmingly positive:

- Legitimacy: Bitcoin is no longer toxic; it sits in university endowments (Harvard & Brown most recently), corporate treasuries, and sovereign discussions.

- Policy & Custody: Regulatory clarity is improving, and custody has matured, particularly with fault-tolerant Multi-Institution Custody models.

- Liquidity: Lending markets are deeper and healthier, reducing forced sales.

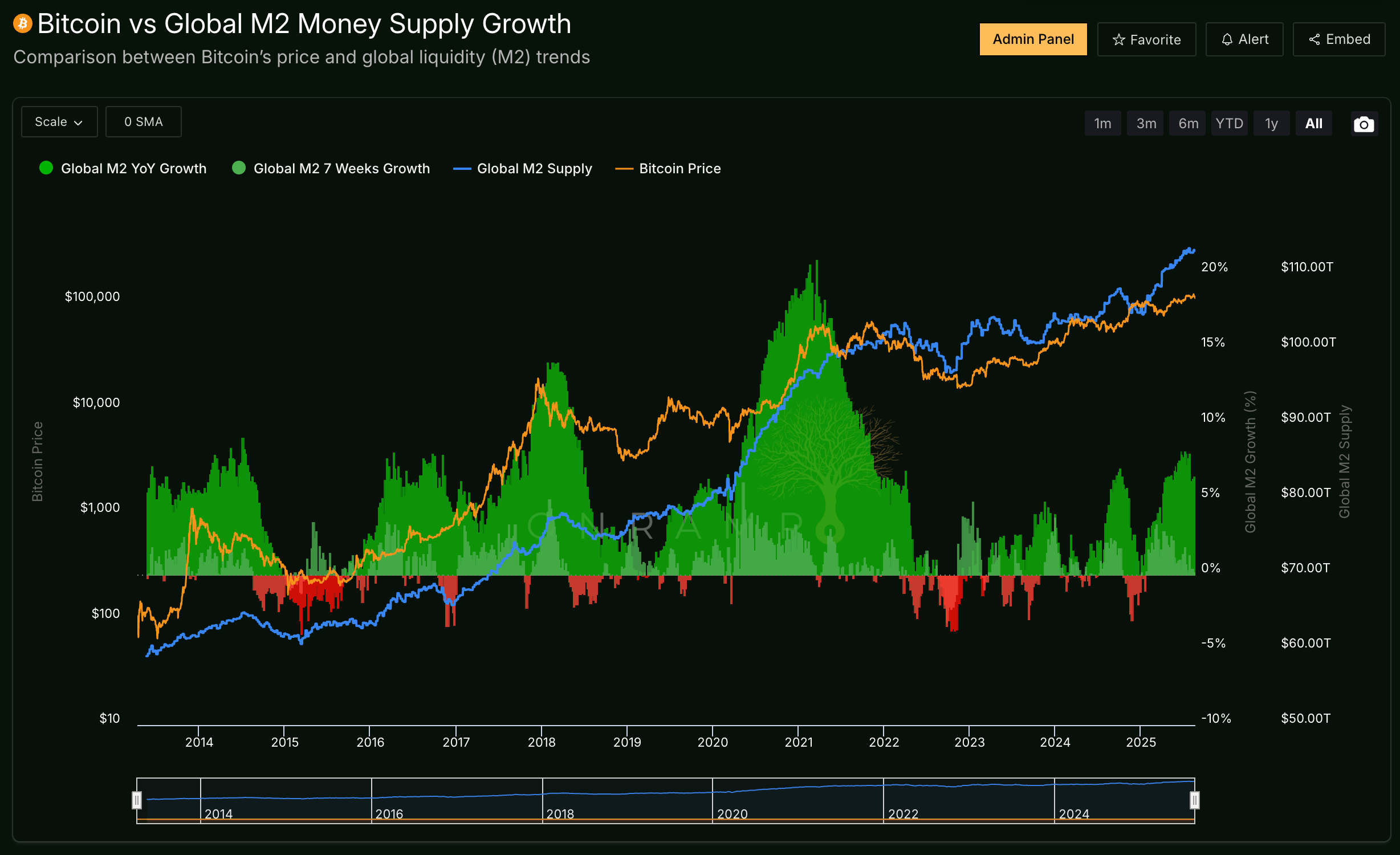

- Macro: Inflation is sticky, debt is unsustainable, and fiscal dominance is accelerating. The monetary case for bitcoin has never been stronger.

Key Takeaway

Short-term volatility is part of the DNA, but the framework for interpreting it has shifted. Cycles are no longer defined solely by halvings and retail mania. They are increasingly shaped by structural demand, institutional allocation, and the steady recognition of bitcoin’s role as sound money.

The real “cycle” now may not be four years, but the secular trend of adoption itself.

All of these charts are available on the Onramp Terminal, our bitcoin-only analytics platform. The Terminal brings together real-time market data, on-chain activity, adoption metrics, derivatives positioning, ETF flows, and much more.

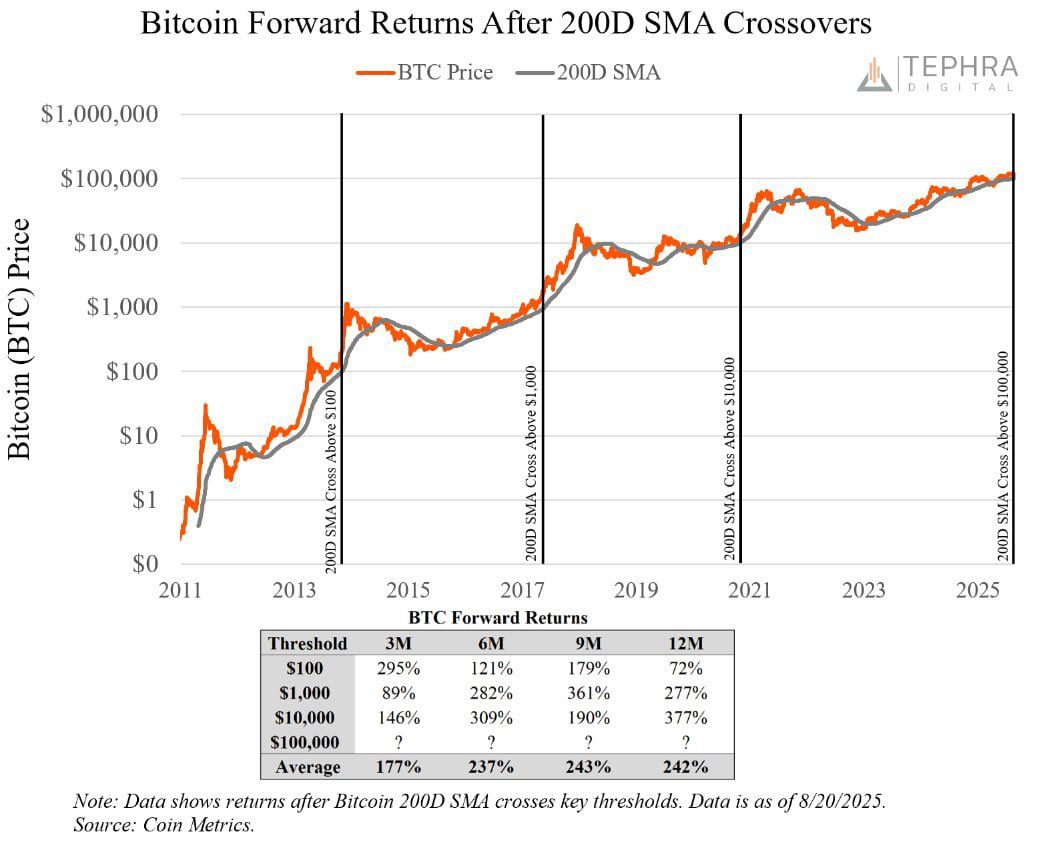

Chart of the Week

"With Bitcoin’s 200-day moving average now above $100K, it joins prior milestones ($100, $1,000, $10,000) that marked significant inflection points in adoption and price history."

Quote of the Week

"Bitcoin’s neutrality, openness, and decentralization makes it a very compelling choice for banks as the replacement for antiquated correspondent banking vs. other centralized options. No one wants to king-make another closed, corp controlled payment network again. Open will win."

Podcasts of the Week

$150 Billion Later: The Truth About Bitcoin ETFs and Who’s Buying

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis are joined by James Seyffart , ETF Analyst at Bloomberg, to discuss bitcoin ETFs smashing all records, TradFi resistance: bias, denial, & ignorance, BTC & gold leading the sound money renaissance, Harvard buys in; why institutions just getting started and more!

Trust Experts Reveal the Strategy to Protect Your Bitcoin Fortune

In this episode of Scarce Assets, hosts Jackson Mikalic & Michael Tanguma are joined by Paul Hoilman & David Greene of First Covenant Trust & Advisors, to break down Onramp Bitcoin Dynasty Trusts, BTC as the ultimate “acorn” asset, investment control & wealth preservation, trusts as “protocols” for succession & more!

Bitcoin Eats All Markets: IPO Hype, Treasury Grifts & Buffett Lessons

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down crypto IPO hype & the DAT bubble, retail missing & institutions lagging, mining converging with AI infrastructure, Buffett's lessons around bitcoin’s moat, key deals of the week & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis