9/4/25 Roundup: The Long End Calls the Bluff

Brian Cubellis | Chief Strategy Officer

Sep 4, 2025

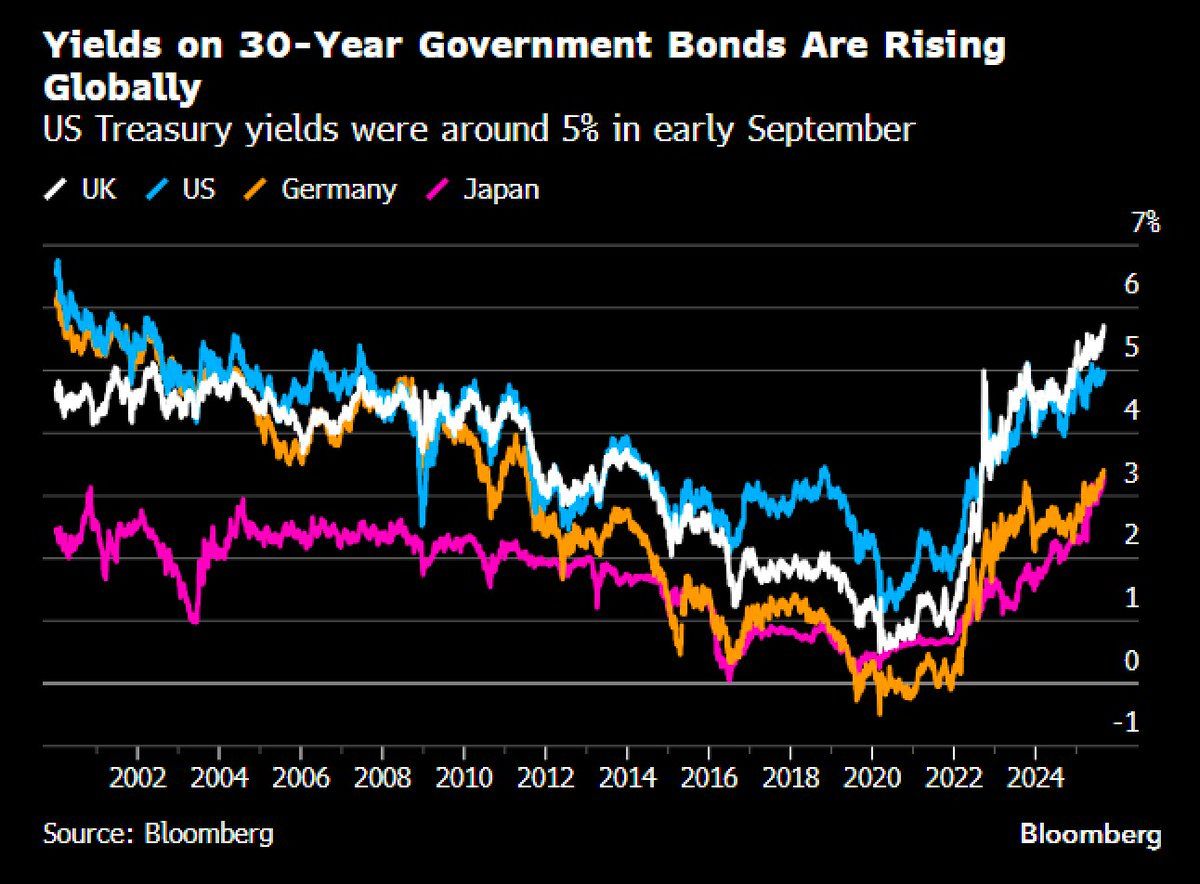

Long-term bond yields jumped across major markets this week even as central banks lean toward easing at the short end. The Fed is now openly signaling a September interest rate cut.

That divergence is the tell.

"When you have $324 trillion of global debt, irresponsible fiscal deficits, and relentless inflation, investors demand more premium for the additional risk. And so, even as the Fed looks to lower short-term rates, yields on long-term bonds are still rising." — James Lavish on X

What is happening?

➤ Term premiums ripping higher: Buyers of 10–30 year debt are demanding more yield to hold duration in a world of rising issuance, persistent inflation, and fiscal dominance.

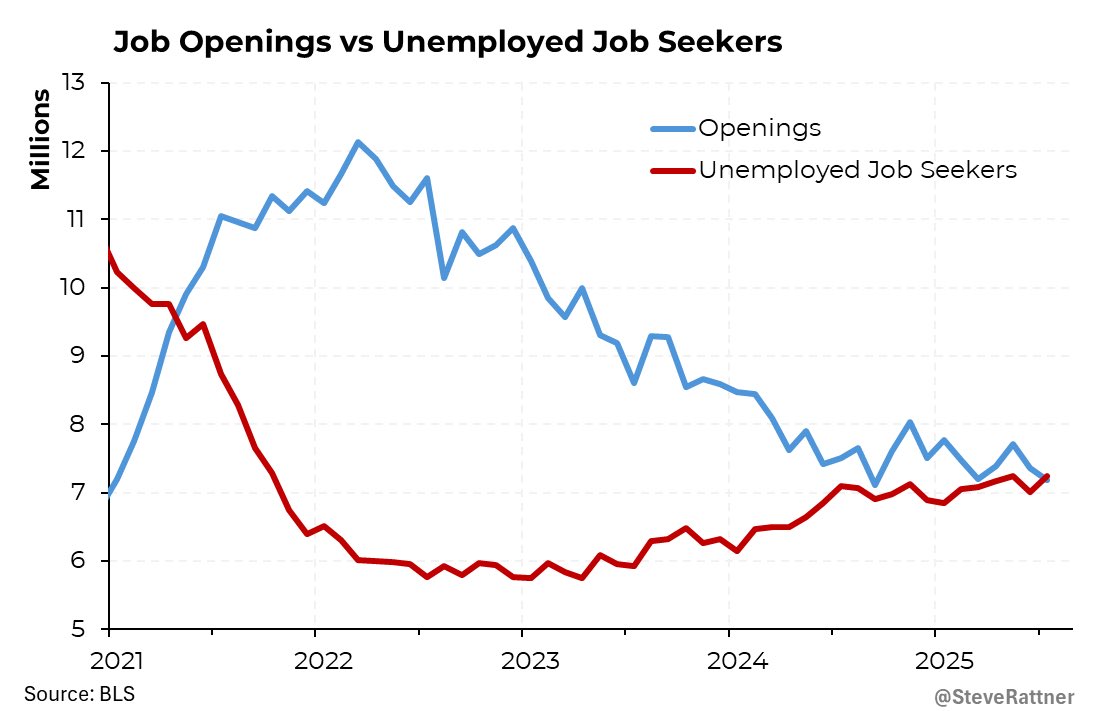

➤ Policy is loosening at the front: Several foreign central banks have already begun to cut rates. The Fed is guiding to a cut as labor data softens.

➤ The result: A steeper curve driven by the market, not the Fed. The long end is repricing the true risks of funding structurally larger deficits.

Why does it matter?

Bond math is simple but unforgiving. When investors believe future dollars will be diluted by persistent deficits and balance-sheet expansion, they require higher coupons today.

That is how a debt spiral begins: higher rates raise interest expense, which widens deficits, which requires more issuance, which pushes term premiums higher still.

Rate policy at the front end cannot fix an arithmetic problem at the long end. Guidance and dot plots move headlines. Supply, inflation risk, and credibility move 10s and 30s.

Reading the Fed’s shift

The communication pivot to “labor market weakness” prepares the ground for cuts, even with CPI near 3% and broad monetary debasement running faster over multi-year windows.

Quietly, the 2% target is becoming a flexible aspiration. In practice, high nominal growth, positive inflation, and financial repression help manage the debt stock. Savers in cash pay the bill.

Portfolio implications

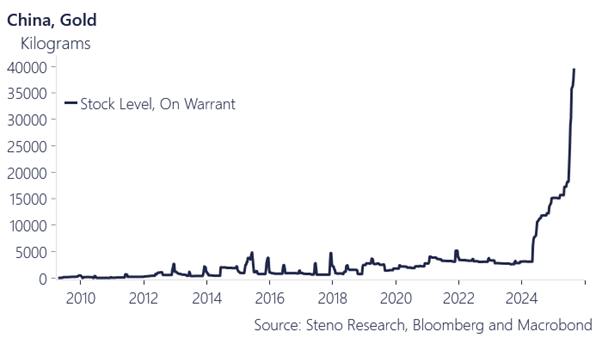

➤ Own outside money: Assets with no issuer and no dilution channel protect purchasing power when policy converges on financial repression. That means bitcoin and gold.

➤ Avoid long-duration bonds: You are short inflation risk and long political promises. Government bonds will continue to deliver negative real returns.

➤ Equities are not a free pass: They can benefit from nominal growth, but margins and multiples are sensitive to rate volatility and fiscal tinkering. Equities are also presently at all-time high valuation levels.

The sovereign signal

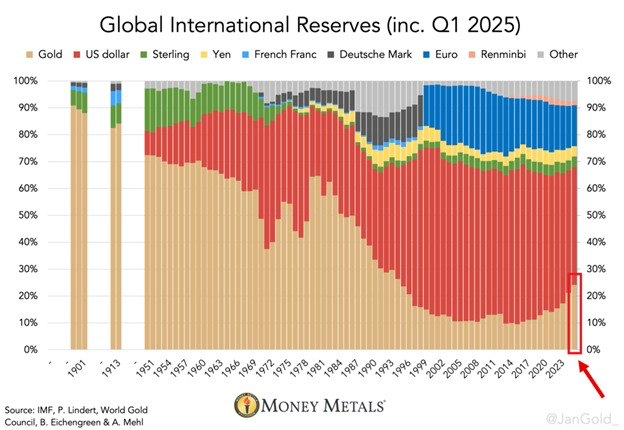

China and other reserve managers continue to add gold. Discussion among BRICS members about commodity-linked settlement periodically resurfaces.

Whether a formal gold-linked unit emerges is secondary. The primary signal is diversification away from U.S. debt toward neutral reserves. Gold fits that brief. Bitcoin increasingly does as well.

Bitcoin is a finite, bearer asset with transparent issuance and global settlement. It has no liability, no central bank, and no discretionary supply lever. In a regime where the long end is calling out dilution, those properties matter.

Add in maturing market rails—regulated ETFs, institutional custody, multi-institution custody (MIC) for fault tolerance—and the investable case strengthens.

Looking ahead

➤ FOMC (September): Magnitude and language of the first cut. Pay attention to balance-sheet guidance and any “flexible average” framing around inflation.

➤ Treasury issuance: Quarterly refunding, net supply, buyback chatter. The supply calendar drives term premium.

➤ Global labor and PMI data: Weakening data will justify cuts; watch how the long end reacts.

➤ Reserve behavior: Central bank gold purchases, public or quiet signals of bitcoin accumulation, and ongoing ETF flows.

Bottom line

The market is repricing the cost of funding an era of permanent deficits. Policy can massage the front end; the long end is voting on solvency, credibility, and dilution. In that world, neutrality and scarcity are not luxuries. They are portfolio necessities.

Hold hard assets. Hold outside money.

Chart of the Week

"Gold is replacing fiat currencies as a reserve currency: Gold's share of global international reserves rose 3 percentage points in Q1 2025, to 24%, the highest in 30 years. This marks the 3rd consecutive annual increase. Meanwhile, the US Dollar's share declined ~2 percentage points, to 42%, the lowest since the mid-1990s. The Euro share remained roughly unchanged at ~15%. Gold is now the world’s second-largest reserve asset after surpassing the Euro in 2024. Gold is seeing historic levels of demand."

Quote of the Week

"The bitcoin thesis is simple. Will governments continue to debank, deplatform, and devalue? If so, then bitcoin will grow in value. If not, then no one will feed it electricity and it will slowly die. Your call."

Podcasts of the Week

The 100-Year Reset with Luke Gromen: Gold, Bitcoin, and Fiat’s Demise

In this episode of The Last Trade, hosts Jackson Mikalic, Michael Tanguma, & Brian Cubellis are joined by Luke Gromen to discuss why gold & BTC are leading markets, how reserve seizures changed everything, the endgame for fiat & the dollar system, stablecoins, ETF flows, US policy shifts, nationalization, AI, the future of money, & more!

Altcoin Confusion, Political Tokens, and the Hard-Money Answer

In this episode of Final Settlement, hosts Michael Tanguma, Liam Nelson, & Brian Cubellis break down GDP on-chain theater, political grift & gambling, fiat fragility vs. outside money, financialization bloat & counterparty risk, key deals of the week & more!

Closing Note

Onramp provides bitcoin financial services built on multi-institution custody. To learn more about our products for individuals and institutions, schedule a consultation to chat with us about your situation and needs.

Until next week,

Brian Cubellis