9/12/25 Roundup: Monetary Mission Creep

Brian Cubellis | Chief Strategy Officer

Sep 12, 2025

Treasury Secretary Scott Bessent’s recent op-ed in The International Economy deserves close attention. It is not a routine policy note. It is a diagnosis of how U.S. monetary management drifted from crisis tools to a standing operating system.

Bessent writes: “The Fed’s new operating model is effectively a gain-of-function monetary policy experiment.” He adds that “overuse of nonstandard policies, mission creep, and institutional bloat are threatening the central bank’s monetary independence.” The point is plain. Extraordinary measures became permanent, and the institution expanded to fill the space created by costless money.

A Broken Compass

According to Bessent, the Fed has repeatedly misread both growth and inflation. He warns that “The Fed simply does not comprehend how the new gain-of-function monetary policy works,” and he captures the distributional effect in one line: “socialism for investors, capitalism for everyone else.” When balance sheets and asset purchases replace market price signals, owners of financial assets are protected and savers bear the cost.

He also argues that “Central bank independence is fundamental to the economic success of the United States.” That principle is strained when policy goals stretch from lender of last resort to guardian of markets and employment outcomes, all while fiscal pressures rise.

Downstream of Broken Money

Bessent’s critique lands because the problems are structural. A debt-based fiat system administered by an unelected committee invites mandate creep. If money can be issued at near zero marginal cost, intervention becomes habit. Forecast misses are not the core failure. The core failure is a regime that relies on constant tuning to remain "stable".

Portfolio Implications

For allocators, this is not an academic debate. Wealth preserved in policy-sensitive assets remains exposed to dilution and financial repression. Exposure to outside money becomes a necessity, not a novelty. Gold has served that role for centuries. Bitcoin now plays in the same arena with properties that are transparent, verifiable, and finite by design.

Zoltan Pozsar anticipated this shift when he described a move back toward “outside money.” That shift is now visible in reserve behaviors, regulatory normalization for bitcoin, and a steady migration of institutional infrastructure toward assets that do not depend on committee discretion.

Closing Thoughts

Bessent’s piece is a reminder that the current system is already in a form of controlled demolition, with inflation targets redefined, debt monetized, and independence compromised. For investors, the way forward is to build portfolios around assets that do not rely on promises of restraint but on physics and code. That is the heart of the sound money renaissance.

Bitcoin and gold provide that ballast. In a regime of debt, drift, and debasement, they are not speculative side bets. They are the countermeasure against the very dynamics Bessent describes.

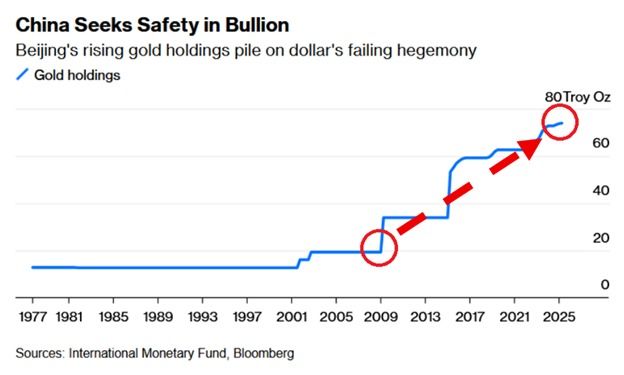

Chart of the Week

"China's official gold holdings rose 60,000 troy ounces in August, to a record 74.02 million. This marks their 10th consecutive month of purchases. As a result, the People’s Bank of China has increased its gold holdings by 1.22 million troy ounces since November. In Dollar terms, China’s gold reserves hit $253.8 billion in August, an all-time high. Chinese gold holdings now reflect a record 7.6% of China's total official reserve assets. Central banks are still stocking up on gold."

Quote of the Week

"The model in this paper highlights the extent to which the risk of sanctions can drive broader reserve diversification away from Treasuries toward Bitcoin, gold, and RMB. The model also emphasizes the tradeoff among sanctions risk, volatility, and expected return. In particular, the model shows how Bitcoin, gold, and RMB can provide insurance against Western sanctions, with Bitcoin complementing gold and RMB. Indeed, the model suggests that a country’s decision to embrace cryptocurrency could boost its resilience to geopolitical economic shocks."

Podcasts of the Week

The Sound Money Supercycle: Gold & Bitcoin vs. the Dollar

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis are joined by corporate attorney & investor, Jesse Kobernick, to discuss equity proxies lagging BTC, why NAV premiums will fade, gold as the canary, why bonds are cracking, preconditions for a 'supercycle' & more!

Fidelity’s Chris Kuiper: Bonds Are Broken & Bitcoin’s 4-Year Cycle Is Dead

In this episode of Scarce Assets, hosts Jackson Mikalic and Michael Tanguma are joined by Chris Kuiper, VP of Research at Fidelity Digital Assets, to discuss the institutional investment landscape, the emergence of bitcoin as a risk-off allocation, ETFs, advisor adoption, liquidity, why sound money belongs in the 60/40 portfolio & more!

Walled Garden Wars: Corporate Chains vs Open Money

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down token freezes & decentralization theater, the perps arms race: Hyperliquid vs Coinbase, sovereigns stacking: UAE, hashrate ripping, the sound-money pair trade: gold + BTC, key deals of the week & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis