9/18/25 Roundup: Nashville Notes & The Fed's Third Mandate

Brian Cubellis | Chief Strategy Officer

Sep 18, 2025

Custody & the Next Phase of Institutional Bitcoin Adoption

This week the Onramp, Early Riders, and Acropolis teams are in Nashville for a series of events hosted at Bitcoin Park, including the Custody & Treasury Summit and the Imagine IF conference.

The focus has been squarely on what comes next for institutional adoption: building robust custody frameworks, preparing corporate and public treasuries for bitcoin allocation, and bridging the gap between traditional finance and protocol-native models like multi-institution custody (MIC).

These conversations highlight how quickly the industry is moving past “should we allocate?” and into “how do we hold responsibly?”

Yield Curve Control Loading

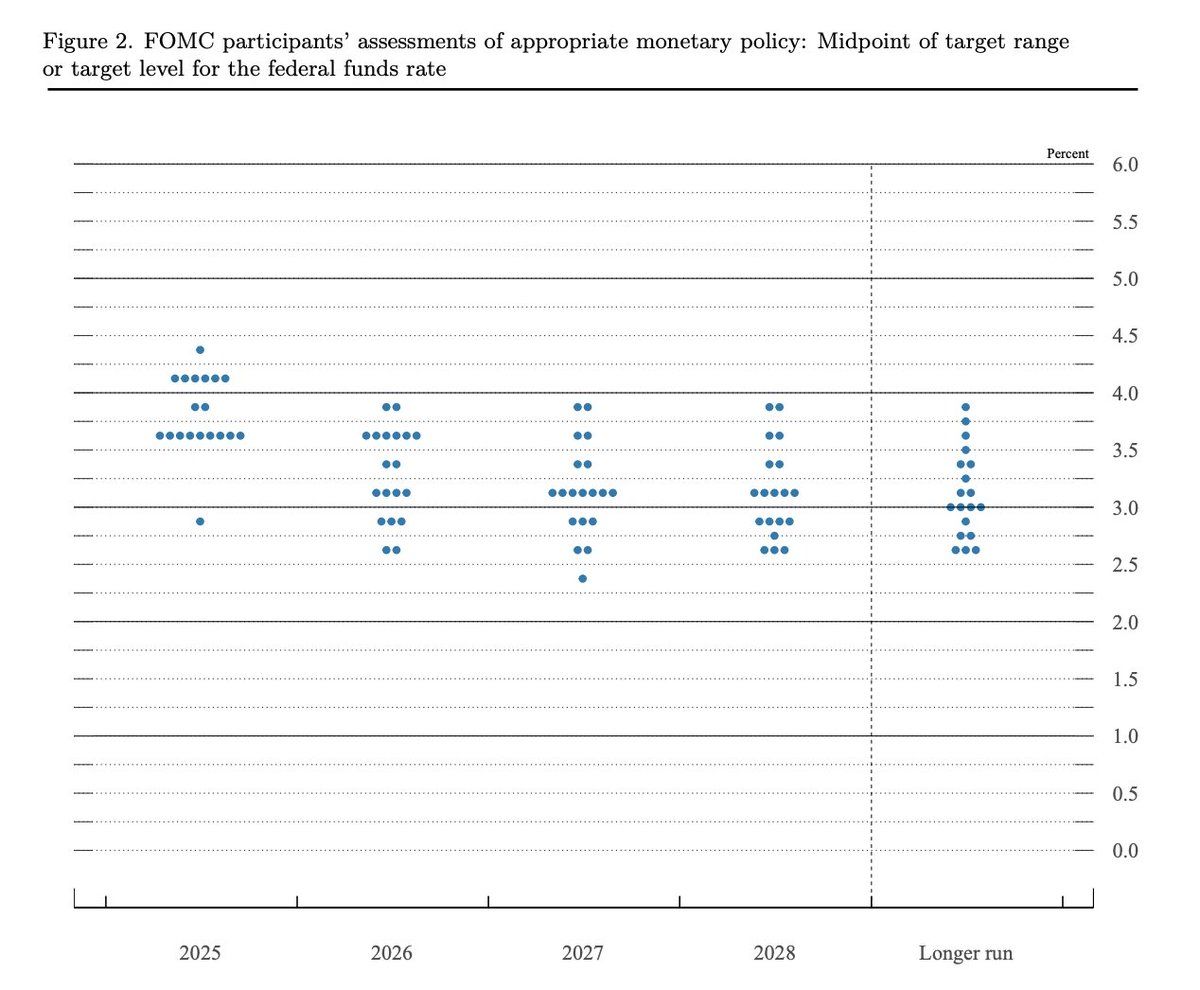

The Fed's 25bps rate cut yesterday was the headline, but the subtext is important. Washington has pivoted from “inflation first” to “labor softness,” laying the groundwork for easier policy into year-end. Markets are now pricing at least two more cuts. This is the objective reality of an unpayable interest bill and chronic deficits.

Add the emerging “third mandate.” With Governor Stephen Miran now confirmed, language is being floated around pursuing “moderate long-term interest rates.” In plain English, that’s yield-curve management: policies—formal or informal—that lean on the long end to keep funding costs contained.

Call it what you like; the effect is financial repression by another name. Implications include:

- Lower policy rates + managed long yields = cheaper government funding, persistent inflation risk, and continued balance-sheet support.

- Price signals get distorted. If the long end can’t clear freely, capital is nudged toward risk assets and away from savings in dollars.

- Hard assets gain. In a regime of soft targets and engineered yields, assets outside central-bank liabilities—bitcoin and gold—become the ballast cash and duration no longer provide.

Portfolio takeaway: Position for a world where the Fed cuts, tolerates hotter inflation, and leans on tools that pin the curve. Own scarce, bearer-style assets; minimize reliance on instruments whose real return can be managed away.

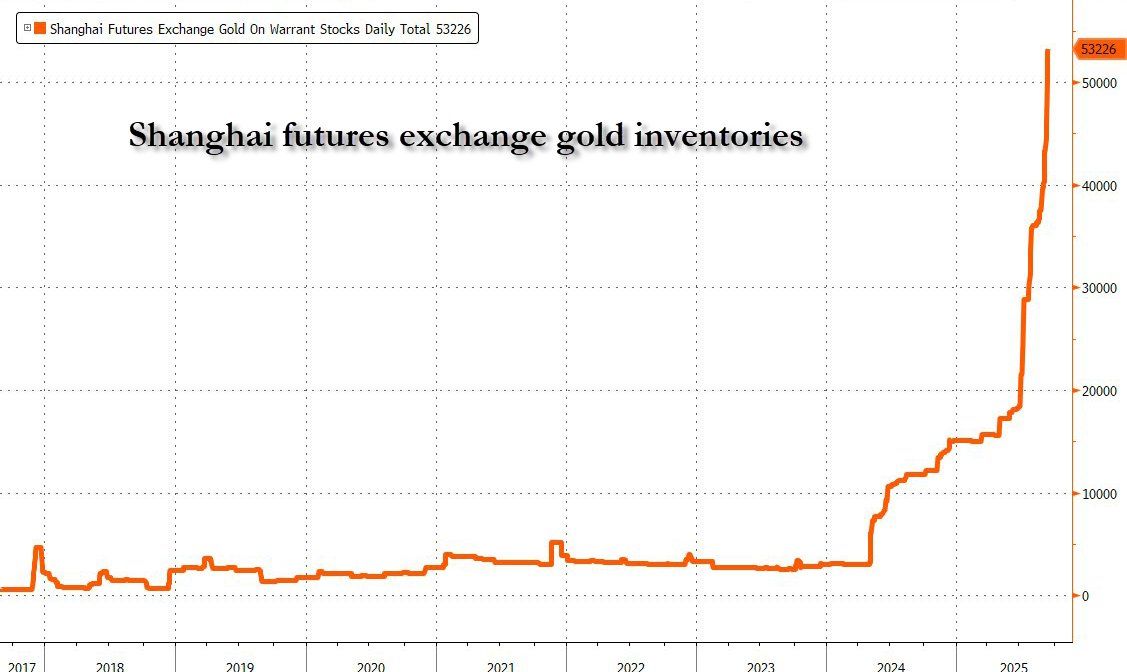

Gold at New Highs, Bitcoin Right Behind

Meanwhile, gold continues its breakout, posting new all-time highs as central banks and sovereigns expand reserves (inventories in China spiking, as shown below). The trend confirms a simple truth: outside money is gaining share in the global system. Bitcoin, often lagging gold’s moves, is positioned as the higher-beta beneficiary of this structural shift.

Both assets have been the standout performers of 2025, and their concurrent rise is no coincidence. They are the only assets immune to the policy improvisations and political compromises defining the fiat regime.

The Bigger Picture

Taken together, these developments signal a transition underway in the monetary order:

- Fiscal dominance is entrenched, with inflation targets abandoned in practice.

- Neutral reserves—gold and increasingly bitcoin—are asserting themselves as safe havens in a multipolar world.

- Institutions are no longer asking if they will allocate to bitcoin, but how they will custody it in ways that withstand political, technical, and counterparty risks.

Sound money is no longer a theoretical debate. It is a live market response to fiscal and monetary gravity. Bitcoin and gold are lifelines against a system that is running out of credible promises.

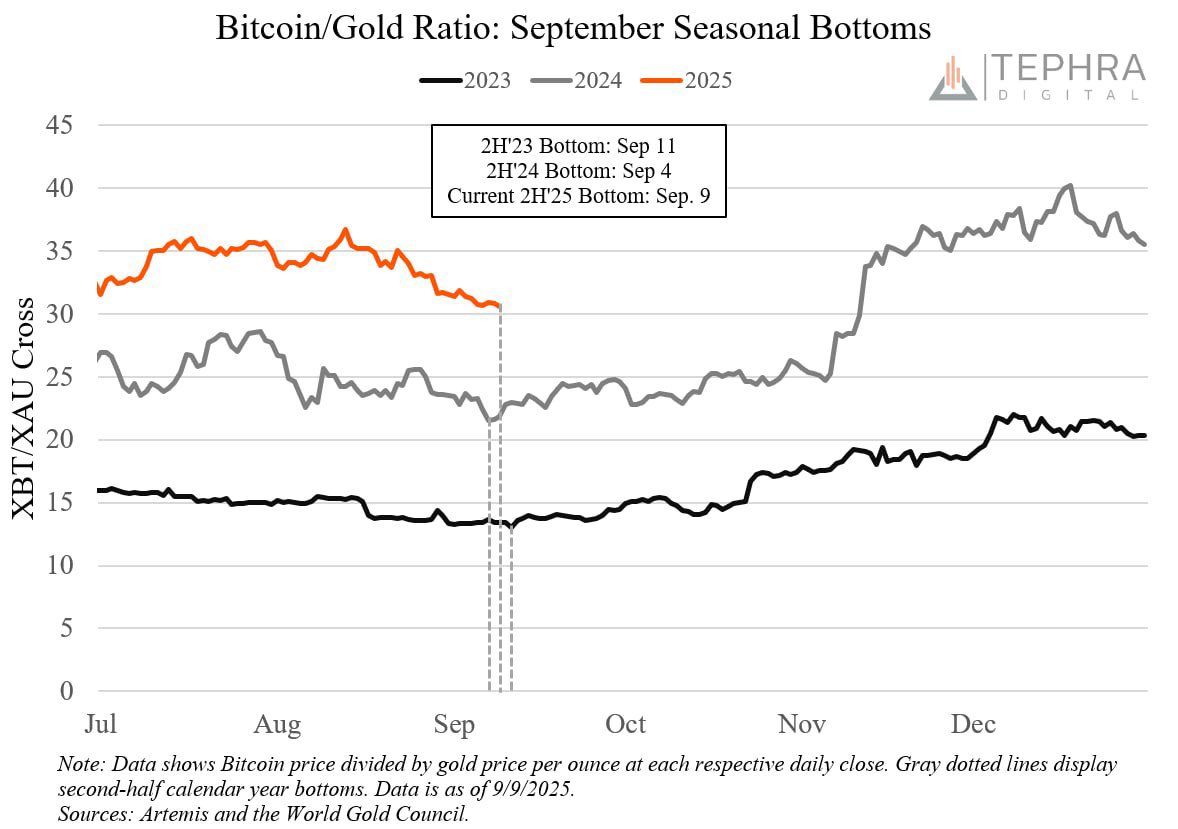

Chart of the Week

"BTC/Gold ratio bottomed here the last two years. Gold led, now it’s Bitcoin’s turn. Catch-up mode into year-end."

Quote of the Week

"The established sequence:

1. Gold moves up. It outperforms BTC for weeks or months while BTC is quiet or drops.

2. Gold’s outperformance over BTC begins to slow, then reverse.

3. BTC catches up and vastly outperforms gold and other assets.

If this gold/BTC cycle plays out like previous ones, we’ve entered #2."

Podcasts of the Week

Monetary Reset Is Here: Bitcoin, Gold & the End of the Fed?

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis break down Treasury vs Fed power plays, stablecoins as dollar statecraft, gold leading, bitcoin follows, sovereign & TradFi adoption, the bottleneck of custody & more!

The Last Trade: The Death of Fiat Denominated Venture Capital

In this special episode of The Last Trade, we unpack Early Riders' launch of The Stables—a basecamp for bitcoin founders and innovation in Texas Hill Country—why we built it, what we’re funding, and how sound building beats noise.

Tether's Fedcoin, Thailand Banking Crisis, & The Shifting Monetary Order

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down Tether's Fedcoin, the Thailand banking crisis, Nepal uprising, open-source coordination, AI agents & micropayments on bitcoin rails, key deals of the week & more!

Introducing Bitcoin for Businesses: The Supercycle Catalyst

Presented collaboratively by Onramp Media, Early Riders, and Acropolis, this new podcast aims to turn headlines into operator decisions. All businesses big and small need bitcoin, and this show will serve as their playbook.

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis