8/28/25 Roundup: Fed Policy Theatre & Sound Money Realities

Brian Cubellis | Chief Strategy Officer

Aug 28, 2025

This past week delivered three developments that, taken together, suggest the foundations of the U.S. monetary and financial order are shifting.

None of them were shocking in isolation. But when viewed together, they point to accelerating change, and highlight why assets outside the fiat system, like bitcoin and gold, continue to gain relevance.

1. The Fed Moves the Goalposts

At Jackson Hole, Jerome Powell signaled that the Federal Reserve is preparing to justify rate cuts on the basis of labor market weakness, even as CPI remains stubbornly nearly 3%.

More striking was the quiet admission that the Fed’s long-standing 2% inflation target no longer holds the same weight.

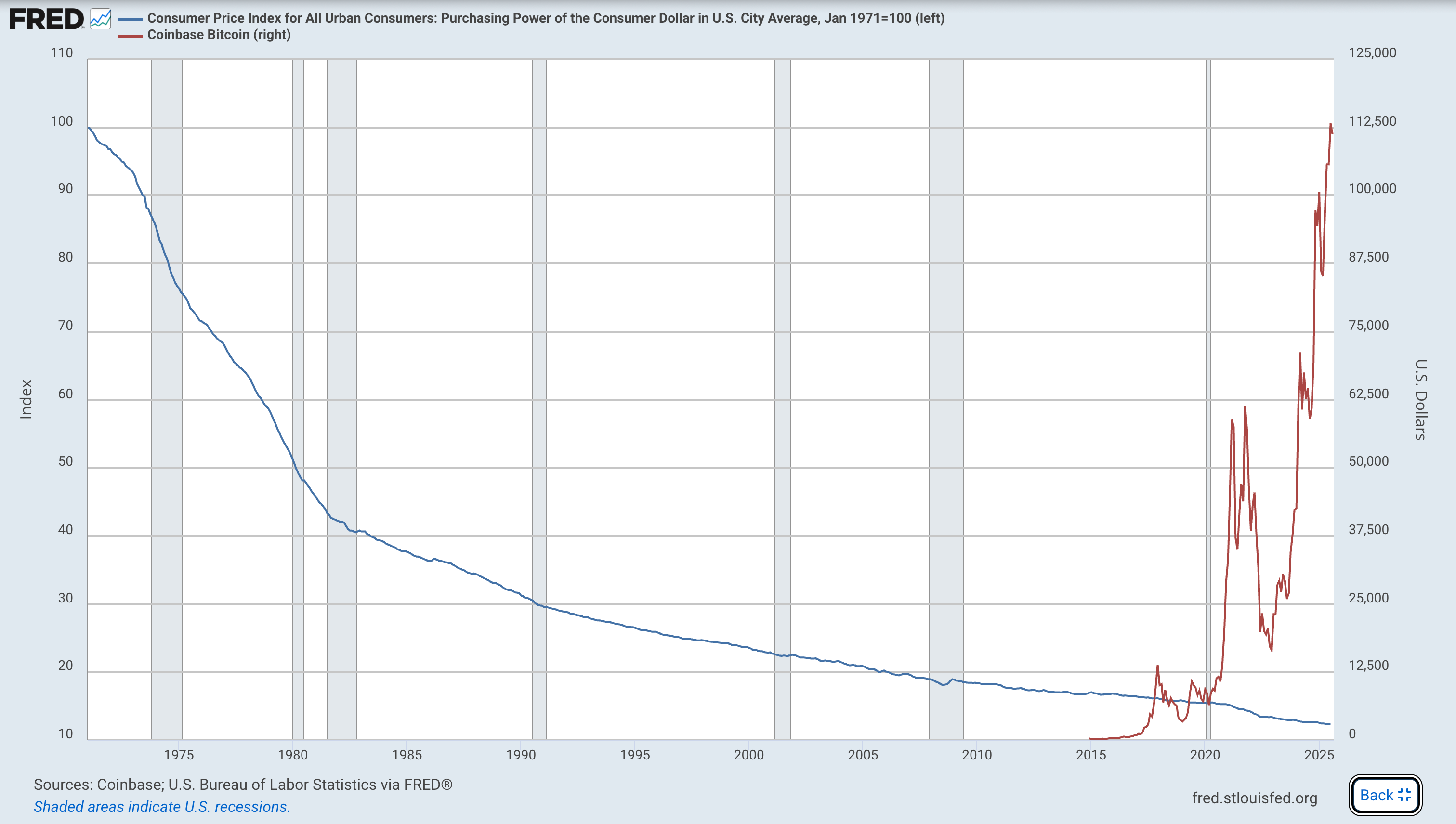

It’s also worth noting that CPI itself understates the degree of monetary debasement underway. Asset prices, fiscal deficits, and monetary aggregates all reflect inflation far above the reported figure, reminding us that the official number often obscures the true erosion of purchasing power.

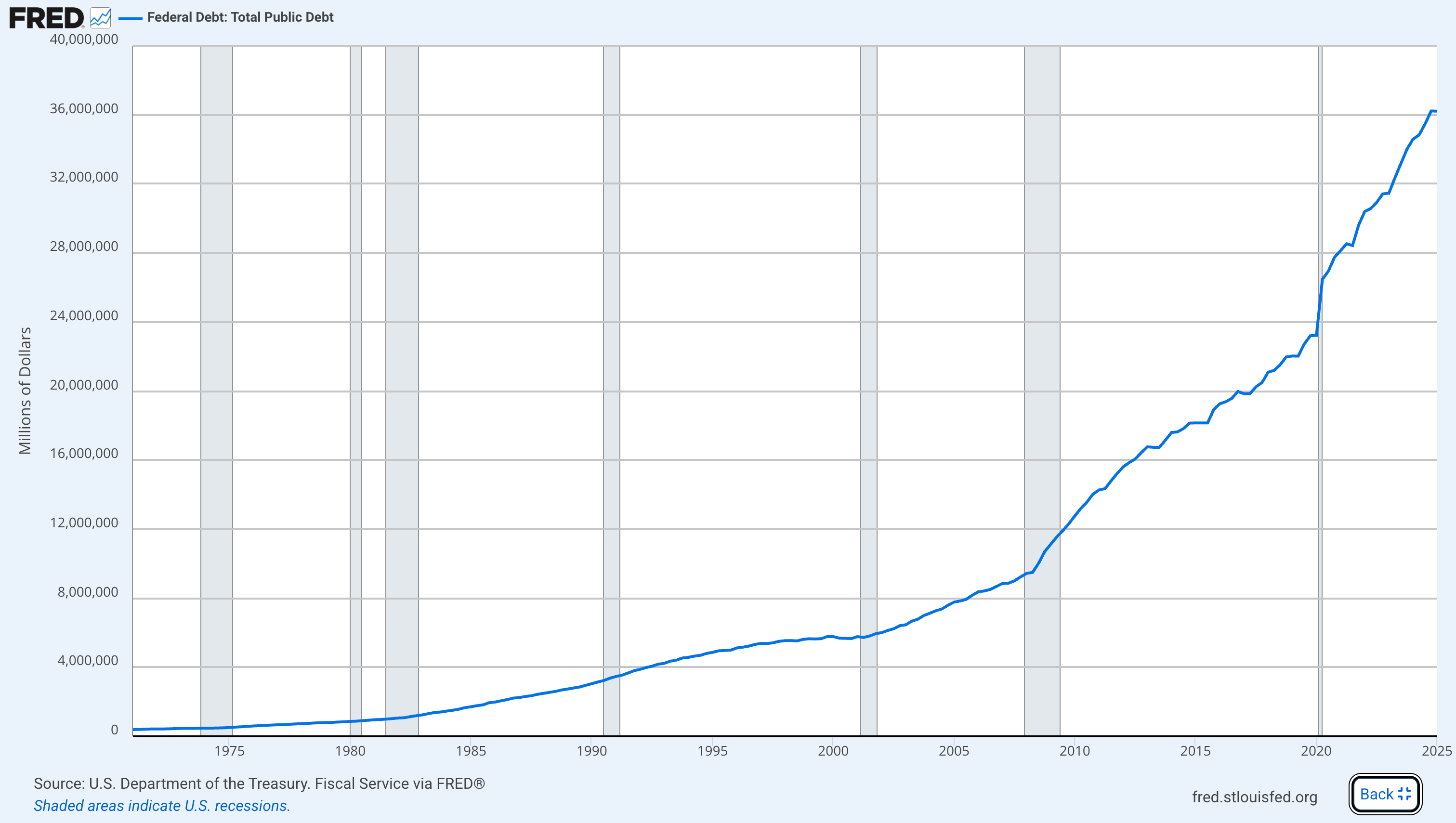

Behind the language is fiscal reality. With $37+ trillion in public debt and interest expense ballooning, the U.S. government cannot sustain obligations with rates at current levels. “Price stability” may remain in speeches, but debt service is the priority.

This is fiscal dominance in practice.

2. Fed Independence, Laid Bare

The Trump administration’s move to oust Fed Governor Lisa Cook was a sharp reminder that central bank independence has always been more fragile than it appeared.

Even if Powell completes his term, the direction of policy is no longer in doubt. The next chair will be selected to deliver rate cuts, regardless of where inflation stands.

Markets have long suspected politics influences monetary policy. What’s new is the explicitness. The pretense of separation between the White House and the Fed is gone.

3. Washington Buys Intel

Perhaps the most remarkable event was the administration’s acquisition of a 10% stake in Intel. Officials framed it as a national security necessity, supporting domestic chip production in the midst of an AI arms race.

The precedent, however, is clear: when Washington decides a company is too strategic to fail, capital markets no longer determine outcomes.

Nationalization, even partial, distorts price signals and undermines the premise of free markets. Investors must now consider which other sectors might be targeted: defense, AI, commodities, or even bitcoin-exposed corporates like Strategy (MSTR).

The probability of intervention or political capture is no longer theoretical.

This also highlights the importance of direct ownership. Spot bitcoin in cold storage has no management team to pressure, no board to strong-arm, no equity for the government to purchase.

The Common Thread

Powell’s shifting inflation stance, the administration’s pressure on the Fed, and Washington’s intervention in Intel are all expressions of the same reality:

- Monetary policy is subordinated to fiscal needs

- Central bank independence has faded into myth

- Market outcomes are increasingly subject to political discretion

Each reduces the reliability of fiat-denominated wealth. Each strengthens the case for assets that operate outside government control.

The Sound Money Hedge

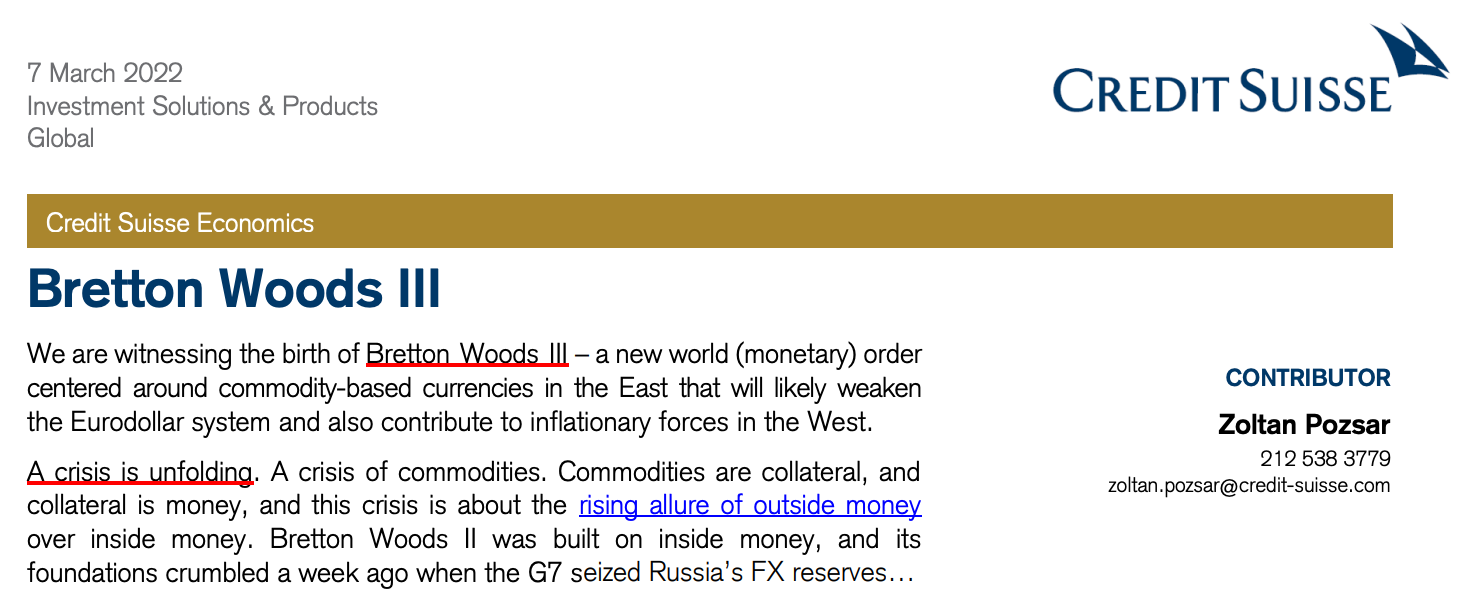

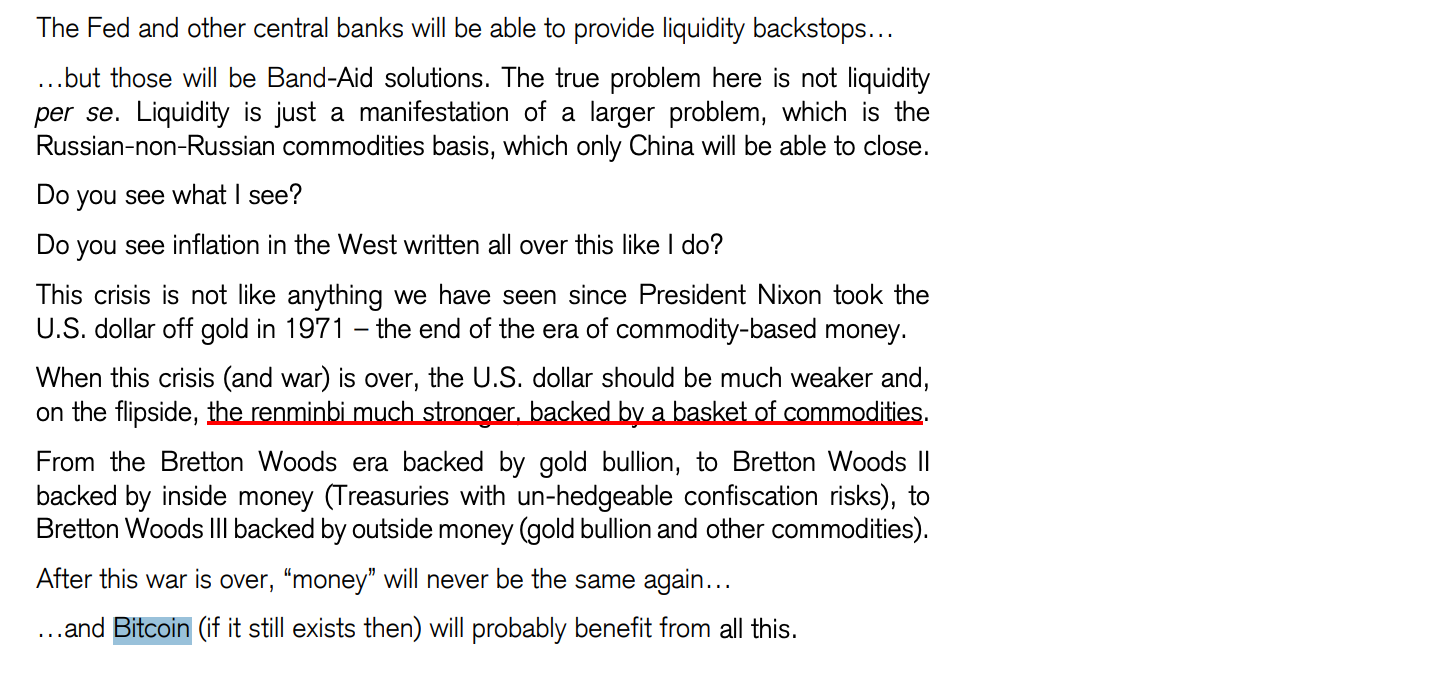

Zoltan Pozsar predicted in 2022 that the world would move toward “outside money” (i.e. assets not created by states or central banks). Gold and bitcoin are the clearest examples. Both are hitting record highs this year. Both are hard assets, bearer-based, and neutral.

When the rules of the system are rewritten mid-game, wealth needs a refuge in assets that cannot be diluted, seized, or politicized.

Bitcoin is uniquely suited to this role. Unlike equities, it cannot be nationalized. Unlike fiat, it cannot be inflated away. Unlike debt, it cannot be restructured. It is digital sound money devoid of centralized dependancies.

Closing Thoughts

The guardrails of the old system of stable inflation targets, Fed independence, and free capital markets, are eroding. What replaces them is discretion, politics, intervention, and ultimately, continued debasement.

That shift may create noise for markets, but the signal is clear: outside money is no longer optional. It is the necessary hedge against a monetary order that is losing its ability to govern itself.

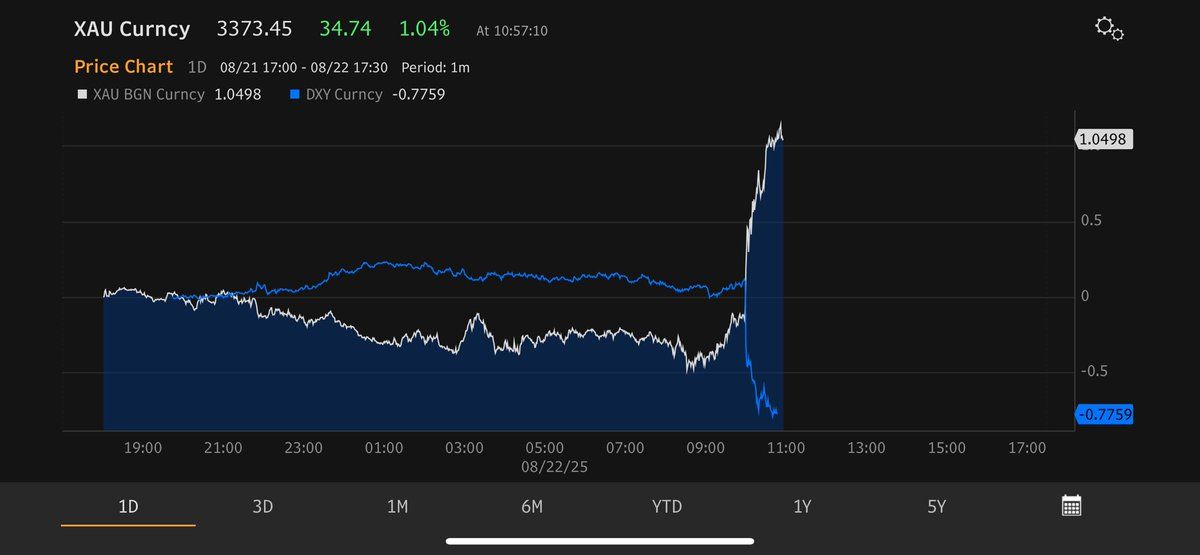

Chart of the Week

"The most telling price action after Powell caved? Gold vs. USD. Gold rockets in a straight line up. Dollar collapses in a straight line down. We are a 3rd world country."

Quote of the Week

"Gold should be watched here. Quietly near its high, tight range for months, out of the headlines. Futures positioning hasn’t given strong signals this year, partly due to the huge underlying sovereign bid that has made positioning a less reliable indicator than in the past. In this type of environment it’s best to just let price tell you what it wants to do next. A sustained spot move to 3450 and then 3500+ would have big implications, including for BTC as we’ve seen in the past. To be clear: I don’t have a strong short-term view on gold, just saying it should stay on the radar. Along with its $116 million BTC disclosure, Harvard’s sudden new $100 million gold position last quarter sticks in the mind."

Podcasts of the Week

The Big Red Button That’s Destroying Your Future

In this episode of The Last Trade, hosts Jackson Mikalic, Liam Nelson, & Brian Cubellis are joined by Joe Bryan, creator of the film ‘What’s The Problem?’, to discuss the ills of money printing & inflation, hidden shrinkflation & quality decay, the small business squeeze & housing strain, forced speculation vs. savings tech & more!

Trump Nationalizes Intel, Fed Turns Dovish & Warms the Money Printer

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down the US stake in Intel fueling state creep, private equity ponzi games & capital destruction, altcoin mania returning, counterparty risk in focus, key deals of the week & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis