The Onramp Primer

Brian Cubellis | Chief Strategy Officer

Jun 11, 2024

What does Onramp do?

We provide financial services for bitcoin.

What type of client does Onramp serve?

We serve individuals, institutional allocators, financial advisors, and corporate treasuries. We can assist with both existing and new allocations to bitcoin.

What makes Onramp different?

All our products and services are built on the foundation of Multi-Institution Custody. We leverage bitcoin’s native properties of multisig to offer a superior form of custody that eliminates single points of failure while alleviating the burden of private key management. As such, we are focused on bitcoin, and bitcoin only.

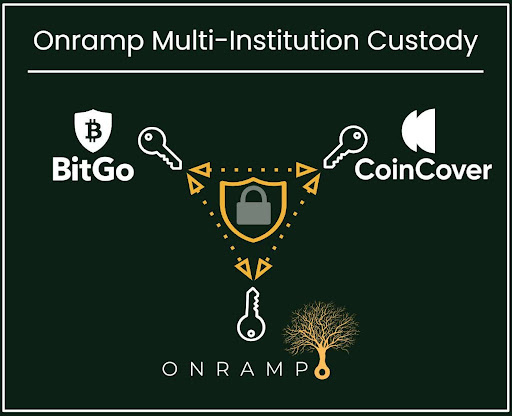

What is Multi-Institution Custody?

Onramp’s Multi-Institution Custody solution leverages a 2-of-3 multisig (multi-signature) quorum to secure our client’s bitcoin. In this arrangement, three separate institutional entities – Onramp, BitGo, and Coincover – each hold one private key, and any two of these three keys are required to effect the movement of funds. Unlike “collaborative custody” models, the end client does not need to hold any keys. Instead, three institutions work together on behalf of the end client to manage private keys and facilitate transactions.

Resilience & Security

The structure underpinning the 2-of-3 multisig quorum is critical to its security:

- Distributed Trust & Redundancy: By distributing keys across three independent institutions, Onramp’s Multi-Institution Custody model mitigates the risk of a single point of failure. If any one institution is unable to provide their signature, funds can still be accessed by the remaining two institutions, and if necessary, new institutions can be added to the quorum.

- Institutional Collaboration: Each institution has a vested interest in maintaining the security of the arrangement and monitoring the others. This mutual oversight driven by a shared economic partnership reduces the likelihood of collusion and enhances overall security.

- Key Generation & Governance: Each private key held by an institution in the quorum is generated with enterprise-grade security and cryptographic sharding standards, requiring a hybrid of online and offline controls to be met.

- Client Control: Although the end client does not hold any keys, they retain control over their assets through the coordinated actions of the institutions. This ensures that no single entity can unilaterally access or transfer the client’s assets. Only the end client can direct the movement of funds and they can withdraw assets at any time.

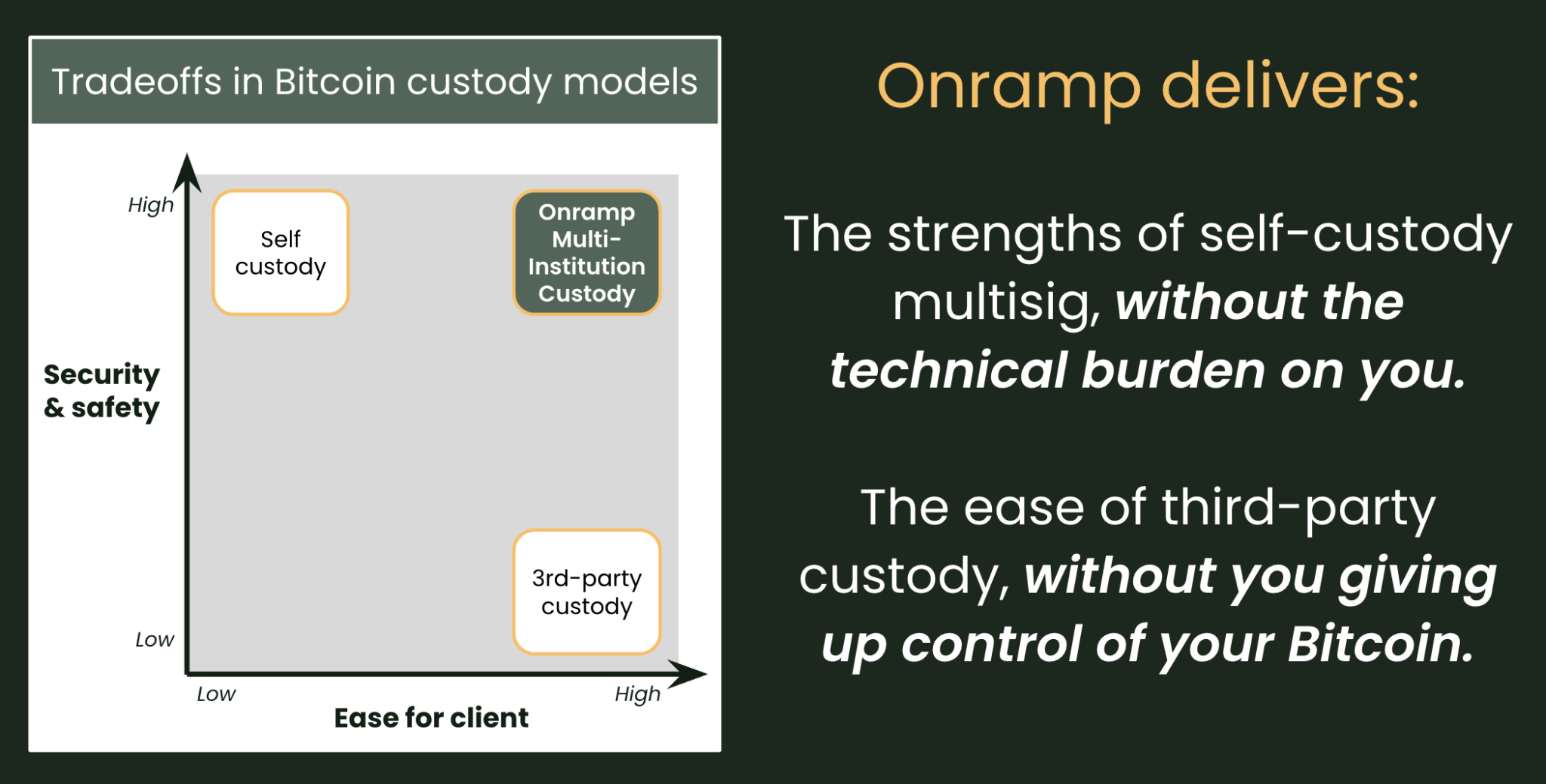

Advantages Over Single-Party Custody

- Elimination of Single Points of Failure: Existing custodial models (even if they utilize multisig) rely on a single entity, making them vulnerable to internal fraud, hacking, or regulatory actions that could lead to asset loss. Multi-Institution Custody distributes this counterparty risk across multiple entities, enhancing security and eliminating the need to trust a single entity.

- Auditability & Transparency: The end client can always verify the state of their multi-institution vault on chain and ensure that their assets remain secure. This transparency is often lacking in traditional custodial arrangements, where the user must trust the custodian’s reports.

- Segregation of Client Assets: With most single-party custodians, assets are typically pooled together. In contrast, Multi-Institution Custody ensures that each client’s assets are segregated in their own vault, providing greater clarity and ownership assurances.

Advantages Over Self-Custody

- Reduced Burden of Key Management: Self-custody requires individuals to manage their own private keys, which can be a complex and stressful task. Mistakes can lead to permanent loss of assets. Multi-Institution Custody alleviates this burden by offloading key management to trusted entities, none of which have unilateral control.

- Protection Against Physical Attacks: Holding private keys oneself can expose an individual to physical threats, such as coercion or “wrench attacks” (where someone is forced to hand over keys under duress). In a Multi-Institution Custody arrangement, an attacker would need to coerce multiple institutional entities, simultaneously. As an Onramp client, any potential attackers would determine that you do not hold private key material on your person or at your residence, and recognize the task of coercing multiple institutions is exceedingly more difficult than compromising other existing custodial models.

- Inheritance & Estate Planning: With self-custody, bitcoin holders are forced to leave a “treasure map” for their family, which can be fraught with risks and complications. Further, self-custody does not solve the legal transfer of title. Multi-Institution Custody and our services via Onramp Heritage allow clients to name beneficiaries and legally prepare for the transition of assets to loved ones or heirs, ensuring a smooth and secure transfer.

At Onramp, we understand that navigating the complexities of managing bitcoin private keys can be daunting. That’s why all our products and services are designed around the Multi-Institution Custody model, which distributes trust across multiple institutional entities, each holding a single key in a 2-of-3 multisig quorum. This approach not only enhances security by minimizing counterparty risk, but also enables clients to retain control over their assets, audit key holder activity, and withdraw assets if necessary.

Financial Services on a Sound Foundation

By building on the foundation of a superior form of custody, Onramp is uniquely positioned to offer a comprehensive suite of products and services tailored to meet the diverse needs of our clients. Our offerings include:

- Onramp Multi-Institution Custody: Our flagship offering; direct spot bitcoin exposure via segregated multisig vaults controlled by three distinct entities.

- Onramp Bitcoin Trust: Grantor trust vehicles (US & International); security-like bitcoin exposure via shares of a grantor trust which utilizes Onramp Multi-Institution Custody to secure the underlying bitcoin.

- Onramp Heritage: Bitcoin-specific inheritance & estate planning; as part of our commitment to comprehensive financial services, we offer tailored inheritance, tax and estate planning solutions to help clients manage their bitcoin assets in a tax-efficient and legally compliant manner, now and for generations to come.

- Onramp Transaction Protection: An additional layer of protection; through our partnership with Coincover we can provide segregated transaction protection to mitigate any tail risks associated with transaction signing.

- Onramp Research & Insights: High-signal educational resources; to empower our clients with the knowledge and insights needed to make informed decisions, we provide educational resources and research on bitcoin, as well as its increasing intersection with traditional financial markets (written reports, podcasts, webinars, analytic tools).

- Onramp Private Client: All of the above & more; as an Onramp Private Client, you will receive white glove services and access to our entire offering, as well as private investment opportunities, reduced trading fees, exclusive research, events, and more.

Multi-Institution Custody represents a step-function improvement over traditional custodial models in the bitcoin space. By distributing trust across multiple institutions and allowing end clients to retain control, this model minimizes counterparty risk, enhances security, and provides our clients with greater ownership assurances. The game theory underpinning the 2-of-3 multisig quorum further strengthens the system against potential threats, providing a robust and redundant solution for end clients.

Onramp was founded to help shepherd private clients and institutions to the lifeboat that is bitcoin. We believe bitcoin is the most important asset for investors to understand as they position their portfolios for the next several decades. It is paramount, however, that investors are onboarded to bitcoin in a manner that protects their interests and safeguards them from the custodial pitfalls that have historically plagued the industry.

As subsequent waves of bitcoin adoption loom on the horizon, Onramp’s goal is to provide our clients with superior methods for gaining exposure to this asset by leveraging the native properties of the protocol to minimize counterparty risk and eliminate single points of failure.

We are here to help you navigate your bitcoin journey.