9/25/25 Roundup: Sovereign Accumulation Watch

Brian Cubellis | Chief Strategy Officer

Sep 25, 2025

The past week has brought fresh reminders that bitcoin is no longer just a speculative instrument. It is steadily becoming a strategic reserve asset—quietly adopted by governments and states seeking protection from the vulnerabilities of debt-based fiat systems.

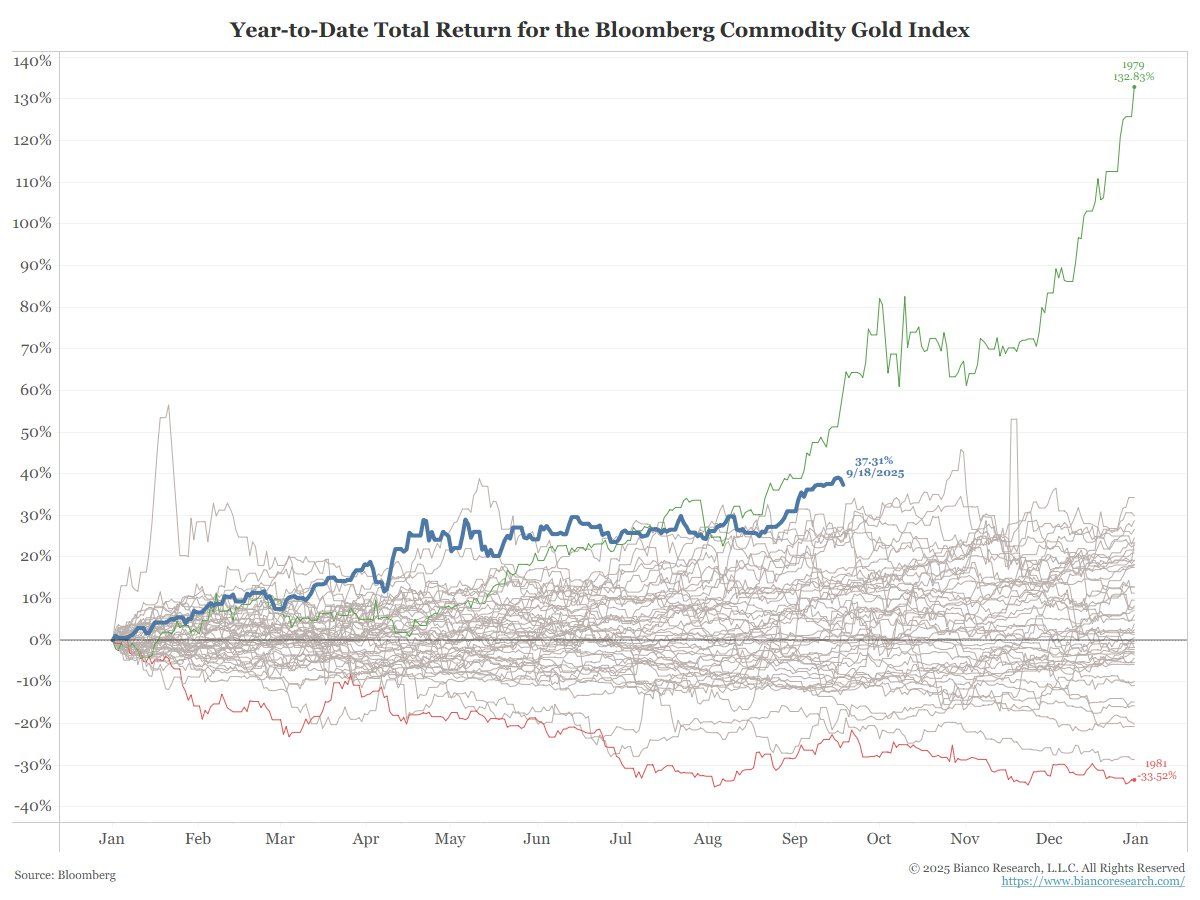

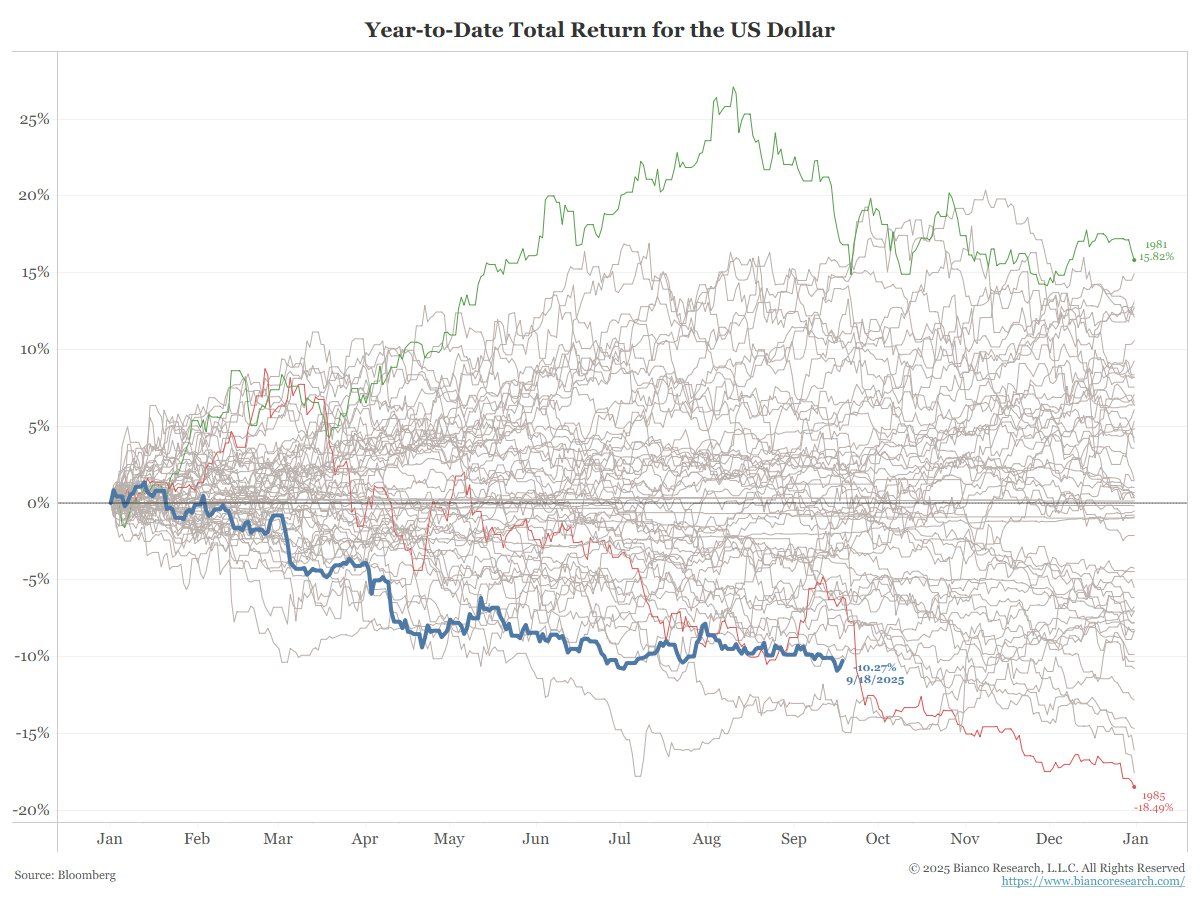

What we are witnessing is the early architecture of a reserve reordering. Neutral assets like gold and bitcoin are moving from the fringes of debate into the core of policy design.

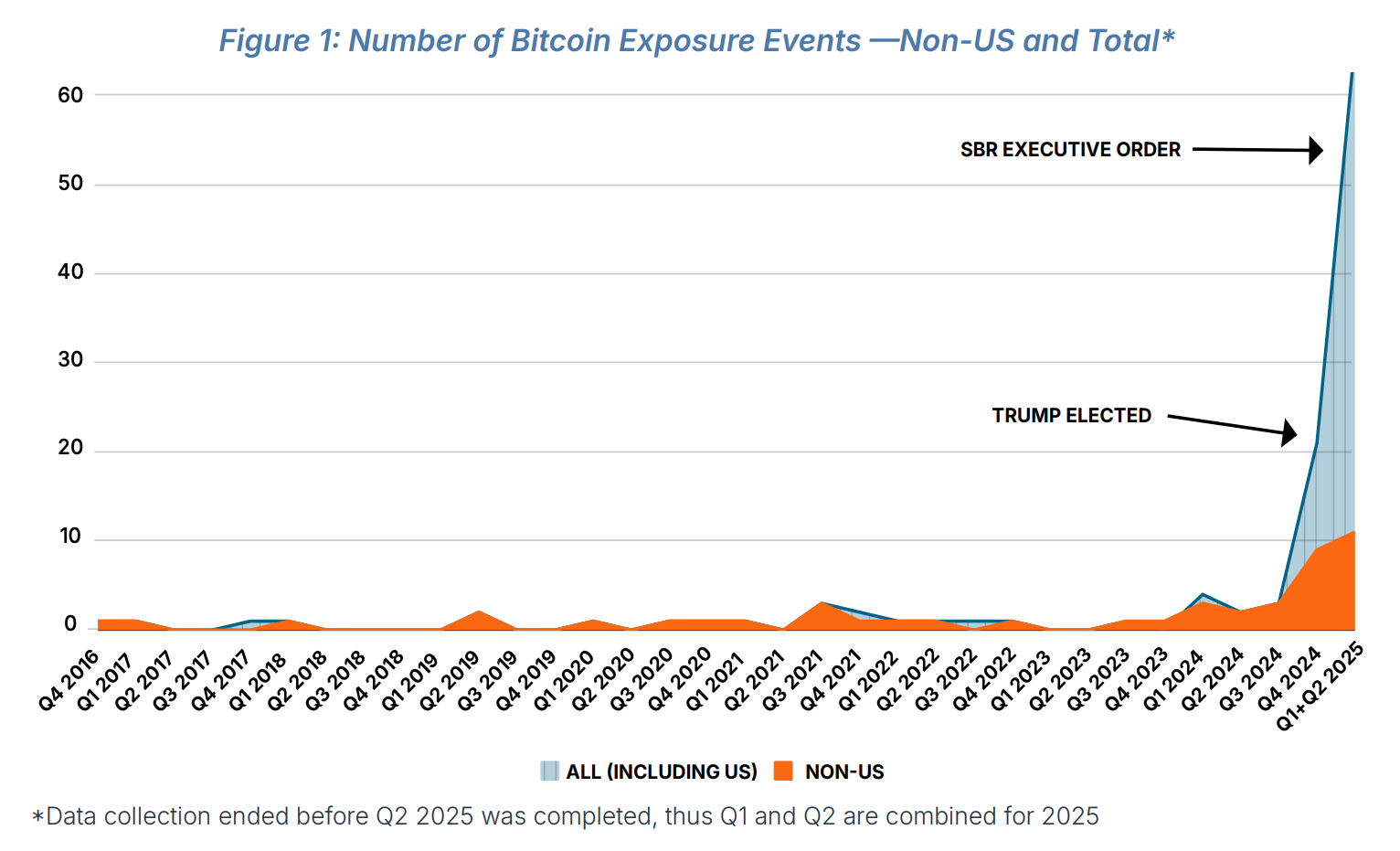

A new report from the Bitcoin Policy Institute, Nation State Adoption: How and Why Countries Are Gaining Exposure to Bitcoin, makes one point unmistakably clear: governments are moving from speculation to strategy.

A Game-Theoretic Shift

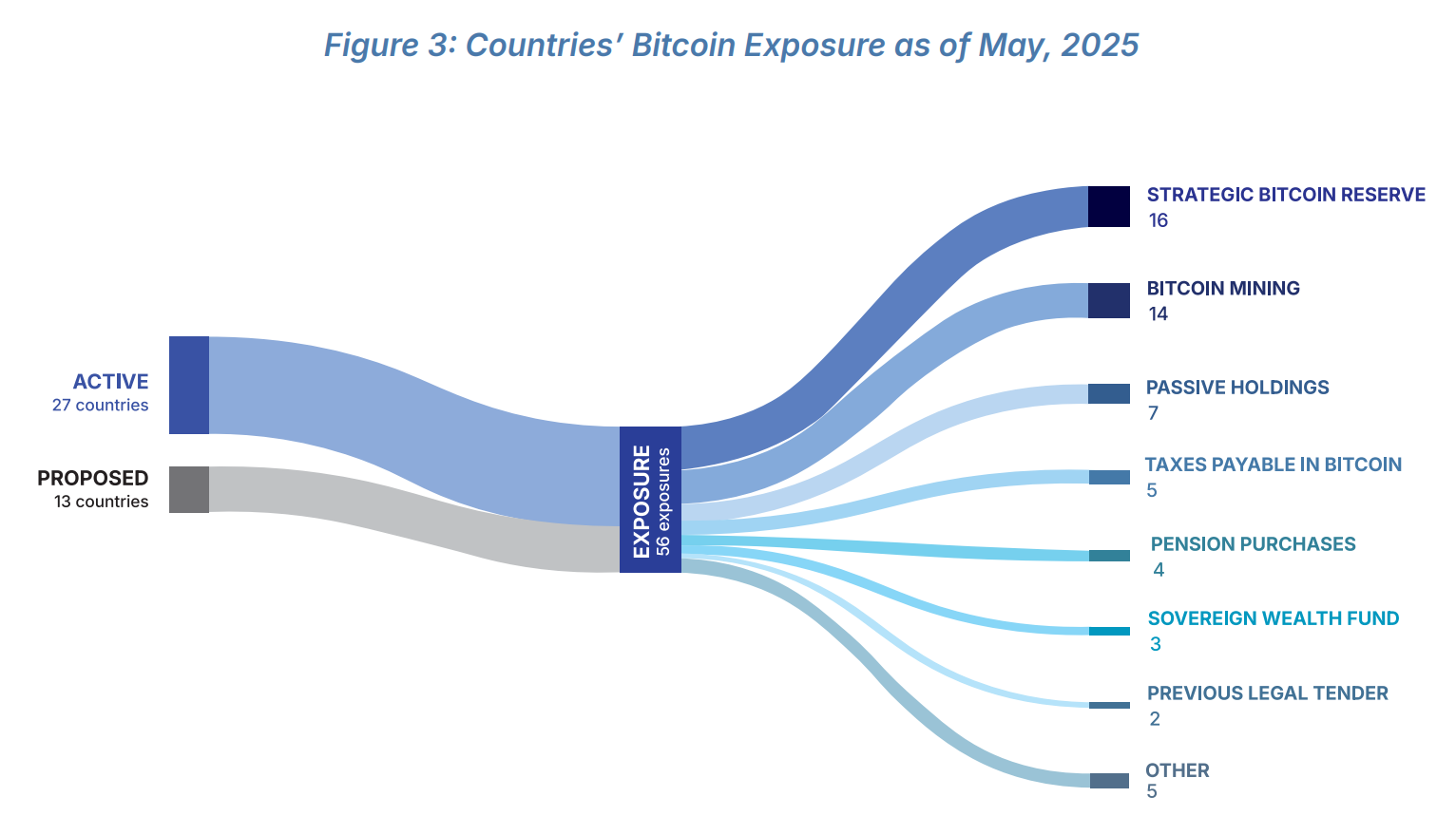

According to BPI, 27 countries now have active exposure to bitcoin, and 13 more are pursuing legislation or policy to establish reserves. That means roughly one in seven nations on earth is already experimenting with bitcoin at some level.

The most common path is the creation of Strategic Bitcoin Reserves (SBRs), but governments are also engaging through sovereign wealth funds, pension allocations, government-backed mining, and even accepting tax payments in bitcoin.

What began with El Salvador and the Central African Republic has spread across every major region. The United States has led in pioneering formal reserves through Trump’s Executive Order, while states like Arizona, Texas, and New Hampshire have already codified SBRs into law.

Abroad, countries as diverse as Argentina, the UAE, Switzerland, and Bhutan have found their own entry points—whether through direct purchases, mining ventures, or indirect exposure via ETFs and public bitcoin treasury shares.

Why It Matters

The “why” is just as important as the “how.”

The report highlights three core rationales:

Reserve diversification. As trust in U.S. Treasuries erodes and foreign ownership of U.S. debt declines, governments are looking for neutral assets to complement gold.

Trade facilitation. Bitcoin’s portability and neutrality make it a viable bridge currency, especially for developing economies constrained by scarce dollar reserves.

Fear of being late. Once a handful of major sovereigns adopt, the feedback loop will force others to follow. As BPI notes, what was once dismissed as speculative now looks like strategic insurance.

Beyond Speculation

This is not about “crypto” or token markets. It is about money. Neutral, censorship-resistant reserves that can serve the same function gold has played for centuries, but with greater portability, divisibility, and verifiability.

As the report concludes, bitcoin has emerged as the first new macroeconomic reserve asset in more than a century. The Overton window has shifted: the debate is no longer whether governments will gain exposure, but how much, how quickly, and by what mechanisms.

Portfolio Implications

For allocators, the lesson mirrors that of sovereigns: exposure to bitcoin is not a speculative trade but a structural hedge. Just as central banks have steadily accumulated gold while letting inflation run above target, they are beginning to layer in bitcoin as a complement.

The rationale is simple: in a world of fiscal dominance, policy improvisation, and reserve diversification, wealth must be anchored in assets outside the control of any one government. That is the logic driving sovereign accumulation. And it is the same logic that should drive institutional and individual portfolios.

Charts of the Week

"Over the last 50 years of gold trading (gray lines), 2025 (blue) has only seen one better year, 1979 (green)."

"Conversely, the dollar in 2025 (blue) only seen two worse years, 1972 and 1986 (two gray lines below the blue line). This year is still tracking worse than 1981 (red), the biggest loss for the dollar in a year since 1972 (gray lines)."

Quote of the Week

"IF U.S. incomes spiked 60%, we'd return to pre-pandemic housing affordability levels. IF U.S. home prices fell 38%, we'd return to pre-pandemic affordability. IF mortgage rates fell 4.15 percentage points (from 6.5% to 2.23%), we'd return to pre-pandemic affordability."

Podcasts of the Week

Jeff Booth: Bitcoin Is Repricing the Entire World

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis are joined by Jeff Booth to discuss tech deflation vs fiat debt, BTC as the real ‘yardstick’, building lean & leveraging AI, gold & stables as bridges (not endpoints), saving, spending, and operating in BTC & more!

Yield Traps, Paper Games, & Bitcoin's Path to $10M

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down spot BTC versus yield schemes, why MIC unlocks scale, why proof-of-reserves ≠ safety, AI deflation + debt = hard-asset bid, key deals of the week & more!

America’s Debt Crisis & Bitcoin’s Institutional Era with Avik Roy

In this episode of Scarce Assets, host Jackson Mikalic is joined by Avik Roy, co-founder and chairman of FREOPP, to discuss the US fiscal reckoning ahead, policy fights over rails & access, broad bitcoin ownership as defense, multi-jurisdiction multi-institution custody, real returns over nominal & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis